TIDMQIF

RNS Number : 4991F

Qatar Investment Fund PLC

12 November 2015

12 November 2015

Qatar Investment Fund plc

(the "Company")

2015 Annual General Meeting Results

Discontinuation Vote Rejected

The Board of Qatar Investment Fund plc (QIF.L) announces that at

the Annual General Meeting ("AGM") held today at 11.00 a.m., all

resolutions were duly passed on a poll with the exception of

Resolution 6 (the Discontinuation Vote as set out in the Company's

Articles of Association) which was rejected. The results are shown

below.

ORDINARY BUSINESS

Resolution 1

The Report of the Investment Manager and Investment Adviser,

Report of the Directors, Directors' Remuneration Report, Auditors'

Report and the Audited Consolidated Financial Statements of the

Company for the year end to 30 June 2015 be approved with

115,663,008 votes cast in favour, nil votes cast against and 3,207

abstentions.

Resolution 2

The final dividend of USD 4.0 cents per ordinary share for the

year ended 30 June 2015 was approved with 115,663,008 votes cast in

favour, nil votes cast against and 3,207 abstentions.

Resolution 3

KPMG Audit LLC Isle of Man was re-appointed as auditor of the

Company for the year ending 30 June 2016 with 112,839,932 votes

cast in favour, 2,823,076 votes cast against and 3,207

abstentions.

Resolution 4

Mr Leonard O'Brien who retires in accordance with the corporate

governance codes adopted by the Nomination Committee of the Company

be re-elected a director of the Company with 111,661,533 votes cast

in favour, 2,679,019 votes cast against and 1,325,663

abstentions.

SPECIAL BUSINESS

Resolution 5

The Company generally and unconditionally be authorised to make

market purchases of ordinary shares of US$0.01 each provided that:

(a) the maximum aggregate number of ordinary shares that may be

purchased is 20,720,084 (being the equivalent of 14.99% of the

Company's issued share capital at the date of this notice); (b) the

minimum price (excluding expenses) which may be paid for each

ordinary share is US$0.01 being the nominal value per ordinary

share; (c) the maximum price (excluding expenses) which may be paid

for each ordinary share is the higher of: (i) 105 per cent of the

average market value of an ordinary share in the Company for the

five business days prior to the day the purchase is made; and (ii)

the value of an ordinary share calculated on the basis of the

higher of the price quoted for (I) the last independent trade of

and (II) the highest current independent bid for, any number of the

Company's ordinary shares on the trading venue where the purchase

is carried out; and (d) the authority conferred by this resolution

shall expire on 12 November 2016 or, if earlier, at the conclusion

of the Company's next annual general meeting save that the Company

may, before the expiry of the authority granted by this resolution,

enter into a contract to purchase ordinary shares which will or may

be executed wholly or partly after the expiry of such authority.

All Shares purchased pursuant to the above authority shall be

either: (i) held, sold, transferred or otherwise dealt with as

treasury shares; or (ii) cancelled immediately upon completion of

the purchase, with 112,983,989 votes cast in favour, 2,679,019

votes cast against and 3,207 abstentions.

Resolution 6

Pursuant to Article 162 of the Articles of Association, the

Directors proposed that the Company ceases to continue in

existence.

The resolution was not passed, with 7,949,935 votes cast in

favour, 107,713,073 votes cast against and 3,207 abstentions.

Resolution 7

The rights of holders of equity securities in the Company to

receive a pre-emptive offer of equity securities pursuant to

Article 5A.2 of the Company Articles of Association shall be and is

hereby excluded in respect of 13,822,604 Ordinary shares, this

exclusion to expire immediately prior to the annual general meeting

of the Company to be held in 2016, was approved with 111,517,476

votes cast in favour, 2,733,775 votes cast against and 1,414,964

abstentions.

A copy of resolutions 5, 6 and 7 will be submitted to the

National Storage Mechanism and will be available for inspection at:

www.hemscott.com/nsm.do.

The total number of votes cast was 115,663,008 which represents

84% of the Company's total voting rights.

Nick Wilson, Chairman of the Company, said:

"We are pleased with the support that shareholders have shown in

the vote against discontinuation. As a result the fund will

continue to provide investors with exposure to the powerful growth

prospects offered by Qatar; and we will strive to deliver

investment performance ahead of the Qatar stockmarket."

For further information:

Qatar Investment Fund plc +44 (0) 1624 622 851

Nick Wilson

Panmure Gordon +44 (0) 20 7886 2500

Richard Gray / Andrew Potts

Maitland +44 (0) 20 7379 5151

William Clutterbuck / Cebuan Bliss

Galileo Fund Services Limited +44 (0) 1624 692 600

Ian Dungate / Suzanne Jones

This information is provided by RNS

The company news service from the London Stock Exchange

END

RAGEAFFAFAFSFFF

(END) Dow Jones Newswires

November 12, 2015 06:32 ET (11:32 GMT)

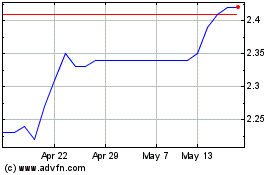

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

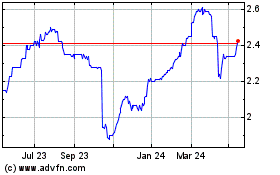

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Nov 2023 to Nov 2024