TIDMENET

RNS Number : 0147T

Ethernity Networks Ltd

10 November 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse (amendment) (EU Exit) Regulations 2019/310

("MAR"). With the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

10 November 2023

Ethernity Networks Ltd

("Ethernity" or the "Company")

Update Regarding Subscription Agreement and TVR

Notice of General Meeting

Ethernity Networks Ltd (AIM: ENET; OTCMKTS: ENETF), a leading

supplier of networking processing semiconductor technology ported

on field programmable gate arrays for virtualised networking

appliances, announces the following update on the share

subscription agreement with 5G Innovation Leaders Fund LLC (the

"Subscriber"), details of which were announced on 25 February 2022

(the "Subscription Agreement").

On 24 October 2023, the Company announced that it was engaging

with the Subscriber to seek to come to an agreed position in

relation to the Subscription Agreement. The Company is pleased to

announce that it has now entered into a settlement deed with the

Subscriber (the "Agreement"), pursuant to which the Company will

issue a fixed number of shares to the Subscriber, terminate the

Subscription Agreement, and extinguish the Company's liability to

the Subscriber.

Pursuant to the Agreement, the Company will issue up to a

maximum of 150,000,000 new ordinary shares of NIS 0.001 each in the

Company ("Ordinary Shares") to the Subscriber (the "Settlement

Shares"). The Settlement Shares will be issued to the Subscriber in

tranches, subject to the restriction that the Subscriber cannot

hold an interest in more than 24.99% of the Company's issued share

capital from time to time.

T he Company has issued and allotted an initial 44,900,000

Ordinary Shares (the "Tranche 1 Shares"), conditional on their

admission to trading on AIM, pursuant to the Company's existing

share authorities. It will issue a further 43,600,000 Ordinary

Shares to the Subscriber on receipt of a notice from the

Subscriber, also pursuant to the Company's existing share

authorities. Subject to the Company receiving shareholder approval

for an increase in its headroom to allot shares free from

pre-emptive or other preferential rights or other rights or

restrictions, the Company will issue a further 61,500,000 new

Ordinary Shares (the "Conditional Subscription Shares") to the

Subscriber on receipt of subsequent notices. Out of the 61,500,000

Conditional Subscription Shares, 50,000,000 can be issued only

provided that the market price of an Ordinary Share exceeds 0.3p at

the time of issue. Ethernity will shortly be convening a general

meeting ("General Meeting") of the Company to seek shareholder

approval for an increase in its authorities to allot shares on a

non-preemptive basis.

Subject to the passing of the resolutions at the General

Meeting, the Subscriber will have until the thirtieth calendar day

after the date of the General Meeting to notify the Company to

issue the Settlement Shares in full (the "Issuance Notice Period").

Should the Subscriber not call the entire allotment of the

Settlement Shares during the Issuance Notice Period, the Company

will have no further obligation to the Subscriber at the end of the

Issuance Notice Period.

The entering into of the Agreement has been approved by the

Court in Lod in accordance with the requirements of the ongoing

temporary suspension of proceedings to which the Company is subject

("TSP") process. Pursuant to the Agreement, should the resolutions

not be passed at the General Meeting, the Company would have an

outstanding debt to the Subscriber of US$600,000 to reflect the

non-issue of the Conditional Subscription Shares. The Directors of

Ethernity believe that this debt could seriously adversely impact

the Company's ability to exit the TSP process and therefore

strongly recommends that shareholders vote in favour of the

resolutions at the General Meeting.

Notice of General Meeting

A circular convening the General Meeting of the Company, to be

held at 3rd Floor Beit Golan, 1 Golan St. Corner HaNegev, Airport

City 7019900, Israel at 11:00 a.m. IST (09:00 a.m. GMT) on 14

December 2023 will be posted to shareholders shortly and will be

made available on the Company's website at:

https://ethernitynet.com/investors/ .

As previously announced, in order to exit the TSP, it is

expected that the Company will be required to raise additional

funds. Whilst the structure of this is not yet known, the Board

believes it is prudent to put in place sufficient authorities to

permit an equity fundraising, should that be the required route.

The resolutions at the General Meeting are therefore seeking

sufficient headroom over and above those required to issue the

Conditional Subscription Shares. Should any fundraise takes place,

the Company will prioritise structures that would enable existing

shareholders to participate on the same terms as any incoming

investors.

Application for admission and total voting rights

Application has been made to the London Stock Exchange for the

Tranche 1 Shares to be admitted to trading on AIM ("Admission"),

and Admission is expected to occur on or around 14 November 2023.

The shares will, upon Admission, rank pari passu with the existing

Ordinary Shares of the Company.

Following Admission, the Company's enlarged issued share capital

will be 194,121,091 Ordinary Shares. The Company holds no Ordinary

Shares in Treasury. This figure of 194,121,091 Ordinary Shares may

be used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Holdings in Company

On Admission, the Tranche 1 Shares will represent 23.13% of the

Company's issued share capital as enlarged by the issue of those

shares. The Subscriber has confirmed to the Company that it

currently holds no Ordinary Shares. Therefore, its interest in the

Company's share capital following Admission will be 23.13% of the

Company's issued share capital.

For further information, please contact:

Ethernity Networks Ltd Tel: +972 8 915 0392

David Levi, Chief Executive Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0)20 3328

and Joint Broker) 5656

James Reeve / Piers Shimwell (Corporate

Finance)

Amrit Nahal / Stefano Aquilino (Sales

and Corporate Broking)

Peterhouse Capital Limited (Joint Broker) Tel: +44 (0)20 7562

0930

Lucy Williams / Duncan Vasey / Eran Zucker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDZMGMZLFGFZZ

(END) Dow Jones Newswires

November 10, 2023 02:00 ET (07:00 GMT)

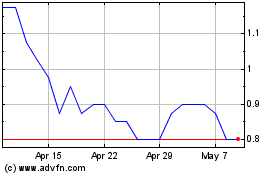

Ethernity Networks (LSE:ENET)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethernity Networks (LSE:ENET)

Historical Stock Chart

From Dec 2023 to Dec 2024