TIDMEMH

European Metals Holdings Limited

18 May 2023

18 May 2023

Reach

European Metals Holdings Limited

("European Metals" or the "Company")

Czech PM visits Cinovec, signs key MoC with PM of Saxony

Highlights:

- Czech Republic Prime Minister, Petr Fiala, visits the globally

significant Cinovec Lithium Project

- PM Fiala signs Memorandum of Cooperation ("MoC") with Prime

Minister Kretschmer of the German state of Saxony to enhance

cooperation on strategic projects, including Cinovec.

European Metals Holdings Limited ( ASX & AIM: EMH, OTCQX:

EMHXY, ERPNF and EMHLF ) is pleased to advise Czech Republic Prime

Minister, Petr Fiala, has visited the Cinovec Project, which is a

globally significant lithium deposit and also sought to expedite

the development of significant projects, such as Cinovec.

Prime Minister Fiala has commented on the Cinovec project via

social media , which translates to:

"Lithium is a critical and key raw material. Cínovec is the

largest European deposit of this raw material. Thanks to this, the

Czech Republic has a unique opportunity to contribute to both its

own and European raw material security.

"We are on the threshold of a "lithium revolution" as the use of

lithium will grow significantly. As a country with a large share of

the automotive industry, it is important for us to support it and

capture current trends.

"We are offered a unique chance to build the entire chain from

mining to the production of electric cars. That is why we need

lithium and we are trying to build a battery factory, the so-called

gigafactory."

Prime Minister Fiala also commented on the MoC via social media

, which translates to:

"I believe that this memorandum will help our cooperation on the

development of the lithium deposit in Cínovec and, in the future,

the creation of the entire production chain for the production of

batteries for cars."

Prime Minister Petr Fiala (Left) and Pavel Cyrani, ČEZ

Vice-Chairperson of the Board of Directors (Right) at the Cinovec

project.

Following a visit to Cinovec, Mr Fiala continued across the

Czech border to the nearby German city of Dresden, signing a

Memorandum of Cooperation ("MoC") on the implementation of projects

of strategic importance with Saxon Prime Minister Michael

Kretschmer.

The MoC strengthens cooperation between the states on raw

materials, energy and fuel security, with a particular emphasis on

lithium, given the strategic location of the Cinovec lithium

deposit on the Saxon-Czech border.

Prime Minister Fiala has continued to highlight the importance

of lithium development in the Czech Republic and it is anticipated

the MoC will further expedite the regulatory and development

pathway of Cinovec.

Commenting on the enhanced government support European Metals

Executive Chairman Keith Coughlan said:

"The recent visit by Prime Minister Fiala and the subsequent

Memorandum of Cooperation between the Czech Republic and the state

of Saxony are highly significant. These developments highlight the

strategic importance of our project to the region and to the

broader European Union. With increased recognition of the

importance of Cinovec, EMH anticipates further acceleration in

support throughout the project's development pathway."

This announcement has been approved for release by the CEO.

CONTACT

For further information on this update or the Company generally,

please visit our website at www.europeanmet.com or see full contact

details at the end of this release.

BACKGROUND INFORMATION ON CINOVEC

PROJECT OVERVIEW

Cinovec Lithium/Tin Project

Geomet s.r.o. controls the mineral exploration licenses awarded

by the Czech State over the Cinovec Lithium/Tin Project. Geomet has

been granted a preliminary mining permit by the Ministry of

Environment and the Ministry of Industry. The company is owned 49%

by EMH and 51% by CEZ a.s. through its wholly owned subsidiary,

SDAS. Cinovec hosts a globally significant hard rock lithium

deposit with a total Measured Mineral Resource of 53.3Mt at 0.48%

Li(2) O and 0.08% Sn, Indicated Mineral Resource of 360.2Mt at

0.44% Li(2) O and 0.05% Sn and an Inferred Mineral Resource of

294.7Mt at 0.39% Li(2) O and 0.05% Sn containing a combined 7.39

million tonnes Lithium Carbonate Equivalent and 335.1kt of tin (

refer to the Company's ASX release dated 13 October 2021) (Resource

Upgrade at Cinovec Lithium Project).

An initial Probable Ore Reserve of 34.5Mt at 0.65% Li(2) O and

0.09% Sn reported 4 July 2017 ( Cinovec Maiden Ore Reserve -

Further Information ) has been declared to cover the first 20 years

mining at an output of 22,500tpa of lithium carbonate ( refer to

the Company's ASX release dated 11 July 2018) ( Cinovec Production

Modelled to Increase to 22,500tpa of Lithium Carbonate ).

This makes Cinovec the largest hard rock lithium deposit in

Europe, the fifth largest non-brine deposit in the world and a

globally significant tin resource.

The deposit has previously had over 400,000 tonnes of ore mined

as a trial sub-level open stope underground mining operation.

On 19 January 2022, EMH provided an update to the 2019 PFS

Update, conducted by specialist independent consultants, which

indicates a post-tax NPV of USD1.938B and a post-tax IRR of 36.3%

and confirmed that the Cinovec Project is a potential low operating

cost producer of battery-grade lithium hydroxide or battery grade

lithium carbonate as markets demand. It confirmed the deposit is

amenable to bulk underground mining (refer to the Company's ASX

release dated 19 January 2022) ( PFS Update delivers outstanding

results ). Metallurgical test-work has produced both battery-grade

lithium hydroxide and battery-grade lithium carbonate in addition

to high-grade tin concentrate at excellent recoveries. Cinovec is

centrally located for European end-users and is well serviced by

infrastructure, with a sealed road adjacent to the deposit, rail

lines located 5 km north and 8 km south of the deposit, and an

active 22 kV transmission line running to the historic mine. As the

deposit lies in an active mining region, it has strong community

support.

The economic viability of Cinovec has been enhanced by the

recent strong increase in demand for lithium globally, and within

Europe specifically.

There are no other material changes to the original information

and all the material assumptions continue to apply to the

forecasts.

BACKGROUND INFORMATION ON CEZ

Headquartered in the Czech Republic, CEZ a.s. is an established,

integrated energy group with operations in a number of Central and

South-eastern European countries and Turkey. CEZ's core business is

the generation, distribution, trade in, and sales of electri city

and heat, trade in and sales of natural gas, and coal extraction.

CEZ Group is one of the ten largest energy companies in Europe, has

28,000 employees and annual revenue of approximately EUR 9.97

billion.

The largest shareholder of its parent company, CEZ a.s., is the

Czech Republic with a stake of approximately 70%. The shares of CEZ

a.s. are traded on the Prague and Warsaw stock exchanges and

included in the PX and WIG-CEE exchange indices. CEZ's market

capitalization is approximately EUR 17.7 billion.

As one of the leading Central European power companies, CEZ

intends to develop several projects in areas of energy storage and

battery manufacturing in the Czech Republic and in Central

Europe.

CEZ is also a market leader for E-mobility in the region and has

installed and operates a network of EV charging stations throughout

Czech Republic. The automotive industry in the Czech Republic is a

significant contributor to GDP, and the number of EV's in the

country is expected to grow significantly in the coming years.

ENQUIRIES:

European Metals Holdings Limited

Keith Coughlan, Executive Chairman Tel: +61 (0) 419 996 333

Email: keith@europeanmet.com

Kiran Morzaria, Non-Executive Director Tel: +44 (0) 20 7440 0647

Shannon Robinson, Company Secretary Tel: +61 (0) 418 675 845

Email: shannon@europeanmet.com

WH Ireland Ltd (Nomad & Broker)

James Joyce/Darshan Patel Tel: +44 (0) 20 7220 1666

(Corporate Finance)

Harry Ansell (Broking)

Panmure Gordon (UK) Limited (Joint

Broker) Tel: +44 (0) 20 7886 2500

John Prior

Hugh Rich

James Sinclair Ford

Harriette Johnson

Blytheweigh (Financial PR) Tel: +44 (0) 20 7138 3222

Tim Blythe

Megan Ray

Chapter 1 Advisors (Financial PR

- Aus) Tel: +61 (0) 433 112 936

David Tasker

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAEALSPFFXDEEA

(END) Dow Jones Newswires

May 18, 2023 02:00 ET (06:00 GMT)

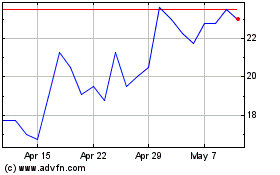

European Metals (LSE:EMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

European Metals (LSE:EMH)

Historical Stock Chart

From Apr 2023 to Apr 2024