Trading Statement

May 10 2024 - 1:00AM

UK Regulatory

Trading Statement

Mothercare plc

Pre-close trading update

Mothercare plc ("Mothercare" or "the Company"),

the leading specialist global brand for parents and young children,

today issues a pre-close trading update for the 53 week period to

30 March 2024 (“FY24”). Comparatives are based on the 52 week

period to 25 March 2023. This update is based upon draft figures

pending finalisation of the year end audit.

Highlights

- Unaudited net worldwide retail

sales by franchise partners of £281 million for the year,

representing a decline of 13%.

- Adjusted EBITDA for FY24 marginally

above the £6.7 million achieved in the previous year and in line

with market expectations.

- Net debt of £14.7 million at the

year end.

- Pension scheme deficit remains at

£35 million (March 2023: £35 million).

EBITDA before adjusting items, for the financial

year to 30 March 2024, is now expected to be marginally above the

£6.7 million achieved in the year to 25 March 2023, showing a

continuing year on year improvement in the underlying profitability

of the business.

Unaudited net worldwide retail sales by

franchise partners were £281 million, compared to £323 million for

the previous financial year. The year-on-year decline in retail

sales of 13% reduces to 8% at constant currency exchange rates. Our

Middle East markets (41% of our total retail sales) continued to be

the most challenging, particularly in the latter part of the

financial year. The UK and Indonesia operations were amongst the

markets that increased retail sales year-on-year, with Indonesia

growing to become our second largest market by retail sales behind

the Kingdom of Saudi Arabia. As previously reported, in addition to

the global economic uncertainties which are impacting our retail

sales, in many of our territories our partners are still clearing

inventory due to the suppressed demand during Covid-19.

We expect these factors will continue to impact

the Group results in FY25, notwithstanding ongoing improvements in

product and service, although our medium-term guidance is unchanged

for the steady state operation in more normal circumstances. We

continue to believe our continuing franchise operations remain

capable of exceeding £10 million operating profit and maintain our

focus on accelerating our growth in both existing and new

markets.

Financing

At the year-end Mothercare had total cash of

£5.0 million (March 2023: £7.1 million), against the £19.7 million

(March 2023: £19.5 million) of the Group’s existing loan facility,

which remained fully drawn across the year.

With interest rates remaining at an elevated

level, the interest rate on the Group’s existing loan facility is

currently approximately 19.2%, which coupled with the extended time

to return to pre-pandemic retail sales levels, particularly in our

Middle Eastern markets, highlighted above, means the Board’s

current forecasts for continuing operations show the Group requires

waivers to our covenant tests. We have therefore commenced

refinancing discussions with our lender to vary, renegotiate or

refinance this debt facility. Additionally, we are well advanced in

looking at various financing alternatives (including equity and

equity linked structures) to give us both additional flexibility

and reduced cash financing costs. For the avoidance of doubt the

Group does not require (and is not seeking through this

refinancing) additional liquidity.

Clive Whiley, Chairman of Mothercare,

commented:

“As highlighted in my last Chairman’s statement,

it has been six years of hard work and transformative change for

the Group and, on behalf of the Board, I would like to thank our

colleagues across the business, alongside our pension trustees and

all other stakeholders for their unstinting support during these

difficult times. That support and the resilience we have built into

the business throughout this journey, allows us to deal with the

major challenges we have faced and Mothercare operations would not

be in the profitable and cash generative position we are today

without it.

Given the exogenous factors influencing some of

the Company’s operating markets, our immediate priority remains to

support our franchise partners, ultimately for the benefit of our

own business, however we have also redoubled our efforts to restore

critical mass and are focused upon monetising the Mothercare global

brand IP. This remains an exciting prospect for our partners, our

colleagues and all stakeholders.”

Investor and analyst enquiries to:

Mothercare plc

Email: investorrelations@mothercare.com

Clive Whiley, Chairman

Andrew Cook, Chief Financial

Officer

Deutsche

Numis Tel: 020

7260 1000

(NOMAD & Joint Corporate

Broker)

Luke Bordewich

Henry Slater

Cavendish Capital Markets Limited

Tel: 020

7220 0500

(Joint Corporate

Broker)

Carl Holmes

Media enquiries to:

MHP

Email: mothercare@mhpc.com

Rachel

Farrington Tel: 07801

894577

Tim Rowntree

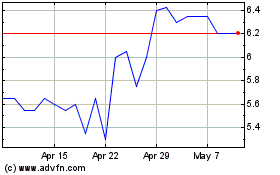

Mothercare (LSE:MTC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mothercare (LSE:MTC)

Historical Stock Chart

From Nov 2023 to Nov 2024