TIDMKEFI

RNS Number : 6775A

Kefi Gold and Copper PLC

24 January 2024

24 January 2024

KEFI Gold and Copper plc

("KEFI" or the "Company")

Q4 2023 Quarterly Operational Update

Ethiopia - Tulu Kapi Gold progressing towards launch

Saudi Arabia - Jibal Qutman Gold development scenarios being

reviewed, Hawiah - development studies progress, regional

exploration progress

KEFI (AIM: KEFI), the gold and copper exploration and

development company, has focused on the Arabian-Nubian Shield since

2008, assembling a pipeline of projects in the Kingdom of Saudi

Arabia and in the Federal Democratic Republic of Ethiopia, with the

most advanced being the shovel-ready, high-grade Tulu Kapi Gold

Project ("Tulu Kapi") in Ethiopia which is being prepared for its

launch.

We are pleased to provide this operational update covering the

three months to 31 December 2023 and more recent developments. This

update encompasses the activities of the Company, as well as wholly

owned KEFI Minerals (Ethiopia) Ltd ("KME"), majority-owned Tulu

Kapi Gold Mines Share Company ("TKGM") in Ethiopia, and

minority-owned Gold & Minerals Ltd ("GMCO") in Saudi Arabia

.

ETHIOPIA

Tulu Kapi Gold Project (currently 95%-owned but planned to

reduce to c.70% at finance closing)

The three critical conditions precedent for project financing

and launch, all requiring government regulatory confirmations, were

achieved by October 2023:

-- Central bank exemptions from exchange and capital controls, announced in October 2023;

-- Government security protection for strategic mining projects, announced earlier in 2023; and

-- Finance Ministry approval of country membership for AFC, announced earlier in 2023

Conditional final Credit Committee approval by the lead lender

has been granted, as announced on 10 January 2024, following the

Ethiopian Government's commitment to reinforce security protection

as requested at stakeholder workshops in early December 2023.

Detailed definitive agreements for the project financing are in

near-final form with contractors, equity investors and government

agencies. Those for the lenders have also been drafted, but await

credit committee approval by the co-lender before finalisation.

Independent confirmation was received of compliance with

international banking standards with regard to:

-- updated technical due diligence; and

-- appropriate preparations to date as regards security

As previously reported (see Q3 2023 Operational Update announced

on 31 October 2023), to facilitate equity investor analyses (as

compared with the lender-dominated analyses regularly reported in

respect of the open-pit), the financial projections were updated to

reflect the Company's business plan:

-- Development of the underground deposit so that it begins to

contribute to production as from Production Year 3;

-- Processing of the low-grade stockpiles at end of mine life;

-- Equity analysts' consensus long-term gold prices (as per

Standard and Poor's) now at US$1,862/oz;

-- Lifting the process rate by 20% to c, 2.4Mtpa; and

-- The intention to refinance the debt package with conventional

corporate finance during the third year of production, at which

point the more expensive components of start-up finance would be

repaid.

The summary metrics are tabulated below and will be further

refined during construction at Tulu Kapi alongside in-fill grade

control drilling for the open pit and some deep-drilling of the

underground resource, the last drill-hole in which was 90m at c.3

grammes per tonne gold.

Gold Price Gold Price

US$1,862/oz US$2,020/oz

NPV, IRR & Valuation

Leveraged IRR @ construction start 36% 43%

Leveraged NPV8% @ construction start US$288.6m US$377.4m

Leveraged NPV8% @ production start US$480.4m US$588.0m

EBITDA (average of first three production years) US$166.8m US$192.3m

Enterprise valuation @ 3.5x EBITDA US$583.6m US$673.1m

Cash Cost Metrics

AISC (US$/oz) US$908 US$919

AIC (US$/oz) US$1,138 US$1,149

Breakeven cost (inc everything e.g. debt repayment, US$1,239 US$1,282

taxes etc) - US$/oz

Cash Balances & Inventory

Cash built up in TK over life of mine US$667.9m US$812.4m

Cash at bank in TKGM at end of year three US$72.4m US$94.8m

US$ gold content of ore on hand at end of production US$51.4m US$55.7m

year three

Footnote: These metrics reflect initial modest contribution from

the underground mine, based on current indicated resources. As the

orebody remains open, the finalised plans will in due course

reflect a higher expected contribution from the underground mine.

in addition, we exclude herein the possibility of any contribution

from the satellite prospects that require follow-up

exploration.

SAUDI ARABIA (25% owned GMCO joint venture)

Jibal Qutman Gold and Hawiah Copper-Gold Development

Projects

These two discoveries are undergoing Feasibility Studies for

development, targeting commitments in 2024 and 2026

respectively.

Progress continued during Q4 2023:

-- Drilling programmes (drilling to date is 81,000m at Jibal

Qutman and 101,000m at Hawiah ), to date focused primarily on

establishing and upgrading Mineral Resource and declaring maiden

Ore Reserves. Today the GMCO board is focused on selection of the

preferred development plans.

-- A comprehensive exploration update (previous update was

announced 6 September 2023) is being assembled for publication

shortly;

-- Metallurgical testing for selection of preferred process flowsheet;

-- Geotechnical and hydrological drilling programmes for mine planning;

-- Initial mine planning;

-- Environmental and social responsibility plans for permitting;

-- Trenching programme over the planned locations for

infrastructure to ensure no mineralisation;

-- Evaluation water source alternatives;

-- Electricity cost optimisation studies;

-- Costings of capex and opex; and

-- Completion of the initial accommodation and works compound at site.

KEFI GROUP

Group Development Plan

-- The planned KEFI project development sequencing remains as follows:

o We have triggered the staged launch of the Tulu Kapi open-pit

development in Ethiopia for build-up to full construction during

H1-2024, starting commissioning eighteen months later and full

production mid-2026;

Then

o H2-2024 launch Jibal Qutman open-pit development in Saudi

Arabia based on 2023/24 reserves and resources and targeting first

production 2026;

Then

o 2026 launch of the Hawiah development in Saudi Arabia for

first production to follow that in Tulu Kapi and Jibal Qutman;

And then

o Launch of underground mine development at Tulu Kapi.

Group Metrics

Aggregate Mineral Resources across all three projects are 4.7

million ounces of gold-equivalent in-situ, of which KEFI's

beneficial interest is 2.0 million ounces.

Aggregate annual production from the three advanced projects is

currently projected at 340,000 ounces of gold-equivalent, of which

149,000 ounces is KEFI's beneficial interest, over an initial

seven-year period.

The Tulu Kapi open pit is already bankable with a 1 million

ounce Ore Reserve. Combined with the first preliminary planned

250,000 ounce minable resource contribution from the underground

mine. Tulu Kapi open pit is planned to produce c.144,000 ounces

gold per annum at start-up throughput rate. By lifting

process-plant throughput by 20% to 2.4 million tonnes per annum and

feeding in the underground and low-grade stockpiles, production

would be c.165,000 ounces gold per annum at an All-In-Sustaining

Costs of c.US$908 per ounce, assuming a gold price of US$1,862/oz.

At those same prices, this provides Net Operating Cash Flow of

US$141 million per annum (100% basis) for the first seven full

years of production.

Group Working Capital

The Company working capital requirements are currently being met

through:

-- ARTAR funding KEFI's GMCO joint venture contributions whilst

we optimise plans for our first development at Jibal Qutman by mid

2024. We currently owe c. GBP3.5 million to ARTAR and intend to

settle the amount owing in due course rather than be further

diluted in the GMCO Joint Venture.

-- Unsecured advances being provided by a UK-based lender, for

general working capital, as implemented regularly in recent years.

As of December 31, 2023, the advanced amount stood at GBP1.5

million.

Group Exploration Project Pipeline

Ethiopia Project Pipeline

Regional exploration: subsidiary KME lodged applications for

exploration licences over other areas in Ethiopia prospective for

gold, base metals and lithium.

In addition, we have commenced administrative proceedings in

respect of our long-standing proximal Exploration Licenses ("ELs")

surrounding the Tulu Kapi Project Mining Licence area, in order to

continue exploration programmes and community development which

have always complemented the Tulu Kapi project. During an overhaul

of the title-regulatory system in 2022, these ELs were over-pegged

by a Hong Kong shell company owned by a British Virgin Islands

shell company. We are confident that this situation can be resolved

satisfactorily.

Saudi Project Pipeline

Following the expansion of GMCO's exploration portfolio covering

four project areas of more than 1,000km(2) , regional exploration

teams have mobilised to the new ELs. As was the case at Jibal

Qutman and Hawiah, many of these ELs have abundant evidence of

historical workings and surface expression of mineralisation.

Corporate Presentation

KEFI will be presenting at 121 Mining Investment Cape Town,

South Africa, on 5 February 2024. The presentation to be delivered

is available on the Company's website:

https://www.kefi-goldandcopper.com .

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Executive Chairman) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

3PPB LLC (Institutional IR)

Patrick Chidley +1 (917) 991 7701

Paul Durham + 1-203-940-2538

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBIGDBDBDDGSX

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

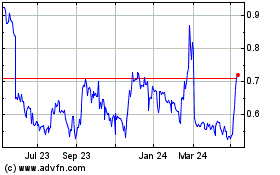

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

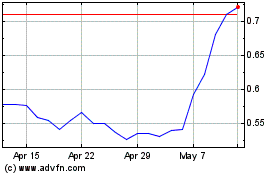

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2023 to Dec 2024