TIDMEDL

RNS Number : 4184F

Edenville Energy PLC

10 July 2023

10 July 2023

Edenville Energy Plc

("Edenville" or the "Company")

Notice of AGM

Related Party Transactions

Proposed Change of Name

Edenville Energy Plc (AIM: EDL), an African focused mine

operator and developer, announces that the the Company's Annual

General Meeting ("AGM") will be held at the offices of Fasken

Martineau LLP at 100 Liverpool Street, London, EC2M 2AT on 3 August

2023 at 11.00 a.m. The notice of AGM has been published and is

available on the Company's website at:

https://edenville-energy.com/aim-rule-26/

The AGM will include certain resolutions pursuant to the

Company's announcements on 1 June 2023 and 2 June 2023 in

connection with the Company's recent capital raising, proposed

issue of shares and warrants to certain directors and proposed

change of name. This includes resolutions to grant the Directors

the authority to allot shares and disapply pre-emption rights (the

"Share Authority Resolutions").

Background to the Capital Raising

The Company announced on 1 June 2023 that it had raised

GBP1,468,000 (before expenses) (the "Capital Raising") from

strategic investors Q Global Commodities Group ("QGC"), a South

African commodity, mining, logistics and investment fund and

Gathoni Muchai Investments Limited ("GMI"), an East Africa based

mining investment group under two tranches comprising: (i)

GBP575,000 under the Company's existing share allotment authorities

("Firm Subscription") and (ii) subject to the Share Authority

Resolutions being passed at the AGM, a further GBP893,000

("Conditional Subscription").

Under the Firm Subscription the Company issued 7,000,000 new

ordinary shares of 1 pence each in the capital of the Company

("Ordinary Shares") to QGC and 4,500,000 new Ordinary Shares to GMI

at a subscription price of 5 pence per Ordinary Share ("Firm

Subscription Shares"). The Firm Subscription Shares were admitted

to trading on AIM on 12 June 2023.

Under the Conditional Subscription the Company has conditionally

allotted, subject to the Share Authority Resolutions being passed

at the AGM, 10,586,598 new Ordinary Shares to QGC and a further

7,273,402 new Ordinary Shares to GMI ("Subscription Shares").

Subject to the Share Authority Resolutions being passed at the

AGM, QGC will also receive warrants to subscribe for 3,265,555 new

Ordinary Shares and GMI will also receive warrants to subscribe for

2,186,136 new Ordinary Shares, each with an exercise price of 25

pence per share, exercisable until 25 May 2024 ("Fundraise

Warrants").

The AGM will seek Shareholders' approval to allot 17,860,000

Subscription Shares, 5,451,691 Fundraise Warrants, 3,500,000

Director Fee Shares and 3,600,000 Director Warrants, as further

described below. It is also proposed to obtain a general authority

to allot further equity securities on both a non pre-emptive basis

and on a pre-emptive basis. If the Share Authority Resolutions are

passed, the Subscription Shares, the Fundraise Warrants, the

Director Fee Shares and Director Warrants are expected to be issued

immediately after the AGM.

The Directors do not currently have the authority under section

551 of the Companies Act 2006 to allot the Subscription Shares, the

Fundraise Warrants, the Director Fee Shares and the Director

Warrants. The Subscription Shares, the Fundraise Warrants, the

Director Fee Shares and the Director Warrants will not be allotted

therefore until the Share Authority Resolutions are passed at the

AGM.

GMI is a Nairobi-based investment firm focused on mining,

property and retail sectors and headed up by Mr Jason Brewer and Ms

Jackline Muchai. GMI have existing investments in four East African

countries, including Tanzania and are a major shareholder in

London-listed and battery metals focused mining company Marula

Mining plc, and new uranium mine development company Neo Energy

Metals Limited, which is in the process of coming to market by way

of a reverse takeover of London Stock Exchange listed Stranger

Holdings plc.

QGC is a South African based commodity, logistics and investment

fund and has a broad global network in the mining finance sectors

and the marketing and sales of commodities. QGC has 12 thermal coal

mines currently under management and is actively expanding its

metal mining interests throughout Southern and East Africa through

direct equity investments and partnership and co-development

agreements with a number of emerging mining and exploration

companies.

QGC is led by Mr Quinton van der Burgh, who has almost 20 years

of mining experience and has developed over 47 projects to mining

stage, including two large-scale mining companies.

If the Share Authority Resolutions are passed at the AGM,

following issue of the Director Fee Shares and completion of the

Conditional Subscription, QGC will hold, via its wholly-owned Dubai

incorporated subsidiary AUO Commercial Brokerage LLC, 29.20% of the

Company's enlarged share capital and GMI will hold 19.55% of the

enlarged share capital.

Funds from the Capital Raising will be used by the Company to

fund its ongoing working capital requirements and due diligence on

potential new and strategically complimentary projects in

Africa.

The Conditional Subscription

The Company has conditionally raised GBP893,000 (before

expenses) by way of the Conditional Subscription. Application will

be made for the Subscription Shares to be admitted to trading on

AIM, conditional on the Share Authority Resolutions being passed at

the AGM.

Subject to completion of the Conditional Subscription, QGC and

GMI will also receive an aggregate of 5,451,691 Fundraise Warrants.

If the Fundraise Warrants are exercised in full, this would result

in the issue of a further 5,451,691 new Ordinary Shares, raising

GBP1,362,922 for the development of the Company's business, and

which would represent in aggregate approximately 8.3% of the

Company's share capital as enlarged by the Subscription Shares, the

Director Fee Shares and assuming full exercise of the Fundraise

Warrants.

Each of QGC and GMI have agreed that, unless the Takeover Panel

grants a waiver from the requirement to make an offer under Rule 9

of the City Code on Takeover and Mergers, their individual

interests in the Company's Ordinary Shares, including those of any

persons deemed to be acting in concert with them, shall not exceed

29.99% of the total voting rights as a result of future

acquisitions of Ordinary Shares pursuant to the exercise of the

Fundraise Warrants or otherwise. Each of QGC and GMI have also

agreed that to the extent QGC are unable to subscribe for their

full allocation of Subscription Shares because their holding would

otherwise exceed 29.99% of the total voting rights, then GMI will

subscribe for such number of Subscription Shares so that the

Company receives the same amount of subscription funds.

The Conditional Subscription is conditional on the Share

Authority Resolutions being passed at the AGM and Admission.

Board Changes

Jason Brewer was appointed Executive Director of the Company on

1 June 2023.

Mr Brewer, is a Director of GMI and currently the Chief

Executive Officer of Marula Mining plc (AQUIS: MARU) ("Marula"), an

African battery metals focused mining and development company which

has a broad portfolio of mining and exploration projects in South

Africa, Tanzania and Zambia. Marula currently operates the Blesberg

Lithium Mine in South Africa, and is developing the Kinusi Copper

Mine in Tanzania as well as advancing a number of graphite and rare

earth elements projects in Tanzania and Zambia. Mr Brewer is a

senior mining executive with over 25 years of experience in

international mining, financial markets and investment banking and

being based in Nairobi is ideally positioned to oversee the

development of our current mining and exploration ongoing projects

in East Africa, and his on-site presence will prove invaluable in

identifying and securing new mining and mine development

opportunities for the Company.

Following the AGM, it is intended that Mr Quinton van der Burgh

will join the board as Non-Executive Director subject to the

satisfactory completion of customary due diligence by the Company's

nominated adviser. A further announcement in that regard will be

made in due course.

It is anticipated that Nicholas (Nick) von Schirnding,

Non-Executive Chairman, will resign as Director and Non-Executive

Chairman of the Company once Mr van der Burgh joins. In addition,

the Company is seeking to further enhance the Board and will update

on progress in due course.

Ordinary Shares Issued in lieu of Director Fees

Subject to the passing of the Share Authority Resolutions at the

AGM, the Company has agreed to issue a total of 2,000,000 new

Ordinary Shares at a subscription price of 8.75 pence per share to

Paul Ryan in lieu of GBP175,000 of accrued outstanding director

fees and bonuses (for 2022 and 2023) and the Company will issue a

total of 1,500,000 new Ordinary Shares at a subscription price of

8.75 pence per share to Noel Lyons in lieu of GBP131,250 of accrued

outstanding director fees and bonuses (for 2022 and 2023)

("Director Fee Shares"). These measures will assist the Company to

preserve cash resources during a period of business development and

expected growth. These Director Fee Shares are in substitution for

the proposed issue of Director Fee Shares in respect of certain

accrued fees for 2022, as referred to in the Company's announcement

of 1 June 2023.

Director Warrants

The Company also intends, in order to provide a meaningful

incentivisation package for executive directors, to grant Director

Warrants over a total of 3,600,000 new Ordinary Shares to the

Executive Directors on the terms summarised below. The Director

Warrants are exercisable at 9.125 pence per share, being the

closing price on 6 July 2023, are non-transferable and shall vest

as to 50% upon issue and 50% on the first anniversary of issue,

subject to continued employment.

Director Director Warrants Exercise Exercise Period

Price (per

Warrant)

5 years from the date

Paul Ryan 1,200,000 9.125p of grant

------------------ ------------ ----------------------

5 years from the date

Noel Lyons 1,200,000 9.125p of grant

------------------ ------------ ----------------------

5 years from the date

Jason Brewer 1,200,000 9.125p of grant

------------------ ------------ ----------------------

Related Party Transactions

The issue of the Director Fee Shares and grant of the Director

Warrants ("Director Issues") constitute related party transactions

as defined by Rule 13 of the AIM Rules for Companies. Nick von

Schirnding and André Hope, being the Directors of the Company

independent of the Director Issues as at the date of this

announcement, having consulted with the Company's nominated

advisor, Strand Hanson Limited, consider the terms of the Director

Issues to be fair and reasonable insofar as the Company's

shareholders are concerned.

Relationship Agreements

On Admission QGC and GMI (the "Investors") will hold 29.20% and

19.55%, respectively, of the Company's share capital, as shown in

the table below.

Investors Firm Subscription % Shareholding Subscription Shareholding % of Enlarged

Shares post Firm Shares post completion Share Capital

Subscription of the Conditional

Subscription

QGC 7,000,000 18.01% 10,586,598 17,586,598 29.20%

------------------ --------------- ------------- -------------------- ---------------

GMI 4,500,000 11.58% 7,273,402 11,773,402 19.55%

------------------ --------------- ------------- -------------------- ---------------

TOTAL 11,500,000 17,860,000 29,360,000

------------------ --------------- ------------- -------------------- ---------------

As each Investor will be a substantial shareholder in the

Company following completion of the Conditional Subscription, the

Investors have each entered into a Relationship Agreement with the

Company and Strand Hanson, as nominated adviser. The Relationship

Agreements will cease to have any effect if the Share Authority

Resolutions are not passed. The Relationship Agreements contain

customary protections for the Company. Under the terms of the

Relationship Agreements each Investor agrees to ensure that the

Company will at all times be capable of carrying on its business

independently of the respective Investor and that all transactions

and arrangements between each respective Investor and the Company

will be on arm's length and on normal commercial terms. Each

Relationship Agreement will remain in force while the respective

shareholder retains an interest of 20% or more of the issued share

capital of the Company.

Change of Name

As announced on 2 June 2023, the Company is proposing to change

its name to "Shuka Minerals Plc" subject to shareholders passing a

Special Resolution approving the name change at the AGM.

The Directors believe that the change of name better reflects

the Company's key focus in Africa, values of environmental

sustainability, community engagement and responsible mining

practices.

The Company's name change is also in line with its strategic

objectives and enhanced focus on investing in and developing mining

assets in Africa, aligning perfectly with its long-term

strategy.

Subject to the change of name becoming effective:

- the Company's market ticker will change from "EDL" to "SKA"

- the ISIN number will remain unchanged

- the Company does not expect to issue new share certificates

- The Company's website, containing the information to be

disclosed pursuant to Rule 26 of the AIM Rules for Companies will

be changed, with the new details to be notified at the time of

change.

Admission and Total Voting Rights

An application will be made to the London Stock Exchange for

Admission of the Subscription Shares and the Director Fee Shares,

which is expected to occur at 8.00 a.m. on or around 9 August

2023.

Assuming the Share Authority Resolutions are passed and no other

issue of new Ordinary Shares takes place (i.e. following the

exercise of any existing options or warrants) prior to the AGM, on

Admission the total issued share capital of the Company with voting

rights will comprise 60,219,861 Ordinary Shares.

The Company does not hold any Ordinary Shares in treasury.

Therefore, on Admission, the above figure of 60,219,861 Ordinary

Shares may be used by shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the Financial

Conduct Authority's Disclosure, Guidance and Transparency

Rules.

Enquiries:

Edenville Energy Plc

Jason Brewer - Executive Director

Noel Lyons - CEO +254 (0)743 303075

Via IFC Advisory

Financial and Nominated Adviser

Strand Hanson Limited

James Harris | Richard Johnson +44 (0) 20 7409 3494

---------------------

Broker

Tavira Securities Limited

Oliver Stansfield | Jonathan

Evans +44 (0) 20 7100 5100

---------------------

Financial PR and IR

IFC Advisory Limited

Tim Metcalfe | Florence Chandler +44 (0) 20 3934 6630

---------------------

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR") and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOASSIFWUEDSEIW

(END) Dow Jones Newswires

July 10, 2023 02:00 ET (06:00 GMT)

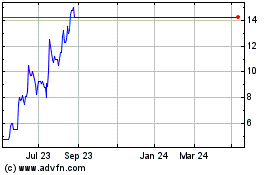

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Edenville Energy (LSE:EDL)

Historical Stock Chart

From Jan 2024 to Jan 2025