TIDMCPT

RNS Number : 4866H

Concepta PLC

18 August 2016

For immediate release

18 August 2016

Concepta Plc (formerly, Frontier Resources International

Plc)

("Concepta" or the "Company")

Unaudited interim results for the six months ended 30 June

2016

Concepta plc (AIM:CPT), the pioneering UK healthcare company and

developer of a proprietary platform and suite of products targeted

at the personalised mobile health market with a primary focus on

women's fertility and specifically unexplained infertility,

announces its unaudited results for the six months ended 30 June

2016.

Operational highlights

-- Disposal or dissolution of all oil and gas related subsidiaries

-- Undertook strategic review and completed the acquisition of

Concepta plc for GBP3.026 million comprising 30,343,950 New

Ordinary Shares and GBP0.75 million in cash in July 2016

-- Concepta is an innovative player in the Mobile Health and

Connected Health Sector that has developed proprietary products for

home self-testing as well as in a point-of-care environment

-- Concepta's products will initially address the specific needs

of women with fertility issues, in particular unexplained

infertility

-- MyLotus brand - unique offering allowing quantitative and

qualitative measurement of a woman's personal hCG and LH hormone

levels in urine samples

-- Defined route to market:

o Regulatory approvals for launch in China in place - first

order from distributor with payment in advance expected following

hospital testing in Q3 2016

o CE-Marking for UK and Europe to follow in 2017

-- Attractive market opportunity to capitalise on the Chinese

and EU infertility market with annual revenue potential worth

c.GBP600m

-- New Product Development growth opportunities - Concepta's

proprietary platform lends itself to wider family home-health

monitoring to improve individual health parameters including

chronic stress, inflammation, urinary tract, healthy pregnancy

progression etc.

Financial Position

-- February 2016, placing raised $1.787m net after costs

-- Cash balance at the period end was $1.335m (H1 2015: $0.02m)

-- Loss of $0.336m from continuing operations (H1 2015: $.0504m)

-- Discontinued operations resulted in a profit of $0.109m (H1 2015: loss $0.318m)

-- Cash outlay of $72k towards RTO costs

CHAIRMAN'S STATEMENT

Following a period of substantial change in 2015 I am pleased to

present the interim results for the first half of 2016, following

the transformational acquisition of leading women's health

diagnostics company Concepta Diagnostics for GBP3.026 million in

July 2016.

Following the Board decision to pursue investment in non-oil

exploration projects, I joined the Board of Concepta plc,

(previously Frontier Resources International plc) in February 2016.

Following the placing of GBP1.425m, which completed on 16 February,

the process for either disposal or dissolution of all the

subsidiaries at the time commenced to convert the Company into a

cash shell. The process for divesting the Company of its operating

subsidiaries was completed on 23 March leaving the Company with

cash of GBP1.4m before expenses.

As laid out in the Final Results for 2015 of Frontier Resources

International plc, the former AIM cash shell (see press release 3

May 2016), the Board's strategy during H1 2016 was to identify

suitable acquisition opportunities in a new sector, which would

satisfy the requirements of AIM Rule 15 and indeed offer

significant growth potential for the Company.

With this in mind, we found a compelling acquisition target in

Concepta, which we believed would be in the best interests for the

Company, wider stakeholders and offers a value accretive

opportunity to reward the patience of our supportive shareholders.

Since its foundation in 2013, Concepta has established itself as a

leading and innovative developer of personalised mobile health

diagnostics with a primary focus on women's fertility, where a

significant market opportunity exists to develop a 'best in class'

product to help women with unexplained infertility to conceive.

To this end, the Company has developed a proprietary product

branded 'MyLotus', which has a unique product offering that allows

both quantitative and qualitative measurement of a woman's personal

hCG and LH hormone levels to help increase conception

probability.

In March 2016 negotiations for the acquisition of Concepta

Diagnostics proceeded, which culminated in the announcement on 7

July 2016 of the acquisition of the entire issued share capital of

Concepta Diagnostics and a fund raising of GBP3.5m.

At a General Meeting on 25 July 2016 all resolutions were passed

and Erik Henau and Mark Wyatt were appointed to the Board. The

acquisition is a fundamental change of direction for the

business.

Financial review

-- The Group's total comprehensive loss for the six months to 30

June 2016 was USD 326,000 (30 June 2015: loss USD 707,000).

-- The basic and diluted loss per share was USD 0.01 (six months to 30 June 2015: USD 1.55).

-- Concepta raised USD 1,787,000 (GBP1.425,000 excluding costs)

in the six months ended 30 June 2016 (USD NIL in the six months

ended 30 June 2015).

As foreseen at the time of Admission to AIM, given that the

Company is at an early stage of development, it is not anticipated

that there will be any earnings arising from the Company's

activities in the short to medium term. Accordingly, the Board does

not expect to recommend or pay any dividends in the foreseeable

future.

Outlook

We are delighted to have successfully completed the reverse

takeover at the end of this reporting period and are looking

forward to an exciting future as Concepta.

The immediate focus following Concepta's RTO in July 2016, is

the launch of MyLotus in China later this year (2016) and,

subsequent to CE marking, targeting launch in the UK and Europe in

2017. In addition we are looking to set up new manufacturing

facilities in Yorkshire, which will be another key milestone in our

Company's development. Excitingly, Concepta has the opportunity to

translate its proprietary platform into commercial success in these

initial markets where annual revenues in the infertility segment

are estimated to be worth c.GBP600m.

Furthermore, Concepta's products have myriad applications beyond

fertility diagnostics, and we are in a unique position to come in

at the ground floor of the fast growing global connected healthcare

sector, which is set to be worth $61bn by 2020.

We look forward to updating the market on these exciting

developments during the course of 2016 and beyond as we implement

our defined growth strategy, focused on delivering commercial

success and becoming the global market leader for over-the counter

products for women with fertility issues and, ultimately, tackling

the wider mobile health market.

Adam Reynolds

Chairman

Enquiries:

Concepta Plc

Adam Reynolds, Chairman Tel: +44(0) 7785 908 158

Spark Advisory Partners Tel: +44 (0)20 3368 3550

Limited

(Nominated Advisor)

Neil Baldwin/Mark Brady

Beaufort Securities Tel: +44 (0)20 7382 8300

Limited (Broker)

Jon Belliss

Yellow Jersey PR Limited Tel: +44 (0) 7748 843 871

(Financial PR)

Felicity Winkles/ Joe

Burgess/ Josh Cole

A copy of this announcement is available from the Company's

website www.conceptaplc.com

Concepta Plc

Interim consolidated statement of comprehensive income

Notes Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

USD'000 USD'000 USD'000

---------------------------------- ------ ----------- ----------- -------------

Unaudited Unaudited Audited

---------------------------------- ------ ----------- ----------- -------------

Continuing operations

Revenue - - -

---------------------------------- ------ ----------- ----------- -------------

Cost of sales - - -

---------------------------------- ------ ----------- ----------- -------------

Gross loss - - -

Administrative expenses (357) (488) (207)

Share-based payments 5 21 (16) (32)

---------------------------------- ------ ----------- ----------- -------------

Operating loss (336) (504) (239)

Finance costs - - (7)

---------------------------------- ------ ----------- ----------- -------------

Loss before tax (336) (504) (246)

Taxation 6 - - -

---------------------------------- ------ ----------- ----------- -------------

Loss for the period from

continuing operations (336) (504) (246)

---------------------------------- ------ ----------- ----------- -------------

Discontinued operations

Profit/(loss) for the

period from discontinued

operations 4 109 (318) (2,855)

---------------------------------- ------ ----------- ----------- -------------

Loss for the period (227) (822) (3,101)

---------------------------------- ------ ----------- ----------- -------------

Other comprehensive income:

Exchange differences

arising on translation

of foreign operations (26) 115 (181)

Cumulative foreign exchange (73) - -

gain relating to disposal

of subsidiaries recycled

to profit from discontinued

operations

Total comprehensive loss

for the period (326) (707) (3,282)

---------------------------------- ------ ----------- ----------- -------------

Loss per share (USD)

---------------------------------- ------ ----------- ----------- -------------

Basic and diluted earnings

per share

From continuing operations 7 (0.02) (0.95) (0.25)

From discontinued operations 7 0.01 (0.60) (2.90)

From continuing and discontinued

operations 7 (0.01) (1.55) (3.15)

---------------------------------- ------ ----------- ----------- -------------

Concepta Plc

Interim consolidated statement of financial position

Notes Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

USD'000 USD'000 USD'000

------------------------------- ------ ----------- ----------- -------------

Unaudited Unaudited Audited

------------------------------- ------ ----------- ----------- -------------

ASSETS

Non-current assets

Property, plant and equipment - 2 -

Exploration and evaluation

assets 8 - 3,017 -

Total non-current assets - 3,019 -

------------------------------- ------ ----------- ----------- -------------

Current assets

Trade and other receivables 99 57 76

Cash and cash equivalents 1,335 20 26

------------------------------- ------ ----------- ----------- -------------

Total current assets 1,434 77 102

------------------------------- ------ ----------- ----------- -------------

Assets classified as

held for sale - - 699

------------------------------- ------ ----------- ----------- -------------

TOTAL ASSETS 1,434 3,096 801

------------------------------- ------ ----------- ----------- -------------

EQUITY AND LIABILITIES

Equity attributable to

holders of the parent

Share capital 9 1,302 2,652 636

Deferred shares 9 2,323 - 2,323

Share premium 9 6,862 5,081 5,741

Share-based payment reserve 26 506 522

Foreign exchange reserve (110) 285 (11)

Retained losses (9,100) (7,069) (9,348)

------------------------------- ------ ----------- ----------- -------------

Total equity 1,303 1,455 (137)

------------------------------- ------ ----------- ----------- -------------

Current liabilities

Trade and other payables 131 1,641 203

------------------------------- ------ ----------- ----------- -------------

Liabilities classified

as held for sale - - 735

------------------------------- ------ ----------- ----------- -------------

TOTAL EQUITY AND LIABILITIES 1,434 3,096 801

------------------------------- ------ ----------- ----------- -------------

Concepta Plc

Interim consolidated statement of changes in equity

Share Share Retained Share-based Foreign Total

Capital Deferred Premium Losses Payment Exchange Equity

share Reserve Reserve

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

As at 1 January

2016 636 2,323 5,741 (9,348) 522 (11) (137)

Loss for the

period - - - (227) - - (227)

Other comprehensive

income

Exchange differences

arising on translation

of foreign operations - - - - - (26) (26)

Cumulative foreign

exchange relating

to disposal of

subsidiaries

recycled to profit

from discontinued

operations - - - - - (73) (73)

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

Total comprehensive

income for the

period - - - (227) - (99) (326)

Issue of share

capital 666 - 1,121 - - - 1,787

Transfer of share

based payment

on cancelled

share options - - - 475 (475) - -

Share based payments - - - - (21) - (21)

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

As at 30 June

2016 (Unaudited) 1,302 2,323 6,862 (9,100) 26 (110) 1,303

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

As at 1 January

2015 2,652 - 5,081 (6,247) 490 170 2,146

Loss for the

period - - - (822) - - (822)

Other comprehensive

income - - - - - 115 115

Share based payments - - - - 16 - 16

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

As at 30 June

2015 (Unaudited) 2,652 - 5,081 (7,069) 506 285 1,455

------------------------- --------- ----------- --------- --------- ------------ ---------- --------

The following describes the nature and purpose of each reserve

within owners' equity.

Share capital Amount subscribed for share capital at nominal

value.

Share premium Amount subscribed for share capital in excess of

nominal value.

Retained losses Cumulative net losses recognised in the

financial statements.

Share-based payment reserve Amounts recognised for the fair value of share options granted

Foreign exchange reserve Exchange differences on translating foreign operations.

Concepta Plc

Interim consolidated statement of cash flows

Notes Six months Six months Year

ended ended ended

30 June 30 June 31 December

2016 2015 2015

USD'000 USD'000 USD'000

------------------------------- ------- ----------- ----------- -------------

Unaudited Unaudited Audited

------------------------------- ------- ----------- ----------- -------------

Cash flows from operating

activities

Loss before taxation (336) (822) (3,101)

Adjustments for:

Impairment of assets - - 2,241

Depreciation of plant

& equipment - - 1

Finance costs - - 7

Increase in trade and

other receivables (32) (8) (27)

(Decrease)/ increase

in trade and other payables (87) 559 (144)

Expenses settled through

issue of shares - - 497

Share based payments (21) 16 32

Net Cash used in continuing

operations (476) (255) (494)

Net cash used in discontinued - - -

operations

Net cash used in operating

activities (476) (255) (494)

---------------------------------------- ----------- ----------- -------------

Cash flows from investing

activities

Cash flow from disposal (2) - -

of businesses

Expenditures for exploration

and evaluation - (5) (91)

Net cash used in investing

activities (2) (5) (91)

---------------------------------------- ----------- ----------- -------------

Cash flows from financing

activities

Net proceeds from issue

of share capital 1,787 - 470

Finance costs - - (7)

---------------------------------------- ----------- ----------- -------------

Net cash from financing

activities 1,787 - 463

---------------------------------------- ----------- ----------- -------------

Net increase in cash

and cash equivalents 1,309 (260) (122)

Cash and cash equivalents

at the beginning of period 26 165 165

Effect of foreign exchange

rate changes - 115 (17)

---------------------------------------- ----------- ----------- -------------

Cash and cash equivalents

at end of period 1,335 20 26

---------------------------------------- ----------- ----------- -------------

Notes to the Unaudited Interim Financial Information

1 General information

Concepta Plc (formerly, Frontier Resources International plc) is

a Public Company incorporated in the United Kingdom under

registered number 06573154 with its registered office at 2a St

Martins Lane, York, YO1 6LN.

The Company is an AIM-traded company in London. The Company

changed its name on the 25 July 2016.

2 Significant accounting policies

Basis of preparation

The interim financial information for the six months ended 30

June 2016, which was approved by the Board of Directors on 17

August 2016, does not constitute statutory accounts as defined by

section 434 of the Companies Act 2006. The financial information

presented is unaudited and has been prepared using the same

accounting policies as those adopted in the financial statements

for the year ended 31 December 2015 and is expected to be adopted

in the financial year ending 31 December 2016. The financial

statements for the year ended 31 December 2015 were reported on by

the Company's auditors and delivered to the Registrar of Companies.

The report of the auditors was unqualified and did not contain an

adverse statement under section 498 (2) or (3) of the Companies Act

2006.

In the opinion of the Directors, the condensed half-year

accounts for the period present fairly the financial position and

the results from operations and cash flows for the period.

The condensed half-year accounts include unaudited comparative

figures for the half year ended 30 June 2015 and comparatives for

the year ended 31 December 2015 that have been extracted from the

audited financial statements for that year.

No new IFRS standards, amendments or interpretations became

effective in the six months to the 30 June 2016 which had a

material effect on this consolidated interim financial

information.

The interim financial information is presented in US Dollars

(USD or US$) rounded to the nearest thousand dollars (USD'000).

Accounting Policies

The condensed half year accounts have been prepared using

accounting policies based on International Financial Reporting

Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted by the

European Union, including IAS 34 'Interim Financial Reporting' and

IFRS 6 'Exploration for and Evaluation of Mineral Resources' and on

the historical cost basis.

The Group's financial risk management objectives and policies

are consistent with those disclosed in the 2015 annual report.

Going Concern

The half-year accounts have been prepared on a going concern

basis. The Group made a loss of USD 227,000 during the half year

ended 30 June 2016 and continues to be loss making. At 30 June

2016, the Group had cash balances of USD 1,335,000 and net assets

of USD 1,303,000.

Cash balances at the date of approval of these accounts are

approximately USD4.5m (GBP3.5m).

The Directors have prepared a cash flow forecast covering a

period extending 12 months from the date of approval of these

interim financial statements which shows that the Group will have

sufficient cash to meet its debts as they fall due over that

period. Concepta is an evolving healthcare company and

uncertainties exist in the forecast as a result. The forecast

contains certain assumptions about the performance of the business

including growth in future revenue, the cost model and margins, and

the level of cash recovery from trading. In the next 12 months, the

most critical assumptions are those concerning the launch of the

product and platform in China and the UK. The Directors are aware

of the risks and uncertainties facing the business as it pursues

its strategy but the assumptions used are the Directors' best

estimate of the future development of the business.

After considering the forecasts and the risks, the Directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence over the period of the

forecast. For these reasons, they continue to adopt the going

concern basis of accounting in preparing these financial

statements. However, beyond the forecast period the Group will need

either to increase its revenues or take actions to ensure it

remains sufficiently funded. As with any evolving healthcare

company there is always an inherent risk over the ability of the

Group and Company to continue as a going concern if forecasts are

not met and cash resources are not adequate. These interim

financial statements do not include any adjustments that would

result from the going concern basis of preparation being

inappropriate.

3 Operating segment information

The operations of the Group for the year ended December 2015 and

period ended June 2015 comprise of one operating segment, being oil

and gas exploration. The Group has oil and gas exploration and

evaluation licenses in Oman, Namibia and Zambia. However, during

the year to December 2015 the activity of this operating segment

has been discontinued (see note 4 for more details).

4 Discontinued operations and held for sale

On 2 March 2016 the Company agreed to liquidate their

subsidiaries, Frontier Resources Zambia Limited ("Zambia") and

Frontier Resources Namibia Limited("Namibia"). Both companies

ceased trading on 11 March 2016.

Frontier Inc ("Inc") and Frontier Oman ("Oman") has been

classified as held for sale in December 2015. On 23 March 2016,

entire interests in Frontier Resources Oman Limited and Frontier

Resources International Inc have been sold to Mr Jack Keyes, the

former chief executive of the Company for a consideration of GBP1

and deferred consideration, which is contingent on the achievement

of certain targets.

The results for these discontinued operations for Zambia,

Namibia, Oman and Inc below excluded any intercompany balances

written off or forgiven in the individual entities. These were

eliminated on consolidation of the group results.

Six Six months Year ended

months ended 31 December

ended 30 June 2015

30 June 2015

2016

USD'000 USD'000 USD'000

Profit on disposal of businesses* 109 - -

Administrative expenses - (318) (1,030)

Exceptional item-assets

impairment - - (1,825)

Profit/(loss) after tax 109 (318) (2,855)

--------- ----------- -------------

*this included $73,000 of cumulative foreign exchange gains

relating to the disposal of the subsidiaries recycled to income

statement.

The major classes of assets and liabilities of these

discontinued operations sold during the period ended 30 June 2016

are as follows:

Six months

ended

30 June

2016

$'000

Property, plant and equipment 2

Exploration and evaluation

assets 690

Cash and cash equivalents 2

Trade and other receivables 5

Trade and other payables (735)

-----------

Net liabilities (36)

Cumulative foreign exchange

recycled from translation

reserve (73)

Profit on disposal 109

-----------

Net consideration -

-----------

Net cashflow in respect

of disposal of the businesses

Cash received -

Cash and cash equivalents

sold (2)

-----------

(2)

-----------

5 Share options and share based payments

During the period, no share options were issued.

On 17 February 2016, the Company issued 4,750,000,000 new

ordinary shares of 0.01p as fully paid up with existing and new

investors at a placing price of 0.03p per ordinary share. In

addition, the Company issued 361,999,056 warrants to subscribe for

new ordinary shares.

On 7 April 2016, 47,857,593 warrants which were issued in

February 2016 were exercised at 0.03p.

The Company has the following outstanding share warrants at 30

June 2016:

Warrants over Exercise price Expiry date

existing ordinary

shares

------------------- --------------- -----------------

314,141,463 0.03p 7 October 2016

------------------- --------------- -----------------

12,500,000 1.0p 12 November 2019

------------------- --------------- -----------------

1,440,000 6.0p 5 July 2018

------------------- --------------- -----------------

328,081,463

------------------- --------------- -----------------

A credit of USD21,274 has been recognised in the six months

ended 30 June 2016 (six months ended 30 June 2015: charge of

USD16,452) and is included in the statement of comprehensive

income. During the period, 8,250,000 share options were surrendered

and cancelled by the share option holders as these options were

underwater where the option's exercise price is higher than market

price. As a result, US$475,000 charge were transferred from the

share based reserve to profit and loss reserve.

On 7 July 2016, 40,139,630 warrants which were issued in

February 2016 ("Warrants") were exercised. The exercise price is

0.03p per ordinary share of 0.01p ("Ordinary Share") and the gross

proceeds of exercise amounted in aggregate to GBP12,041.89, which

provides additional working capital for the Company.

On 25 July 2016, the remaining warrants of 274,001,833 with an

exercise date of 7 October 2016 and exercise price of 0.03p, were

after share consolidation (250 to 1), resulted in warrants over

1,096,007 of new ordinary shares with an exercise price of 7.5p.

12,500,000 and 1,440,000 warrants with an exercise price of 1.0p

and 6.0p, respectively were also after share consolidation (250 to

1) resulted in warrants over 50,000 and 5,760 of new ordinary

shares with an exercise price of 250p and 1500p, respectively.

On 25 July 2016 new warrants over 8,133,633 new ordinary shares

was also issued.

6 Taxation

The Group has incurred tax losses for the six months ended 30

June 2016 and a corporation tax charge for the period is not

anticipated.

7 Loss per share

Six months Six months Year

ended 30 ended 30 ended

June 2016 June 2015 31 December

2015

USD'000 USD'000 USD'000

-------------------------------- ----------- ----------- -------------

Unaudited Unaudited Audited

-------------------------------- ----------- ----------- -------------

Loss for the period -

continuing operations (336) (504) (246)

Profit/(loss) for the

period - discontinued

operations 109 (318) (2,855)

-------------------------------- ----------- ----------- -------------

Loss for the year (227) (822) (3,101)

-------------------------------- ----------- ----------- -------------

Weighted average number

of ordinary shares* 15,402,031 529,873 984,674

-------------------------------- ----------- ----------- -------------

Basic loss per share

- continuing operations

(USD) (0.02) (0.95) (0.25)

Basic profit/(loss) per

share - discontinued

operations(USD) 0.01 (0.60) (2.90)

-------------------------------- ----------- ----------- -------------

Basic loss per share(USD) (0.01) (1.55) (3.15)

-------------------------------- ----------- ----------- -------------

Weighted average number

of ordinary shares allowing

for the exercise of warrants* 16,714,357 1,079,947 2,432,670

-------------------------------- ----------- ----------- -------------

*The weighted average number of ordinary shares for each period

above were restated and based on the new number of shares and

issued, following the share consolidation whereby 250 existing

0.01p shares issued at each period end were converted to 1 new 2.5p

ordinary share on the 25 July 2016. The warrants were also subject

to the share consolidation and this is reflected in the weighted

average number of ordinary shares allowing for the exercise of

warrants for each period above.

The Company did not issue share options in the six months to 30

June 2016 or the comparative six months period. The diluted loss

per share has been kept the same as the basic loss per share as the

conversion on share options decreases the basic loss per share,

thus being anti-dilutive.

8 Exploration and evaluation assets

Cost (USD'000) Six months Six months Year ended

ended ended 31 December

30 June 30 June 2015

2016 2015

---------------------------- ----------- ----------- -------------

Brought forward 1,229 3,012 3,012

Additions - 5 91

Reclassified as held

for sale - - (1,702)

Disposals (1,229) - -

Foreign exchange movements - - (172)

---------------------------- ----------- ----------- -------------

Carried forward - 3,017 1,229

---------------------------- ----------- ----------- -------------

Depreciation (USD'000)

---------------------------- ----------- ----------- -------------

Brought forward (1,229) - -

Disposals 1,229 - -

Impairment losses - - (2,241)

Reclassified as held

for sale - - 1,012

---------------------------- ----------- ----------- -------------

Carried forward - - (1,229)

---------------------------- ----------- ----------- -------------

Geographic analysis

---------------------------- ----------- ----------- -------------

Oman - 1,810 -

Namibia - 977 -

Zambia - 230 -

---------------------------- ----------- ----------- -------------

Total - 3,017 -

---------------------------- ----------- ----------- -------------

The amount of capitalised exploration and evaluation expenditure

for Zambia and Namibia was fully impaired at 31 December 2015 and

subsequently disposed, following liquidation of the Zambia and

Namibia entities in March 2016.

The capitalised EEA relating to Oman licence has been

reclassified as held for sale at 31 December 2015 and subsequently,

Oman was disposed of in March 2016.

9 Share capital and share premium

The changes to issued share capital and share premium were as

follows:

Ordinary Share Deferred Deferred Share

shares

(number)

-------------------- --------------

Capital Share Share Premium

--------------

Company USD'000 Number USD'000 USD'000

-------------------- -------------- --------- ------------ --------- --------

As at 1 January

2015 165,430,505 2,652 - - 5,081

Issue of share - - - - -

capital

-------------------- -------------- --------- ------------ --------- --------

As at 30 June

2015 (Unaudited) 165,430,505 2,652 - - 5,081

Issue of share

capital 196,568,551 307 - - 660

Subdivision 165,430,505 - - - -

of existing

ordinary shares

into 1 ordinary

share of 0.1p

plus one deferred

share

Transferred

to Deferred

Shares (165,430,505) (2,323) 165,430,505 2,323 -

-------------------- -------------- --------- ------------ --------- --------

At 31 December

2015 361,999,056 636 165,430,505 2,323 5,741

Issue of share

capital 4,797,857,593 666 - - 1,121

-------------------- -------------- --------- ------------ --------- --------

As at 30 June

2016 (Unaudited) 5,159,856,649 1,302 165,430,505 2,323 6,862

-------------------- -------------- --------- ------------ --------- --------

10 Related party transactions

These comprise (a) transactions between the Company and its

subsidiaries which have been written off at year ended 31 December

2015 and eliminated on consolidation; (b) compensation and other

payments to key management personnel (including directors); (c)

consultancy fees for finance management services that were paid to

CFPro Limited and Cambridge Financial Partners LLP, companies in

which Barbara Spurrier (appointed a Director of the Company in

2013) has a financial interest.

The Group owed USD nil to Michael J Keyes, former CEO at 30 June

2016 (30 June 2015: USD216,922 and 31 December 2015: USD402,946).

In addition, the Group also owes USD nil to Michael J Keyes, former

CEO at 30 June 2016 (30 June 2015: USD38,664 and 31 December 2015:

USD20,000). Michael J Keyes resigned as a director on 17 February

2016.

The Directors voluntarily agreed unpaid accrued emoluments were

to be written off during the year 2015. There are no directors'

emoluments outstanding as at 30 June 2016 (30 June 2015:

USD558,148, 31 December 2015: USD nil).

The Directors, in their continuing support of the Group business

needs, agreed to continue the deferral of a proportion of their

remuneration

11 Control

The Company is under the control of its shareholders and not any

one party.

12 Subsequent events

On 12 July 2016, the Company allotted and issued 40,139,630 new

ordinary shares of 0.01p as fully paid up to holders of warrants

who exercised their rights. Further the Company also allotted 3,721

ordinary shares at an issue price of 0.03p each to Barbara Spurrier

to create Share Premium to cancel deferred shares.

On 25 July 2016, the Company's name has been changed to Concepta

Plc. Additionally, the following proposals become unconditional in

all respects upon Admission of the Enlarged share capital to

trading on AIM on the 26 July 2016:

1. the acquisition by the Company of the entire issued share

capital of Concepta Diagnostics Limited, resulting in the issue of

30,343,950 New Ordinary Shares;

2. the issue of 32,050,342 New Ordinary Shares under the Firm

Placing, 1,373,330 New Ordinary Shares under the Subscription,

10,833,333 New Ordinary Shares under the Debt Conversion,

13,759,618 New Ordinary Shares under the Open Offer.

3. Erik Henau and Dr Mark Wyatt join the Board as Chief

Executive and Non-Executive Director respectively.

On 25 July 2016, the Company has consolidated shares, whereby

every 250 existing ordinary shares of 0.01p is consolidated into 1

new ordinary share of 2.5p each. Thus the total 5,200,000,000

existing ordinary shares of 0.01p are consolidated into 20,800,000

new ordinary shares.

At a General Meeting held on 25 July 2016, the Company's

shareholders accepted completing the subscription, placing and open

offer to raise GBP3.5 million in new funds to support the continued

growth of the business.

On 26 July 2016 the Company has successfully started trading on

AIM. 109,160,573 new ordinary shares are admitted to trade by way

of reverse takeover of Frontier Resources International plc

(renamed as Concepta plc).

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGMRNNZGVZM

(END) Dow Jones Newswires

August 18, 2016 02:01 ET (06:01 GMT)

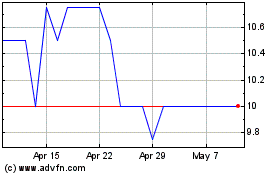

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From Apr 2024 to May 2024

Myhealthchecked (LSE:MHC)

Historical Stock Chart

From May 2023 to May 2024