Getting Personal Data Right Gets Expensive -- WSJ

May 26 2018 - 2:02AM

Dow Jones News

By Nina Trentmann

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 26, 2018).

Companies are spending millions on their security infrastructure

ahead of new European data protection rules, but some worry that

the law's lack of clear technical guidelines may mean that these

steps aren't enough.

The EU's General Data Protection Regulation, or GDPR, aims to

safeguard data-privacy rights by requiring companies to get consent

before using personal data and requiring them to store it safely.

The law, which goes into effect on Friday, also forces firms to

report a security breach within 72 hours and penalizes

noncompliance with hefty fines.

One of the challenges for executives is that the legislation

doesn't specify how regulators will assess compliance, making it

difficult for companies to decide if they have made sufficient

changes to their data policies or invested enough in upgrading

their systems.

German sportswear maker Adidas AG, U.K. recruiting firm Hays PLC

and French building materials maker Compagnie de Saint-Gobain SA

are among the firms wrangling investments to comply with the new

laws. Around 60% of companies surveyed by PricewaterhouseCoopers

LLP in the fall of 2017 said they would spend more than $1 million

on preparing for GDPR, while 12% reported allocating more than $10

million. PwC questioned 300 executives at U.S., U.K. and Japanese

firms with a presence in Europe.

Adidas' digital presence, whether on its online storefront or on

social-media platforms such as Facebook Inc.'s Instagram, is key to

building a stronger relationship with consumers, said finance chief

Harm Ohlmeyer. The company began making changes to comply with GDPR

in 2016. The shoe maker, which already records personal data such

as names, partial credit card details and addresses from customers

who buy goods on its website, plans to sell more products directly

through its own online retail channels; potentially resulting in

more personal data held by the company.

"You cannot spend enough to protect yourself," Mr. Ohlmeyer

said, declining to provide a figure for the company's GDPR budget.

"We have been taking it very seriously," Mr. Ohlmeyer said.

Forrester Research Inc., a research company, said it had

anecdotal evidence that large firms allocate on average $20 million

to $25 million to become GDPR-compliant, while smaller companies

budget $4 to $5 million.

At Saint-Gobain, the French building-materials maker, the cost

of becoming GDPR-compliant was "significant," according to Claude

Imauven, its chief operating officer.

Saint-Gobain introduced a new data-privacy management platform,

overhauled its data-processing procedures and held training

sessions for employees, Mr. Imauven said.

The company also deployed 400 so-called privacy correspondents

to ensure that data is handled correctly. The company forecasts

"additional ongoing costs" because of GDPR, the COO said.

Companies must maintain an updated record of all the EU-based

personal information they collect, and incorporate privacy and

data-protection controls into their system design. Standard clauses

in contracts and other legal documents need to be rewritten, adding

to the administrative burden.

Firms have to respond to individual data requests in a timely

manner, requiring some of them to hire additional employees, said

Russell Marsh, a managing director at Accenture PLC.

Recruiter Hays spent between GBP2 million ($2.7 million) and

GBP3 million to become compliant, said Chief Financial Officer Paul

Venables. The recruiter started making changes about a year ago to

account for how it would handle the more than 10 million individual

résumés on file.

"We had to go through our database and sort out those candidates

we didn't have meaningful exchange with in the past two years," Mr.

Venables said.

The stakes for getting it right are high. Companies which fail

to report breaches face a fine of up to 2% of global annual revenue

or EUR10 million ($11.7 million), whichever is higher. Firms that

process personal data without consent could be fined up to 4% of

annual revenue or EUR20 million, whichever is higher.

"It is really hard for companies to forecast how much they

should budget for this," said Laura Jehl, a partner at Baker &

Hostetler LLP. Some of her clients up until a few weeks ago didn't

have a budget for GDPR, she said

Making sure that third-party suppliers conform to GDPR adds

another layer of complexity. "We have seen companies ask their

business partners and suppliers to demonstrate their GDPR

practices," said Enza Iannopollo, a security and risk analyst at

Forrester.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

May 26, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

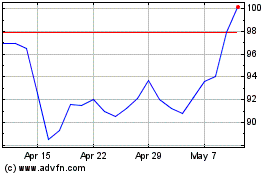

Hays (LSE:HAS)

Historical Stock Chart

From Apr 2024 to May 2024

Hays (LSE:HAS)

Historical Stock Chart

From May 2023 to May 2024