TIDMMBT

RNS Number : 8979N

Mobile Tornado Group PLC

28 September 2023

28 September 2023

Mobile Tornado Group plc

("Mobile Tornado", the "Company" or the "Group")

Half Yearly Report

Mobile Tornado (AIM: MBT), a leading provider of resource

management mobile solutions to the enterprise market, announces its

unaudited results for the six-month period to 30 June 2023.

Financial highlights

Six months Six months

ended ended

30 June 30 June

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

Recurring revenue 964 932

Non-recurring revenue* 293 172

------------------------- ----------- -----------

Total revenue 1,257 1,104

Gross profit 1,129 1,066

Administrative expenses (1,284) (1,275)

Adjusted EBITDA** (155) (209)

Group operating loss (144) (454)

Loss before tax (527) (775)

----------- -----------

-- Total revenue increased by 14% to GBP1.26m (H1 2022: GBP1.10m)

o Recurring revenues increased by 3% to GBP0.96m (H1 2022:

GBP0.93m)

o Non-recurring revenues* increased by 70% to GBP0.29m (H1 2022:

GBP0.17m)

-- Operating expenses increased by 1% to GBP1.28m (H1 2022: GBP1.28m)

-- Adjusted EBITDA** loss of GBP0.16m (H1 2022: GBP0.21m)

-- Group operating loss for the period decreased to GBP0.14m (H1

2022: GBP0.45m) - impacted by exchange differences of GBP0.10m gain

(H1 2022: GBP0.15m loss)

-- Loss before tax of GBP0.53m (H1 2022: GBP0.78m)

-- Basic loss per share of 0.14p (H1 2022: 0.20p)

-- Net cash outflow from operating activities of GBP0.28m (H1 2022: GBP0.02m inflow)

-- Net debt at 30 June 2023 of GBP10.43m (H1 2022: GBP10.03m)

-- Cash and cash equivalents of GBP0.05m (30 June 2022: GBP0.12m)

*Non-recurring revenues comprising installation fees, hardware,

professional services and capex license fees

**Earnings before interest, tax, depreciation, amortisation,

exceptional items and excluding exchange differences

Operating Highlights

-- Increased investment in business development activities to

capitalize on strength of our technical solution . Post 2022 year

end fundraise was completed to support this scale up

-- Landmark push-to-talk over cellular ("PoC") deal concluded

with Leeds Bradford Airport

-- Extension to agreement with our existing partner in South

Africa which will see us become an exclusive reseller of their

personnel management platform

Jeremy Fenn, Chairman and acting CEO of Mobile Tornado, said:

"The Company has for some time been a key player in the PTToC

market, with a presence in Africa, South America and Europe. Our

solution meets the mission-critical communication needs of our

customers, and is characterised by a number of key differentiators,

such as seamless transition, market-leading group sizes, a unique

dispatcher console, and highly efficient data utilization. These

features continue to set us apart from our competitors and allow us

to deliver market leading performance to our partners and

customers.

"The process of building a much deeper and wider business

development operation commenced during the first half of the year

and has made great progress. As a result, we have begun to open up

new markets in the USA, parts of Asia and the Middle East. Physical

attendance at trade shows and a more sophisticated PR strategy is

generating significant inbound interest across many international

markets. As previously mentioned, we have strengthened our sales

teams to handle this increased activity and are now in the process

of building much deeper and better quality sales pipelines.

"Despite a challenging economic environment, the Board are

confident that our solution offers quality and good value,

particularly when compared to the traditional radio platforms. We

are building a much wider partner network and are confident that

the developing sales pipeline will convert into new customers in

due course. At the same time, we are working with our partners to

develop bespoke solutions for key verticals which will provide

further opportunity as we look to push those solutions into the

wider partner network."

Enquiries:

Mobile Tornado Group plc +44 (0)7734 475 888

Jeremy Fenn, Chairman and acting CEO www.mobiletornado.com

Allenby Capital Limited (Nominated Adviser

& Broker) +44 (0)20 3328 5656

James Reeve / Piers Shimwell (Corporate

Finance)

David Johnson (Sales and Corporate Broking)

Financial results

Total turnover in the six-month period to 30 June 2023 increased

by 14% to GBP1.26m (H1 2022: GBP1.10m). Recurring revenues

increased by 3% to GBP0.96m (H1 2022: GBP0.93m).

Non-recurring revenues, comprising installation fees, hardware,

professional services and capex license fees increased by 70% to

GBP0.29m (H1 2022: GBP0.17m). Gross profit increased by 6% to

GBP1.13m (H1 2022: GBP1.07m).

Our underlying total operating cost-base remained largely

unchanged over the comparative period, increasing by 1% to GBP1.28m

(H1 2022: GBP1.28m). Due to the annual revaluation of certain

financial liabilities on the balance sheet, the Group reported a

currency translational gain of GBP0.10m (H1 2022: GBP0.15m loss)

arising principally from the appreciation of Sterling against the

US Dollar compared to the start of the period. As a result of the

above, the loss after tax for the period decreased to GBP0.56m (H1

2022: Loss of GBP0.76m).

The Group reported a net cash outflow from operating activities

during the period of GBP0.28m (H1 2022: GBP0.02m inflow). At 30

June 2023, the Group had GBP0.05m cash at bank (30 June 2022:

GBP0.12m) and net debt of GBP10.43m (30 June 2022: GBP10.03m).

Review of operations

The Board are pleased to report a robust set of financial

results for the first six months of the year. A small increase in

the recurring revenue stream illustrates the high-quality customer

base we have established, and the 70% uplift in non-recurring

revenues reflects the renewals on existing capex based license

deals. As highlighted earlier in the year, the Board is now focused

on delivering a significantly enhanced business development

operation to build out a much wider partner base, and ultimately

generate a material uplift in customers. We are confident that the

investment we have made in the technical platform over recent years

has delivered superior performance against competing solutions.

It's now essential that we capitalise on this and expose the

platform to many more partners across all international markets and

industry sectors.

To facilitate this, there has been an increase in business

development activity during the period. A sophisticated outreach

campaign has been developed, supported by our attendance at the

major critical communication trade shows. We have recruited into

the sales team to manage the increasing levels of new partner and

customer engagement. As a result of this activity, new partners

have been contracted in the UK, USA, Chile, Germany and UAE with

expansion into further new territories anticipated.

Our existing partners have continued to make progress during the

year. In South and Central America, we continued to focus on the

deployment of the solution to public safety organisations and

progress has been made here. We are now awaiting final confirmation

around the hardware that will be utilised alongside our platform,

and this should be the catalyst for a significant roll out. A

number of other public safety organisations are now using our

solution across the Caribbean, and we are in discussions with

others across multiple territories. The quality of our solution and

the relative cost compared to traditional radio platforms is

attracting a lot of interest across the public safety sector, and

we hope for a breakthrough before the end of the year.

In the UK we closed out a deal at Leeds Bradford airport

('LBA'), to provide their ground operations staff with our full

PTToC solution. We understand that LBA is one of the first airports

in Europe to upgrade its radio system to PTToC, and the publicity

that was generated from this deal has resulted in a significant

amount of interest from other airports.

A partnership agreement has also been reached with a UK security

services business to deploy our solution into water utility

businesses. This represents an interesting development, whereby our

solution is adapted to meet the specific requirement of a

particular industry sector. On a similar note, we are working with

another UK partner to develop the solution specifically for the

retail supermarket sector, to address opportunities both in the UK

and Ireland. If these bespoke applications meet with success, we

will look to roll them out to our global partner network and work

with them to address their own local markets.

In Africa, we recently extended our partnership with Instacom, a

leading provider of critical communication solutions to government

agencies and private companies. As part of the agreement, we will

also act as exclusive UK reseller for Instacom's PTX personnel

management platform. The platform enables the simple and effective

management of employees, helping to improve operational

efficiencies and productivity as well as reducing costs. We have

been working with Instacom since 2010 and the continued growth of

mobile network coverage across Africa is creating big opportunities

for government agencies and private enterprises to increase safety,

reduce costs, boost productivity and improve efficiency among their

remote workforces. Completing this deal, and integrating the PTX

platform into our own, will allow the Company to reduce R&D

operating costs, as we can reduce the resources currently allocated

to the development of our own workforce management platform.

In the Caribbean, our partner has built up strong sales momentum

with Digicel, one of the main mobile network operators in the

region. Deals have been closed within multiple sectors including

public safety, security, hotels and logistics.

Funding

As announced on 22 September 2023, we agreed a 12-month

extension of our revolving loan facility with our principal

shareholder, InTechnology plc. This facility has a term ending on

26 September 2024 with a maximum principal amount of GBP500,000.

The balance drawn down at 30 June 2023 was GBP150,000 and as at

today's date, the balance drawn down is GBP190,000.

In March 2023, we concluded a subscription for 25.0m new

ordinary shares of 2 pence each representing approximately 6.6 per

cent. of the existing issued ordinary share capital of the Company

at a price of 2 pence per share to raise GBP500,000. The Company

also announced the capitalisation of GBP259,490 of indebtedness

owed by the Company to InTechnology plc into 12,974,492 new

Ordinary Shares, also at 2 pence per share.

We remain confident that our available cash resources together

with our long-established recurring revenue customer base and

anticipated future contracts will provide us with adequate

financial resources for the foreseeable future.

Outlook

The Company has for some time been a key player in the PTToC

market, with a presence in Africa, South America and Europe. Our

solution meets the mission-critical communication needs of our

customers, and is characterised by a number of key differentiators,

such as seamless transition, market-leading group sizes, a unique

dispatcher console, and highly efficient data utilization. These

features continue to set us apart from our competitors and allow us

to deliver market leading performance to our partners and

customers.

The process of building a much deeper and wider business

development operation commenced during the first half of the year

and has made great progress. As a result, we have begun to open up

new markets in the USA, parts of Asia and the Middle East. Physical

attendance at trade shows and a more sophisticated PR strategy is

generating significant inbound interest across many international

markets. As previously mentioned, we have strengthened our sales

teams to handle this increased activity and are now in the process

of building much deeper and better quality sales pipelines.

Despite a challenging economic environment, the Board are

confident that our solution offers quality and good value,

particularly when compared to the traditional radio platforms. We

are building a much wider partner network and are confident that

the developing sales pipeline will convert into new customers in

due course. At the same time, we are working with our partners to

develop bespoke solutions for key verticals which will provide

further opportunity as we look to push those solutions into the

wider partner network.

Jeremy Fenn

Chairman

28 September 2023

Consolidated income statement

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 1,257 1,104 2,279

--------------------------------------- ----- --------------- ----------------- -----------------

Cost of sales (128) (38) (56)

--------------------------------------- ----- --------------- ----------------- -----------------

Gross profit 1,129 1,066 2,223

Operating expenses

Administrative expenses (1,284) (1,275) (2,507)

Exchange differences 101 (148) (227)

Depreciation and amortisation expense (90) (97) (212)

--------------------------------------- ----- --------------- ----------------- -----------------

Total operating expenses (1,273) (1,520) (2,946)

Group operating loss before exchange

differences,

depreciation and amortisation expense (155) (209) (284)

--------------------------------------- ----- --------------- ----------------- -----------------

Group operating loss (144) (454) (723)

Finance costs (383) (321) (696)

Loss before tax (527) (775) (1,419)

Income tax (expense)/credit (29) 12 37

Loss for the period (556) (763) (1,382)

--------------------------------------- ----- --------------- ----------------- -----------------

Loss per share (pence)

Basic and diluted 3 (0.14) (0.20) (0.36)

--------------------------------------- ----- --------------- ----------------- -----------------

Consolidated statement of comprehensive income

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss for the period (556) (763) (1,382)

Other comprehensive income

Exchange differences on translation

of foreign operations 23 (58) (61)

Total comprehensive loss for

the period (533) (821) (1,443)

-------------------------------------- ----------- ----------- ------------

Consolidated statement of financial position

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 130 139 155

Right-of-use assets 300 - 350

430 139 505

-------------------------------------- ----- ---------- -------------------- ------------

Current assets

Trade and other receivables 1,472 1,701 1,414

Inventories 35 34 25

Cash and cash equivalents 45 122 145

-------------------------------------- ----- ---------- -------------------- ------------

1,552 1,857 1,584

-------------------------------------- ----- ---------- -------------------- ------------

Liabilities

Current liabilities

Trade and other payables (5,244) (5,139) (5,191)

Borrowings (4,748) (4,414) (10,558)

Lease liabilities (105) - (105)

Net current liabilities (8,545) (7,696) (14,270)

-------------------------------------- ----- ---------- -------------------- ------------

Non-current liabilities

Trade and other payables (861) (1,219) (1,076)

Borrowings (5,723) (5,734) (27)

Lease liabilities (209) - (258)

(6,793) (6,953) (1,361)

-------------------------------------- ----- ---------- -------------------- ------------

Net liabilities (14,908) (14,510) (15,126)

-------------------------------------- ----- ---------- -------------------- ------------

Equity attributable to the owners of

the parent

Share capital 4 8,354 7,595 7,595

Share premium 4 15,787 15,797 15,797

Reverse acquisition reserve (7,620) (7,620) (7,620)

Merger reserve 10,938 10,938 10,938

Foreign currency translation reserve (2,247) (2,267) (2,270)

Accumulated losses (40,120) (38,953) (39,566)

Total equity (14,908) (14,510) (15,126)

-------------------------------------- ----- ---------- -------------------- ------------

Consolidated statement of changes in equity

For the six months ended 30 June 2023

Foreign

Reverse currency

Share Share acquisition Merger translation Accumulated Total

capital premium reserve reserve reserve Losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January

2022 7,595 15,797 (7,620) 10,938 (2,209) (38,196) (13,695)

Loss for the

period - - - - - (763) (763)

Exchange

differences

on translation

of foreign

operations - - - - (58) - (58)

Total

comprehensive

loss for the

year - - - - (58) (763) (821)

Equity settled

share-based

payments - - - - - 6 6

Balance at 30

June

2022 7,595 15,797 (7,620) 10,938 (2,267) (38,953) (14,510)

--------------- -------------- ---------------- ------------------ ---------------- ------------------- --------------------- -----------------

Foreign

Reverse currency

Share Share acquisition Merger translation Accumulated Total

capital premium reserve reserve reserve Losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July

2022 7,595 15,797 (7,620) 10,938 (2,267) (38,953) (14,510)

Loss for the

period - - - - - (619) (619)

Exchange

differences

on translation

of foreign

operations - - - - (3) - (3)

Total

comprehensive

loss for the

year - - - - (3) (619) (622)

Equity settled

share-based

payments - - - - - 6 6

Balance at 31

December

2022 7,595 15,797 (7,620) 10,938 (2,270) (39,566) (15,126)

--------------- -------------- ---------------- ------------------ ---------------- ------------------- --------------------- -----------------

Foreign

Reverse currency

Share Share acquisition Merger translation Accumulated Total

capital premium reserve reserve reserve Losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January

2023 7,595 15,797 (7,620) 10,938 (2,270) (39,566) (15,126)

Issue of share

capital 759 (11) - - - - 749

Transactions

with

owners 759 (11) - - - - 749

Loss for the

period - - - - - (556) (556)

Exchange

differences

on translation

of foreign

operations - - - - 23 - 23

Total

comprehensive

loss for the

year - - - - 23 (556) (532)

Equity settled

share-based

payments - - - - - 2 2

Balance at 30

June

2023 8,354 15,786 (7,620) 10,938 (2,247) (40,120) (14,908)

--------------- -------------- ---------------- ------------------ ---------------- ------------------- --------------------- -----------------

Consolidated statement of cash flows

For the six months ended 30 June 2023

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Operating activities

Cash used in operations 5 (247) (265) (173)

Tax (paid)/received (29) 281 238

Interest paid - - 9

----------------------------------------- ----- --------------------

Net cash (outflow)/inflow from operating

activities (276) 16 74

------------------------------------------------ ----------------- ----------------- --------------------

Investing activities

Purchase of property, plant & equipment (1) (20) (60)

Net cash used in investing activities (1) (20) (60)

----------------------------------------- ----- ----------------- ----------------- --------------------

Financing

Issue of ordinary share capital 759 - -

Share issue costs (11) - -

(Repayment of)/Increase in borrowings (514) 145 240

IFRS 16 leases (55) (89) (180)

Net cash (outflow)/inflow from

financing 179 56 60

----------------- ----------------- --------------------

Effects of exchange rates on cash

and cash equivalents (2) 5 6

----------------------------------------- ----- ----------------- ----------------- --------------------

Net (decrease)/increase in cash

and

cash equivalents in the period (100) 57 80

Cash and cash equivalents at beginning

of period 145 65 65

Cash and cash equivalents at end

of period 45 122 145

----------------------------------------- ----- ----------------- ----------------- --------------------

Notes to the interim report

For the six months ended 30 June 2023

1 General information

The financial information in the interim report does not

constitute statutory accounts within the meaning of section 434 of

the Companies Act 2006 and has not been audited or reviewed. The

financial information relating to the year ended 31 December 2022

is an extract from the latest published financial statements on

which the auditor gave an unmodified report that did not contain

statements under section 498 (2) or (3) of the Companies Act 2006

and which have been filed with the Registrar of Companies.

2 Basis of preparation

These interim financial statements are for the six months ended

30 June 2023. They have been prepared using the recognition and

measurement principles of IFRS.

The interim financial statements have been prepared under the

historical cost convention.

The interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year ended 31 December 2022. The

accounting policies have been applied consistently throughout the

Group for the purpose of preparation of the interim financial

statements.

3 Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP556,000 (30 June 2022:

GBP763,000, 31 December 2022: GBP1,382,000) by the weighted average

number of ordinary shares in issue during the period of 406,390,009

(30 June 2022: 379,744,923, 31 December 2022: 379,744,923).

Six months

ended Six months ended Year ended

31 December

30 June 2023 30 June 2022 2022

Unaudited Unaudited Audited

Basic and diluted Basic and diluted Basic and diluted

Loss Loss Loss Loss Loss Loss

per

share per share per share

GBP'000 pence GBP'000 pence GBP'000 pence

Loss attributable

to

ordinary shareholders (556) (0.14) (763) (0.20) (1,382) (0.36)

----------------------- ----------- ----------- ----------- ------------- ------------ ------------

4 Share capital and share premium

Number of

issued and

fully paid Share Share

shares capital premium Total

'000 GBP'000 GBP'000 GBP'000

At 1 January 2022, 30 June

2022 & 31 December 2022 379,745 7,595 15,797 23,392

Issue of shares 37,974 759 (11) 749

As at 30 June 2023 417,719 8,354 15,786 24,141

---------------------------- ------------------ ------------ ------------- -------------

Non-voting preference shares

Number

of Nominal

shares Value

'000 GBP'000

As at 30 June 2022, 31 December 2022 and

30 June 2023 71,277 5,702

------------------------------------------- -------- ----------

Liabilities and preference shares totalling GBP5,702k were

converted into 71,277k 8p preference shares on 28 August 2013. The

preference shares are non-voting, non-convertible redeemable

preference shares currently redeemable at par value on 31 December

2023, or, at the Company's discretion, at any earlier date. T he

Preference Shares accrue interest at a fixed rate of 10% per

annum.

5 Cash used in operations

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Loss before taxation (527) (775) (1,419)

Adjustments for:

Depreciation and amortisation 90 97 212

Share based payment charge 2 6 12

Interest expense 383 321 696

Changes in working capital:

(Increase)/decrease in inventories (17) 41 49

(Increase)/decrease in trade and

other receivables (59) (264) 41

(Decrease)/increase in trade and

other payables (119) 309 236

Net cash used in operations (247) (265) (173)

------------------------------------ ------------------- -------------------- ----------------------

6 Shareholder information

The interim announcement will be published on the company's

website www.mobiletornado.com on 28 September 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCUXDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

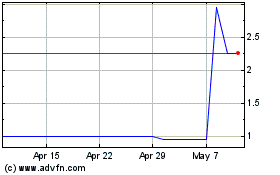

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Apr 2023 to Apr 2024