Triple Point Social Housing REIT Acquisitions, Rent Collection and Dividend Cover (2892V)

August 06 2020 - 1:00AM

UK Regulatory

TIDMSOHO

RNS Number : 2892V

Triple Point Social Housing REIT

06 August 2020

6 August 2020

Triple Point Social Housing REIT plc

(the "Company" or, together with its subsidiaries, the

"Group")

UPDATE ON ACQUISITIONS, RENT COLLECTION AND DIVIDEND COVER

The Board of Triple Point Social Housing REIT plc (ticker: SOHO)

is pleased to announce the following updates:

-- The Group completed the acquisition of a further 16

properties (comprising 70 individual units) for an aggregate

consideration of approximately GBP9.6 million (excluding

acquisition costs)

-- As at 5 August 2020, 100% of rent due for June 2020 was

received and 97% of the rent due for July 2020 had also been

received, with the balance expected to be received within the next

two weeks

-- The Company now has a look-through dividend cover of over

100%, as measured on an EPRA earnings run-rate basis(1)

Acquisitions Update

The Group has completed the acquisition of 16 properties,

comprising 70 individual units in total, for an aggregate

consideration of approximately GBP9.6 million (excluding

acquisition costs). The properties are located in the West Midlands

(64 units), the East of England (4 units) and Yorkshire (2

units).

The Group has entered into new FRI leases in respect of each of

the properties acquired for periods of between 20 and 40 years. The

leases are with specialist care providers or housing associations

regulated by the Regulator of Social Housing, including Blue Square

Residential, Inclusion Housing, Keys Group and Sandwell Community

Caring Trust.

The rents received under these leases are subject to annual,

upward-only rent reviews, increasing in line with the Consumer

Price Index.

The properties comprise specialist, high quality homes for

individuals with mental health and other support and care

needs.

The properties generate net initial yields in line with the

Company's existing portfolio.

Rental Collection and Dividend Cover

The Group continues to receive rents on a timely basis and in

line with both expectations and the experience in prior years. As

at 5 August 2020, 100% of rent due for June 2020 was received and

97% of rent due for July 2020 had also been received, with the

balance expected to be received within the next two weeks.

Following the further acquistions announced today the Company's

look-through dividend cover has increased to over 100% as measured

on an EPRA earnings run-rate basis(1) .

Note:

1 Including revenue from operational and forward funded properties

FOR FURTHER INFORMATION ON THE COMPANY, PLEASE CONTACT:

Triple Point Investment Management Tel: 020 7201 8989

LLP

(Investment Manager)

Ben Beaton

Max Shenkman

Isobel Gunn-Brown

Akur Capital (Joint Financial Adviser) Tel: 020 7493 3631

Tom Frost

Anthony Richardson

Siobhan Sergeant

Stifel (Joint Financial Adviser Tel: 020 7710 7600

and Corporate Broker)

Mark Young

Mark Bloomfield

Rajpal Padam

The Company's LEI is 213800BERVBS2HFTBC58.

Further information on the Company can be found on its website

at www.triplepointreit.com .

NOTES:

The Company invests in primarily newly developed social housing

assets in the UK, with a particular focus on supported housing. The

assets within the portfolio are subject to inflation-adjusted,

long-term (typically from 20 years to 30 years), Fully Repairing

and Insuring ("FRI") leases with Approved Providers (being Housing

Associations, Local Authorities or other regulated organisations in

receipt of direct payment from local government). The portfolio

comprises investments into properties which are already subject to

an FRI lease with an Approved Provider, as well as forward funding

of pre-let developments but does not include any direct development

or speculative development.

There is increasing political and financial pressure on Housing

Associations to increase their housing delivery and this is

creating opportunities for private sector investors to participate

in the market. The Group's ability to provide forward financing for

new developments not only enables the Company to secure fit for

purpose, modern assets for its portfolio but also addresses the

chronic undersupply of suitable supported housing properties in the

UK at sustainable rents as well as delivering returns to

investors.

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 8 August

2017 and was admitted to the premium segment of the Official List

of the Financial Conduct Authority and migrated to trading on the

premium segment of the Main Market on 27 March 2018. The Company

operates as a UK Real Estate Investment Trust ("REIT") and is a

constituent of the FTSE EPRA/NAREIT index.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUPUBCRUPUGRA

(END) Dow Jones Newswires

August 06, 2020 02:00 ET (06:00 GMT)

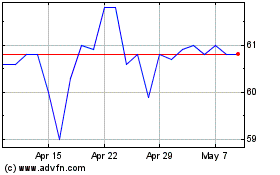

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From Apr 2024 to May 2024

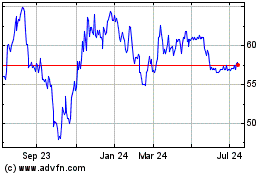

Triple Point Social Hous... (LSE:SOHO)

Historical Stock Chart

From May 2023 to May 2024