Milton Capital PLC First Day of Dealings (6907B)

October 04 2022 - 1:10AM

UK Regulatory

TIDMMII

RNS Number : 6907B

Milton Capital PLC

04 October 2022

4 October 2022

Milton Capital plc

("Milton Capital" or the "Company")

Admission to a Standard Listing

and to trading on the Main Market of the London Stock

Exchange

First day of dealings

Admission details

Milton Capital plc (LSE: MII) announces that 100,000,000

Ordinary Shares will today be admitted to the Standard Segment of

the Official List of the Financial Conduct Authority and to trading

on the Main Market for listed securities of the London Stock

Exchange. The placing of new ordinary shares has successfully

raised a total of GBP950,000, at a placing price of GBP0.01 per

share.

Highlights:

-- One Price for All - All investors have come in at the same

IPO price; no Founder Shares or pre-IPO rounds; no warrants; no

options.

-- No Advisory/Broking Fees - The Company's advisor and broker,

Peterhouse Capital, has agreed to waive all advisory fees and

commission on all funds raised at the IPO and will receive no

annual retainer.

-- Capped listing and on-going costs -

- The IPO costs, including all accounting, legal, PR and

Exchange fees, which amount to GBP55,955, have been capped at

GBP50,000 by Peterhouse Capital and as such, post Admission, the

Company will have net proceeds of GBP950,000 ;

- Total costs for the first full year after listing are also capped at GBP50,000.

-- No ongoing director salaries - The Company's directors will

receive no salaries or consultancy fees; compensation will only be

received by way of a success fee on the completion of an

acquisition approved by shareholders.

Strategy

The Company was formed to undertake one or more acquisitions of

a majority interest in a company or business. Any such acquisition

undertaken by the Company will be treated as a reverse takeover for

the purposes of Chapter 5 of the Listing Rules.

The directors intend to search initially for acquisition

opportunities in the technology sector. The theme focus for the

prospective acquisition is megatrends. This includes sectors such

as space, artificial intelligence, machine learning and blockchain

technology.

Megatrends are powerful, transformative forces that can change

the global economy, business and society. They drive innovation and

redefine business strategies and have a meaningful impact on how we

live, how we spend our money and how we invest. The disrupters in

particular have produced dynamic profits for early-stage

shareholders.

Admission details

Prior to Admission, the Company had 5,000,000 Existing Ordinary

Shares in issue and conditional on Admission issued 95,000,000

Placing Shares. All Existing Ordinary Shares and Placing Shares

were issued at a price of GBP0.01 per share.

Capitalised terms used in this announcement are as defined in

the prospectus published by the Company on 29 September 2022,

unless the context otherwise requires. Such prospectus was

published to allow for Admission of 5,000,000 Existing Issued

Ordinary Shares and 95,000,000 Placing Shares and following any

relevant triggering event(s) from time to time, secondary Admission

of up to 205,000,000 Shares deriving from the exercise of warrants

issued in connection with the Placing. A copy of the prospectus is

available at the Company's website, www.milton-capital.co.uk.

The total number of Ordinary Shares in issue on Admission will

be 100,000,000 and this number may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the Disclosure Guidance and

Transparency Rules.

Dealing will commence at 8.am. today. The codes for the Ordinary

Shares will be as follows:

ISIN GB00BMWLC750

SEDOL code BMWLC75

TIDM MII

The Company is incorporated and registered in England and Wales

under the Companies Act 2006 with company number 13628457.

For further enquiries please contact:

Milton Capital plc

Directors

Malcolm Burne info@milton-cpaital.co.uk

Eran Zucker

Peterhouse Capital Limited

Financial Adviser and

Brefo Gyasi / Lauren Riley /

Guy Miller

Corporate Broker

Lucy Williams / Duncan Vasey +44 (0)20 7469 0930

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

LISMIBFTMTMMMIT

(END) Dow Jones Newswires

October 04, 2022 02:10 ET (06:10 GMT)

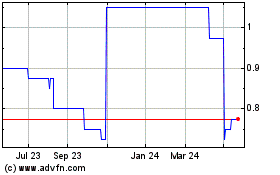

Milton Capital (LSE:MII)

Historical Stock Chart

From Nov 2024 to Dec 2024

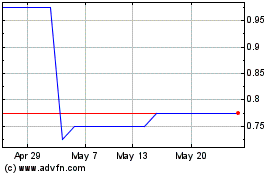

Milton Capital (LSE:MII)

Historical Stock Chart

From Dec 2023 to Dec 2024