Exxon, Amazon, Ford, Best Buy: Stocks That Defined the Week

May 28 2021 - 6:30PM

Dow Jones News

By Dan Fitzpatrick

Exxon Mobil Corp.

The ground underneath the oil industry is getting slicker. Exxon

Mobil Corp. and Royal Dutch Shell PLC suffered significant defeats

Wednesday as environmental groups and activist investors step up

pressure on the oil industry to address concerns about climate

change. First a Dutch court ordered Shell to sharply reduce its

carbon emissions, and then hours later an activist investor won at

least two seats on Exxon's board. Exxon's shares rose 1.2%

Wednesday.

Amazon.com Inc.

A titan of the tech world wants to direct one of Hollywood's

most fabled studios. Amazon.com Inc. said Wednesday it agreed to

buy MGM Holdings, a pact that would turn a film operation known for

classics like "Singin' in the Rain" and "Rocky" into a streaming

asset for the e-commerce giant. The deal is part of a larger

consolidation in the media world; last week AT&T agreed to

combine its media assets with Discovery Inc. A MGM purchase would

mark Amazon's second-largest acquisition in history, behind its

$13.7 billion pickup of Whole Foods in 2017, and highlights the

premium that content is commanding as streaming wars force

consolidation. Amazon's shares rose 0.2% Wednesday.

Bank of America

A big bank is hanging up on the cold call. Bank of America

Corp.'s Merrill Lynch Wealth Management unit is banning trainee

brokers from pushing hot investments on anyone who will pick up the

phone, a practice once widely viewed within the industry as a rite

of passage. On Monday Merrill rolled out a revamped

adviser-training program that prohibits participants from cold

calling and directs would-be brokers to use internal referrals or

LinkedIn messages to land clients instead. The decision comes after

the program's 3,000 trainees were told to stop outbound recruiting

efforts to find new customers last year after problematic phone

calls. Bank of America's shares were up 0.5% Monday.

Best Buy Co.

Is America running out of TVs? Best Buy is rushing to have

enough televisions and appliances to sell in its stores this year

amid surging demand from American consumers. Comparable sales at

Best Buy shot up 37% during the company's quarter that ended

earlier this month as it worked to navigate supply-chain

challenges, and the company expects "some level of inventory

constraints" through the rest of 2021, according to Best Buy Chief

Executive Corie Barry. The situation is a sharp turn from the

depths of the Covid-19 pandemic a year ago, when many retail

executives worried aloud about whether shoppers would ever return.

Best Buy's shares rose 1% Thursday.

Ford Motor Co.

A plan by Ford to boost its electric-vehicle production is

picking up speed. Ford executives told investors Wednesday that

they expect 40% of the company's global sales to be fully electric

by 2030, and that the company would boost spending on

electric-vehicle development to $30 billion by 2025, roughly

one-third more than it forecast earlier this year. The pledges are

part of a tech-centric strategy to electrify much of Ford's vehicle

lineup and sharply grow its commercial truck and van business. Its

shares rose 8.5% Wednesday.

HCA Healthcare Inc.

A national hospital chain wants to Google its patient health

records. HCA Healthcare Inc. and Alphabet Inc.'s Google unit

announced an agreement Wednesday to develop healthcare algorithms

from digital health records and internet-connected medical devices.

The companies said this would help improve operating efficiency,

monitor patients and guide doctors' decisions. HCA said patient

records would be stripped of identifying information before being

shared with Google data scientists and that the hospital system

would control access to the data. Google has previously reached

deals with other prominent U.S. hospital systems that granted

access to personal patient information, drawing public scrutiny.

HCA shares rose .77% Wednesday.

HP Inc.

Will demand for the PC wane once the pandemic fades? HP Inc.'s

chief executive expects personal computers to remain a hot item

into next year, he said Thursday as the company posted a roughly

27% jump in second-quarter revenue and raised its full-year

earnings outlook. A pandemic-fueled run on computers helped HP

deliver strong results despite a semiconductor shortage that is

denting some industries. Personal-computer sales registered their

strongest growth in a decade last year, underscoring a shift from

mobile devices brought on by the coronavirus pandemic, according to

industry data. Investors may not yet be convinced the run can

continue. HP shares dropped 8.9% Friday.

Write to Dan Fitzpatrick at dan.fitzpatrick@wsj.com

(END) Dow Jones Newswires

May 28, 2021 19:15 ET (23:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

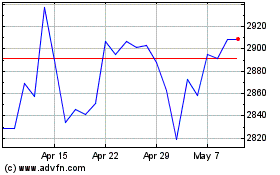

Shell (LSE:SHEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

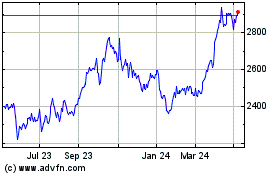

Shell (LSE:SHEL)

Historical Stock Chart

From Feb 2024 to Feb 2025