MediaZest Plc Fundraising of £130,000 via Convertible Loan Notes

August 07 2023 - 1:00AM

UK Regulatory

TIDMMDZ

Market soundings, as defined in the EU Market Abuse Regulation (MAR), were taken

in respect of the Fundraise with the result that certain persons became aware of

inside information, as permitted by MAR. That inside information is set out in

this announcement and has been disclosed as soon as possible in accordance with

paragraph 7 of article 17 of MAR. Therefore, those persons that received inside

information in a market sounding are no longer in possession of inside

information relating to the Company and its securities.

7 August 2023

MediaZest Plc

("MediaZest", the "Company" or the "Group"; AIM: MDZ)

Fundraising of £130,000 via Convertible Loan Notes and Repayment of £150,000 3

Year Convertible loan notes issued 5 August 2020

MediaZest (AIM: MDZ), the creative audio-visual company, announces that it has

raised £130,000 (before expenses) via the issue of new 3-year unsecured

convertible loan notes (the "New CLNs") to existing investors (the "Fundraise").

The Company has also repaid £150,000 of unsecured convertible loan notes

previously issued on 5 August 2020, which had a maturity date of 5 August 2023

(the "Existing CLNs").

The gross amount raised via the Existing CLNs was £150,000 via subscriptions

from four different shareholders. Of these, three shareholders have agreed to

enter into the New CLNs via subscriptions totalling £130,000 and one shareholder

has been repaid £20,000 in full from free cashflow.

Pursuant to the terms of the Existing CLNs, a total of 28,571,429 warrants over

the Company's ordinary shares of 0.01p ("Ordinary Shares") have been granted to

holders of the Existing CLNs (the "Existing CLN Warrants"). The Existing CLN

Warrants have an exercise price of 0.0525p, being the closing mid-market price

of MediaZest's Ordinary Shares on 4 August 2023 and have a twelve month term,

expiring on 4 August 2024.

The net proceeds of the Fundraise will provide the Group with additional working

capital.

New CLN Terms

The terms of the New CLNs are as follows:

- 3-year CLN (the "Term"), with interest of 10% per annum, payable

quarterly in arrears;

- MediaZest will make a bullet repayment to each investor at the end of

the Term if the CLN (in whole or in part) remains unconverted;

- The Company may repay in full the CLN at any time, including

accumulated interest on a pro-rata basis;

- Each investor can convert the CLNs (in whole or in part) into new

Ordinary Shares by serving written notice 14 days after each annual anniversary

during the Term;

- The CLN conversion rate will be calculated by dividing the principal

amount of the CLN by the mid-market price of the Ordinary Shares, on the last

business day before the relevant anniversary date of the CLN, less a discount of

10%; and

- If the CLN is repaid at the end of the Term then warrants over new

Ordinary Shares will be granted to each investor (the "Warrants"). The number of

Warrants granted will be calculated by dividing a sum equal to 10% of the

principal amount of the CLN by the mid-market price of the shares in MDZ at on

the last business day before the closing of the CLN. The Warrants' exercise

price will be the mid-market price of the shares in MDZ on the last business day

before the closing of the CLN and the Warrants will expire 12 months from the

date of grant.

Geoff Robertson, MediaZest's CEO said: "We are delighted to announce the

Fundraise and the Board is grateful for the continued support of our existing

shareholders. The Fundraise provides further confidence as we seek to build on

the Group's encouraging recent performance during the second half of the current

financial year."

Related Party Transaction

Certain existing shareholders have subscribed for New CLNs as part of the

Fundraise.

City and Claremont Capital Assets Ltd ("CCCAL") is a substantial shareholder in

the Company and has subscribed for £100,000 of New CLNs pursuant to the

Fundraise (the "CCCAL Subscription").

The CCCAL Subscription therefore constitutes a related party transaction in

accordance with AIM Rule 13 of the AIM Rules for Companies. The Directors, who

are all considered to be independent Directors for these purposes, having

consulted with the Company's nominated adviser consider the terms of the CCCAL

Subscription to be fair and reasonable insofar as the Company's shareholders are

concerned.

CCCAL has been granted 19,047,619 Existing CLN Warrants pursuant to the terms of

the Existing CLN.

Enquiries:

Geoff Robertson 0845 207 9378

Chief Executive Officer

MediaZest Plc

David Hignell/Adam Cowl 020 3470 0470

Nominated Adviser

SP Angel Corporate Finance LLP

Claire Noyce 020 3764 2341

Broker

Hybridan LLP

Notes to Editors:

About MediaZest

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest was

admitted to the London Stock Exchange's AIM market in February 2005. For more

information, please visit www.mediazest.com

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

August 07, 2023 02:00 ET (06:00 GMT)

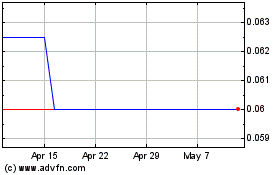

Mediazest (LSE:MDZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mediazest (LSE:MDZ)

Historical Stock Chart

From Jan 2024 to Jan 2025