Kelso Group Holdings PLC Angling Direct Plc new investment (9746U)

November 29 2023 - 1:00AM

UK Regulatory

TIDMKLSO

RNS Number : 9746U

Kelso Group Holdings PLC

29 November 2023

Kelso Group Holdings Plc ("Kelso" or the "Company")

Angling Direct Plc new investment

Mello conference

Kelso, the main market listed investment company, is pleased to

announce that it will be speaking on Thursday 30 November at the

Mello conference at the Clayton Hotel Chiswick, Chiswick High Road,

London, W4 5RY Chiswick, where the Company will be outlining its

views on current market conditions and its investment case.

In the year to date over 30 companies, with a market

capitalisation between GBP50 million and GBP1 billion have exited

the UK market via acquisition to trade or private equity, in many

cases yielding high exit premiums. This highlights the current low

valuations and the short-term opportunity for investors, but if the

lack of investor interest in UK listed companies is unabated, we

see this trend continuing. Kelso will benefit from this current

extreme under-valuation but, as a strong supporter of the UK listed

market, believes there will continue to be attractive investment

opportunities for the medium term, particularly at the smaller end

of the market.

New investment in Angling Direct Plc ("Angling")

Kelso is pleased to announce that it purchased 2.32 million

ordinary shares in Angling, at an average price of 35.1p,

representing 3.0% of the total issued share capital in the

company.

Angling is the largest specialist fishing retailer in the UK

with an estimated UK market share of 12%, according to the company,

being approximately 8x larger than any other UK competitor. From

IPO in 2017 to today, Angling has grown its stores from 15 to 46,

with revenue growth from GBP21 million 1 to GBP83 million 1

expected for the year ending January 2024, with EBITDA growth from

GBP0.8 million 1 to an expected GBP2.7 million 1 . Despite the fact

that revenue is expected to have grown 4x since IPO and EBITDA is

expected to grow c.2.4x to the current year end, Angling's current

share price of 40p is less than two thirds of the issue price of

64p. Its current market cap, of which c.60% (GBP17.6m) is in net

cash, is almost exactly the same market cap as on IPO, and lower

than the capital raised since IPO. Angling has also grown their

online revenue to c.40% of total revenue creating an effective omni

channel distribution model. Angling is currently trading on a 5.0x

EV/EBITDA to January 2024 (pre IFRS 16) and 4.2x for the following

year to January 2025 (pre IFRS 16).

At IPO Current

Number of stores 15 46

Share price (pence) 64 40

N umber of issued shares

(million) 42 .8 77.3

Market cap (GBPm) 27.4 31.0

Capital raised (GBPm) 7.5 33.0

Revenue (GBPm) 1 21.0 83.0

EBITDA (GBPm) 1 Pre-IFRS 0.8 2.7

Net (debt)/cash 2 Pre-IFRS (1.4) 17.6

EV Pre-IFRS 28.8 13.4

EV/EBITDA 1 Pre-IFRS 36.0x 5.0x

1 At IPO: year ended 31 January 2017, Current: year ending 31

January 2023

2 At IPO: as at 31 January 2017, Current: as at 31 July 2023

Since IPO, Angling has successfully grown its portfolio and

there continues to be significant opportunity for Angling to grow

its UK business towards 20% of the UK market. The European business

is early stage and approaching break-even; despite Europe being a

potential opportunity, the commitment to this part of the business,

particularly given its own shares trade on such a low multiple,

needs to be reviewed before further significant capital

investment.

Kelso also believes that Angling has surplus capital and that

some of the GBP17.6 million of net cash, being c.60% of the market

cap, should be used to buy back a portion of its equity whilst the

shares are at or close to the current level.

John Goold commented:

"Kelso is delighted to become a small shareholder in Angling

Direct whilst acknowledging that the top 4 holders control 66% of

the company. Given the potential growth of the business and current

low valuation, a sustained investor relations strategy along with a

buy back would, in our view, significantly enhance value for

shareholders."

For further information please contact:

Kelso Group Holdings plc +44 (0) 75 4033 3933

John Goold, Chief Executive Officer

Mark Kirkland, Chief Financial Officer

Jamie Brooke, Chief Investment Officer

Zeus (Broker) +44 (0) 20 3829 5000

Nick Cowles, Ed Beddows (Investment Banking)

Ben Robertson (Corporate Broking)

About Kelso

Kelso was established in 2022 to identify, engage and unlock

trapped value in the UK stock market. Kelso's strategy is to invest

in situations where there is an anomaly between the intrinsic value

and prospects of a company and its stock market valuation. Kelso

will, in particular, look for situations where it believes the sum

of the parts of a business is greater than the current value.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFEWFUAEDSELF

(END) Dow Jones Newswires

November 29, 2023 02:00 ET (07:00 GMT)

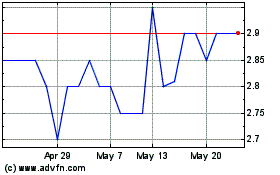

Kelso (LSE:KLSO)

Historical Stock Chart

From Feb 2025 to Mar 2025

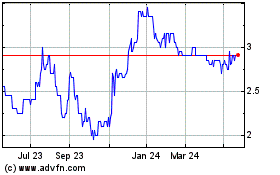

Kelso (LSE:KLSO)

Historical Stock Chart

From Mar 2024 to Mar 2025