TIDMPDL

RNS Number : 4115K

Petra Diamonds Limited

25 August 2023

FOR IMMEDIATE RELEASE

25 August 2023 LSE: PDL

Sales results for Tender 1 FY 2024

First tender of FY 2024 yields US$79.3 million in sales

Richard Duffy, Chief Executive Officer of Petra Diamonds

(Petra), said:

"Petra's first tender of FY 2024 yielded US$79.3 million from

696.2kcts sold. We saw very strong attendance at the Tender

although demand was more muted than we had expected in exiting the

summer holiday period. Average prices for both Cullinan Mine and

Finsch benefited from an improved product mix, while like-for-like

[1] prices declined by 4.3% compared to our most recent tender,

Tender 5 of FY 2023, which closed in May 2023.

The expected seasonal improvement in demand was evident for

higher quality +10.8ct stones with solid prices realised, including

US$82,630 per carat for a 20.9 ct yellow diamond from Cullinan Mine

that sold for US$1.7m. This was offset by slower demand for 2-10

carat size ranges with like-for-like prices down by c. 14% compared

to Tender 5. Demand in smaller categories remains resilient, with

like-for-like prices increasing between 1-2%.

Macro-economic uncertainties around prevailing high interest and

inflation rates have resulted in a more cautious approach from the

mid-stream towards holding inventory. Indications are that these

rates have now peaked and will start to decline, providing support

to our view of improved demand in the medium-term as a result of

the structural supply deficit. Although demand for lab grown goods

increased, this was coupled with further price depreciation that

continues to substantially differentiate this market segment from

our unique and rare natural diamonds that provide enduring benefit

in celebrating life's most significant moments.

As we enter a seasonally stronger period which includes Diwali,

Thanksgiving, Christmas and the Chinese New Year, we remain

optimistic that jewellery demand will improve and provide some

support to prices over the balance of the calendar year."

Sales

Overall, 696,194 carats were sold for a total of US$79.3 million

from Petra's South African operations during Tender 1 of FY 2024.

No Exceptional Stones(2) were sold as part of Tender 1. This cycle

included goods deferred for sale following an earlier decision to

defer the majority of Tender 6 in June 2023, as well as the

75.9kcts of goods withdrawn from our May tender (Tender 5), with

prices for these goods remaining largely flat compared to the bids

received in May 2023.

No sales for either Koffiefontein or Williamson were recorded in

this cycle. Following the restart of operations at Williamson in

July 2023, Petra is planning a first sale of Williamson goods

during September 2023.

Rough diamond sales results for the respective periods are set

out below:

Tender Tender Variance Tender FY 2023

1 FY24 5 FY23 1 FY23

Aug-23 May-23 T1 FY24 Sep-22 12 months

to

vs 30 June

2023

T5 FY23

Diamonds sold (carats) 696,194 468,817 49% 520 011 2,339,675

Sales (US$ million) 79.3 42.1 88% 102.9 328.4

Average price (US$/ct) 114 90(1) 27% 198 140

Revenue from Exceptional Stones (US$ million) 0.0 5.6 -100% 0.0 12.6

---------------------------------------------- ------- ------- --------- ------- ----------

Note 1: As announced in May 2023, Petra estimated the overall

realised price for Tender 5 FY 2023 to be between US$105 and US$115

per carat including withdrawn parcels, based on bids received and

reserve prices for the withheld parcels.

Mine by mine average prices for the respective periods are set

out in the table below:

US$/carat Tender 1 Tender 5 Tender 1 FY 2023

FY23(1)

FY24 May-23 FY23 12 months

to

Aug-23 Sep-22 30 June 2023

Cullinan Mine(1) 113 99 212 139

Finsch 116 81 132 110

Williamson(1) n/a n/a 383 452

Koffiefontein n/a n/a 297 280

------------------ ---------- ---------- ---------- --------------

Note 1: Where applicable, prices for both Cullinan Mine and

Williamson include proceeds from the sale of Exceptional

Stones.

Note 2: As announced in May 2023, Petra estimated the overall

realised price for Tender 5 FY2023, including withdrawn parcels, to

be between US$110 and US$115 per carat for Cullinan Mine, and

between US$105 and US$110 per carat for Finsch .

Like-for-like prices

Like-for-like rough diamond prices declined by 4.3% on Tender 5

FY 2023, resulting from a 14% decrease in prices of 2 to 10.8 carat

diamonds and a 1-2% increase in diamonds smaller than 2ct.

Product mix

The balance of price movements is attributable to product mix,

with both Cullinan Mine and Finsch benefiting from improved overall

quality compared to Tender 5 FY2023, after normalising for the

withdrawn parcels, partly offset by the lack of Exceptional Stones

in this period compared to US$5.6 million sold as part of Tender 5

FY 2023. Tender 1 FY 2023, which closed in September 2022, included

an unusually high contribution of high-value stones at Cullinan

Mine, resulting in the average price of US$212 per carat for that

tender, with the overall average price of US$139 per carat for FY

2023.

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Patrick Pittaway investorrelations@petradiamonds.com

Julia Stone

Camarco (Financial PR)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Company's portfolio incorporates interests in three

underground mines in South Africa (Finsch, Cullinan Mine and

Koffiefontein) and one open pit mine in Tanzania (Williamson).

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Company aims to generate tangible

value for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Company's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com.

[1] Like-for-like refers to the change in realised prices

between tenders and excludes revenue from all single stones and

Exceptional Stones, while normalising for the product mix

impact

(2) Petra classifies "Exceptional Stones" as rough diamonds

which sell for US$5 million or more each

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDXGDIGDDDGXS

(END) Dow Jones Newswires

August 25, 2023 02:00 ET (06:00 GMT)

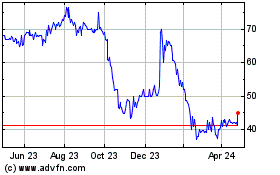

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

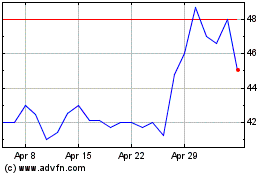

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Apr 2023 to Apr 2024