TIDMNTOG

RNS Number : 9069N

Nostra Terra Oil & Gas Company PLC

28 September 2023

28 September 2023

Nostra Terra Oil and Gas Company PLC

Interim Results for the six months ended 30 June 2023

Nostra Terra (AIM: NTOG), the oil and gas exploration and

production company with a portfolio of assets in the USA, is

pleased to announce its unaudited results for the six-month period

ended 30 June 2023. A copy of the Interim Results is available on

the Company's website, www. ntog.co.uk .

Financial Highlights

-- $1,472,000 Revenue for the period (30 June 2022: $2,003,000)

-- $530,000 Gross profit from operations for the period (30 June 2022: $1,203,000 profit)

-- $481,000 profit before non-cash items (depletion, depreciation, amortisation, and interest)

-- $48,000 profit for the period (30 June 2022: $203,000 loss)

-- 21,023 barrels of oil total production for the period (30 June 2022: 20,383 barrels of oil)

-- Borrowing increased to $4,203,000, an increase of $317,000 vs. 31 December 2022

Post-period events:

-- Favourable ruling regarding Fouke Wells increasing the

production limit to 126 bopd per well (50%+) as announced on 30

August 2023

Chairman's report

The first six months of 2023 have been a period of consolidation

and prudent progress for Nostra Terra Oil & Gas.

In the wider world, the war in Ukraine continued, though the

global pandemic crisis has finished with the end of lockdowns in

China. This was supposed to release pent-up demand for energy in

China as their economy fired back up. It has yet to happen for a

variety of reasons. However, a global increase in energy demand and

continuing effects from the war mean that the WTI spot benchmark

price has strengthened to around $90 per barrel at the time of

writing.

The Company continued to take advantage of these relatively high

oil prices throughout the period to concentrate on optimising

production from our existing producing wells. Toward that end, a

further four workovers at Pine Mills were carried out to continue

supporting production volumes and revenues.

Despite some well-specific operational issues, Nostra Terra

produced an operating profit for the period of $176,000 ($48,000

after financing costs).

In March 2023, Jeffrey Henry LLP was replaced by MAH as the

Company's auditors. Jeffrey Henry no longer had sufficient capacity

to service Nostra Terra and many others of its clients' needs, and

so had to withdraw from providing audit services to several

companies.

Post period, in August 2023, the Texas Railroad Commission (as

regulator) approved the operator's request for an increase in the

allowable field rate from 82 bopd to 126 bopd each for the Fouke #1

and Fouke #2 wells. This significantly increased the cap on the

production rate from the Company's two currently most productive

wells, removing a regulatory brake on our potential revenue

stream.

I would like to thank our shareholders again for their support

over the last six months.

Dr Stephen Staley

Chairman

28 September 2023

Chief Executive Officer's report

We had a strong first half of the year. Our focus has been on

increasing cash flow. This was achieved by maintaining production

levels and keeping operating costs low.

Revenue was robust at $1,472,000 for the period (30 June 2022:

$2,003,000). Gross profit from operations for the period was

$530,000 (30 June 2022: $1,203,000 profit). Average oil sales

prices during the period were $70.04 per barrel (30 June 2022:

$98.28), and average production was 116 bopd (2022: 112 bopd)

At the beginning of 2022, the Fouke 2 (32.5% WI) well was

drilled and put into production. The well was then tested and

flowed at a rate of 145 bopd over a 24-hour period with 0% watercut

and placed into continuous production. This production rate

exceeded that of the offset Fouke 1 well by 77% because the Fouke 1

had been limited by field rules ("allowable") to 82 bopd per well.

As a result of the past performance of the Fouke 1 and the test

rate of the Fouke 2, the operator requested a substantial increase

in the field allowable rate so that both wells could be produced at

higher and more efficient rates. The hearing took place in March

2023, with the final order granting the proposed changes being

approved in August 2023.

Due to the excellent returns from these wells, Nostra Terra

continues to look for similar opportunities in the Company's 100%

working interest acreage in Pine Mills. We have let our application

for Tunisian acreage lapse for now but maintain good relations with

the authorities there and may recommence the process in due course.

Additionally, the Company continues actively seeking and assessing

new opportunities within the US and abroad.

I wish to extend a sincere thank you to our shareholders for

your continued support, and I look forward to updating you as we

continue to grow our Company.

Matt Lofgran

Chief Executive Officer

28 September 2023

For further information, visit www.ntog.co.uk

or contact:

Nostra Terra Oil and Gas Company

plc

Matt Lofgran, CEO +1 480 993 8933

Beaumont Cornish Limited

(Nominated Adviser) +44 (0) 20 7628 3396

James Biddle / Roland Cornish

Novum Securities Limited (Broker) +44 (0) 207 399 9425

Jon Belliss

Nostra Terra Oil and Gas Company plc

Consolidated Income Statement

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 December

30 June 30 June 2022

2023 2022

Note $'000 $'000 $'000

------------------------------ ----- ---------------- ---------------- -------------

Revenue 1,472 2,003 4,021

Cost of sales

Production Costs (647) (581) (1,779)

Well impairment - - (897)

Depletion, depreciation,

amortisation (295) (219) (539)

---------------- ---------------- -------------

Total cost of sales (942) (800) (3,215)

---------------- ---------------- -------------

GROSS PROFIT 530 1,203 806

Exploration costs written - (813) -

off

Share based payment (40) (80) (156)

Administrative expenses (319) (478) (1,074)

Foreign exchange (loss)/gain 5 (25) 26

---------------- ---------------- -------------

OPERATING PROFIT/ (LOSS) 176 (193) (398)

Finance costs (138) (49) (199)

Other income 10 39 51

---------------- ---------------- -------------

INCOME/ (LOSS) BEFORE TAX 48 (203) (546)

Income tax - - -

---------------- ---------------- -------------

INCOME/ (LOSS) FOR THE

PERIOD 48 (203) (546)

Attributed to:

Owners of the company 48 (203) (546)

---------------- ---------------- -------------

Earnings per share expressed

in cents per share:

Continued Operations

Basic (cents per share) 3 0.006 (0.03) (0.07)

---------------- ---------------- -------------

Diluted (cents per share) 3 0.005 (0.03) (0.07)

---------------- ---------------- -------------

The Group's operating profit or loss arose from continuing

operations.

There were no recognised gains or losses other than those

recognised in the income statement above.

Nostra Terra Oil and Gas Company plc

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 December

30 June 30 June 2022

2023 2022

---------------------------------- ------------- ---------------- ---------------- -------------

$'000 $'000 $'000

---------------------------------- ------------- ---------------- ---------------- -------------

INCOME (LOSS) FOR THE PERIOD

Other comprehensive income: 48 (203) (546)

Currency translation differences 6 - - -

Total comprehensive income

for the period 48 (203) (546)

------------------------------------------------- ---------------- ---------------- -------------

Total comprehensive income

attributable to:

Owners of the company 48 (203) (546)

------------------------------------------------- ---------------- ---------------- -------------

Nostra Terra Oil and Gas Company plc

Consolidated Statement of Financial Position as at 30 June

2023

Unaudited Unaudited Audited

As at 30 As at 30 As at 31

June June December 2022

2023 2022

Note $'000 $'000 $'000

----------------------------- ----- -------------- ------------- ---------------

ASSETS

Non-current assets

Intangible assets 2,519 2,328 2,224

Property, plant and

equipment

- oil and gas assets 1,215 1,119 1,308

3,734 3,447 3,532

Current assets

Trade and other receivables 571 650 558

Deposits and prepayments 64 16 66

Cash and cash equivalents 125 114 132

-------------- -------------

760 780 756

-------------- ------------- ---------------

LIABILITIES

Current liabilities

Trade and other payables 761 1,153 1,051

Borrowings 164 273 94

925 1,426 1,145

-------------- ------------- ---------------

NET CURRENT LIABILITIES (165) (646) (389)

Non-current liabilities

Decommissioning liabilities 361 321 340

Borrowings 4,203 3,295 3,886

4,564 3,616 4,226

-------------- ------------- ---------------

NET LIABILITIES (995) (815) (1,083)

============== ============= ===============

EQUITY AND RESERVES

Share capital 4 8,142 8,142 8,142

Share premium 22,115 22,115 22,115

Translation reserve (676) (676) (676)

Share option reserve 463 386 423

Retained losses (31,039) (30,782) (31,087)

-------------- ------------- ---------------

(995) (815) (1,083)

============== ============= ===============

Nostra Terra Oil and Gas Company plc

Consolidated cash flow statement

For the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year to

to 30 June to 31 December

2023 30 June 2022 2022

Notes $'000 $'000 $'000

------------------------------------- ------ ----------- ------------- ------------

Cash flows from operating

activities

Operating income (loss) for

the period 48 (203) (546)

Adjustments for:

Depreciation of property,

plant and equipment 154 113 299

Amortisation of intangible

assets 121 87 202

Exploration costs written

off - 813 -

Well impairment - - 897

Depletion 21 19 38

Other Income (10) (39) (51)

Foreign exchange (5) 25 26

Share based payment 40 80 156

Operating cash flows before

movements in working capital 369 895 1,021

(Increase) /decrease in receivables (13) (302) (211)

(Decrease)/increase in payables (295) 208 105

(Increase)/decrease in deposits

and prepayments 2 - (50)

Interest paid 138 49 199

Net cash generated by operations 201 850 1,064

Cash flows from investing

activities

Purchase of intangible assets (416) (1,214) (1,318)

Purchase of plant and equipment (64) (345) (719)

Disposals 2 30 40

Increase in decommissioning

liabilities 21 19 38

----------- ------------- ------------

Net cash from investing

activities (457) (1,510) (1,959)

----------- ------------- ------------

Cash flows from financing

activities

Proceeds from issued share

capital - 194 194

Net borrowing 387 591 1,003

Finance costs (138) (49) (199)

Lease payments - (7) (16)

----------- ------------- ------------

Net cash from financing

activities 249 729 982

----------- ------------- ------------

Increase/(decrease) in cash

and cash equivalents (7) 69 87

Cash and cash equivalents

at the beginning of the period 132 45 45

----------- ------------- ------------

Cash and cash equivalents

at the end of the period 125 114 132

=========== ============= ============

Nostra Terra Oil and Gas Company plc

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Share Deferred Share Share Translation Retained Total

capital shares premium option reserve losses

reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000

-------------- -------- -------- -------- -------- ----------- -------- -------

As at 1

January 2023 1,593 6,549 22,115 423 (676) (31,087) (1,083)

-------------- -------- -------- -------- -------- ----------- -------- -------

Income for

the period - - - - - 48 48

Share based

payments - - - 40 - - 40

-------------- -------- -------- -------- -------- ----------- -------- -------

As at 30

June 2023 1,593 6,459 22,115 463 (676) (31,039) (995)

-------------- -------- -------- -------- -------- ----------- -------- -------

Share Deferred Share Share Translation Retained Total

capital shares premium option reserve losses

reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------- -------- -------- -------- -------- ----------- -------- -----

As at 1

January 2022 1,538 6,549 21,976 306 (676) (30,579) (886)

----------------- -------- -------- -------- -------- ----------- -------- -----

Loss for

the period - - - - - (203) (203)

Shares issued,

net of expenses 55 - 139 - - - 194

Share based

payments - - - 80 - - 80

----------------- -------- -------- -------- -------- ----------- -------- -----

As at 30

June 2022 1,593 6,549 22,115 386 (676) (30,782) (815)

----------------- -------- -------- -------- -------- ----------- -------- -----

Share Deferred Share Share Translation Retained Total

capital shares premium option reserve losses

reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------- -------- -------- -------- -------- ----------- -------- -------

As at 1

January 2022 1,538 6,549 21,976 306 (676) (30,579) (886)

----------------- -------- -------- -------- -------- ----------- -------- -------

Loss for

the year - - - - - (546) (546)

Shares issued,

net of expenses 55 - 139 - - - 194

Expired options

& warrants - - - (38) - 38 -

Share based

payments - - - 155 - - 155

----------------- -------- -------- -------- -------- ----------- -------- -------

As at 31

December

2022 1,593 6,549 22,115 423 (676) (31,087) (1,083)

----------------- -------- -------- -------- -------- ----------- -------- -------

Nostra Terra Oil and Gas Company plc

Notes to the interim report

For the six months ended 30 June 2023

1. General Information

Nostra Terra Oil and Gas Company plc (Nostra Terra) is a company

incorporated in England and Wales and quoted on the AIM market of

the of the London Stock Exchange (ticker: NTOG). The principal

activity of the group is disclosed as described in the report

Chairman's statement and Chief Executive Officer's Report.

2. Basis of preparation

The consolidated interim financial information for the 6 months

to 30 June 2023 has been prepared in accordance with the

measurement and recognition principles of UK adopted international

accounting standards and accounting policies that are consistent

with the Group's Annual report and Accounts for the year ended 31

December 2022 and that are expected to be applied in the Group's

Annual Report and Accounts for the year ended 31 December 2023.

They do not include all of the information required for the full

financial statements and should be read in conjunction with the

2022 Annual Report and Accounts which were prepared in accordance

with UK adopted international accounting standards.

The comparative financial information for the year ended 31

December 2022 in this interim report does not constitute statutory

accounts for that period under section 435 of the Companies Act

2006. Statutory accounts for the year ended 31 December 2022 have

been reported on by the Group's auditors and delivered to the

Registrar of Companies. The report of the auditors contained a

"material uncertainty related to going concern" paragraph but the

auditor's report did not contain any statement under section 498 of

the Companies Act 2006.

Going concern

The consolidated interim financial information has been prepared

on the assumption that the Group is a going concern. When assessing

the foreseeable future, the directors have looked at a period of 12

months from the date of approval of this report.

The Group's forecasts and projections, taking account of

reasonable possible changes in trading performance, show that the

group should be able to operate within the level of its current

cash resources, however a material uncertainty exists in relation

to the Group's ability to repay its liabilities as they become due.

We note that as at the balance sheet date, the Group has net

current liabilities of $165k and net liabilities of $995k.

After making enquiries, the directors have a reasonable

expectation that the Company and Group have adequate resources to

continue in operational existence for the foreseeable future. They

continue to adopt the going concern basis in preparing the

consolidated interim financial information, however as noted above

a material uncertainty exists which may cast significant doubt on

the Group's ability to continue operating as a going concern.

3. Earnings/(loss) per share

The calculation of earnings per ordinary share is based on

earnings after tax and the weighted average number of ordinary

shares in issue during the period. For diluted earnings per share,

the weighted average number of ordinary shares in issue is adjusted

to assume conversion of all dilutive potential ordinary shares. The

group had two classes of dilutive potential ordinary shares, being

those share options granted to employees and suppliers where the

exercise price is less than the average market price of the group's

ordinary shares during the year, and warrants granted to directors

and one former adviser.

Unaudited Unaudited Audited

Six months Six months Year to

to to 31 December

30 June 30 June 2022

2023 2022

Income (loss) per ordinary

shareholders ($000) 48 (203) (546)

Weighted average number

of ordinary shares 746,520,534 718,736,004 732,742,452

Basic (cents per share) 0.006 (0.04) (0.07)

Diluted (cents per share) 0.005 (0.04) (0.07)

------------ ------------ -------------

4. Share Capital

The issued share capital as at 30 June 2023 was 746,520,534

ordinary shares of 0.1p each (31 December 2022: 746,520,534; 30

June 2022: 746,520,534).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VDLFLXKLBBBB

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

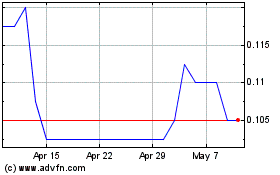

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nostra Terra Oil And Gas (LSE:NTOG)

Historical Stock Chart

From Apr 2023 to Apr 2024