TIDMQRT

RNS Number : 9413U

Quarto Group Inc

31 March 2023

The Quarto Group Inc.

("Quarto", the "Company", or the "Group")

Final Results for the Year Ended 31 December 2022

The Quarto Group Inc. (LSE: QRT), the leading global illustrated

book publisher, announces its audited results for the year ended 31

December 2022.

Results ($m) 2022 2021

----------------------------------------------------- ------ ------

Revenue 141.0 151.5

Adjusted operating profit(1) 21.3 16.0

Exceptional items 0.8 -

Operating profit 22.1 16.0

Adjusted profit before tax(1) 20.1 14.2

Profit before tax 20.9 14.2

Profit for the year 16.6 9.9

Adjusted diluted earnings per share from continuing

operations(2) 37.8 24.3

Basic earnings per share from continuing operations 40.6 24.3

Net debt(3) 0.6 5.5

1 Adjusted items excludes the amortization of acquired

intangibles and exceptional items.

2 There were exceptional items of $0.8m but no dilutive share

options nor amortization of acquired intangibles in 2022.

3 Net debt excludes lease liabilities relating to right of use

assets (IFRS 16).

Operating Highlights

-- Clear focus on maximizing the Group's core strengths,

retaining a disciplined business model and developing future growth

opportunities

-- Increase in Adjusted Operating Profit of 33% due to tight

cost control, lower pre-publication and amortization costs

-- Profit Before Tax up 47% at $20.9m

-- Revenue of custom publishing channel of $14.2m, up 33% year on year

-- Net debt down by $4.9m to $0.6m

-- New Shoe Press launched in 2022 with 25 titles repurposing

existing IP to compete at a value price point. Short-run printing

allows low inventory level responding to demand

-- Kaddo, a new gift imprint, created with the first products

publishing in autumn 2023. Product lines span both the adult and

children's market consisting of games, card decks and jigsaw

puzzles many of which are based on existing book content

-- We are also targeting growth in one of the largest sectors of

the book market and will be launching a new imprint focused on food

and wellness

-- SmartLab, our Toy business, was sold to Educational

Development Corp. to focus on our core publishing activities

Commenting on the results, Group Chief Executive Officer, Alison

Goff said:

During 2022 most markets around the world reopened and we saw a

return to buying in physical bookstores with a corresponding

reduction in our online sales.

With the economic pressures squeezing consumer spending the

overall book market contracted slightly in 2022 with non-fiction

sales showing one of the biggest declines, down by c. 7%.

Notwithstanding the sale of SmartLab during 2022, Quarto

outperformed the market delivering increased market share in all

our core categories.

The company ended the year with sales of $141.0m down from prior

year by 7% (2021: $151.5m); adjusted operating profit increased by

33% to $21.3m (2021: $16.0m); profit before tax increased to $20.9m

(2021: $14.2m) and the strength of the balance sheet improved to

$67.3m (2021: $53.2m). The group ended the year with net debt down

89% at $0.6m (2021: $5.5m). Results were driven by nimble

publishing maximizing opportunities which arose, strong

cost-control and reduced finance costs.

The balance of our business remains broadly 69% of revenue being

derived from adult titles and 31% from children. New books

accounted for 42% of total sales and the backlist continues to

deliver strong sales delivering 58% of our revenue.

=====

The Legal Identifier of the Company is 549300BJ2WPX3QUATW58.

For further information, please contact:

The Quarto Group Inc.

Michael Clarke, Company Secretary +44 20 7700 6700

About The Quarto Group

The Quarto Group (LSE: QRT) creates a wide variety of books and

intellectual property products, with a mission to inspire life's

experiences. Produced in many formats for adults, children and the

whole family, our products are visually appealing, information rich

and stimulating.

The Group encompasses a diverse portfolio of imprints and

businesses that are creatively independent and expert in developing

long-lasting content across specific niches of interest. Quarto

sells and distributes its products globally in over 50 countries

and 40 languages, through a variety of sales channels, partnerships

and routes to market.

Quarto employs c.300 talented people in the US and the UK. The

group was founded in London in 1976. It is domiciled in the US and

listed on the London Stock Exchange.

For more information, visit quarto.com or follow us on Twitter

at @TheQuartoGroup.

Business Overview

During 2022 most markets around the world reopened and we saw a

return to buying in physical bookstores with a corresponding

reduction in our online sales.

The company ended the year with sales of $141.0m down from prior

year by 7% (2021: $151.5m); adjusted operating profit increased by

33% to $21.3m (2021: $16.0m); profit before tax increased to $20.9m

(2021: $14.2m) and the strength of the balance sheet improved to

$67.3m (2021: $53.2m). The group ended the year with net debt down

89% at $0.6m (2021: $5.5m). Results were driven by nimble

publishing maximizing opportunities which arose, strong

cost-control and reduced finance costs.

With the economic pressures squeezing consumer spending the

overall book market contracted slightly in 2022 with non-fiction

sales showing one of the biggest declines, down by c. 7%.

Notwithstanding the sale of SmartLab during 2022, Quarto

outperformed the market delivering increased market share in all

our core categories.

The balance of our business remains in favour of adult

publishing with 69% of our revenue derived from adult titles. New

titles accounted for 42% of sales and our strong back catalog

continues to perform well delivering 58% of overall revenue. Our US

publishing operation and our UK publishing drive broadly equal

shares of our overall revenue.

Our most valuable series Little People Big Dreams continues to

grow and we will publish the 100th title in this series in 2023.

This series delivered $8.3m revenue in the year. Another valuable

property in our children's publishing the Story Orchestra series

delivered $2.7m in the year from just 7 titles.

During the year we ceased offering sales services to other

publishers and exited a non-core business with the sale of

SmartLab.

Key Strategies

PUBLISHING

Quarto's publishing remains focused on key categories: Cookery,

Home and Garden, Art and Craft, Children's, Reference and

Wellbeing. These sectors remain strong internationally. Each of our

imprints has a distinct focus and develops new titles aiming to

grow our market share in targeted categories. We also make

extensive use of our backlist where existing content may be

repurposed to create new products.

Highlights of 2022

-- Quarto kids is the #1 publisher of children's general

non-fiction in the UK

-- Best-selling author of Little People Big Dreams - Maria

Isabel Sanchez Vegara - is the #2 non-fiction children's author in

the UK

-- McDonald's Happy Meal program will put Little People Big

Dreams books into the hands of 40 million children around the

world

-- Strong growth in the Manga and Anime market where Quarto has

built significant market share

-- New range of graphic novels produced in partnership with

Saturday AM

-- Beautiful Boards: 50 amazing snack boards for any occasion

continues to sell strongly - over 200k copies and $2.5m revenue in

the year - some 3 years after publication

-- Custom publishing deal with Pokemon creating 4 titles which

delivered $1.5m in the year

-- Speed to market an important factor with Wordle Challenge

created and delivered within 8 weeks

-- Start-up of a new gift imprint which will launch in 2023

producing puzzles, games and related products from existing

content

-- Timely publication of Little People Big Dreams: Queen

Elizabeth selling over 175k copies

-- New cookery and health imprint to launch in 2023 expanding

our reach into one of the largest categories in non-fiction

publishing

SALES PERFORMANCE

One of Quarto's great strengths is our foreign language

co-edition sales team who delivered a strong performance in 2022

despite some challenging international situations. Trade with

Russia and Ukraine was halted and persistent lockdowns in China

severely impacted that market. All other foreign language markets

delivered growth. Reprints of existing titles were 5% up on prior

year and core series continued to perform well. We also saw a

resurgence in sales of reference titles which had been reduced

during the pandemic in favour of practical titles.

Our international sales team began travelling again in 2022 with

bookfairs and in-person meetings back on the agenda. Overall these

sales were 6% down on prior year but with mixed results by region.

South East Asia delivered growth +14% and the Middle East +8%

accounting for over $500k for the first time. Sales to Europe held

steady but Australia and China were both down -7% and -34%

respectively.

UK sales were 2% down on 2021 with new titles performing well

but backlist sales $2.3m down from the pandemic peak which was

driven by lockdown hobbyists. The reopening of physical bookstores

saw our field sales reps deliver over GBP1m for the first time in 3

years.

US sales were down 11% on prior year with both Amazon and the

main bookstore chain, Barnes & Noble, showing much slower

ordering patterns. However we saw a marked increase (+17%) in our

sales through independent bookstores as customers returned to

stores.

Our Chartwell division targets the value end of the market

creating books primarily from existing content. Books are sold

non-returnable. This division had an outstanding year delivering

sales significantly ahead of budget and 32% up on the previous

year.

OPERATIONS

During the year we continued our development of systems and

processes to improve our operational efficiency. Our goal is to be

free of reliance on 3rd party systems by 2024.

POST COVID WORKING

During 2022 we saw staff returning to our offices both in the UK

and US. We now operate a blended working model. This ongoing

flexibility has become an important factor in the workplace. We do

however firmly believe that in-person collaboration is vital to our

creative business and essential to team-building and staff

morale.

SUPPLY CHAIN

Disruptions to the supply chain continued through much of 2022

with longer than usual shipping times resulting from strikes and

port disruptions. To mitigate the impact of these our operations

team remained nimble switching onward shipping to trucks rather

than rail when necessary and putting in place local printings.

Whilst these measures incurred some extra costs there were

significant benefits in maintaining supply to the market. In Q4 we

saw much improved freight prices and improved shipping times. We

believe the market has now stabilized and we do not anticipate a

return to the volatility of 2021 and 2022.

STRATEGY

Quarto's strategic goals in the short to medium term will be to

continue to drive organic growth through its publishing and we will

launch 2 new imprints in 2023. We will also look at acquiring other

related businesses where we believe they can be leveraged across

our existing operations and provide a good strategic fit.

VIABILITY STATEMENT

In accordance with Provision 31 of the 2018 revision of the UK

Corporate Governance Code, the Directors assessed the prospects of

the Group over both a going concern period to 31 March 2024 and a

viability period to 31 December 2025. The going concern period has

a greater level of certainty and was therefore, used to set budgets

for all our businesses which culminated in the approval of a Group

budget by the Board. The Directors have determined that the

three-year period is an appropriate term over which to provide its

viability statement, being aligned with both the publishing program

cycle and the long-term incentives offered to Executive Directors

and certain senior management.

The Directors have considered the underlying robustness of the

Group's business model, products and its recent trading

performance, cash flows and key performance indicators. They have

also reviewed the cash forecasts prepared for the three years

ending 31 December 2025, which comprise a detailed cash forecast

for the period ending 31 December 2023 based on the budget for that

year and standard growth assumptions for revenue and costs for the

years ending 31 December 2024 and 2025. This is to satisfy

themselves of the going concern assumption used in preparing the

financial statements and the Group's viability over a three-year

period ending on 31 December 2025. As part of this work, the model

was sensitized initially by an 8% reduction in revenue to ensure

headroom within the covenants. This is deemed as a plausible

scenario, given in 2022 revenue dropped 7% year on year. Management

performed a reverse stress test to assess the point in which the

banking covenants were breached. This occurred at a reduction in

revenue of 13%. It is considered unlikely that such a reduction of

revenue would occur, given, sales dropped 7% in 2022 and also

dropped 7% during 2020.

In February 2021, the Group renewed its bank facilities, which

run until July 2024. Management do not foresee any issues with

regards to the repayment of loans or longer-term viability of the

Company. In the 3 year model we have shown that the business is

profitable and therefore capable of repaying the bank loans in line

with the facility agreements of $2.7m. We continue to receive

support from the banks. In carrying out their analysis of

viability, the Directors took account of the Group's projected

profits and cash flows and its banking facilities and

covenants.

In addition to the agreement to the facility, 1010 Printing

Limited (a subsidiary of the Lion Rock Group Limited) and C.K. Lau

extended the original $13m unsecured and subordinated loans to the

Group (entered into on 31 October 2018) on identical terms and on

normal commercial terms. Furthermore, 1010 Printing Limited agreed

to provide a further $10m unsecured and subordinated loan to the

Company on normal commercial terms. Whilst these unsecured and

subordinated loans were repayable by 31 August 2024, the loan of

$13m to C.K. Lau was fully repaid including interest at 3.75%

during 2022. A repayment of $2m was also made including interest at

4% to 1010 Printing Limited during the year, reducing the balance

to $8m. In the 3 year forecast we have shown that the business is

profitable and therefore capable of repaying the remainder of the

subordinated loans as per the agreements. The forecast also allows

for the repayment of the remaining $8m subordinated loan and

interest in Q1 2023. Approval for these specific subordinated loan

repayments was agreed by the banks and payment was made in Q1 2023.

We continue to receive support from 1010 Printing Limited.

The Directors also took account of the principal risks and

uncertainties facing the business referred in the annual report.

The review focused on the occurrence of severe but plausible

scenarios in respect of the principal risks and considered the

potential of these scenarios to threaten viability.

The key principal risk that the business faces is a downturn

caused by a global recession. The financial impact of this downturn

has been quantified to illustrate the Group's ability to manage the

impact on liquidity and covenants, with sensitivity analysis on the

key revenue growth assumptions and the effectiveness of available

mitigating actions. In considering this analysis, the Directors

took account of the mitigating actions that had been previously

taken. These actions included reductions in investment in

pre-publication costs, print volumes, staffing levels and other

variable costs.

Based on the above indications, after taking into account the

downside scenario projections, the Directors strongly believe have

a reasonable expectation that the Group has adequate resources to

continue in operation and meet its liabilities throughout the

viability period to 31 December 2025.

OUTLOOK

Quarto remains in a good financial position with a strong

pipeline of new title publishing for 2023 and beyond. Our large

back catalog is a significant strength and continues to perform

well. We feel confident in our ability to navigate the challenging

market conditions expected of 2023 and in the broad appeal of our

books.

Our people culture has been a focus in 2022 and will remain so

during 2023. Attracting and retaining high-caliber staff is vital

for the long-term health of the business.

We remain confident and focused on delivering a sustainable,

profitable business for the future.

THE QUARTO GROUP, INC .

Condensed Consolidated Income Statement

For the year ended 31 December 2022

Year ended Year ended

31 December 31 December

2022 2021

Note $000 $000

Continuing operations

Revenue 2 141,017 151,483

Cost of sales (87,319) (103,897)

-------------------------------------------- ---- ------------ ------------

Gross profit 53,698 47,586

Distribution costs (7,582) (8,439)

Impairment of financial assets (69) (874)

Administrative expenses (24,723) (22,314)

Operating profit before amortization of

acquired intangibles and exceptional items 21,324 15,959

Amortization of acquired intangibles - (7)

Exceptional items 3 774 -

-------------------------------------------- ---- ------------ ------------

Operating profit 2 22,098 15,952

Finance costs 4 (1,213) (1,796)

-------------------------------------------- ---- ------------ ------------

Profit before tax 20,885 14,156

Tax 5 (4,279) (4,230)

-------------------------------------------- ---- ------------ ------------

Profit for the year 16,606 9,926

============================================ ==== ============ ============

Attributable to:

Owners of the parent 16,606 9,926

============================================ ==== ============ ============

Earnings per share (cents)

From continuing operations

Basic 6 40.6 24.3

Diluted 6 40.6 24.3

THE QUARTO GROUP, INC .

Condensed Consolidated Statement of Comprehensive Income

For the year ended 31 December 2022

Year ended Year ended

31 December 31 December

2022 2021

$000 $000

Profit for the year 16,606 9,926

Items that may be reclassified to profit

or loss

Foreign exchange translation differences (2,475) (506)

Tax relating to items that may be reclassified

to profit or loss - 66

-------------------------------------------------- ------------------------- ------------

Total other comprehensive income (2,475) (440)

-------------------------------------------------- ------------------------- ------------

Total comprehensive income for the year

net of tax 14,131 9,486

================================================== ========================= ============

Attributable to:

Owners of the parent 14,131 9,486

================================================== ========================= ============

THE QUARTO GROUP, INC.

Condensed Consolidated Balance Sheet

At 31 December 2022

31 December 31 December

2022 2021

Note $000 $000

Non-current assets

Goodwill 7 18,622 19,286

Other intangible assets 1 51

Property, plant and equipment 7,677 5,181

Intangible assets: Pre-publication

costs 8 25,473 29,941

Deferred tax assets 1,835 2,436

----------------------------------- ---- ----------- -------------

Total non-current assets 53,608 56,895

----------------------------------- ---- ----------- -------------

Current assets

Inventories 21,826 20,393

Trade and other receivables 40,122 51,242

Cash and cash equivalents 13,290 28,432

Total current assets 75,238 100,067

----------------------------------- ---- ----------- -------------

Total assets 128,846 156,962

----------------------------------- ---- ----------- -------------

Current liabilities

Short term borrowings (4,636) (5,438)

Trade and other payables (33,869) (53,789)

Lease liabilities (944) (1,363)

Tax payable (3,295) (7,467)

----------- -------------

Total current liabilities (42,744) (68,057)

----------------------------------- ---- ----------- -------------

Non-current liabilities

Long term borrowings (9,301) (28,508)

Deferred tax liabilities (2,798) (3,130)

Tax payable (386) (386)

Lease liabilities (6,277) (3,672)

Total non-current liabilities (18,762) (35,696)

----------------------------------- ---- ----------- -------------

Total liabilities (61,506) (103,753)

----------------------------------- ---- ----------- -------------

Net assets 67,340 53,209

=================================== ==== =========== =============

Equity

Share capital 4,089 4,089

Paid in surplus 48,701 48,701

Retained earnings and other

reserves 14,550 419

----------------------------------- ---- ----------- -------------

Total equity 67,340 53,209

=================================== ==== =========== =============

THE QUARTO GROUP, INC .

Condensed Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Equity attributable

Share Paid Translation Retained to owners

capital in surplus reserve earnings of the parent

$000 $000 $000 $000 $000

Balance at 1 January 2021 4,089 48,701 (5,607) (3,470) 43,713

Profit for the year - - - 9,926 9,926

Foreign exchange translation

differences - - (506) - (506)

Tax relating to items that may

be reclassified to profit or loss - - 66 - 66

------------------------------------- -------- ----------- ----------------------- ---------- -------------------

Total comprehensive income for

the year - - (440) 9,926 9,486

Share based payments credit - - - 10 10

Balance at 31 December 2021 4,089 48,701 (6,047) 6,466 53,209

Profit for the year - - - 16,606 16,606

Foreign exchange translation

differences - - (2,475) - (2,475)

Tax relating to items that may

be reclassified to profit or loss - - - - -

------------------------------------- -------- ----------- ----------------------- ---------- -------------------

Total comprehensive income for

the year - - (2,475) 16,606 14,131

Share based payments credit - - - - -

Balance at 31 December 2022 4,089 48,701 (8,522) 23,072 67,340

===================================== ======== =========== ======================= ========== ===================

THE QUARTO GROUP, INC.

Condensed Consolidated Cash Flow Statement

For the year ended 31 December 2022

Year ended Year ended

31 December 31 December

2022 2021

Note $000 $000

Profit for the year 16,606 9,926

Adjustments for:

Net finance costs 4 1,213 1,796

Depreciation of property, plant and equipment 2,029 1,741

Software amortization 50 101

Tax expense 5 4,279 4,230

Impairment of right-to-use assets 228 -

Loss on disposal of property, plant and

equipment 3 -

Loss on disposal of SmartLab 3 1,498 -

Forgiveness of Cares Act Loan 3 (2,272) -

Share based payments - 10

Amortization of acquired intangibles - 7

Amounts expensed work-in-progress 8 2,875 4,333

Amortization and impairment of pre-publication

costs 8 16,331 26,567

----------------------------------------------------- ------ ------------ ------------

Operating cash flows before movements

in working capital 42,840 48,811

Increase in inventories (3,299) (5,036)

Decrease/(increase) in receivables 8,594 (7,106)

(Decrease)/increase in payables (17,119) 4,035

----------------------------------------------------- ------ ------------ ------------

Cash generated by operations 31,016 40,704

Income taxes paid (7,561) (3,053)

----------------------------------------------------- ------ ------------ ------------

Net cash from operating activities 23,455 37,651

----------------------------------------------------- ------ ------------ ------------

Investing activities

Proceeds from sale of SmartLab 3 1,437 -

Investment in pre-publication costs 8 (18,067) (20,229)

Purchases of property, plant and equipment (1,238) (111)

Net cash used in investing activities (17,868) (20,340)

----------------------------------------------------- ------ ------------ ------------

Financing activities

Interest payments (397) (1,866)

Lease payments (1,708) (1,426)

Drawdown of revolving credit facility

and other loans 1,500 22,994

Repayment of revolving credit facility

and other loans (19,693) (30,840)

Net cash used in financing activities (20,298) (11,138)

----------------------------------------------------- ------ ------------ ------------

Net (decrease)/increase in cash and

cash equivalents (14,711) 6,173

Cash and cash equivalents at beginning

of year 28,432 22,079

Foreign currency exchange differences

on cash and cash equivalents (431) 180

----------------------------------------------------- ------ ------------ ------------

Cash and cash equivalents at end of

year 13,290 28,432

===================================================== ====== ============ ============

THE QUARTO GROUP, INC.

Notes to the condensed financial statements

1. Basis of preparation

The results have been extracted from the audited financial

statements of the Group for the year ended 31 December 2022. The

results do not constitute statutory accounts within the meaning of

Section 434 of the Companies Act 2006. Whilst the financial

information included in this announcement has been computed in

accordance with the principles of 'UK Adopted' International

Financial Reporting Standards ("IFRS") and Companies Act 2006 that

applies to companies reporting under IFRS, this announcement does

not of itself contain sufficient information to comply with IFRS.

The Group will publish full financial statements that comply with

IFRS. The auditors have reported on these accounts; their report

was unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain

statements under s498(2) or (3) of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2022, will not

have been filed with the Registrar of Companies. The accounting

policies applied are consistent with those described in the Annual

Report & Accounts for the year ended 31 December 2022.

The Group financial statements are presented in US Dollars and

all values are shown in thousands of dollars ($000) rounded to the

nearest thousand dollars, except where otherwise stated. Each

entity in the Group determines its own functional currency and

items included in the financial statements of each entity are

measured using that functional currency.

Going Concern

The Board assessed the Group's ability to operate as a going

concern for at least the next 12 months from the date of signing

the financial statements.

The Directors have considered the underlying robustness of the

Group's business model, products and proposition and its recent

trading performance, cash flows and key performance indicators.

They have also reviewed the cash forecasts prepared in detail to 31

March 2024. This is to satisfy themselves of the going concern

assumption used in preparing the financial statements. The base

case model was built using a detailed sales forecast driven by the

publishing program for 2023. Trade receivable days remaining

consistent with 2022.

As part of this work, the model was sensitized initially by a 5%

reduction in revenue to ensure headroom within the covenants. This

is deemed as a severe but plausible scenario. Management performed

a reverse stress test to assess the point in which the banking

covenants were breached. This occurred at a reduction in revenue of

13%. It is considered unlikely that such a reduction of revenue

would occur, given, sales dropped 7% in 2022 and dropped 7% during

2020. Should we start to see a reduction in revenue, then

mitigating action will be taken, such as reduction in investment in

pre-publication costs, print volumes, staffing levels and other

variable costs.

Based on the above indications, the Directors believe that it

remains appropriate to continue to adopt the going concern in

preparing the financial statements.

2. Operating segments

The analysis by segment is presented below. This is the basis on

which the operating results are reviewed and resources allocated by

the Chief Executive Officer, who is deemed to be the chief

operating decision maker.

US UK

2022 Publishing Publishing Total

$000 $000 $000

External revenue - continuing operations 75,329 65,688 141,017

============ ============ ========

Operating profit before amortization

of acquired intangibles and exceptional

items 10,608 11,875 22,483

Amortization of acquired intangibles - - -

------------ ------------ --------

Segment result 10,608 11,875 22,483

Unallocated corporate expenses (1,159)

Corporate exceptional items (note

3) 774

--------

Operating profit 22,098

Finance costs (1,213)

--------

Profit before tax 20,885

Tax (4,279)

--------

Profit after tax 16,606

========

2021 US Publishing UK Publishing Total

$000 $000 $000

External revenue - continuing operations 81,062 70,421 151,483

============== ============== ========

Operating profit before amortization

of acquired intangibles and exceptional

items 10,024 7,001 17,025

Amortization of acquired intangibles (7) - (7)

-------------- -------------- --------

Segment result 10,017 7,001 17,018

Unallocated corporate expenses (1,066)

Corporate exceptional items (note

3) -

--------

Operating profit 15,952

Finance costs (1,796)

--------

Profit before tax 14,156

Tax (4,230)

--------

Profit after tax 9,926

--------

Segmental balance sheet

2022 2021

$000 $000

Quarto Publishing Group USA 65,945 54,313

Quarto Publishing Group UK 49,590 71,877

Unallocated (Deferred tax and cash) 13,311 30,772

Total Assets 128,846 156,962

======= =======

Quarto Publishing Group USA 21,175 28,472

Quarto Publishing Group UK 22,265 30,351

Unallocated (Deferred tax, corporation tax and

debt) 18,066 44,930

Total Liabilities 61,506 103,753

======= =======

2. Operating segments (continued)

Geographical revenue

The Group operates in the following geographical

areas:

Non-current

Revenue assets

2022 2021 2022 2021

$000 $000 $000 $000

United States of America 85,397 93,399 28,908 31,333

United Kingdom 17,052 20,241 22,865 23,126

Europe 23,099 21,204 - -

Rest of the world 15,469 16,639 - -

Total 141,017 151,483 51,773 54,459

============================================ ======== ======== ======= =======

3. Exceptional items

2022 2021

$000 $000

SmartLab disposal (1,498) -

Cares Act loan forgiveness 2,272 -

Total 774 -

============================ ======== =====

On 30 August 2022, the Group publicly announced that we were

committed to sell SmartLab, our toy imprint. On 1 September 2022,

the intellectual property of SmartLab to the value of $1.825m was

sold for $0.5m. Sales were continued to be made until 29 November

2022, when the inventory on hand of $1.11m was sold at cost for

$1.088m. The overall loss on disposal was $1.498m after incurring

legal fees of $31k and redundancy costs of $120k.

During 2022, the Cares Act loan of $2.422m relating to

government support given under the Coronavirus Aid, Relief and

Economic Security Act of the USA, was forgiven to the value of

$2.272m.

4. Finance costs

2022 2021

$000 $000

Interest expense on borrowings 778 1,399

Amortization of debt issuance costs and bank

fees 70 85

Interest expense on lease liabilities 365 276

Other interest - 36

---------------------------------------------- ------ ------

Total 1,213 1,796

============================================== ====== ======

5. Taxation

2022 2021

$000 $000

Corporation tax

C urrent year 3,477 6,209

Prior periods 201 -

----------------- -------

Total current tax 3,678 6,209

----------------- -------

Deferred tax

Origination and reversal of temporary differences 601 (1,979)

------------------------------------------------------- ----------------- -------

Total tax expense 4,279 4,230

======================================================= ================= =======

5. Taxation (continued)

Corporation tax on UK profits is calculated at 19% (2021: 19%),

based on the UK standard rate of corporation tax of the estimated

assessable profit for the year. Taxation for other jurisdictions is

calculated at the rate prevailing in the respective jurisdictions.

An increase in the UK corporation rate from 19% to 25% is effective

1 April 2023. The table below explains the difference between the

expected expense at the UK statutory rate of 19% and the total tax

expense for the year.

2022 2021

$000 $000

Profit before tax 20,885 14,156

------ ------

Tax at the UK corporation tax rate of 19%

(2021: 19%) 3,968 2,690

Effect of different tax rates of subsidiaries

operating in other jurisdictions 813 1,058

Adjustment to prior years 201 -

T ax effect of items that are not deductible

in determining taxable profit (10) (16)

Tax effect of non-taxable items (587) -

Other (106) 498

------ ------

Tax expense 4,279 4,230

====== ======

Effective tax rate for the year 20.5% 29.9%

====== ======

6. Earnings per share

2022 2021

$000 $000

From continuing operations

Profit for the year 16,606 9,926

Amortization of acquired intangibles (net of

tax) - 5

Exceptional items (net of tax) (1,160) -

----------- -----------

Earnings for the purposes of adjusted earnings

per share 15,446 9,931

==================================================== =========== ===========

Number of shares Number Number

Weighted average number of ordinary shares 40,889,100 40,889,100

Diluted weighted average number of ordinary

shares 40,889,100 40,889,100

---------------------------------------------------- ----------- -----------

Earnings per share (cents) - continuing operations

Basic 40.6 24.3

Diluted 40.6 24.3

Adjusted earnings per share (cents)

Basic 37.8 24.3

Diluted 37.8 24.3

7. Goodwill

2022 2021

$000 $000

Cost

At 1 January 43,007 43,102

Exchange differences (664) (95)

At 31 December 42,343 43,007

====================================== ========= =========

Accumulated impairment losses

At 1 January (23,721) (23,721)

Impairment - -

Exchange differences - -

-------------------------------------- --------- ---------

At 31 December (23,721) (23,721)

====================================== ========= =========

Carrying value:

At 31 December 18,622 19,286

-------------------------------------- --------- ---------

The cash generating units containing

goodwill are as follows:

2022 2021

$000 $000

Quarto Publishing Group USA

(QUS) 12,882 12,882

Quarto Publishing Group UK

(QUK) 5,740 6,404

-------------------------------------- --------- ---------

18,622 19,286

====================================== ========= =========

Quarto identifies its cash-generating units based on its

operating model and how data is collected and reviewed for

management reporting and strategic planning purposes, in accordance

with IAS36 - Impairment of Assets. Corporate overheads have been

divided between cash-generating units and factored into the value

in use calculation.

The recoverable amount of each cash generating unit ('CGU') is

determined using the value in use basis. In determining value in

use, management prepares a detailed bottom up budget for the

initial twelve-month period, with reviews conducted at each

business unit. A further two years are forecast using relevant

growth rates and other assumptions. Cash flows beyond the

three-year period are extrapolated into perpetuity, by applying a

2% growth rate from the addressable market. The cashflows are then

discounted using a country-specific discount rate. The growth rates

used are consistent with the growth expectations for the sector in

which the company operates and the discount rate has been

calculated using pre-tax Weighted Average Cost of Capital

analysis.

The key assumptions for calculating value in use are:

Terminal Growth

Rates Discount Rates

------------------------- ================== ==============================

2022 2021 2022 2021

========================= ======== ======== ============== ==============

United States of America 2% 2% 10.75% 11.13%

------------------------- -------- -------- -------------- --------------

United Kingdom 2% 2% 11.13% 10.86%

========================= ======== ======== ============== ==============

Revenue growth rates: forecast sales growth rates are based on

those applied to the Board approved budget for the year ending 31

December 2023 and three-year plan. They incorporate future

expectations of growth driven by investment plans for each CGU.

Long-term growth rates: the three-year forecasts are

extrapolated to perpetuity on the basis that the CGU's are

long-established business units. The long-term growth rates are

blended rates formed from the territory-specific long-term growth

rates.

Gross margins: gross margins are based on historic performance

and expected changes to the sales mix in future periods.

The Group has undertaken various sensitivities of the QUK and

QUS CGU's. There were no reasonably possible changes in QUK that

would lead to impairment. QUS, which has the largest goodwill and

non-current assets, carries a greater risk that reasonably possible

changes would result in impairment. Based on the above long-term

growth rate and discount rate, QUS exceeded the carrying value of

the CGU by $4.3m. The following sensitivities were applied to this

CGU:

-- 0.75% increase in discount rate, at which level there was no

impairment. The recoverable amount exceeded the carrying value of

the CGU by $0.1m. The discount rate would need to increase to

11.75% to record any impairment.

-- 1.5% terminal growth rate, at which level there was no

impairment. The recoverable amount exceeded the carrying value of

the CGU by $2m. The terminal growth rate would need to be 1% before

any impairment was recorded.

Should there be a headline change in revenues and margins, this

could create an impairment.

8. Intangible assets: Pre-publication costs

2022 2022 2022 2021 2021 2021

$000 $000 $000 $000 $000 $000

============================ ========= ========= ======= ========= ========= =======

Work in Published Work in Published

progress products Total progress products Total

============================ ========= ========= ======= ========= ========= =======

Cost

---------------------------- --------- --------- ------- --------- --------- -------

At 1 January 10,105 102,528 112,633 11,442 86,496 97,938

---------------------------- --------- --------- ------- --------- --------- -------

Exchange difference (456) (7,240) (7,696) (64) (1,037) (1,101)

---------------------------- --------- --------- ------- --------- --------- -------

Additions 18,067 - 18,067 20,229 - 20,229

---------------------------- --------- --------- ------- --------- --------- -------

Transfers (16,036) 16,036 - (17,069) 17,069 -

---------------------------- --------- --------- ------- --------- --------- -------

Amounts expensed(1) (2,875) - (2,875) (4,433) - (4,433)

---------------------------- --------- --------- ------- --------- --------- -------

Disposals (note 5) (626) (4,072) (4,698) - - -

============================ ========= ========= ======= ========= ========= =======

At 31 December 8,179 107,252 115,431 10,105 102,528 112,633

============================ ========= ========= ======= ========= ========= =======

Amortization and impairment

---------------------------- --------- --------- ------- --------- --------- -------

At 1 January - 82,692 82,692 - 57,025 57,025

---------------------------- --------- --------- ------- --------- --------- -------

Exchange difference - (6,193) (6,193) - (900) (900)

---------------------------- --------- --------- ------- --------- --------- -------

Amortization charge - 17,060 17,060 - 19,808 19,808

---------------------------- --------- --------- ------- --------- --------- -------

(Reversal)/impairment

of published product - (729) (729) - 6,759 6,759

---------------------------- --------- --------- ------- --------- --------- -------

Disposals (note 5) - (2,872) (2,872) - - -

============================ ========= ========= ======= ========= ========= =======

At 31 December - 89,958 89,958 - 82,692 82,692

============================ ========= ========= ======= ========= ========= =======

Net book value 8,179 17,294 25,473 10,105 19,836 29,941

============================ ========= ========= ======= ========= ========= =======

1 Amounts expensed relate to the impairment of Work-In-Progress.

Titles which have no economic future are impaired.

The carrying amount of the intangible assets is reviewed

annually at each balance sheet date to determine whether there is

any indication of impairment. If any such indication exists, the

asset's recoverable amount is estimated. The recoverable amount is

the higher of fair value, reflecting market conditions less costs

to sell, and value in use based on an internal discounted cash flow

valuation.

Pre-publication costs form part of the carrying value of the CGU

for each segment and are considered for impairment of goodwill as

set out in note 7.

9. Alternative performance measures

The Group uses alternative performance measures to explain and

judge its performance.

Adjusted operating profit excluding amortization of acquired

intangibles and exceptional items. The Directors consider this to

be a useful measure of the Group operating performance as it shows

the performance of the underlying business.

Exceptional items are those which the Group defines as

significant items outside the scope of normal business that need to

be disclosed by virtue of their size or incidence.

Free cashflow is the cash generated by operations less

pre-publication investment and purchases of property, plant and

equipment and software.

Backlist % refers to book titles that were published in previous

calendar years and is a key measure of the performance of our

intellectual property assets.

Intellectual property development spend refers to the amounts

spent annually on the creation and publication of book titles

against which we monitor subsequent sales (see note 8).

2022 2021

$000 $000

Adjusted Operating Profit

Operating profit 22,098 15,952

Add back:

Amortizatio n of acquired intangibles - 7

Exceptional items (note 3) (774) -

------- -------

Adjusted operating profit 21,324 15,959

Adjusted profit before tax befor e amortization of acquired

intangibles and exceptional items

Adjusted operating profit befor e amortization of acquired

intangibles and exceptional items 21,324 15,959

Less: net finance costs (1,213) (1,796)

------- -------

Adjusted profit before tax befor e amortization of acquired

intangibles and exceptional items 20,111 14,163

======= =======

2022 2021

$000 $000

Net debt

Short term borrowings 4,636 5,438

Long term borrowings 9,301 28,508

Cas h and cash equivalents (13,290) (28,432)

-------- --------

Net debt 647 5,514

======== ========

10. Post balance sheet events

Quarto repaid the remaining loan of $8m plus accrued interest to

1010 Printing Limited in February 2023. This repayment was made

outside the agreement due to a favorable liquidity position at this

point in time and had been agreed by the bank. No additional

charges will be payable as a result of the early repayment.

11. Principal risks and uncertainties facing the Group

a. Economic conditions. The Group has adequate liquidity with up

to $22m in available debt facilities. In addition, the Directors

have the ability to take a number of mitigating actions, including

the reduction of spend on pre-publication costs, inventory

printings and other discretionary items. The Group offers

non-Chinese printing for customers in order to avoid US tariffs on

books. The Company's management information systems allow it to

assess sales performance quickly and so take the appropriate steps

to maximize operating performance. The Group has shown itself to be

adaptable by quickly accommodating the changes necessary to its

sales and marketing activities during the Covid-19 pandemic and to

subsequent supply chain pressures. The Group has a very limited

exposure to the Russian and Ukrainian markets.

b. Currency. The Group has a natural hedge that mitigates

against currency movements impacting its earnings in that one of

its largest costs, which is print costs, are paid in US

Dollars.

c. Loss of intellectual property. A cloud storage solution is

integrated into our production workflow to provide storage, back-up

and recovery services for product files in development. Complete

backlist archives are stored in a mirrored storage array.

d. Financial. In 2021, a three year and five months banking

facility of $20m was secured, together with additional shareholder

support. Performance during 2022 allowed the Company to accelerate

its debt reduction.

e. Customer. The Group has a long-established strategy of

diversifying its international customer base, including specialty

retailers, resulting in the fact that with one exception no

customer has over 20% of the business. Customer relations are

managed to ensure a fair-trading relationship. Management monitors

debts closely and maintains close relationships with its customers,

and distributors, which may provide prior warning of likely

failure. The Group continues to adapt to supporting online selling

and continues to offer and promote e-book versions of its

books.

f. Supply chain and raw materials. The Group maintains

relationships with printers in other parts of the world and is

confident that printing could be carried out by an alternative

range of printers if supply from China was interrupted or to

mitigate shipping costs. We maintain close relations with our

printers, reducing the risk of a lack of knowledge of any printer

being in financial trouble. The Group has worked with its major

printers on a plan to adopt sustainable paper and recently

instituted a Forest Stewardship Council (FSC) paper or Sustainable

Forestry Initiative (SFI) paper policy across all our imprints.

By monitoring frequency of factory downtime from acute climate

events (days lost) and using forecasting data as part of scenario

planning to model chronic climate change, the Company will be

better prepared in the selection of global suppliers. Further

development of internal scenario planning tools, and through

working more closely with suppliers on identified risks, the Group

can mitigate the potential impact of longer-term climate changes

and ensure security of supply. Acute interruptions to either raw

materials or manufacturing are mitigated by maintaining a flexible

manufacturing supplier base. The Group can mitigate the impact of

regional climate events by relocating manufacturing globally. This

approach was tested successfully during the Covid-19 pandemic.

g. Cyber security. The Group uses enterprise level firewalls and

IT controls to prevent attack as well as maintaining cloud-based

copies and offsite back-up of IP. Computerized files of the Group's

books are also maintained by printers. We do not store any personal

or credit card data on our websites www.quarto.com or

www.quartoknows.com. The Group undertakes industry standard system penetration testing.

h. Transition to net zero economy. By engaging in its own

emissions-reducing ambitions and as supply sectors themselves

transition towards net-zero practices, the Group will be better

placed to address climate-related transitional risks. Increasing

our engagement at industry level will support establishment of best

practice approaches.

The Group continues to engage with customers and explore

emerging channels to ensure that the Group remains competitive. By

working in partnership with customers the Company will be better

placed to mitigate these risks. We have also used insight gained

from Ivy Eco, an environmentally led imprint launched in 2020, to

better understanding market forces and customer levers. The Company

has also established a register identifying the environmental

offerings available through its global supplier base to ensure that

all customer climate-related needs can be met.

j. Product safety. All components receive safety testing from

specialist and accredited independent third parties. Management

carefully selects suppliers for the components the Company

uses.

The Company continues to monitor the regulatory impact of

product testing following the UK's departure from the European

Union and maintains a European presence to ensure compliance with

European Union Product Safety legislation following the UK's

departure from the European Union

k. Laws and regulations. Quarto reviews its licensing,

permission-acquisitions and other contracts routinely receiving

advice from relevant professional firms (including the possible

impact of Brexit) so that legal instruments remain current and

represent best practices so that we ensure that our practices are

aligned and consistent across imprints, and Quarto's IP rights are

properly protected.

l. People. Quarto's Publishers are experienced and talented

professionals who work alongside sales and marketing teams and

strive to stay close to publishing trends and markets. The Group

encourages diversity and inclusion in its workforce and offers

competitive market rate remuneration packages and works hard to

make Quarto an attractive place to work. The Group operates a

flexible hybrid working regimen.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EANDFDESDEEA

(END) Dow Jones Newswires

March 31, 2023 05:11 ET (09:11 GMT)

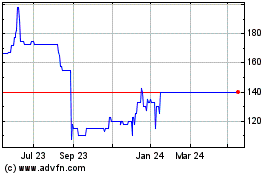

Quarto (LSE:QRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Quarto (LSE:QRT)

Historical Stock Chart

From Feb 2024 to Feb 2025