Mattioli Woods PLC Acquisition of Broughtons Financial Planning (2652X)

August 09 2018 - 1:00AM

UK Regulatory

TIDMMTW

RNS Number : 2652X

Mattioli Woods PLC

09 August 2018

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

9 August 2018

Mattioli Woods plc

("Mattioli Woods", "the Company" or "the Group")

Acquisition of Broughtons Financial Planning Limited

Mattioli Woods plc (AIM: MTW.L), the specialist wealth

management and employee benefits business, is pleased to announce

the acquisition of the entire issued share capital of Broughtons

Financial Planning Limited ("Broughtons") from its shareholder

("the Seller") for a total consideration of up to GBP4.0

million.

Broughtons was founded in 2001 and provides wealth management

advice and administration for 250 individual clients with over

GBP120 million of assets under advice. Based in Oldbury in the West

Midlands, the business specialises in the provision of financial

planning advice. Broughtons' experienced management team will be

retained by Mattioli Woods following the acquisition, which is

expected to be earnings enhancing in the first full year of

ownership.

In the year ended 31 July 2017, Broughtons generated a profit

before taxation of GBP0.62 million on revenues of GBP0.99 million.

At 31 July 2017 Broughtons' net assets were GBP0.56 million.

The total consideration comprises:

-- An initial consideration of GBP2.7 million (subject to

adjustment for the value of net assets acquired), comprising GBP2.1

million in cash plus 77,171 new ordinary shares of 1 pence each in

Mattioli Woods ("the Consideration Shares"), which are valued at

GBP0.60 million based on the closing price of a Mattioli Woods

share on 8 August 2018; and

-- Deferred consideration of up to GBP1.3 million payable in

cash in the two years following completion, subject to certain

financial targets being met based on growth in earnings before

interest, tax, depreciation and amortisation generated during that

period.

Payment of the initial cash consideration, deal costs and

estimated net asset adjustment resulted in a cash outflow at

completion of GBP2.2 million.

Application has been made to AIM for the admission of the

Consideration Shares to trading ("Admission"). Admission of the

Consideration Shares, which will rank parri passu in all respects

with Mattioli Woods' existing shares in issue, is expected to

become effective on 15 August 2018.

Following the issue of the Consideration Shares, the total

number of ordinary shares of 1p each ("the Ordinary Shares") in the

Company with voting rights will be 26,276,770. Mattioli Woods does

not hold any Ordinary Shares in Treasury.

The above figure of 26,276,770 Ordinary Shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the Financial Conduct Authority's Disclosure and

Transparency Rules.

The Seller has entered into a lock-in deed with Mattioli Woods

and its nominated adviser and broker, Canaccord Genuity Limited,

restricting sales of the Consideration Shares during the two years

following completion.

Commenting on the acquisition, Ian Mattioli, Chief Executive

Officer of Mattioli Woods, said:

"Broughtons has a similar culture to Mattioli Woods and holds

high values with the client being at the core of all it does. The

combined business gives us all opportunities to grow and develop

the client offering and we welcome Gary and his team. Long term

stability and sustainability is key to growing a modern financial

services group and we will all continue to strive to achieve

this".

Gary Bond, Broughtons' Managing Director, added:

"From our initial discussions with Mattioli Woods it was clear

that we shared the same values and business culture. We are all

excited by the opportunity this gives us as we work to create a

great financial services business and to be part of a large group

which has clients at its core".

- Ends -

For further information please contact:

Mattioli Woods plc

Ian Mattioli MBE, Chief Executive

Officer

Nathan Imlach, Chief Financial Tel: +44 (0) 116 240 8700

Officer

www.mattioliwoods.com

Canaccord Genuity Limited

Sunil Duggal Tel: +44 (0) 20 7523 8000

David Tyrrell www.canaccordgenuity.com

Media enquiries:

Camarco

Ed Gascoigne-Pees Tel: +44 (0) 20 3757 4984

www.camarco.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQLLFFTTAITIIT

(END) Dow Jones Newswires

August 09, 2018 02:00 ET (06:00 GMT)

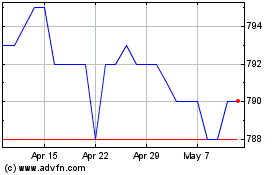

Mattioli Woods (LSE:MTW)

Historical Stock Chart

From Apr 2024 to May 2024

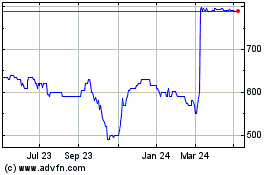

Mattioli Woods (LSE:MTW)

Historical Stock Chart

From May 2023 to May 2024