TIDMLEX

RNS Number : 7219L

Lexington Gold Limited

07 September 2023

7 September 2023

Lexington Gold Ltd

("Lexington Gold" or the "Company")

Completion of Acquisition of White Rivers Exploration (Pty)

Ltd,

Issue of Equity, Additional Subscription

and Total Voting Rights

Lexington Gold (AIM: LEX), the gold exploration and development

company, further to its announcement of 15 May 2023 and associated

circular to shareholders published on 2 June 2023, is pleased to

announce, inter alia, the completion of its acquisition of White

Rivers Exploration Proprietary Limited ("WRE"), an exploration and

development company with significant gold assets in South

Africa.

Accordingly, WRE has now exited its business rescue process with

no creditors other than the Lexington Gold group, and the Company,

through its wholly owned subsidiary Lexington Gold South Africa

Proprietary Limited, is now the sole shareholder of WRE, with a 26

per cent. interest in WRE to be issued to Lexington Gold's

Broad-Based Black Economic Empowerment ("BBBEE") partners in due

course which will reduce Lexington Gold's remaining interest in WRE

to 76 per cent. Capitalised terms in this announcement have the

same meanings as ascribed to them in the Company's announcement of

15 May 2023 unless indicated otherwise.

Highlights :

-- Lexington Gold is now the sole ultimate beneficial owner of

WRE with a 26 per cent. interest to be issued to Lexington Gold's

BBBEE partners in due course which will serve to reduce Lexington

Gold's resultant interest in WRE to 76 per cent. Lexington Gold is

currently finalising arrangements with a well-known BBBEE group in

South Africa and will announce further details when this transfer

of a 26 per cent. ownership interest has been completed.

-- In accordance with the terms of the acquisition, Lexington

Gold is issuing 36,129,032 new common shares (the "Initial

Consideration Shares") to settle GBP2.24 million, representing 35

per cent. of the maximum Lexington Gold Equity of up to GBP6.4

million to be paid as consideration under the WRE Acquisition and

Loan Agreements.

-- The Initial Consideration Shares are being issued at a price

of 6.20 pence per new common share (the "Issue Price") based on the

30-day VWAP to Tuesday, 5 September 2023 being 2 business days

prior to this announcement.

-- The balance of the consideration due under the WRE

Acquisition and Loan Agreements is to be settled by way of the

issue of new common shares in Lexington Gold at the Issue Price

based on certain milestones being achieved.

-- The Initial Consideration Shares are being issued as follows:

o 27,142,784 shares to Mark Creasy or his nominee; and

o 8,986,248 shares to Sunswell Holdings Pty Limited or its

nominees.

-- In addition, Mark Creasy has invested an amount of GBP100,000

by way of a subscription for 1,666,666 new common shares (the

"Creasy Subscription Shares") and 1,666,666 associated Fundraising

Warrants on the same commercial terms as the Company's approximate

GBP2.5 million equity fundraising announced on 10 July 2023.

-- Following the issue of the Initial Consideration Shares and

the Creasy Subscription Shares, Mr Creasy will own 33,867,065

common shares representing approximately 9.16 per cent. of the

Company's enlarged issued share capital.

Edward Nealon, Lexington Gold's Non-Executive Chairman,

commented :

" The Company is delighted to have completed this potentially

game changing acquisition, which received the overwhelming support

of our shareholders. We are also excited to be working with Mark

Creasy as we commence our initial work programmes seeking to

convert the internally estimated 37 million ounces of non-compliant

gold resource to an independent JORC code compliant estimate and

unlocking long term shareholder value from these promising

assets."

Deferred consideration milestones, extension of consent deadline

and WRE's licence interests

The balance of the Lexington Gold Equity payable, being up to

GBP4.16m, will fall due to be issued at the Issue Price upon the

achievement of the following milestones:

Lexington Gold Equity

-------------------------------

% No. of common Amount Milestone event

shares

-------------- ------------------------------------------------

45% 46,451,613 GBP2.88m Later of 30 November 2023 and the date

of renewal of four of the Prospecting

Rights split, 25%, 10%, 8% and 2% respectively

between the four Prospecting Rights concerned.

20% 20,645,161 GBP1.28m Receipt of Ministerial Consent.

Table 1 below shows the current status of WRE's Prospecting

licences and Prospecting Right applications.

Table 1 : WRE's Prospecting Licences and Prospecting Right

Applications

Project Tenement Area (hectares) Status Expiry date

----------------- -------------------- --------------- -------------------- -----------

FS 30/5/1/1/2/10350

Jelani Resources PR 956.76 Renewal Awarded (1)

FS 30/5/1/1/2/889

Kroonstad PR 13,845.77 Renewal under appeal (2)

FS 30/5/1/1/2/10520

Kroonstad PR 12,429.45 Renewal under appeal (2)

Kroonstad FS 30/5/1/1/2/10519 22,193.1 Executed 28-May-24

PR

Bothaville FS 30/5/1/1/2/10578 9,510 Executed 03-Mar-24

PR

Bothaville FS 30/5/1/1/2/10579 9,119.58 Executed 17-Mar-24

PR

Ventersburg FS 30/5/1/1/2/888 8,418.7 Executed 09-Dec-23

PR

Ventersburg FS 30/5/1/1/2/10489 8,965.9 Executed 09-Dec-23

PR

Ventersburg FS 30/5/1/1/2/10528 2,248.6 Executed 21-Aug-24

PR

NW 30/5/1/1/2/11335

Klerksdorp PR 1,816.9 Renewal under appeal (2)

----------------- -------------------- --------------- -------------------- -----------

Total 89,504.79

--------------------------------------- --------------- -------------------- -----------

(1) In South Africa renewals are for 3 years from the grant date of

the renewal.

(2) Renewals under appeal by WRE following an initial rejection due

to technical non-compliance of original renewals previously submitted

by WRE. New applications by Lexington Gold SA have also been submitted

over the same areas.

Further to Lexington Gold South Africa Proprietary Limited's

receipt of its interest in WRE, the procedural application for

Ministerial Consent in respect of the transaction will be made

shortly and the parties to the WRE Acquisition and Loan Agreements

have agreed that the deadline for obtaining such consent will be

extended to 31 August 2024 or such later date as may be further

agreed between the parties.

Lock-up and Orderly Market Arrangements

The Initial Consideration Shares and future issues of Lexington

Gold Equity are subject to a 12-month lock-up from the date of

issue and thereafter to a further 12-month orderly market

arrangement via Lexington Gold's broker.

Application to trading on AIM and Total Voting Rights

Application will be made to the London Stock Exchange for the

36,129,032 Initial Consideration Shares and the 1,666,666 Creasy

Subscription Shares (together, the " New Common Shares " ) to be

admitted to trading on AIM ("Admission"). It is expected that

Admission will become effective and that dealings in the New Common

Shares will commence at 8.00 a.m. on or around 14 September

2023.

On Admission, the number of common shares in issue outside

treasury and the total voting rights in the Company will be

369,894,673. This figure may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, Lexington Gold under the notification

provisions incorporated in the Company's Bye-laws.

Full details on WRE and its asset portfolio are set out in the

Company's announcement of 15 May 2023 and associated circular of 2

June 2023.

Planned Work Programme

The Company's Directors believe that a multi-million ounce JORC

2012/SAMREC compliant Mineral Resource Estimate (" MRE ") can be

established in respect of WRE's asset portfolio and intends,

subject to additional funding as necessary, for the Company to:

-- Undertake detailed analysis and modelling of the existing

geological database and extensive drilling data set; and

-- Establish and implement the requisite work required to

convert the current non-JORC/non-SAMREC complaint Mineral Resources

into a code compliant MRE including verification and duplication

drilling, as appropriate, as well as the re-sampling and assaying

of historical drill core, where possible.

Furthermore, the Directors plan to unlock value from the Jelani

Resources JV by engaging and working closely with Harmony Gold with

the aim of progressing the project into future gold production.

Whilst WRE has internally estimated that it potentially has over

37 million ounces of non-code compliant gold resources across over

its projects, there can be no guarantee that the planned

exploration and technical work by the Company will be sufficient to

establish JORC (2012) compliant Mineral Resources.

For further information, please contact :

Lexington Gold Ltd www.lexingtongold.co.uk

Bernard Olivier (Chief Executive Officer) via Yellow Jersey

Edward Nealon (Chairman)

Mike Allardice (Group Company Secretary)

Strand Hanson Limited (Nominated Adviser) www.strandhanson.co.uk

Matthew Chandler / James Bellman / Abigail T: +44 207 409 3494

Wennington

WH Ireland Limited (Joint Broker) www.whirelandplc.com

Katy Mitchell T: +44 207 220 1666

Peterhouse Capital Limited (Joint Broker) www.peterhousecap.com

Duncan Vasey / Lucy Williams (Broking) T: +44 207 469 0930

Eran Zucker (Corporate Finance)

Yellow Jersey PR Limited (Financial Public www.yellowjerseypr.com

Relations) T: +44 7747 788 221

Charles Goodwin / Annabelle Wills / Soraya

Jackson

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

Note to Editors :

Lexington Gold (AIM: LEX) is a gold exploration and development

company currently holding interests in four diverse gold projects,

covering a combined area of approximately 1,675 acres in North and

South Carolina, USA and in five gold projects covering

approximately 89,505 hectares in South Africa.

Further information is available on the Company's website:

www.lexingtongold.co.uk . Neither the contents of the Company's

website nor the contents of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUCCBUPWURM

(END) Dow Jones Newswires

September 07, 2023 04:45 ET (08:45 GMT)

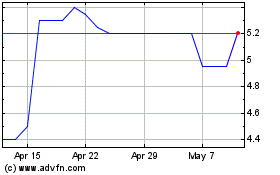

Lexington Gold (LSE:LEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lexington Gold (LSE:LEX)

Historical Stock Chart

From Dec 2023 to Dec 2024