TIDMMBT

RNS Number : 5942X

Mobile Tornado Group PLC

27 April 2023

27 April 2023

Mobile Tornado Group plc

("Mobile Tornado", the "Company" or the "Group")

2022 Final results

Mobile Tornado Group plc, a leading provider of resource

management mobile solutions to the enterprise market, announces its

audited results for the year ended 31 December 2022.

Financial Highlights

2022 2021

GBP'000 GBP'000

Recurring revenue 1,969 2,112

Non-recurring revenue* 310 479

--------------------------- -------- --------

Total revenue 2,279 2,591

Gross profit 2,223 2,491

Administrative expenses** (2,507) (2,525)

Adjusted EBITDA*** (284) (34)

-------- --------

Group operating loss (723) (253)

Loss before tax (1,419) (861)

-- Total revenue decreased by 12% to GBP2.28m (2021: GBP2.59m)

o Recurring revenues decreased by 7% to GBP1.97m (2021:

GBP2.11m)

o Non-recurring revenues* decreased by 35% to GBP0.31m (2021:

GBP0.48m)

-- Gross profit decreased by 11% to GBP2.22m (2021: GBP2.49m)

-- Administrative expenses before depreciation, amortisation,

exceptional items and exchange differences decreased by 1% to

GBP2.51m (2021: GBP2.53m)

-- Adjusted EBITDA** loss of GBP0.28m (2021: loss of GBP0.03m)

-- Group operating loss for the year increased to GBP0.72m (2021: GBP0.25m)

-- Loss after tax of GBP1.38m (2021: loss of GBP0.63m)

-- Basic loss per share of 0.36p (2021: loss of 0.17p)

-- Cash at bank at 31 December 2022 of GBP0.15m (31 December

2021: GBP0.07m) with net debt of GBP10.44m (2021: GBP9.63m)

* Non-recurring revenues comprise installation fees, hardware,

professional services and capex license fees

** Administrative expenses excludes depreciation, amortisation

and exchange differences

***Earnings before interest, tax, depreciation, amortisation,

exceptional items and excluding exchange rate differences

Operating highlights

-- Successful trials completed with several public sector

organisations across South & Central America and commercial

discussions now in progress

-- Deal closed in Caribbean with leading mobile network operator ("MNO")

-- Landmark push-to-talk over cellular ("PoC") deal concluded

with Leeds Bradford Airport post year-end, having run extensive

trials during 2022

-- Post year end fundraise to support the scale up of our sales,

marketing and business development activities

Jeremy Fenn, Chairman of Mobile Tornado, said: "The business has

successfully established itself as a key player in the PoC market,

with a presence in Africa, South America and Europe. We deliver a

high-quality, reliable PoC solution that meets the mission-critical

communication needs of our customers. Our platform boasts several

key differentiators, such as seamless transition, market-leading

group sizes, a unique dispatcher console, and highly efficient data

utilization, which set us apart from our competitors and contribute

to our platform's reputation for superior performance.

" The Board is fully committed to maintaining the technical

advantages that have been established, at the same time driving a

much deeper and wider business development operation. The outreach

campaign that has been running since the start of the year has

already generated a good flow of new partner and customer

opportunities, many of them in new geographic markets. We believe

that this momentum can be accelerated significantly if we can

successfully deploy our solution into a public safety organisation.

Our teams worked hard on multiple trials during the last 15 months

and we are hopeful that we will very shortly see a successful

conclusion with full platform deployment. This would represent a

significant commercial breakthrough, and we are confident will lead

to a material uplift in financial performance as we push towards

profitability in 2023. "

Enquiries :

Mobile Tornado Group plc www.mobiletornado.com

Jeremy Fenn, Chairman +44 (0)7734 475 888

Allenby Capital Limited (Nominated

Adviser & Broker) +44 (0)20 3328 5656

James Reeve / Piers Shimwell (Corporate

Finance)

David Johnson (Sales and Corporate

Broking)

Financial results and key performance indicators

Total revenue for the year ended 31 December 2022 decreased by

12% to GBP2.28m (2021: GBP2.59m). Recurring revenues decreased by

7% to GBP1.97m (2021: GBP2.11m). Non-recurring revenues, comprising

installation fees, hardware, professional services and capex

license fees decreased to GBP0.31m (2021: GBP0.48m). As a result,

gross profit decreased by 11% to GBP2.22m (2021: GBP2.49m).

Our former customer located in Canada, which the Group lost at

the end of 2021 as previously reported, accounted for 20% of total

revenue and 10% of recurring revenues in the prior year comparative

figures. It is pleasing to report therefore, that outside of this,

we recorded a modest increase in both our total and recurring

revenues across the remainder of our customer base.

Administrative expenses before depreciation, amortisation,

exceptional items and exchange differences in the year decreased by

1 % to GBP2.51m (2021: GBP2.53m), reflecting the continued positive

impact that further investment in the development and operating

efficiencies of our enhanced technical platform have delivered.

Due to the annual retranslation of certain financial liabilities

on the balance sheet, the Group reported a translation loss of

GBP0.23m (2021: gain of GBP0.08m) arising from the depreciation of

Sterling relative to both the Euro and the US Dollar as at 31

December 2022 versus the previous year end. The Group recorded a

net income tax credit of GBP0.04m (2021: GBP0.23m).

The loss after tax for the year increased to GBP1.38m (2021:

loss of GBP0.63m) equating to a basic loss per share of 0.36p

(2021: 0.17p).

The net cash used in operations decreased to GBP0.17m (2021:

GBP0.25m). At 31 December 2022, the Group had GBP0.15m cash at bank

(2021: GBP0.07m) and net debt of GBP10.44m (31 December 2021:

GBP9.63m).

The balance sheet continues to reflect the cumulative loss

position of the Group, and those net liabilities that have resulted

from this. We continue to hold levels of debt in the Group which

have funded these historical losses.

Results and dividends

The Directors do not recommend the payment of a dividend in

respect of the year ended 31 December 2022 (year ended 31 December

2021: nil). The Company currently intends to reinvest future

earnings to finance the growth of the business over the near

term.

Review of operations

We have delivered a year of steady progress, managing the exit

of one of our biggest customers and maintaining and securing modest

growth across the balance of the customer base.

Much of our efforts in 2022 were directed towards public safety

organisations in South and Central America, where we have witnessed

growing interest in our solution having delivered 100% service

reliability to our customer base in Colombia over the last 2 years.

Our technical team worked hard during the year to introduce new

features and functionality to meet the requirements of these

organisations and we are pleased to report that all trials

concluded successfully. As is always the case with public sector

organisations, we are in a commercial process which always runs

longer than expected and so it is difficult to know when service

deployment will commence. We anticipate initial deployments in El

Salvador and Guatemala, and providing these run successfully,

further engagements in Costa Rica, Nicaragua and Honduras.

We are increasingly confident that our PoC technology platform

has the potential to greatly enhance communication and coordination

among first responders, law enforcement, and emergency services. By

providing real-time, reliable, and secure communication channels,

PoC can significantly improve response times and operational

efficiency, and this has been borne out by the results of the

trials that ran during the year. Encouragingly, we are now seeing

public safety organisations in other territories express interest

in running trials and we hope to achieve significant commercial

breakthroughs during 2023.

As previously reported, our Caribbean partner signed a contract

with a prominent mobile network operator (MNO) in 2022, initiating

trials and discussions with numerous customers across various

countries. A robust sales pipeline has developed, and we are now

seeing the first commercial deployments across hotel groups,

transportation companies and airports. At the same time, trials

have commenced with several public safety organisations.

Activity levels across South Africa have been low due to

economic and political challenges, but we maintain engagement with

public utilities and agencies interested in deploying our platform.

We are hopeful that commercial success with public safety

organisations in South and Central America will stimulate broader

engagement in the region.

Our UK partner recently finalised a landmark deal with Leeds

Bradford Airport having run extensive trials during 2022. We

understand this is one of the first airports in Europe to replace a

legacy analogue radio system with PoC and anticipate that this will

open engagement and discussions with many others.

Since we announced the Board changes on 9 January 2023, we are

pleased to report that the business has moved quickly to scale up

its sales and business development operation and is now actively

engaged with several potential new partners and customers. We are

in the process of finalising agreements with new partners across

several markets, including Brazil, USA, Philippines and the Middle

East.

Having navigated through the COVID period without any external

funding (the last equity raise was in July 2019), we raised GBP500k

through a strategic funding round in March 2023 to support

marketing and business development activities. This will be

directed towards enhanced PR activity, participation in major

industry trade shows and the recruitment of additional sales

professionals to manage the increasing portfolio of partners.

Research and Development

We are confident that our PoC platform provides a top-tier

mission-critical communications solution, which is distinguished by

the following key differentiators:

Seamless transition - our platform ensures uninterrupted

communication during shifts between different networks or coverage

zones. This allows users to maintain constant connectivity and

enables efficient collaboration across teams, regardless of their

location or network conditions.

Market-leading group sizes - our platform supports larger group

sizes compared to competing solutions, making it ideal for

organizations with extensive teams or complex communication

requirements. The solution can manage group sizes of 5,000 compared

to competing products that are limited to several hundred.

Dispatcher console - the dispatcher console is a centralized and

user-friendly interface that allows for efficient coordination and

management of communication channels. It enables dispatchers to

monitor and control conversations, prioritize messages, and

allocate resources, ensuring smooth communication flow and rapid

response times during critical situations. Our console is capable

of managing 64 groups simultaneously, which we believe puts us

ahead of all competing platforms.

Data utilization - our platform optimizes data usage by

employing advanced compression techniques and minimizing bandwidth

consumption. This results in cost savings for customers while

maintaining high-quality voice and data transmission. Additionally,

the platform's efficient data management allows for seamless

integration with other systems, further enhancing its versatility

and adaptability to various organizational needs.

Our development teams in Israel and India will continue to

enhance the platform, in line with the demands from our customers,

to ensure we maintain our current competitive advantage.

Funding

We increased our GBP0.3m revolving loan facility to GBP500,000

on 24 March 2022 with our principal shareholder InTechnology plc

and extended the term for a further 12 months. This facility now

has a term ending on 26 September 2023 with a maximum principal

amount of GBP500,000 (previously GBP300,000). As at 31 December

2022, the balance drawn down was GBP400,000 (31 December 2021:

GBP150,000).

In March 2023, we concluded a subscription for 25.0m new

ordinary shares of 2 pence each representing approximately 6.6 per

cent. of the existing issued ordinary share capital of the Company

at a price of 2 pence per share to raise GBP500,000. The Company

also announced the capitalisation of GBP259,490 of indebtedness

owed by the Company to InTechnology plc into 12,974,492 new

Ordinary Shares, also at 2 pence per share.

We remain confident that our available cash resources together

with our long-established recurring revenue customer base and

anticipated future contracts will provide us with adequate

financial resources for the foreseeable future.

Principal risks and uncertainties

The management of the business and the nature of the Group's

strategy are subject to a number of risks. The Directors have set

out below the principal risks facing the business. The Directors

are of the opinion that a thorough risk management process is

adopted, which involves the formal review of all the risks

identified below. Where possible, processes are in place to monitor

and mitigate such risks.

Product obsolescence

Due to the nature of the market in which the Group operates,

products are subject to technological advances and as a result,

obsolescence. The Directors are committed to the Group's current

research and development strategy and are confident that the Group

can react effectively to developments within the market.

Indirect route to market

As described above, one of the Group's primary channels to

market are MNOs reselling our services to their enterprise

customers. Whilst MNOs are ideally positioned to forward sell our

services and are likely to possess material resources for doing so,

there remains an inherent uncertainty arising from the Group's

inability to exert full control over the sales and marketing

strategies of these customers.

Going concern

The Financial Statements are prepared on a going concern

basis.

When determining the adoption of this approach, the Directors

have considered a wide range of information relating to present and

future conditions, including the current state

of the Balance Sheet, together with that continued support

offered by our principal shareholder Intechnology plc, who, as in

previous years, has agreed not to call on existing loans and

borrowings totaling GBP10,148,000 and to extend the duration of our

GBP500,000 working capital facility if requested to do so. Further

consideration has been given to future projections, cash flow

forecasts, access to funding, ability to successfully secure

additional investment, available mitigating actions and the

medium-term strategy of the business.

The Group is dependent on its ability to meet its cash flow

forecasts. Within those forecasts the Group has included a number

of significant payments and receipts based on its best estimate

but, as with all forecasts, there does exist some uncertainty as to

the timing and size of those payments and receipts. In particular,

the forecasts assume the ongoing deferral and phased payment of

some of the Group's creditors, including a contingent consideration

balance of GBP2,815,000, (as disclosed in note 12 to the financial

statements), and the continuation at the current level of recurring

revenue and a significant increase in the level of non-recurring

revenues. In the event that some or all of these receipts are

delayed, deferred or reduced, or payments not deferred, management

has considered the actions that it would need to take to conserve

cash. These actions would include significant cost savings

(principally payroll based) and/or seeking additional funding from

its shareholders, for which there is currently no shareholder

commitment requested. These conditions, together with the other

matters explained in note 1 to the financial statements, indicate

the existence of a material uncertainty which may cast significant

doubt about the Group's ability to continue as a going concern. The

financial statements do not include the adjustments that would

result if the Group was unable to continue as a going concern.

The Directors, whilst noting the existence of a material

uncertainty and having considered the possible management actions

as noted above, are of the view that the Group is a going concern

and will be able to meet its debts as and when they fall due for a

period of at least 12 months from the date of signing these

accounts.

Section 172 statement - our stakeholders

The Board recognises its duty to consider the needs and concerns

of the Group's key stakeholders during its discussions and

decision-making. The Board has had regard to the importance of

fostering relationships with its stakeholders as set out below, and

also detailed in the Corporate Governance section of this Annual

Report.

Colleagues

We have an experienced, and dedicated workforce which we

recognise as the key asset of our business. It is vital to the

success of the Group to continue to create the right environment to

encourage and create opportunities for individuals and teams to

realise their full potential. The Board and management team pay

close attention to employee feedback and seek to respond

constructively to any suggestions or concerns raised.

Regular colleague briefing sessions are held with the Chief

Executive Officer to enable colleagues to ask questions and raise

issues and for colleagues to be provided with updates on the

business. Key performance information such as trading updates and

financial results are always promptly communicated to colleagues.

The Group has in place a share option scheme to enable colleagues

to become personally invested as shareholders of the Group.

Customers

Regular communication is with the Group's core customers to

discuss operational updates, product roadmap developments and gain

key customer feedback. This enables increased engagement with

customers at a strategic level and a greater understanding of both

customer pain points and future requirements from strategic to

end-user level.

Strategy

The Group continues to invest in an R&D strategy, current

details of which are provided in paragraph six of the review of

operations.

Suppliers

The Board is committed to building trusted partnerships with the

Group's suppliers. Through these partnerships, we deliver value and

quality to our other stakeholders.

Shareholders

The Executive Chairman holds analyst and investor roadshow

meetings during the year, particularly following the release of the

Group's interim and full year results and feedback from those

meetings is shared with the Board. The AGM is a key opportunity for

engagement between the Board and shareholders, particularly private

shareholders. The Group's annual report and accounts is made

available to all shareholders both online and in hard copy where

requested. All presentations and announcements and other key

shareholder information is available on the investor section of the

Group's website.

Outlook

The business has successfully established itself as a key player

in the PoC market, with a presence in Africa, South America and

Europe. We deliver a high-quality, reliable PoC solution that meets

the mission-critical communication needs of our customers. Our

platform boasts several key differentiators, such as seamless

transition, market-leading group sizes, a unique dispatcher

console, and highly efficient data utilization, which set us apart

from our competitors and contribute to our platform's reputation

for superior performance.

The Board is fully committed to maintaining the technical

advantages that have been established, at the same time driving a

much deeper and wider business development operation. The outreach

campaign that has been running since the start of the year has

already generated a good flow of new partner and customer

opportunities, many of them in new geographic markets. We believe

that this momentum can be accelerated significantly if we can

successfully deploy our solution into a public safety organisation.

Our teams worked hard on multiple trials during the last 15 months

and we are hopeful that we will very shortly see a successful

conclusion with full platform deployment. This would represent a

significant commercial breakthrough, and we are confident will lead

to a material uplift in financial performance as we push for

profitability in 2023.

As always, we would like to thank our team for their outstanding

efforts across the last financial year. We have started the new

year with renewed energy, and we are encouraged by the early

results. We look forward to updating shareholders as the year

develops, and sincerely believe that we are very close to realizing

the potential we have seen now for some years.

Approved by the Board of Directors and signed on behalf of the

Board

Jeremy Fenn

Chairman

27 April 2023

Consolidated income statement

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Continuing operations

Revenue 2,279 2,591

---------------------------------------- --------------- -----------------

Cost of sales (56) (100)

---------------------------------------- --------------- -----------------

Gross profit 2,223 2,491

Operating expenses

Administrative expenses (2,507) (2,525)

Exchange differences (227) 78

Depreciation and amortisation expense (212) (297)

---------------------------------------- --------------- -----------------

Total operating expenses (2,946) (2,744)

Group operating loss before exchange

differences,

depreciation and amortisation expense (284) (34)

---------------------------------------- --------------- -----------------

Group operating loss (723) (253)

Finance costs (696) (608)

Loss before tax (1,419) (861)

Income tax credit 37 231

Loss for the year (1,382) (630)

---------------------------------------- --------------- -----------------

Loss per share (pence)

Basic and diluted (0.36) (0.17)

---------------------------------------- --------------- -----------------

Consolidated statement of comprehensive income

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Loss for the year (1,382) (630)

Other comprehensive gain/(loss)

Item that will subsequently be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations (61) (5)

Total comprehensive loss for the

year (1,443) (635)

---------------------------------------------- -------- --------

Attributable to:

Equity holders of the parent (1,443) (635)

---------------------------------------------- -------- --------

Consolidated statement of financial position

As at 31 December 2022

2022 2021

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 155 122

Right-of-use assets 350 83

505 205

-------------------------------------- --------- --------------------

Current assets

Trade and other receivables 1,414 1,632

Inventories 25 67

Cash and cash equivalents 145 65

--------------------------------------- --------- --------------------

1,584 1,764

-------------------------------------- --------- --------------------

Liabilities

Current liabilities

Trade and other payables (5,191) (4,661)

Borrowings (10,558) (9,662)

Lease liabilities (105) (91)

Net current liabilities (14,270) (12,650)

--------------------------------------- --------- --------------------

Non-current liabilities

Trade and other payables (1,076) (1,213)

Borrowings (27) (37)

Lease liabilities (258) -

(1,361) (1,250)

-------------------------------------- --------- --------------------

Net liabilities (15,126) (13,695)

--------------------------------------- --------- --------------------

Equity attributable to the owners of

the parent

Share capital 7,595 7,595

Share premium 15,797 15,797

Reverse acquisition reserve (7,620) (7,620)

Merger reserve 10,938 10,938

Foreign currency translation reserve (2,270) (2,209)

Accumulated losses (39,566) (38,196)

Total equity (15,126) (13,695)

--------------------------------------- --------- --------------------

Consolidated statement of changes in equity

For the year ended 31 December 2022

Foreign

Reverse currency

Share Share acquisition Merger translation Accumulated Total

capital premium reserve reserve reserve Losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2021 7,595 15,797 (7,620) 10,938 (2,204) (37,583) (13,077)

Loss for the

year - - - - - (630) (630)

Exchange

differences on

translation

of foreign

operations - - - - (5) - (5)

Total

comprehensive

loss for

the year - - - - (5) (630) (635)

Equity settled

share-based

payments - - - - - 17 17

Balance at 31

December 2021 7,595 15,797 (7,620) 10,938 (2,209) (38,196) (13,695)

--------------- -------------- ---------------- ------------------ ---------------- ------------------- --------------------- -----------------

Foreign

Reverse currency

Share Share acquisition Merger translation Accumulated Total

capital premium reserve reserve reserve Losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2022 7,595 15,797 (7,620) 10,938 (2,209) (38,196) (13,695)

Loss for the

year - - - - - (1,382) (1,382)

Exchange

differences on

translation

of foreign

operations - - - - (61) - (61)

Total

comprehensive

loss for

the year - - - - (61) (1,382) (1,443)

Equity settled

share-based

payments - - - - - 12 12

Balance at 31

December 2022 7,595 15,797 (7,620) 10,938 (2,270) (39,566) (15,126)

--------------- -------------- ---------------- ------------------ ---------------- ------------------- --------------------- -----------------

Consolidated statement of cash flows

For the year ended 31 December 2022

2022 2021

GBP'000 GBP'000

Operating activities

Cash used in operations (173) (247)

Tax received 238 238

Interest paid 9 -

-----------------------------------------

Net cash (used in)/from operating

activities 74 (9)

------------------------------------------ ------------------- --------------------

Investing activities

Purchase of property, plant & equipment (60) (19)

Disposal of property, plant & equipment - 7

Net cash used in investing activities (60) (12)

------------------------------------------ ------------------- --------------------

Financing activities

Receipt of borrowings 250 150

Repayment of borrowings (10) (3)

IFRS 16 leases (180) (248)

--------------------

Net cash generated from/(used)

in financing activities 60 (101)

------------------- --------------------

Effects of exchange rates on cash

and cash equivalents 6 -

----------------------------------------- ------------------- --------------------

Net increase/(decrease) in cash

and

cash equivalents in the year 80 (122)

Cash and cash equivalents at beginning

of year 65 187

------------------- --------------------

Cash and cash equivalents at end

of year 145 65

------------------------------------------ ------------------- --------------------

Notes to the financial statements

1 Financial information

The financial information set out in this final results

announcement does not constitute statutory accounts within the

meaning of s434 of the Companies Act 2006. Statutory accounts for

the year ended 31 December 2022 will be made available to

shareholders for approval at the next Annual General Meeting. The

statutory accounts contain an unqualified audit report, which did

not include a statement under s498(2) or s498(3) of the Companies

Act 2006 and will be delivered to the Registrar of Companies.

The statutory accounts for the year ended 31 December 2021 which

have been delivered to the Registrar of Companies, contained an

unqualified audit report and did not include a statement under

s498(2) or s498(3) of the Companies Act 2006.

2 Segmental analysis

The Group presents its results in accordance with internal

management reporting information to the chief operating decision

maker (Board of Directors). At 31 December 2022 the Board continued

to monitor operating results by category of revenue within a single

operating segment, the provision of instant communication

solutions. Under IFRS 8 the Group has only one operating

segment.

Revenue by category

2022 2021

GBP'000 GBP'000

License fees 2,014 2,003

Hardware & software 178 164

Professional services 26 201

Support & Maintenance 61 223

Total 2,279 2,591

-------------------------- -------- --------

2022 2021

GBP'000 GBP'000

Recurring 1,969 2,112

Non-recurring 310 479

Total 2,279 2,591

-------------------------- -------- --------

Revenue is reported by geographical location of customers.

Non-current assets are reported by geographical location of

assets.

2022 2022 2021 2021

Non-current Non-current

Revenue assets Revenue assets

GBP'000 GBP'000 GBP'000 GBP'000

UK 31 - 19 23

Europe 99 - 188 -

North America 65 - 581 -

South America 1,341 - 1,118 -

Israel 351 505 329 182

Africa 382 - 348 -

Asia/Pacific 10 - 8 -

Total 2,279 505 2,591 205

--------------- -------- ----------------------- -------- -----------------------

Of the total revenue of the Group, three customers each

represented revenue greater than 10% of this total - these being

30% or GBP685,000 (2021: 21% or GBP551,000), 29% or GBP656,000

(2021: 22% or GBP567,000) and 17% or GBP382,000 (2021: 13% or

GBP348,000) respectively.

3 Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP1,382,000 (2021:

GBP630,000) by the weighted average number of ordinary shares in

issue during the year of 379,744,923 (2021: 379,744,923).

2022 2021

Basic and diluted Basic and diluted

Loss Loss Loss Loss

per

share per share

GBP'000 pence GBP'000 pence

Loss attributable to

ordinary shareholders (1,382) (0.36) (630) (0.17)

The loss attributable to ordinary shareholders and the weighted

average number of ordinary shares for the purpose of calculating

the diluted earnings per ordinary share are identical to those used

for basic earnings per ordinary share. This is because the exercise

of share options are anti-dilutive under the terms of IAS 33.

4 Annual General Meeting

The Annual General Meeting of the Company will be announced

separately in due course. The audited results for the year ended 31

December 2022 will be made available to shareholders shortly and

will be available on the Company's website at www.mobiletornado.com

at the same time.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUQACUPWGAQ

(END) Dow Jones Newswires

April 27, 2023 02:00 ET (06:00 GMT)

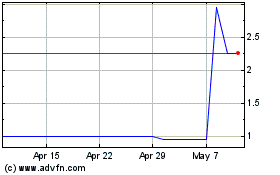

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Jan 2024 to Jan 2025