TIDMSOU

RNS Number : 6784Y

Sound Energy PLC

11 September 2020

11 September 2020

SOUND ENERGY PLC

("Sound Energy", the "Company" or the "Group")

HALF YEARLY REPORT FOR THE SIX MONTHSED 30 JUNE 2020

Sound Energy, the Moroccan focused upstream oil and gas company,

announces its unaudited half-year report for the six months ended

30 June 2020.

OPERATIONAL AND CORPORATE HIGHLIGHTS

-- Liquefied Natural Gas ("LNG") Heads of Terms signed with a leading Moroccan Energy Group

-- Environmental Impact Assessment ("EIA") approvals for

120-kilometre, 20-inch pipeline and gas treatment plant/compression

station received in January 2020 and March 2020 respectively

-- Successful renegotiation of the terms of the Anoual exploration permit in July 2020

FINANCIAL SUMMARY

-- Structural reduction in administrative expenses by 57% compared with H1 2019

-- Total Cash balances as at 30 June 2020 of GBP4.2 million

-- Equity placing to raise gross proceeds of GBP1.5 million at 2

pence per ordinary share announced in December 2019 and completed

in January 2020

-- Equity placing post period end to successfully raise

additional GBP3.2 million after costs at 2.125 pence per ordinary

share in August 2020

-- Continued focus on disciplined cost and cash management

Enquiries:

Vigo Communications - PR Adviser Tel: 44 (0)20 7390

Patrick d'Ancona 0230

Chris McMahon

Sound Energy questions@soundenergyplc.com

Graham Lyon, Executive Chairman

Cenkos Securities - Nominated Adviser Tel: 44 (0)20 7397

Ben Jeynes 8900

Russell Cook

Turner Pope Investments (TPI) Ltd - Broker Tel: 44 (0)20 3657 0050

Andy Thacker

Statement from the Executive Chairman

Despite the challenging business environment brought on by the

Covid-19 global pandemic and exacerbated in the oil and gas sector

by a dispute between Russia and Saudi Arabia which led to an

increase in supply just as demand was falling due to the economic

impact of the pandemic, the first half of 2020 was an active and

productive period for the Company as it reset its strategy to

transition towards becoming a cash generating Company with

significant exploration potential. The period concluded with the

announcement of a key milestone, that the Company had entered into

a heads of terms with, and granted exclusivity to, a Moroccan

conglomerate, to provide partial financing for its Phase 1 micro

LNG project and for the purchase of the LNG produced from the TE-5

Horst under the first phase of development. In addition during, the

Company also received EIA approval for the Tendrara Gas Export

Pipeline and Central Processing Facility ("CPF") whilst continuing

to progress the finalisation of binding terms for the proposed Gas

Sales Agreement ("GSA") with Office National de l'Electricité et de

l'Eau Potable ("ONEE") for the second phase of development of the

TE-5 Horst.

Eastern Morocco Partial Disposal

The Company announced in July 2020 that it is no longer in

discussions with the previously proposed purchaser in relation to

the potential partial disposal of its Eastern Morocco portfolio,

however, having announced its phased development strategy for the

Tendrara Production Concession, the Company continues to engage

with other parties who have expressed interest in participating in

the Company's strategy by way of a potential farm-in. Whilst a

partial disposal of its Eastern Morocco portfolio is not a

strategic priority of the Company, normal business development

discussions are ongoing in this regard. There is no certainty that

any of these discussions will advance and the Company's current key

priority is to deliver a final investment decision on its proposed

Phase 1 development of the Tendrara Production Concession during

2020.

Phase 1 Micro LNG Development

In June, the Company was pleased to announce that heads of terms

had been entered into with a Moroccan conglomerate to permit

exclusive discussions to negotiate definitive agreements for both

the purchase of LNG to be produced from the TE-5 Horst as well as

partial financing for the Phase 1 development by the Moroccan

conglomerate. An LNG Gas Sales Agreement is currently being

negotiated pursuant to which the joint venture will commit, over a

10 year period, to supply an annual contractual quantity of 100

million standard cubic metres of (liquefied) gas from the Phase 1

development, based upon the key commercial terms set out in the

heads of terms.

Phase 2 Tendrara TE-5 Development

The Company continued to make progress in advancing the

development of the Tendrara TE-5 discovery including the approval

of the EIA mentioned above along with progression of discussions to

obtain pipeline corridor rights. Despite the difficulties imposed

by the Covid-19 pandemic, positive discussions with ONEE have

continued in order to finalise the fully termed GSA for gas

offtake. This will form a key building block to support project

sanction of the proposed TE-5 Phase 2 development.

EIA of the Tendrara Gas Export Pipeline and CPF

In January 2020, the Company announced receipt of the EIA

approval from the Moroccan Ministry of Energy, Mines and

Environment to build and operate a 120km 20-inch gas pipeline

connecting the CPF to the Gazoduc Maghreb Europe pipeline ("GME").

This was followed by the ministerial approval of the EIA for the

CPF in March. Approval of the respective EIAs are important steps

in the development process of the TE-5 Horst. The EIA incorporates

the Micro LNG project activity.

Structural Cost Reductions

The Company continues to manage its cash resources prudently

and, accordingly, having paused its operational programme in 2019,

the Company continued a structural cost reduction programme aimed

at materially reducing the Company's ongoing operating expenditure,

including reductions in staff numbers, executive remuneration and

other business costs. By the end of the reporting period, the cost

reduction initiatives that have been implemented delivered a

reduction in general and administrative expenses by 57% compared

with the first half of 2019.

Licensing

The Company announced in July that it had successfully concluded

a renegotiation of the terms of its Anoual Exploration Permit in

order to realign the Company's committed exploration work programme

in Eastern Morocco so that it dovetails more efficiently with the

proposed phasing of our Phase 1 Development Plan at the Tendrara

Production Concession in a manner that underscores both our

confidence in the potential of the basin as a future significant

gas producing province and our ability to deploy capital

judiciously across the portfolio.

Corporate

In February, the Company announced the appointment of myself,

Graham Lyon, as Executive Chairman. The Company was pleased to

subsequently appoint Mohammed Seghiri as Chief Operating Officer in

April. Mohammed brings extensive technical and commercial

experience, as well as Moroccan knowledge and relationships which

will be utilised in particular to drive forward the Company's

phased development strategy in Eastern Morocco. In July, the

Company announced further board strengthening with the appointment

of David Blewden as an Independent non-executive director. David

brings a wealth of experience from the financial side of oil and

gas sector and specific experience around debt restructuring which

is a key priority for the Company in the coming period. As at 30

June 2020, the Company had total cash balances of GBP4.2 million

and, subsequent to the period end, the Company placed 163,529,411

new ordinary shares at a price of 2.125 pence per share to raise

GBP3.2 million after costs in August 2020.

Graham Lyon

Chairman (Executive)

Condensed Interim Consolidated Income Statement

Six months Six months

ended ended Year ended

30 June 30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

Notes GBP'000s GBP'000s GBP'000s

------------------------------------------------ ----- ---------- ---------- ----------

Exploration costs - (6,494) (6,570)

------------------------------------------------ ----- ---------- ---------- ----------

Gross loss - (6,494) (6,570)

------------------------------------------------ ----- ---------- ---------- ----------

Administrative expenses (1,700) (3,995) (6,064)

------------------------------------------------ ----- ---------- ---------- ----------

Group operating loss from continuing operations (1,700) (10,489) (12,634)

------------------------------------------------ ----- ---------- ---------- ----------

Finance revenue 26 57 102

Foreign exchange gain/(loss) 2,890 116 (1,101)

External interest costs (1,596) (1,151) (2,787)

------------------------------------------------ ----- ---------- ---------- ----------

Loss for period before taxation (380) (11,467) (16,420)

------------------------------------------------ ----- ---------- ---------- ----------

Tax expense - - -

------------------------------------------------ ----- ---------- ---------- ----------

Loss for period after taxation (380) (11,467) (16,420)

Other comprehensive (loss)/income

Items that may be subsequently be reclassified

to profit and loss account:

Foreign currency translation income/(loss) 8,044 349 (4,256)

------------------------------------------------ ----- ========== ========== ==========

Total comprehensive income/(loss) for

the period attributable to equity holders

of the parent 7,664 (11,118) (20,676)

------------------------------------------------ ----- ========== ========== ==========

Pence Pence Pence

------------------------------------------------ ----- ---------- ========== ==========

Basic and diluted loss per share for the

period attributable to equity holders of

the parent 3 (0.03) (1.08) (1.54)

------------------------------------------------ ----- ---------- ---------- ----------

Condensed Interim Consolidated Balance Sheet

30 June 30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

Notes GBP'000s GBP'000s GBP'000s

-------------------------------- ----- ---------- ----------- ----------

Non-current assets

Property, plant and equipment 4 157,490 152,844 147,342

Intangible assets 5 33,434 30,996 30,784

Interest in Badile land 1,002 985 936

-------------------------------- ----- ---------- ----------- ----------

191,926 184,825 179,062

-------------------------------- ----- ---------- ----------- ----------

Current assets

Inventories 1,084 1,020 1,014

Other receivables 1,669 1,963 1,492

Prepayments 51 126 41

Cash and short-term deposits 6 4,206 11,091 4,608

-------------------------------- ----- ---------- ----------- ----------

7,010 14,200 7,155

-------------------------------- ----- ---------- ----------- ----------

Total assets 198,936 199,025 186,217

-------------------------------- ----- ---------- ----------- ----------

Current liabilities

Trade and other payables 3,028 6,243 2,444

Lease liabilities 156 181 183

Loans and borrowings 7 23,845 - -

-------------------------------- ----- ---------- ----------- ----------

27,029 6,424 2,627

-------------------------------- ----- ---------- ----------- ----------

Non-current liabilities

Lease liabilities - 151 42

Loans and borrowings 7 - 21,337 21,235

-------------------------------- ----- ---------- ----------- ----------

- 21,488 21,277

-------------------------------- ----- ---------- ----------- ----------

Total liabilities 27,029 27,912 23,904

-------------------------------- ----- ---------- ----------- ----------

Net assets 171,907 171,113 162,313

-------------------------------- ----- ---------- ----------- ----------

Capital and reserves

Share capital and share premium 26,294 24,835 24,835

Warrant reserve 4,090 4,090 4,090

Foreign currency reserve 5,951 2,512 (2,093)

Accumulated surplus 135,572 139,676 135,481

-------------------------------- ----- ---------- ----------- ----------

Total equity 171,907 171,113 162,313

-------------------------------- ----- ---------- ----------- ----------

Condensed Interim Consolidated Statement of Changes in

Equity

Foreign

Share Share Accumulated Warrant currency Total

capital premium surplus reserve reserves equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

---------------------------- --------- --------- ----------- --------- --------- ---------

At 1 January 2020 10,796 14,039 135,481 4,090 (2,093) 162,313

---------------------------- --------- --------- ----------- --------- --------- ---------

Total loss for the period - - (380) - - (380)

Other comprehensive income - - - - 8,044 8,044

---------------------------- --------- --------- ----------- --------- --------- ---------

Total comprehensive income

for the period - - (380) - 8,044 7,664

Issue of share capital 822 816 - - - 1,638

Share issue costs - (179) - - - (179)

Share based payments - - 471 - - 471

---------------------------- --------- --------- ----------- --------- --------- ---------

At 30 June 2020 (unaudited) 11,618 14,676 135,572 4,090 5,951 171,907

---------------------------- --------- --------- ----------- --------- --------- ---------

At 1 January 2019 10,551 12,049 150,242 4,090 2,163 179,095

------------------------- ------ ------ -------- ----- ------- --------

Total loss for the year - - (16,420) - - (16,420)

Other comprehensive loss - - - - (4,256) (4,256)

------------------------- ------ ------ -------- ----- ------- --------

Total comprehensive loss - - (16,420) - (4,256) (20,676)

Issue of share capital 245 2,228 - - - 2,473

Share issue costs - (238) - - - (238)

Share based payments - - 1,659 - - 1,659

------------------------- ------ ------ -------- ----- ------- --------

At 31 December 2019 10,796 14,039 135,481 4,090 (2,093) 162,313

------------------------- ------ ------ -------- ----- ------- --------

Foreign

Share Share Accumulated Warrant currency Total

capital premium surplus reserve reserves equity

GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s GBP'000s

----------------------------- --------- --------- ----------- --------- --------- ---------

At 1 January 2019 10,551 12,049 150,242 4,090 2,163 179,095

----------------------------- --------- --------- ----------- --------- --------- ---------

Total loss for the period - - (11,467) - - (11,467)

Other comprehensive income - - - - 349 349

----------------------------- --------- --------- ----------- --------- --------- ---------

Total comprehensive loss for

the period - - (11,467) - 349 (11,118)

Issue of share capital 245 2,228 - - - 2,473

Share issue costs - (238) - - - (238)

Share based payments - - 901 - - 901

----------------------------- --------- --------- ----------- --------- --------- ---------

At 30 June 2019 (unaudited) 10,796 14,039 139,676 4,090 2,512 171,113

----------------------------- --------- --------- ----------- --------- --------- ---------

Condensed Interim Consolidated Cash Flow Statement

Year

Six months Six months ended

ended ended 31 Dec

30 June 30 June 2019

2020 Unaudited 2019 Unaudited Audited

GBP'000s GBP'000s GBP'000s

-------------------------------------------- --------------- --------------- ---------

Cash flow from operating activities

Cash flow from operations (630) (6,591) (10,909)

Interest received 26 57 102

--------------------------------------------- --------------- --------------- ---------

Net cash flow from operating activities (604) (6,534) (10,807)

--------------------------------------------- --------------- --------------- ---------

Cash flow from investing activities

Capital expenditure and disposals (201) (963) (1,011)

Exploration expenditure (528) (4,351) (5,401)

Disposal of Italian operations - 761 761

--------------------------------------------- --------------- --------------- ---------

Net cash flow from investing activities (729) (4,553) (5,651)

--------------------------------------------- --------------- --------------- ---------

Cash flow from financing activities

Net proceeds from equity issue 1,352 2,235 2,235

Interest payments (622) (627) (1,266)

Lease payments (30) (83) (195)

--------------------------------------------- --------------- --------------- ---------

Net cash flow from financing activities 700 1,525 774

--------------------------------------------- --------------- --------------- ---------

Net decrease in cash and cash equivalents (633) (9,562) (15,684)

Net foreign exchange difference 231 117 (244)

Cash and cash equivalents at the beginning

of the period 4,608 20,536 20,536

--------------------------------------------- --------------- --------------- ---------

Cash and cash equivalents at the end of the

period 4,206 11,091 4,608

--------------------------------------------- --------------- --------------- ---------

Notes to Cash Flow Statement

Year

Six months Six months ended

ended ended 31 Dec

30 June 30 June 2019

2020 Unaudited 2019 Unaudited Audited

GBP'000s GBP'000s GBP'000s

Cash flow from operations reconciliation

Loss for the period before tax (380) (11,467) (16,420)

Finance revenue (26) (57) (102)

Exploration expenditure written off - 6,494 6,570

Impairment of interest in Badile land - - 616

Increase/(decrease) in accruals and short

term payables 550 (4,365) (7,773)

Depreciation 198 266 425

Share based payments charge and remuneration

paid in shares 579 901 1,659

Increase in drilling inventories (70) (91) (85)

Finance costs and exchange adjustments (1,294) 1,035 3,888

(Increase)/decrease in short term receivables

and prepayments (187) 693 313

----------------------------------------------- --------------- --------------- ---------

Cash flow from operations (630) (6,591) (10,909)

----------------------------------------------- --------------- --------------- ---------

Non-cash transactions during the period included the issue of

5,805,555 ordinary shares at a price of 1.86 pence per share, to an

employee of the Company in connection with the termination of an

employment contract. 1,425,000 ordinary shares were issued at a

price of 2 pence per share to a third party in lieu of fees

incurred in connection with a placing announced in December

2019.

Notes to the Condensed Interim Consolidated Financial

Statements

1. Basis of preparation

The condensed interim consolidated financial statements do not

represent statutory accounts within the meaning of section 435 of

the Companies Act 2006. The financial information for the year

ended 31 December 2019 is based on the statutory accounts for the

year ended 31 December 2019. Those accounts, upon which the

auditors issued an unqualified opinion, have been delivered to the

Registrar of Companies and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The condensed interim financial information is unaudited and has

been prepared on the basis of the accounting policies set out in

the Group's 2019 statutory accounts and in accordance with IAS 34

Interim Financial Reporting.

The seasonality or cyclicality of operations does not impact on

the interim financial statements.

Going concern

The Company's Condensed Interim Consolidated Financial

Statements have been prepared on a going concern basis, which

contemplates the realisation of assets and the settlement of

liabilities and commitments in the normal course of operations. The

Company is exploring funding options to enable it to restructure or

refinance the Company's EUR28.8 million bond due for settlement on

21 June 2021. In August 2020, the Company raised through an equity

placing, GBP3.2 million net of issue costs and at the end of August

held cash and cash equivalents of GBP6.5million including GBP1.3

million held as collateral for a bank guarantee of licence

commitments. Cashflow forecasts for the twelve-month period to

September 2021 indicates that additional funding will also be

required to enable the Company to meet its obligations.

The COVID-19 pandemic has not had a material impact on the

Company's operations. The consequential impact of a deterioration

of the pandemic may delay the progress in completing activities

necessary to restructure or refinance the Company's EUR28.8 million

bond.

These conditions indicate the existence of a material

uncertainty which may cast significant doubt about the Company's

ability to continue as a going concern. These Condensed Interim

Consolidated Financial Statements do not include adjustments that

would be required if the Company was unable to continue as a going

concern. The directors have formed a judgement based on the

Company's proven success in raising capital and a review of the

strategic options available to the Company, that the going concern

basis should be adopted in preparing the Condensed Interim

Consolidated Financial Statements.

2. Segment information

The Group categorises its operations into three business

segments based on Corporate, Exploration and Appraisal and

Development and Production. The Group's Exploration and Appraisal

activities are carried out in Morocco. The Group's reportable

segments are based on internal reports about the components of the

Group which are regularly reviewed by the Board of Directors, being

the Chief Operating Decision Maker ("CODM"), for strategic decision

making and resources allocation to the segment and to assess its

performance. The segment results for the period ended 30 June 2020

are as follows:

Segment results for the period ended 30 June 2020

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------- --------- ------------- ------------ ---------

Exploration costs - - - -

--------------------------------------- --------- ------------- ------------ ---------

Administration expenses (1,700) - - (1,700)

--------------------------------------- --------- ------------- ------------ ---------

Operating loss segment result (1,700) - - (1,700)

--------------------------------------- --------- ------------- ------------ ---------

Interest receivable 26 - - 26

Finance costs and exchange adjustments 1,294 - - 1,294

--------------------------------------- --------- ------------- ------------ ---------

Loss for the period before taxation (380) - - (380)

--------------------------------------- --------- ------------- ------------ ---------

The segments assets and liabilities at 30 June 2020 are as

follows:

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

-------------------- --------- ------------- ------------ ---------

Capital expenditure 1,327 157,165 33,434 191,926

Other assets 4,442 785 1,783 7,010

Total liabilities (25,148) - (1,881) (27,029)

-------------------- --------- ------------- ------------ ---------

The geographical split of non-current assets is as follows:

Europe Morocco

GBP'000s GBP'000s

---------------------------------------- --------- ---------

Development and production assets - 157,165

Interest in Badile land 1,002 -

Fixtures, fittings and office equipment 19 166

Right-of-use assets 61 79

Exploration and evaluation assets - 33,333

Software - 101

---------------------------------------- --------- ---------

Total 1,082 190,844

---------------------------------------- --------- ---------

Segment results for the period ended 30 June 2019

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

--------------------------------------- --------- ------------- ------------ ---------

Exploration costs - - (6,494) (6,494)

--------------------------------------- --------- ------------- ------------ ---------

Administration expenses (3,995) - - (3,995)

--------------------------------------- --------- ------------- ------------ ---------

Operating loss segment result (3,995) - - (10,489)

--------------------------------------- --------- ------------- ------------ ---------

Interest receivable 57 - - 57

Finance costs and exchange adjustments (1,035) - - (1,035)

--------------------------------------- --------- ------------- ------------ ---------

Loss for the period before taxation (4,973) - (6,494) (11,467)

--------------------------------------- --------- ------------- ------------ ---------

The segments assets and liabilities at 30 June 2019 were as

follows:

Development Exploration

Corporate & Production & Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

-------------------- --------- ------------- ------------ ---------

Capital expenditure 1,590 152,247 30,988 184,825

Other assets 12,490 - 1,710 14,200

Total liabilities (22,820) - (5,092) (27,912)

-------------------- --------- ------------- ------------ ---------

The geographical split of non-current assets was as follows:

Europe Morocco

GBP'000s GBP'000s

---------------------------------------- --------- ---------

Development and production assets - 152,247

Interest in Badile land 985 -

Fixtures, fittings and office equipment 75 198

Right-of-use assets 120 204

Exploration and evaluation assets - 30,824

Software 8 164

---------------------------------------- --------- ---------

Total 1,188 183,637

---------------------------------------- --------- ---------

Segment results for the year ended 31 December 2019

Exploration

Development &

Corporate & Production Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

----------------------------------------- --------- ------------- ----------- ---------

Exploration costs - - (6,570) (6,570)

----------------------------------------- --------- ------------- ----------- ---------

Administration expenses (6,064) - - (6,064)

----------------------------------------- --------- ------------- ----------- ---------

Operating loss segment result (6,064) - (6,570) (12,634)

----------------------------------------- --------- ------------- ----------- ---------

Interest receivable 102 - - 102

Finance costs and exchange adjustments (3,888) - - (3,888)

----------------------------------------- --------- ------------- ----------- ---------

Loss for the period before taxation from

continuing operations (9,850) - (6,570) (16,420)

----------------------------------------- --------- ------------- ----------- ---------

The segments assets and liabilities at 31 December 2019 were as

follows:

Exploration

Development &

Corporate & Production Appraisal Total

GBP'000s GBP'000s GBP'000s GBP'000s

------------------- --------- ------------- ----------- ---------

Non-current assets 1,530 146,876 30,656 179,062

Current assets 4,795 - 2,360 7,155

Total liabilities (22,636) (9) (1,259) (23,904)

------------------- --------- ------------- ----------- ---------

The geographical split of non-current assets is as follows:

Europe Morocco

GBP'000s GBP'000

---------------------------------------- --------- --------

Development and production assets - 146,876

Interest in Badile land 936 -

Fixtures, fittings and office equipment 46 195

Right-of-use assets 90 135

Exploration and evaluation assets - 30,656

Software 2 126

---------------------------------------- --------- --------

Total 1,074 177,988

---------------------------------------- --------- --------

3.Profit/(loss) per share

The calculation of basic profit/(loss) per Ordinary Share is

based on the profit/(loss) after tax and on the weighted average

number of Ordinary Shares in issue during the period. The

calculation of diluted profit/(loss) per share is based on the

profit/(loss) after tax on the weighted average number of ordinary

shares in issue plus weighted average number of shares that would

be issued if dilutive options, restricted stock units and warrants

were converted into shares. Basic and diluted profit/(loss) per

share is calculated as follows:

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------------------- -------- -------- -----------

Loss after tax from continuing operations (380) (11,467) (16,420)

------------------------------------------- -------- -------- -----------

million million million

--------------------------------- ------- ------- -------

Weighted average shares in issue 1,155 1,057 1,068

--------------------------------- ------- ------- -------

Pence Pence Pence

---------------------------------------------------------- ------ ------ ------

Basic and diluted profit/(loss) per share from continuing

operations (0.03) (1.08) (1.54)

---------------------------------------------------------- ------ ------ ------

Due to the loss for the period, the effect of the potential

dilutive shares on the earnings per share from continuing

operations would be anti-dilutive and therefore are not included in

the calculation of diluted earnings per share from continuing

operations.

4: Property, plant and equipment

30 June 30 June 31 Dec

2020 2019 2019

GBP'000s GBP'000s GBP'000s

--------------------- ---------- ---------- ----------

Cost

At start of period 148,071 151,394 151,394

Additions 216 1,390 1,493

Disposal - (1) (2)

Exchange adjustments 10,118 620 (4,814)

At end of period 158,405 153,403 148,071

--------------------- ---------- ---------- ----------

Depreciation

At start of period 729 389 389

Disposals - - (1)

Charge for period 163 221 340

Exchange adjustments 23 (51) 1

--------------------- ---------- ---------- ----------

At end of period 915 559 729

--------------------- ---------- ---------- ----------

Net book amount 157,490 152,844 147,342

--------------------- ---------- ---------- ----------

5. Intangibles

30 June 30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

---------------------------- ----------- ----------- ----------

Cost

At start of period 41,631 36,412 36,412

Additions 603 5,268 5,974

Exchange adjustments 2,094 383 (755)

---------------------------- ----------- ----------- ----------

At end of period 44,328 42,063 41,631

---------------------------- ----------- ----------- ----------

Impairment and Depreciation

At start of period 10,847 4,404 4,404

Charge for period 35 6,539 6,655

Exchange adjustments 12 124 (212)

---------------------------- ----------- ----------- ----------

At end of period 10,894 11,067 10,847

---------------------------- ----------- ----------- ----------

Net book amount 33,434 30,996 30,784

---------------------------- ----------- ----------- ----------

6. Cash and cash equivalents

30 June 30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

----------------------------- ----------- ----------- ----------

Cash and short-term deposits 4,206 11,091 4,608

----------------------------- ----------- ----------- ----------

The Group has provided collateral of $3.35 million (2019: $3.35

million) to the Moroccan Ministry of Petroleum to guarantee the

Group's minimum work programme obligations. The cash is held in a

bank account under the control of the Company and as the Group

expects the funds to be released as soon as the commitment is

fulfilled on this basis the amount remains included within cash and

cash equivalents. Subsequent to the period end, in August 2020,

$1.6 million of the collateral was released and became

unrestricted.

7. Loans and borrowings

30 June 30 June 31 Dec

2020 2019 2019

Unaudited Unaudited Audited

GBP'000s GBP'000s GBP'000s

---------------------- ----------- ----------- ----------

Current liability

5-year secured bonds 23,845 - -

Non-current liability

5-year secured bonds - 21,337 21,235

---------------------- ----------- ----------- ----------

The Company has 5-year non-amortising secured bonds with an

aggregate value of EUR28.8 million. The bonds are secured over the

share capital of Sound Energy Morocco South Limited, have a 5%

coupon and were issued at a 32% discount to par value. Alongside

the bonds, the Company issued 70,312,500 warrants to subscribe for

new ordinary shares in the Company at an exercise price of 30 pence

per ordinary share and an exercise period of approximately five

years, concurrent with the term of the bonds. The effective

interest rate is approximately 16.3%. The 5-year secured bonds are

due in June 2021.

8. Shares in issue and share based payments

As at 30 June 2020, the Company had 1,161,851,296 ordinary

shares in issue. In January 2020, the Company issued 75 million

shares at 2 pence per share following a placing announced in

December 2019. The net proceeds of the placing were approximately

GBP1.3 million. 1,425,000 shares were issued to a third party to

settle fees relating to the placing.

During the period to 30 June 2020, approximately 0.9 million

Restricted Stock Units (RSU) awards vested and approximately 1.0

million RSU expired. In addition, 8.4 million share options expired

during the period.

9. Post Balance Sheet events

In July 2020, the Company confirmed that negotiations with

Morocco's Office National de l'Electricité et de l'Eau Potable

("ONEE") in relation to the final gas sales agreement were

continuing despite travel restrictions relating to COVID-19.

In July 2020, the Company announced that it had renegotiated the

terms of its Anoual Exploration Permits (the "Permit') with

Morocco's National Office of Hydrocarbons and Mines, which aligns

the work programme commitments on the Permit and the Company's

continued pursuit to unlock the exploration potential of the

Eastern Morocco basin, with the expected phasing of the Company's

recently announced Tendrara Production Concession Phase 1

development plan.

In July 2020, the Company issued 863,682 new ordinary shares in

respect of RSUs that had vested.

Subsequent to the period end, in August 2020 the Company placed

163,529,411 new ordinary shares at a price of 2.125 pence per share

to raise GBP3.2 million after costs.

In August 2020 the Group received a notification from the tax

authority in Morocco of its intention to assess Sound Energy

Morocco East Limited for additional tax liabilities totalling

approximately $14 million. The Group believes that the assessment

arises from a misunderstanding of the underlying transactions and

consequently intends on appealing the assessment. Accordingly, no

liability has been recognised in the financial statements and the

amount is considered to be a contingent liability.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKKBPOBKDOCD

(END) Dow Jones Newswires

September 11, 2020 02:00 ET (06:00 GMT)

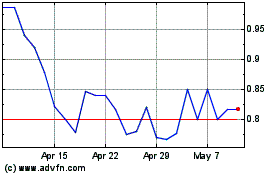

Sound Energy (LSE:SOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sound Energy (LSE:SOU)

Historical Stock Chart

From Apr 2023 to Apr 2024