RNS Number:1548N

Dart Group PLC

15 November 2001

FOR IMMEDIATE RELEASE 15 November 2001

DART GROUP PLC

Interim Results for the Six Months Ended 30 September 2001

Dart Group PLC, the distribution and aviation services group, announces its

interim results for the six months ended 30 September 2001.

CHAIRMAN'S STATEMENT

I am pleased to report on the Group's trading for the six months ended 30

September 2001. Profit before tax, and before the amortisation of goodwill,

has risen to #5.2m (2000: #4.9m) on turnover of #99.2m (2000: #94.4m).

Earnings per share, before the amortisation of goodwill, were 10.38p (2000:

9.91p). Net borrowings have increased to #22.8m (31 March 2001: #2.3m).

This increase has primarily arisen as a result of new loans taken out to

finance the purchase of two Boeing 737-300QC aircraft. Gearing at 30

September 2001 was 70% (31 March 2001: 8%)

The Board has declared an increased interim dividend of 1.85p per share

(2000: 1.8p). The dividend will be paid on 4 January 2002 to shareholders

on the register as at 23 November 2001.

Whilst not directly affected by the events of 11 September, Group companies

are experiencing tighter trading conditions and our cargo airline, Channel

Express (Air Services), higher insurance costs. The second half of the

financial year will, therefore, be challenging but we remain optimistic that

the Group will continue to successfully develop its Distribution and Aviation

Services' activities.

Distribution

The Dart Distribution companies, Coolchain, Fowler Welch and Channel Express

(CI) provide specialist road distribution services to fresh produce,

horticulture and chilled and frozen food suppliers that serve the UK's leading

supermarkets and wholesale markets throughout the country. The companies also

provide a range of value-adding services such as sorting, grading, pre-packing

and storage of fresh produce and horticultural products. They operate through

a network of regional consolidation and distribution centres strategically

sited in the country's main producing and importing areas. Dutch subsidiary,

Fowler Welch BV, based close to the ports of Rotterdam and the Hook of

Holland, principally serves the dynamic Dutch horticultural industry that

supplies leading UK retailers.

There is no doubt that the wet winter, the less buoyant economy and the

national foot and mouth epidemic brought immense problems to the countryside

in general. This affected both the supply of and, through the downturn in

the number of visitors to this country, the demand for fresh produce.

Consequently, the volumes distributed by our business resulted in lower

growth than expected in the first half, however, operating costs have been

carefully managed to mitigate this situation as far as possible.

Predictably, the division's retail customers continue to seek efficiencies and

economies in their supply chains and so, our management co-operates closely

with them to continually develop cost-effective services and seek new business

opportunities. As a result, in Kent, Coolchain recently won additional

pre-packing work on behalf of a major fresh produce supplier, and in

Lincolnshire, Fowler Welch is commissioning a new national distribution

initiative for horticultural products on behalf of a major supermarket. New

business is also being won in the chilled and frozen sectors.

The Dart Distribution companies are particularly focusing their attention on

network efficiencies that will result from the integration of the individual

companies' transport operations. Significantly, the first phase of the

division's new single operating IT system was successfully implemented on

time when Coolchain's Portsmouth and Southampton operations went live. The

roll-out programme continues throughout the division's consolidation centres

and full implementation is on target for June 2002. Traffic managers will

then, for the first time, have on-line visibility across the division's

entire vehicle fleet which will lead to the greatly improved co-ordination and

utilisation of operating resources.

Dart Distribution is the country's leading distributor of fresh produce and

horticultural products and is well-positioned to take advantage of both the

continued growth and consequent commercial opportunities in the sector. The

Group's policy remains to grow the division both organically and through

carefully selected acquisitions.

Aviation Services

The companies within this division are Channel Express (Air Services), which

operates a fleet of 15 freighter aircraft on behalf of express parcel

companies, postal authorities, freight forwarders and other airlines, and

Benair Freight International, which manages international freight movements on

behalf of a wide customer base.

In June and August of this year, Channel Express (Air Services) commenced

operating two Boeing 737-300 "Quick Change" aircraft replacing two of the

company's Lockheed Electras which have been retired. The two Boeing

737-300s, based at Stansted and Edinburgh airports, operate night mail

flights on behalf of Consignia plc and day-time passenger charters for a

varied customer base, which includes orchestras, football teams and their

supporters, incentive groups and conferences. The Quick Change concept

allows the interior of the aircraft to be changed between freighter and

passenger roles in less than 45 minutes and significantly widens the company's

potential customer base.

The company's Airbus A300 "Eurofreighters" and Fokker F27s are fully

contracted to the delivery of overnight express parcels, newspapers and mail

and supplement their income with additional charters, often to meet the

just-in-time delivery needs of vehicle and other manufacturers. In the

present economic climate, our customers' careful control of costs is limiting

the amount of additional charter revenue, whilst at the same time the company

has incurred increased insurance costs post 11 September. However, we

remain optimistic that the air cargo market will maintain its traditional

year-on-year growth as global economic confidence resumes. Therefore,

although naturally cautious in the current economic and political climate, the

Group intends to increase the Boeing 737-300 fleet as its business for the

type develops.

Channel Express Parts Trading, the company's aircraft parts business, has had

a successful half year. The company has dismantled a further two A300

aircraft for their parts and continues to support both the Group's own

aircraft and those of its many other customers. Parts Trading is also

developing its capability to market and deal in parts for the Boeing 737

series in line with the Group's acquisition of that type.

Benair Freight International has had an encouraging six months trading. The

company's offices in London, Manchester, East Midlands and Newcastle, together

with the wholly-owned Singapore business are each generating increased levels

of business and the specialist ornamental fish business continues to grow.

Outlook

Finally, I am pleased to report that trading during the second half of the

year continues satisfactorily.

Philip Meeson,

Chairman 15 November 2001

For further information on Dart Group PLC and its subsidiary companies please

visit our website, www.dartgroup.co.uk

UNAUDITED INTERIM CONSOLIDATED RESULTS

for the half year to 30 September 2001

Half year Half year

to to Year to

30 September 30 September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

Turnover - continuing operations 1 99,225 94,407 190,912

Net operating expenses, excluding

amortisation of goodwill (93,323) (89,212) (180,630)

Amortisation of goodwill (248) (248) (497)

Net operating expenses (93,571) (89,460) (181,127)

Operating profit - continuing operations 5,654 4,947 9,785

(Loss)/Profit on disposal of fixed (13) 42 18

assets

Net interest payable (680) (292) (592)

Profit on ordinary activities before 4,961 4,697 9,211

taxation

Taxation (1,657) (1,564) (3,085)

Profit on ordinary activities after 3,304 3,133 6,126

taxation

Dividends (633) (614) (2,040)

Retained profit for the period 2,671 2,519 4,086

Earnings per share

- basic 9.65p 9.19p 17.94p

- basic, excluding the amortisation of 10.38p 9.91p 19.40p

goodwill

- diluted 9.55p 9.10p 17.77p

Dividend per share 1.85p 1.80p 5.96p

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Half year Half year

to to Year to

30 September 30 September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Profit on ordinary activities after 3,304 3,133 6,126

taxation

Foreign exchange gain on foreign

equity investments 6 21 33

Total gains and losses recognised in the 3,310 3,154 6,159

period

CONSOLIDATED BALANCE SHEET

at 30 September 2001

30 September 31 March

2001 2001

(unaudited) (audited)

Note #'000 #'000

Fixed assets

Intangible assets 9,023 9,271

Tangible assets 51,637 41,534

Investments 59 59

60,719 50,864

Current assets

Stock 2,943 1,756

Debtors 31,463 29,965

Cash at bank and in hand 3,178 7,061

37,584 38,782

Current liabilities

Creditors: amounts falling due

within one year (39,313) (49,301)

Net current liabilities (1,729) (10,519)

Total assets less current liabilities 58,990 40,345

Creditors: amounts falling due after

more than one year (20,930) (6,790)

Provision for liabilities and charges (5,335) (3,569)

(26,265) (10,359)

32,725 29,986

Capital and reserves

Called up share capital 1,713 1,710

Share premium account 7,610 7,551

Profit and loss account 2 23,402 20,725

Shareholders' funds - equity interests 32,725 29,986

CONSOLIDATED CASH FLOW STATEMENT

for the half year to 30 September 2001

Half year Half year

to to

30 30 Year to

September September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

Net cash inflow from operating 3 10,640 13,355 24,909

activities

Returns on investment and

servicing of finance

Interest paid: bank and other loans (697) (472) (832)

Interest element of finance lease rental (13) (20) (44)

payments

Interest received: bank 30 200 284

(680) (292) (592)

Taxation

Corporation tax paid (1,016) (252) (2,089)

Capital expenditure and financial

investment

Purchase of tangible fixed assets (28,456) (7,462) (13,620)

Disposal of tangible fixed assets 397 528 743

(28,059) (6,934) (12,877)

Equity dividends paid (1,422) (1,179) (1,798)

Cash (outflow)/ inflow before financing (20,537) 4,698 7,553

Financing

Share capital issued 62 68 120

Other loans repaid (1,698) (3,374) (7,583)

Bank loans repaid (174) (173) (346)

Other loans advanced 18,595 - -

Finance lease capital (131) (176) (338)

16,654 (3,655) (8,147)

(Decrease)/Increase in cash in the (3,883) 1,043 (594)

period

NOTES TO THE INTERIM RESULTS

at 30 September 2001

1. Turnover

Half year to Half year to Year to

30 September 30 September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Distribution 61,676 57,815 116,065

Aviation Services 37,549 36,592 74,847

99,225 94,407 190,912

Turnover arising within:

The United Kingdom and the Channel 96,238 91,841 185,931

Islands

Mainland Europe 2,236 1,836 3,300

The Far East 751 730 1,681

99,225 94,407 190,912

Analyses of profit before taxation and net assets between the different segments

of the Group are not given as, in the opinion of the directors, such analyses

would be seriously prejudicial to the commercial interests of the Group.

2. Profit and loss account

Half year to Year to

30 September 31 March

2001 2001

(unaudited) (audited)

#'000 #'000

Balance at the beginning of the period 20,725 16,606

Retained profit for the period 2,671 4,086

Currency translation differences 6 33

23,402 20,725

3. Reconciliation of operating profit to net cash flow from

operating activities

Half year to Half year to Year to

30 September 30 September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Operating profit 5,654 4,947 9,785

Depreciation 6,658 7,548 14,690

Amortisation of goodwill 248 248 497

(Increase)/decrease in stock (1,187) (243) 17

Increase in debtors (1,497) (4,712) (4,776)

Increase in creditors 758 5,546 4,663

Exchange differences 6 21 33

10,640 13,355 24,909

NOTES TO THE INTERIM RESULTS

at 30 September 2001

4. Reconciliation of net cash flow to movement in net debt

Half year Half year

to to

30 30 Year to

September September 31 March

2001 2000 2001

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

(Decrease)/increase in cash in the period (3,883) 1,043 (594)

Cash (inflow)/outflow from (increase)/

decrease

in net debt in the period (16,592) 3,723 8,267

Change in net debt in the period (20,475) 4,766 7,673

Net debt at 1 April (2,326) (9,999) (9,999)

Net debt at end of period (22,801) (5,233) (2,326)

5. Other matters

The financial information for the year to 31 March 2001 does

not constitute statutory accounts, as defined in Section 240 of the Companies

Act 1985, but is based on the statutory accounts for the year then ended.

Those accounts, upon which the auditors issued an unqualified opinion, have

been delivered to the Registrar of Companies.

The accounts to 30 September 2001 have been prepared using

accounting policies consistent with those adopted for the year to 31 March

2001.

Basic earnings per share has been calculated by reference to

earnings of #3,304,000 (2000 : #3,133,000) and a weighted average number of

ordinary shares in issue of 34,221,983 (2000:34,111,600).

This report is being sent to all shareholders and copies are

available from the Company Secretary at the registered office of the Company,

Building 470, Bournemouth International Airport, Christchurch, Dorset, BH23

6SE.

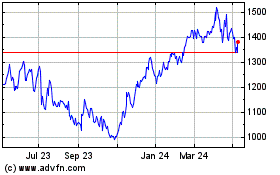

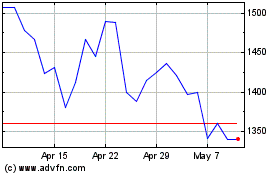

Jet2 (LSE:JET2)

Historical Stock Chart

From Jul 2024 to Aug 2024

Jet2 (LSE:JET2)

Historical Stock Chart

From Aug 2023 to Aug 2024