TIDMMIRI

RNS Number : 9791J

Mirriad Advertising PLC

22 August 2023

22 August 2023

Mirriad Advertising plc

("Mirriad" or the "Company")

Unaudited interim results

Mirriad, the leading in-content advertising company, today

announces unaudited interim results for the six months ended 30

June 2023 (the "Period" or "H1").

H1 results webinar

The Company will host a webinar for analysts and investors at

14:00 BST on 22 August 2023 following which the presentation will

be made available on the Company's website. If you would like to

attend, please email

mirriad@charlottestreetpartners.com to register for dial-in details.

H1 2023 highlights:

Strategic developments

-- The Company completed a strategic review during the Period,

concluding that a restructuring to significantly reduce net cash

burn alongside an equity capital raise was the most appropriate

route forward

-- Continued development of the Company's proprietary platform

to deliver fully programmatic advertising sales, initially focused

on the US market, with expectation of first recurring programmatic

revenues in 2024

-- Continued development and penetration of the US supply-side

customer base with strong focus on the major entertainment and

connected TV players resulting in an expectation of contracting for

a programmatic service with at least one of these US tier 1

customers by the end of 2023

-- Continued development and penetration of the US demand-side

with strong focus on the top 20 advertisers by spend, significantly

increased number of repeat buyers across key industry

categories

-- Technology collaboration with Microsoft announced, targeting

joint market activity and accelerated roadmap advancement including

integration of advanced AI capabilities

-- New partner signed in the Middle East boosting revenue in the EMEA region

Financial headlines

-- Revenue for H1 of GBP592k (H1 2022: GBP577k) despite market

headwinds in the US. Due to seasonal nature of key advertising

markets and the sales pipeline, higher revenues are expected in H2

2023

-- Gross proceeds from Placing and Open Offer in May 2023 of GBP6.3m (GBP5.7m net)

-- Restructuring programme completed with cost of change of

GBP186k recognised in the Period and Company on track to reduce net

cash burn by approximately 35% from GBP1.1m in the 12 months to

June 2023 to around GBP700k per month for the 12 months to June

2024

-- Final closure of Chinese operations at the end of Q1 2023

-- Closing cash at the end of June 2023 of GBP9.8m (30 June

2022: GBP17.7m) and no debt give a forecast runway to end August

2024

-- Marginal increase in cash consumption in the Period to

GBP7.0m (H1 2022: GBP6.7m) due to a number of one-off receipts in

the prior Period

-- Operating loss for the Period reduced to GBP7.5m (H1 2022:

loss of GBP8.5m) as a result of cost reductions announced in

2022

-- Loss per share 2p (H1 2022: loss 3p)

KPIs - continuing operations*

KPI H1 2023 H1 2022 Change

Supply side

1. Active supply partnerships 18 17 +6%

2. Supply partners represented 68 60 +13%

3. Seconds of content available 410,808 337,862 +22%

---------- ---------- -------

Demand side

1. Active agency relationships 18 9 +100%

2. Number of advertisers who have run campaigns 31 18 +72%

3. Strategic and commercial partnership agreements with advertisers and agencies

1 2 -50%

---------- ---------- -------

* data restated to exclude Chinese operations in H1 2022

comparatives

Stephan Beringer, CEO of Mirriad , said: "Our growing momentum

with the biggest entertainment companies in the US and Europe shows

Mirriad is now leading the in-content advertising category and that

the overall market environment is turning in our direction because

of the pressing need for new revenue streams. Our collaboration

with Microsoft, which we announced in May 2023, has accelerated the

development of our platform as an enterprise level solution that is

ready for programmatically sold inventory - a key building block

for tier 1 partnerships and prerequisite for the increased scale

we've been working towards.

"On the demand side, the Company is focusing on a key account

strategy for advertisers. Even before enabling programmatic

trading, we already work with nine of the top twenty US

advertisers, which account for over ten billion dollars in total

combined annual advertising spend. We are also pleased to see an

increase in repeat bookings in H1 from large customers in the

automotive, retail, FMCG, food & beverage, healthcare and

financial services industries.

"We are now moving from market building to growth phase, which

we expect to kick in with programmatic revenues in 2024. This will

move the Company from its current manual sales process to an

automated sales process, facilitating scale. So far in 2023 we've

seen improvements across the majority of our KPIs, despite

continuing advertising market headwinds in the US and the fact that

this is our first year without meaningful revenue from China.

"We expect materially higher revenues in H2 based on the

seasonality of the advertising business. The recent cost-cutting

measures required some difficult decisions but, following a

successful equity fundraise and the strong focus on platform,

programmatic and partnerships, we are confident the business is now

on a strong footing moving into H2 and beyond."

S

For further information please visit www.mirriad.com or

contact:

Mirriad Advertising plc Tel: +44 (0)207 884 2530

Stephan Beringer, Chief Executive Officer

David Dorans, Chief Financial Officer

Nominated Adviser & Broker: Tel: +44 (0)20 7886 2500

Panmure Gordon

James Sinclair-Ford/Daphne Zhang (Corporate

Advisory)

Rupert Dearden (Corporate Broking)

Financial Communications:

Charlotte Street Partners

Tom Gillingham Tel: +44 (0) 7741 659021

Fergus McGowan Tel: +44 (0) 7590 049023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

About Mirriad

Mirriad's award-winning solution unleashes new revenue for

content producers and distributors by creating new advertising

inventory in content. Our patented, AI and computer vision

technology dynamically inserts products and innovative signage

formats after content is produced. Mirriad's market-first solution

seamlessly integrates with existing subscription and advertising

models, and dramatically improves the viewer experience by limiting

commercial interruptions.

Mirriad currently operates in the US, Europe and the Middle

East.

Chairman's Statement

We have now completed the detailed strategic review and closed a

successful equity fundraising round which gives us important

clarity to now deliver on the agreed outcomes.

As has been widely reported, the macro-economic climate we

operate in has not become any easier, but the decisions the Company

has taken are intended to ensure Mirriad can ride out the current

advertising market softness and effectively deploy what is an

effective and scalable solution against global audience fatigue and

shrinking volumes of available inventory.

The restructuring that resulted from the strategic review was

not an easy process, and it's always challenging when a business

has to say goodbye to colleagues. We wish those who have left the

business the best for the next steps in their careers. Throughout

the process we have focused on retaining a motivated workforce and

I'm pleased to say morale is high and we have strong internal

alignment as we drive the business forward.

As part of the strategic review, we have also changed the

composition of our board. Alastair Kilgour and Lois Day have

stepped down and I would like to personally thank them for their

contribution to the business and their strategic insight during the

recent period in particular.

We now look forward to further development in programmatic

delivery, which is the key route to scale for the Company,

particularly in the important US market. As we have indicated, we

anticipate 2024 will be a key year for US revenues stemming from

this transition.

At the same time, we are already starting to realise cost

savings as a result of the steps taken during the strategic review,

and continuing to drive these efficiencies will be a priority as we

deliver on objectives. I have said previously, we will focus our

spend in the areas which will have most impact whilst reducing and

reprioritising expenditure away from areas with less immediate

revenue generating potential, and this remains true today.

H2 is traditionally a busier period for ad campaign booking and

we have a high-quality pipeline. I would like to again thank our

shareholders for their continued engagement and patience during the

strategic review. Management and the whole team are now hard at

work converting the pipeline and preparing the Company for the

transition to programmatic delivery which is the key enabler of

Mirriad's future growth.

John Pearson

Non-executive Chairman

22 August 2023

Chief Executive Officer's Statement

Overview

We recorded a modest increase in overall H1 revenue in 2023

compared to H1 2022, as the Company still operates within its

pre-programmatic sales model. This is set against a backdrop of

significant and ongoing US advertising market pressure, which can

be tracked back to Q4 2022.

It is pleasing to see our ability to make relative revenue

progress in the EU and the Middle East while conditions are less

favourable in the US, but the latter has by far the most potential

and will remain our focus ahead of advertising market confidence

returning.

We have seen improvement across most of the KPIs we regularly

report against, and we expect to see further progress in the areas

that have stayed broadly stable in this most recent reporting

period.

Mirriad's future success will be driven by platform,

programmatic and partnerships. All the work undertaken so far is to

initiate Mirriad's transition to automated programmatic selling at

scale, and with the key building blocks for this now falling into

place, we are confident that the rewards will follow soon. The

collaboration with Microsoft has accelerated our development, and

there is more to come especially as we increasingly leverage

Microsoft's leading AI capabilities in our platform.

Campaigns update

In terms of campaigns delivered in H1 2023, there were notable

achievements with over 20 tier 1 brands across multiple categories

including FMCG, automotive, retail, food & beverages, telco and

alcohol. The number of advertisers who have run campaigns has

increased by 72% since the comparative period in 2022, and now sits

at 31 in total for H1 2023.

The performance of Mirriad campaigns has improved even further,

with recent research results showing brand affinity up by 96%,

purchase intent up by 54% and our format preferred more than eight

times versus traditional TV spot advertising. These results clearly

underline the superiority of our in-content format, as a growing

number of advertisers renew their investments with us.

This month we released a white paper together with Kantar, the

global leader in audience and media research. Our joint study found

that a substantial 86% of all viewers take actions to avoid

interruptive video advertising across broadcast and network TV,

streaming, and online video. In contrast, viewers feel much more

positive about in-content advertising from Mirriad and take no

steps to avoid this integrated ad format. The research adds further

evidence to the value of Mirriad's ad format for the entire

industry across all distribution models including SVOD.

The same Kantar study also found that a viewer's negative

perception of an ad format leads to lower purchase activity.

Viewers are so over-saturated by TV and video advertising that, if

they do see the ads, they purchase the advertised products and

services at a lower rate. Mirriad's virtual in-content format

compares very favourably due to its non-intrusive and natural

nature. It is liked by viewers and, therefore, the research

indicates that it is able to drive 35% more sales.

Pipeline and partners update

Our KPIs show a steep increase in the number of active agency

relationships, as well as a rising number of advertisers who have

run campaigns. We also saw an increase in repeat customers in H1

with a total of 14 repeat brands advertising in H1 2023 versus 4 in

the same period in 2022. While we don't intend to advance the

headline number of supply-side partnerships as rapidly going

forward, we do expect the depth and breadth of the engagements with

top 10 players in the US we're now focusing on, to take our

business to its next level thanks to enterprise-level integrations,

including the enablement of programmatically transacted inventory.

Our expectation is to sign our first programmatic agreement with a

major US entertainment content company by the end of this year.

Technology update

To date our revenue profile has been based on a labour-intensive

manual sales process, and 2023 is the year we initiate the

transition from this first market building and adoption phase to

programmatic selling, which is expected to open up increased

volumes, far shorter lead times, automated transactions and true

scale. We anticipate this form of revenue building in the US market

in particular in 2024.

Outlook

Now that we have completed the strategic review and the equity

fundraising plan, we have a cash runway to the end of August 2024,

which we expect to give us headroom to unlock the significant

opportunity that exists with programmatic selling in 2024 in the US

in particular.

Our pipeline is strong, with interest from the top players in

the industry, thanks to the progress we have made technologically

and by proving the unique performance of our solution with some of

the biggest networks, advertisers and content owners as a true

differentiator in what is a saturated and constrained global ad

market.

This approach is our route to scaling the Company in line with

its full potential in highly challenged multibillion dollar media

and marketing industries, and to creating long-term shareholder

value. Everyone at Mirriad is laser-focused on this objective, and

I have every confidence in our re-shaped, highly motivated team's

ability to deliver.

Stephan Beringer

Chief Executive

22 August 2023

Chief Financial Officer's Statement

Interim results

In H1 2023 revenues were modestly higher than the same period in

2022 even though this was the first year without material revenues

from China. Revenues for the Period were GBP592k (H1 2022: GBP577k)

an increase of 3%. Looking specifically at continuing operations

results were more impressive with revenues for the Period

increasing by 26% to GBP576k (H1 2022: GBP458k). Within this US

revenues continued to be impacted by the overall slowdown in the US

advertising market, an industry wide phenomenon that started in Q4

2022. This meant that US revenues declined Period on Period to

GBP313k (H1 2022: GBP418k).

Conversely Europe & the Middle East ("EMEA") saw a

significant growth in revenue, albeit from a modest base to GBP261k

(H1 2022: GBP40k). This was a result of the sale of regular

campaigns on both RTL Deutschland and ProSieben in Germany and a

new Middle Eastern partner, MBC.

Gross profit for the Period increased modestly to GBP433k (H1

2022: GBP430k). The increase in Gross profit was slightly lower

than the increase in revenue as a result of inflationary increases

in the cost of sales. As previously stated, cost of sales is

principally expenditure on staff as the increase was due to salary

inflation.

The Group's operating loss decreased by 11% during the Period to

GBP7.5m (H1 2022: GBP8.5m) because of a reduction in administrative

expenses following the exit from our Chinese business and other

cost saving measures instigated in H2 2022. The Company had

previously flagged that the exit from China would lead to

annualised savings of GBP1m and that other cost savings measures

would lead to an incremental reduction in operating expenditure of

around GBP1.5m on an annualised basis with an overall reduction of

GBP2.5m anticipated on an annualised basis. This is before the

impact of the restructuring announced in the Period. In total

administrative expenses in the Period decreased by 10% to GBP8.0m

(H1 2022: GBP8.9m). Headcount as at 30 June 2023 was 91 (30 June

2022: 109).

At the half year end, we have again reviewed our compliance with

IAS 38 and we continue to believe that the inherent uncertainty of

future revenue generation means that it is not appropriate to

capitalise any of our development cost in the first six months of

the year.

The Group continues to prioritise expenditure on research and

development as it builds programmatic capability. Nevertheless, the

Company chose to make some tactical reductions in its technology

function in line with the wider business restructuring with a view

to focusing spend on the transition to programmatic sales. For the

period ending June 2023 total expenditure on research and

development was broadly flat at GBP1.9m (H1 2022: GBP2.0m).

The loss for the period before tax decreased by 12% to GBP7.5m

(H1 2022: GBP8.4m) in line with the decrease in operating loss

noted above.

Tax

The Group has not recognised any tax assets in respect of

trading losses arising in the current financial period or

accumulated losses in previous financial years. The tax credit

recognised in the current and previous period arises from the

receipt of R&D tax credits in the UK. The amount receivable for

the Period ended 30 June 2023 is GBP292k (H1 2022: GBP293k).

Earnings per share

The company recorded a loss of 2 pence per share (H1 2022: loss

of 3 pence per share) mainly as a result of the reduced losses.

This calculation is based on the weighted average number of shares

in issue during the period and so the shares issued following the

placing and open offer in June 2023 had a relatively small impact

on the calculation.

Dividend

No dividend has been proposed for the Period ended 30 June 2023

(H1 2022: GBPnil).

Cash flow

Net cash used in operations (defined as the sum of net cash used

in operating activities and the net cash used in investing

activities) during the Period increased marginally to GBP7.0m (H1

2022: GBP6.7m). There are a number of one off items which explain

the divergence between operating loss and cashflow: final cash

closure costs for our China operations were incurred in the Period

whereas the charge was incurred in H2 2022; H1 2022 included a rent

free period on the renegotiated London office lease; and H1 2022

included the receipt for the 2019 restated R&D tax credit

whereas there was no matching receipt in H1 2023. During the period

no development costs were capitalised (H1 2021: GBPnil). The Group

also incurred GBP8k (H1 2022: GBP42k) of capital expenditure on

tangible assets.

210,128,596 Ordinary Shares were issued in the Period (H1 2022:

Nil) as a result of the successful placing and open offer which

closed in May 2023.

Balance sheet

The Group has a debt-free balance sheet. Net assets decreased by

43% to GBP10.3m (30 June 2022: GBP17.9m) as the Company used cash

balances to fund the Group's ongoing operations balanced by the

funds raised from the placing and open offer of GBP5.7m. Cash and

cash equivalents at 30 June 2023 were GBP9.8m (30 June 2022:

GBP17.7m).

Accounting policies

These condensed consolidated interim financial statements for

the half-year reporting period ended 30 June 2023 have been

prepared in accordance with the UK-adopted International Accounting

Standard (IAS) 34, 'Interim Financial Reporting'.

David Dorans

Chief Financial Officer

22 August 2023

Company Information

Directors Independent Auditors

John Pearson PricewaterhouseCoopers LLP

Chairman 7 More London Riverside

Stephan Beringer London

Chief Executive Officer SE1 2RT

David Dorans

Chief Financial Officer Solicitors

Bob Head Osborne Clarke LLP

Non-Executive Director 6th Floor

Nicole McCormack One London Wall

Non-Executive Director London

JoAnna Foyle EC2Y 5EB

Non-Executive Director

Company registration number Company Secretary

09550311 Jamie Allen

-----------------------------------

Registered Office Nominated Adviser & Broker

6(th) Floor Panmure Gordon (UK) Limited

One London Wall 40 Gracechurch St

London London

EC2Y 5EB EC3V 0BT

-----------------------------------

Company website Financial PR

www.mirriad.com Charlotte Street Partners Limited

Prospect House

5 Thistle Street

Edinburgh

EH12 1DF

-----------------------------------

Registrars

Computershare Investor Services

plc

The Pavilions

Bridgwater Road

Bristol

BS99 6ZZ

-----------------------------------

Condensed consolidated statement of profit or loss and condensed

statement of comprehensive income for the six months ended 30 June

2023

Year ended

31 December

Six months ended 30 June 2023 Six months ended 30 June 2022 2022

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

------------------------------- ------------------------------- --------------

Revenue 5 591,883 577,436 1,507,257

Cost of Sales (158,977) (147,154) (286,316)

---------------------------- ------ ------------------------------- ------------------------------- --------------

Gross Profit 432,906 430,282 1,220,941

---------------------------- ------ ------------------------------- ------------------------------- --------------

Administrative expenses (7,960,508) (8,880,678) (16,863,015)

Other operating Income - - -

---------------------------- ------ ------------------------------- ------------------------------- --------------

Operating Loss (7,527,602) (8,450,396) (15,642,074)

---------------------------- ------ ------------------------------- ------------------------------- --------------

Finance Income 80,122 23,093 71,875

Finance costs (5,501) (18,622) (22,512)

---------------------------- ------ ------------------------------- ------------------------------- --------------

Finance income / (costs)

net 74,621 4,471 49,363

Loss before income tax (7,452,981) (8,445,925) (15,592,711)

Income tax credit 291,984 293,300 491,888

---------------------------- ------ ------------------------------- ------------------------------- --------------

Loss for the period / year (7,160,997) (8,152,625) (15,100,823)

---------------------------- ------ ------------------------------- ------------------------------- --------------

Loss per ordinary share - basic 6 (2p) (3p) (5p)

------------------------------------ ------------------------------- ------------------------------- --------------

All activities are classified as continuing.

Year ended

31 December

Six months Six months

ended 30 June ended 30 June

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------- --------------- --------------

Loss for the financial period

/ year (7,160,997) (8,152,625) (15,100,823)

------------------------------------------ --------------- --------------- --------------

Other comprehensive income

Items that may be reclassified

to profit or loss:

Exchange differences on translation

of foreign operations 46,903 276,856 43,782

------------------------------------------ --------------- --------------- --------------

Total comprehensive loss for

the period / year (7,114,094) (7,875,769) (15,057,041)

------------------------------------------ --------------- --------------- --------------

Condensed consolidated balance sheet

At 30 June 2023

As at 31

December

As at 30 As at 30

June 20 23 June 2022 2022

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

----------------------------- ----- -------------- -------------- -------------

Assets

Non-current assets:

Property, plant and

equipment 380,557 704,104 544,242

Trade and other receivables 186,826 188,795 187,657

567,383 892,899 731,899

Current assets

Trade and other receivables 1,511,862 1,307,677 2,221,091

Other current assets 821,361 1,135,286 529,377

Cash and cash equivalents 9,791,488 17,714,189 11,289,123

----------------------------- ----- -------------- -------------- -------------

12,124,711 20,157,152 14,039,591

----------------------------- ----- -------------- -------------- -------------

Total assets 12,692,094 21,050,051 14,771,490

----------------------------- ----- -------------- -------------- -------------

Liabilities

Non-current liabilities

Lease liabilities 110,107 357,912 206,988

----------------------------- ----- -------------- -------------- -------------

110,107 357,912 206,988

----------------------------- ----- -------------- -------------- -------------

Current liabilities

Trade and other payables 1,997,476 2,419,427 2,904,311

Provisions 40,743 - 198,199

Current tax liabilities 14,330 - 14,330

Lease liabilities 264,109 345,196 322,401

----------------------------- ----- -------------- -------------- -------------

2,316,658 2,764,623 3,439,241

----------------------------- ----- -------------- -------------- -------------

Total liabilities 2,426,765 3,122,535 3,646,229

----------------------------- ----- -------------- -------------- -------------

Net Assets 10,265,329 17,927,516 11,125,261

----------------------------- ----- -------------- -------------- -------------

Equity and Liabilities

Equity attributable

to owners of the parent

Share capital 7 54,791 52,690 52,690

Share premium 71,406,966 65,754,666 65,754,666

Share based payment

reserve 5,506,616 4,527,838 4,906,855

( 269,369 ( 83,198 ( 316,272

Retranslation reserve ) ) )

( 66,433,675 ( 52,324,480 ( 59,272,678

A ccumulated losses ) ) )

----------------------------- ----- -------------- -------------- -------------

Total equity 10,265,329 17,927,516 11,125,261

----------------------------- ----- -------------- -------------- -------------

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2023

Six months ended 30 June 2022

--------------------------------------------------------------------------------------------

Share

Share Share based payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

Note GBP GBP GBP GBP GBP GBP

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Balance as at

1 January 2022 52,690 65,754,666 3,665,525 (360,054) (44,171,855) 24,940,972

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Loss for the

period - - - - (8,152,625) (8,152,625)

Other

comprehensive

income for the

period - - - 276,856 - 276,856

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Total

comprehensive

loss for the

period - - - 276,856 (8,152,625) (7,875,769)

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Share based

payments

recognised as

expense - - 862,313 - - 862,313

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Total transactions

with shareholders

recognised directly

in equity - - 862,313 - - 862,313

----------------------------- --------- ----------- --------------- -------------- ------------- ------------

Balance as

at 30 June 2022 52,690 65,754,666 4,527,838 (83,198) (52,324,480) 17,927,516

----------------------------- --------- ----------- --------------- -------------- ------------- ------------

Year ended 31 December 2022 (audited)

----------------------------------------------------------------------------------

Share based

Share Share payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

GBP GBP GBP GBP GBP GBP

----------------------- --- ---------- ----------- ------------ -------------- ------------- -------------

Balance at 1

January 2022 52,690 65,754,666 3,665,525 (360,054) (44,171,855) 24,940,972

Loss for the

financial year - - - - (15,100,823) (15,100,823)

Other comprehensive

income for the

year - - - 43,782 - 43,782

----------------------- --- ---------- ----------- ------------ -------------- ------------- -------------

Total comprehensive

loss for the

year - - - 43,782 (15,100,823) (15,057,041)

----------------------- --- ---------- ----------- ------------ -------------- ------------- -------------

Share based payments

recognised as

expense - - 1,241,330 - - 1,241,330

----------------------- --- ---------- ----------- ------------ -------------- ------------- -------------

Total transactions

with shareholders

recognised directly

in equity - - 1,241,330 - - 1,241,330

---------------------------- ---------- ----------- ------------ -------------- ------------- -------------

Balance as

at 31 December

2022 52,690 65,754,666 4,906,855 (316,272) (59,272,678) 11,125,261

---------------------------- ---------- ----------- ------------ -------------- ------------- -------------

Six months ended 30 June 2023

--------------------------------------------------------------------------------------------

Share

Share Share based payment Retranslation Accumulated Total

Capital Premium reserve reserve Losses Equity

Note GBP GBP GBP GBP GBP GBP

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Balance as at

1 January 2023 52,690 65,754,666 4,906,855 (316,272) (59,272,678) 11,125,261

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Loss for the

period - - - - (7,160,997) (7,160,997)

Other

comprehensive

income for the

period - - - 46,903 - 46,903

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Total

comprehensive

loss for the

period - - - 46,903 (7,160,997) (7,114,094)

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Proceeds from

shares issued 2,101 6,301,757 - - - 6,303,858

Share issue

costs - (649,457) - - - (649,457)

Share based

payments

recognised as

expense - - 599,761 - - 599,761

----------------- ---------- --------- ----------- --------------- -------------- ------------- ------------

Total transactions

with shareholders

recognised directly

in equity 2,101 5,652,300 599,761 - - 6,254,162

----------------------------- --------- ----------- --------------- -------------- ------------- ------------

Balance as

at 30 June 2023 54,791 71,406,966 5,506,616 (269,369) (66,433,675) 10,265,329

----------------------------- --------- ----------- --------------- -------------- ------------- ------------

Condensed consolidated statement of cash flows for the six months ended 30 June 2023

Note Year ended

31 December

Six months 2022

ended 30

June 2023 Six months ended 30 June 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------- ------ -------------- ------------------------------- --------------

Cash flow used

in operating

activities 8 (7,052,411) (6,941,442) (14,017,146)

Tax credit

received - 274,335 1,116,320

Taxation paid (10,848) (14,291) (39,829)

Interest

received 80,122 23,093 71,875

Lease interest

paid (5,501) (18,622) (22,512)

--------------- ------ -------------- ------------------------------- --------------

Net cash used

in operating

activities (6,988,638) (6,676,927) (12,891,292)

--------------- ------ -------------- ------------------------------- --------------

Cash flow from

investing

activities

Purchase of

tangible

assets (8,225) (42,462) (75,647)

Proceeds from - - -

disposal of

tangible

assets

--------------- ------ -------------- ------------------------------- --------------

Net cash used

in investing

activities (8,225) (42,462) (75,647)

--------------- ------ -------------- ------------------------------- --------------

Cash flow from

financing

activities

Proceeds from 5,654,401 - -

issue of

ordinary share

capital (net

of costs of

issue)

Payment of

lease

liabilities (155,173) (67,636) (245,152)

--------------- ------ -------------- ------------------------------- --------------

Net cash used

in financing

activities 5,499,228 (67,636) (245,152)

--------------- ------ -------------- ------------------------------- --------------

Net decrease

in cash and

cash

equivalents (1,497,635) (6,787,025) (13,212,091)

Cash and cash

equivalents

at the

beginning of

the period /

year 11,289,123 24,501,214 24,501,214

Cash and cash

equivalents

at the end of

the period /

year 9,791,488 17,714,189 11,289,123

--------------- ------ -------------- ------------------------------- --------------

Cash and cash equivalents

consists of

Cash at bank and in hand 9,791,488 17,714,189 11,289,123

Cash and cash equivalents 9,791,488 17,714,189 11,289,123

---------------------------- ---------- ----------- -----------

1 Basis of preparation

These condensed consolidated interim financial statements for

the half-year reporting period ended 30 June 2023 have been

prepared in accordance with the UK-adopted International Accounting

Standard (IAS) 34, 'Interim Financial Reporting'.

The interim report does not include all of the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2022, which has been prepared in accordance

with UK-adopted international accounting Standards and with the

requirements of the Companies Act 2006 as applicable to companies

reporting under those standards.

These condensed interim consolidated financial statements for

the six months ended 30 June 2023 and for the six months ended 30

June 2022 do not constitute statutory accounts as defined in

Section 434 of the Companies Act and are unaudited. The financial

information for the six months ended 30 June 2023 presents

financial information for the consolidated Group, including the

financial results of the Company's wholly owned subsidiaries

Mirriad Advertising Private Limited, Mirriad Inc, Mirriad Software

Science and Technology (Shanghai) Co. Ltd, and Mirriad Limited

(dormant). Comparative figures in the condensed interim financial

statements for the year ending 31 December 2022 have been taken

from the Group's audited financial statements on which the Group's

auditors, Pricewaterhouse Coopers LLP, expressed an unqualified

opinion.

The Board approved these interim financial statements on 22

August 2023.

1.1 Going concern

These condensed interim financial statements have been prepared

on the going concern basis, notwithstanding the Group having made a

loss for the period of GBP7.16 million (June 2022: GBP8.15

million). The going concern basis assumes that the Group and

Company will have sufficient funds available to continue to trade

for the foreseeable future and not less than 12 months from the end

of the financial period being reported.

The Group's cash balance was GBP9.8 million at the period end

and the Group remains debt free with no external borrowing.

The Company announced a successful placing and open offer that

raised a total of GBP6.3 million, before costs on 2(nd) June 2023.

This amounts to GBP5.65 million after fees and related costs. After

making enquiries and producing cash flow forecasts for the period

up to 31 December 2025, the Directors have reasonable expectations,

as at the date of approving the financial statements, that the

Company and the Group will have adequate resources to fund the

activities of the Company and the Group for the next 12 months from

the date of the financial period being reported. The Group and

Company's base case forecast suggests that the Group will require

additional external funding in August 2024 to be able to continue

as a going concern. However, in a severe but plausible downside

scenario, if either the revenue growth forecasts or cost saving

initiatives fall below expectation, additional funding may be

required, within 12 months of approving these condensed interim

financial statements which is not currently committed.

While these condensed interim financial statements are prepared

on a going concern basis, under a severe but plausible downside

scenario the future of the Group and Company is dependent on

raising additional external funds from new equity, debt or customer

contracts within 12 months from the date of signing these financial

statements.

As such these conditions indicate the existence of a material

uncertainty which may cast significant doubt about the Group's and

the Company's ability to continue as a going concern. These

condensed interim financial statements do not include the

adjustments that would arise if the Group or Company were unable to

continue as a going concern.

2 Accounting Policies

The accounting policies applied are consistent with those of the

annual report and accounts for the year ended 31 December 2022, as

described in those financial statements other than standards,

amendments and interpretations which became effective after 1

January 2023 and were adopted by the Group. These have had no

significant impact on the Group's loss for the period or

equity.

Seasonality of Operations

Due to the seasonal nature of the US and UK advertising markets

higher revenues are usually expected in the second half of the year

than the first six months. In the financial year ended 31 December

2022, 35% of US revenues accumulated in the first half of the year,

with 65% accumulating in the second half. For the UK Company 22% of

revenues accumulated in the first half of 2022 and 78% in the

second half.

There are no items affecting assets, liabilities, equity, net

income or cash flows that are unusual because of their nature, size

or incidence which are required to be disclosed under IAS 34 para

16A(c).

There are no events after the interim reporting period which are

required to be reported under IAS 34 para 16A(h).

There are no financial instruments being measured at fair value

which require disclosure under IAS 34 para 16A(j)

3 Group financial risk factors

The condensed interim financial statements do not contain all

financial risk management information and disclosures required in

annual financial statements; the information should be read in

conjunction with the financial information, as at 31 December 2022,

summarized in the 2022 annual report and accounts. There have been

no significant changes in any risk management policies since 31

December 2022.

4 Critical accounting estimates and judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results might differ from these estimates. IAS34(16A)(d) In

preparing these condensed interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31 December 2022.

There are no changes in estimates of amounts reported in prior

financial years.

5 Segment information

Management mainly considers the business from a geographic

perspective since the same services are effectively being sold in

every Group entity. Therefore, regions considered for segmental

reporting are where the Company and subsidiaries are based, namely

the UK, the USA, India and China. The revenue is classified by

where the sales were booked not by the geographic location of the

customer.

In the current and prior reporting period there is no income

outside of the primary business activity.

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the steering committee that makes

strategic decisions. The steering committee is made up of the Board

of Directors. There are no sales between segments. The revenue from

external parties reported to the strategic steering committee is

measured in a manner consistent with that in the income

statement.

The Parent company is domiciled in the United Kingdom. The

amount of revenue from external customers by location of the Group

billing entity is shown in the tables below.

Revenue

Year ended

Six months Six months 31 December

ended ended

30 June 30 June 2022

2023 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

----------------------- -------------- -------------- --------------

Turnover by geography

USA 313,425 418,035 1,180,798

UK 261,321 39,654 178,476

China 17,137 119,747 147,983

Total 591,883 577,436 1,507,257

----------------------- -------------- -------------- --------------

Loss before tax

The EBITDA is the loss for the year before depreciation,

amortisation, interest and tax. The loss before tax is broken down

by segment as follows:

Year ended

Six months Six months 31 December

ended ended

30 June 30 June 2022

2023 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------- -------------- -------------- --------------

UK (7,021,637) (7,436,070) (13,483,196)

USA 105,213 (129,500) (253,219)

India (416,438) (321,693) (770,084)

China (30,041) (312,332) (695,848)

Total EBITDA (7,362,903) (8,199,595) (15,202,347)

( 439,727

Depreciation (164,699) (250,801) )

Finance income / (costs)

net 74,621 4,471 49,363

-------------------------- -------------- -------------- --------------

Loss before tax (7,452,981) (8,445,925) (15,592,711)

-------------------------- -------------- -------------- --------------

6 Loss per share

(a) Basic

Basic loss per share is calculated by dividing the loss for the

period / year by the weighted average number of ordinary shares in

issue during the period / year. Potential ordinary shares are not

treated as dilutive as the Group is loss making and such shares

would be anti-dilutive.

Group Six months Six months

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

---------------------------------- ------------ ------------ -------------

Loss attributable to owners

of the parent (GBP) (7,160,997) (8,152,625) (15,100,823)

---------------------------------- ------------ ------------ -------------

Weighted average number of

ordinary shares in issue Number 309,365,026 279,180,808 279,180,808

---------------------------------- ------------ ------------ -------------

The loss per share for the period was 2p (six months to 30 June

2022: 3p; year ended 31 December 2022: 5p).

No dividends were paid during the period (six months to 30 June

2022: GBPnil; year ended 31 December 2022: GBPnil).

(b) Diluted

Potential ordinary shares are not treated as dilutive as the

Group is loss making and such shares would be anti-dilutive

7 Share capital

Ordinary shares of GBP0.00001 each

Allotted and fully paid Number

-------------------------- ------------

At 1 January 2023 279,180,808

Issued during the period 210,128,596

At 30 June 2023 489,309,404

--------------------------- ------------

On 5 June 2023 210,128,596 Ordinary Shares were issued for 3p

per share as part of a GBP6.3 million fundraise from new and

existing shareholders. This was split as follows:

-- 191,666,667 Ordinary Shares issued on 5 June 2023 from the placing exercise;

-- 18,461,929 Ordinary Shares issued on 5 June 2023 from an open

offer to existing shareholders on the basis of 5 new shares for

every 21 existing Ordinary Shares held.

8 Net cash flows used in operating activities

Year ended

Six months Six months

ended ended 31 December

30 June

30 June 2023 2022 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

------------------------------------ ---- --------------- -------------- --------------

Loss for the financial period

/ year (7,160,997) (8,152,625) (15,100,823)

Adjustments for:

Tax on loss on ordinary activities (291,984) (293,300) (491,888)

Interest income (80,122) (23,093) (71,875)

Lease interest costs 5,501 18,622 22,512

Operating loss: (7,527,602) (8,450,396) (15,642,074)

Amortisation of right-of-use

assets 128,446 163,550 302,804

Depreciation of tangible assets 36,253 87,251 136,923

(Profit) / loss on disposal 3,392 - -

of disposal of tangible assets

Bad debts (reversed) / written

off (721) (3,732) (890)

Share based payment charge 599,761 862,313 1,241,330

Adjustment to tax credit in

respect of previous periods - - 2,041

Foreign exchange variance 46,903 276,857 43,782

Movement in provisions (157,456) - 198,199

- Decrease / (increase) in

debtors 710,781 562,374 (336,799)

- (Decrease) / increase in

creditors (892,168) (439,659) 37,538

------------------------------------------ --------------- -------------- --------------

Cash flow used in operating

activities (7,052,411) (6,941,442) (14,017,146)

------------------------------------------ --------------- -------------- --------------

9 Related party transactions

The Group is owned by a number of investors the largest being

M&G Investment Management, which owns approximately 14% of the

share capital of the Company. Accordingly there is no ultimate

controlling party.

During the period the Company had the following related party

transactions. No guarantees were given or received for any of these

transactions.

IP2IPO Limited - a company which shares a parent company with

IP2IPO Portfolio (GP) Limited, a major shareholder in the Group,

and which also appoints a Director of the Group charged Mirriad

Advertising plc for the following transactions during the period:

(1) GBP10,000 for the services of Lois Day as a Director from 1

January 2023 until 30 June 2023. Of this amount GBP1,667 was

accrued and unpaid as at 30 June 2023.

Parkwalk Advisors Limited - a company which shares a parent

company with IP2IPO Portfolio (GP) Limited, a major shareholder in

the Group, and which also appoints a Director of the Group charged

Mirriad Advertising plc for the following transactions during the

period: (1) GBP10,000 for the services of Alastair Kilgour as a

Director from 1 January 2023 until 30 June 2023. GBP3,333 of this

amount was invoiced and unpaid as at 30 June 2023, and subsequently

paid on 12 July 2023. GBP1,667 of this amount was accrued and

unpaid as at 30 June 2023.

All the related party transactions disclosed above were settled

by 30 June 2023 except where stated.

10 Availability of Interim Report

Electronic copies of this interim financial report will be

available on the Company's website at

www.mirriadplc.com/investor-relations .

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFIRTEILFIV

(END) Dow Jones Newswires

August 22, 2023 02:00 ET (06:00 GMT)

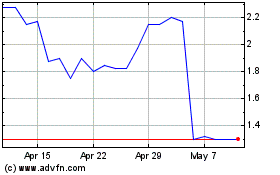

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Apr 2024 to May 2024

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From May 2023 to May 2024