TIDMTENT

RNS Number : 9154D

Triple Point Energy Transition PLC

24 October 2022

NEITHER THIS ANNOUNCEMENT NOR ANYTHING HEREIN FORMS THE BASIS

FOR ANY OFFER TO PURCHASE OR SUBSCRIBE FOR ANY SHARES OR OTHER

SECURITIES IN TRIPLE POINT ENERGY TRANSITION PLC NOR SHALL IT FORM

THE BASIS FOR ANY CONTRACT OR COMMITMENT WHATSOEVER.

24 October 2022

Triple Point Energy Transition plc

("TENT" or the "Company")

Migration to Trading on the Premium Segment of the Main Market

of the London Stock Exchange and Admission to the Premium Listing

Segment of the Official List of the FCA

The Board of Triple Point Energy Transition plc is pleased to

announce that it has received confirmation from the Financial

Conduct Authority (the "FCA") that the Company is eligible for the

admission of its ordinary shares (the "Ordinary Shares") to the

premium listing segment of the Official List of the FCA.

Accordingly, the Company has made applications to the FCA and

London Stock Exchange plc (the "London Stock Exchange"),

respectively, for admission of the Ordinary Shares to the premium

listing segment of the Official List of the FCA and for a transfer

of the Ordinary Shares from trading on the Specialist Fund Segment

to the Premium Segment of the Main Market of the London Stock

Exchange (the "Migration").

The Premium Segment of the Main Market is an established market

which is accessible to a wide range of investors. Accordingly, the

Migration is anticipated to result in an increase of the Company's

profile as an investment company, together with an increase in

liquidity and diversification of its share register with access to

blue chip UK and international investors as well as a potential

FTSE index inclusion.

Since its IPO, the Company has voluntarily complied with the

Listing Rules. However, as a Company whose shares are admitted to

the premium listing segment of the Official List, the Company will

now be required formally to comply with the Listing Rules, in

particular Chapter 15 of the Listing Rules for closed-ended

investment funds.

Admission is expected to occur with effect from 8.00 a.m. on 28

October 2022 ("Admission").

The Company's existing ticker, ISIN, LEI and SEDOL will remain

unchanged.

Working capital

In accordance with LR6.7.1R, the Company is of the opinion that

the working capital available to the Group is sufficient for its

present requirements, that is for at least the next 12 months from

the date of this announcement.

Investment Policy

As a result of the eligibility review, the Company has agreed

with the FCA to make certain non-material amendments to its

Investment Policy. Specifically, the Company has agreed to clarify

the investment restrictions with regards to debt

investments/commitments.

The amended Investment Policy, which has been approved by the

Board, is set out in the Appendix to this announcement.

FOR FURTHER INFORMATION:

Triple Point Investment Management LLP

Jonathan Hick / Ben Beaton +44 (0) 20 7201 8989

J.P. Morgan Cazenove

William Simmonds / Jérémie

Birnbaum (Corporate Finance)

James Bouverat / Liam MacDonald-Raggett

(Sales) +44 (0) 20 7742 4000

Akur Capital

Tom Frost / Anthony Richardson / Siobhan

Sergeant +44 (0) 20 7493 3631

LEI: 213800UDP142E67X9X28

NOTES TO EDITORS:

The Company is an investment trust which aims to have a positive

environmental impact by investing in assets that support the

transition to a lower carbon, more efficient energy system and help

the UK achieve Net Zero.

Since its IPO in October 2020, the Company has made the

following investments and commitments:

-- Harvest and Glasshouse : provision of GBP21m of senior debt

finance to two established combined heat and power ("CHP") assets,

located on the Isle of Wight, supplying heat, electricity and

carbon dioxide to the UK's largest tomato grower, APS Salads

("APS") - March 2021

-- Spark Steam : provision of GBP8m of senior debt finance to an

established CHP asset in Teeside supplying APS, as well as a

further power purchase agreement through a private wire arrangement

with another food manufacturer - June 2021

-- Hydroelectric Portfolio (1) : acquisition of six operational,

Feed in Tariff ("FiT") accredited, "run of the river" hydroelectric

power projects in Scotland, with total installed capacity of 4.1MW,

for an aggregate consideration of GBP26.6m (excluding costs) -

November 2021

-- Hydroelectric Portfolio (2) : acquisition of a further three

operational, FiT accredited, "run of the river" hydroelectric power

projects in Scotland, with total installed capacity of 2.5MW, for

an aggregate consideration of GBP19.6m (excluding costs) - December

2021

-- BESS Portfolio : commitment to provide a debt facility of

GBP45.6m to a subsidiary of Virmati Energy Ltd (trading as

"Field"), for the purposes of building a portfolio of four

geographically diverse Battery Energy Storage System ("BESS")

assets in the UK with a total capacity of 110MW - March 2022

-- Energy Efficient Lighting : Commitment to fund GBP1m to a

lighting solutions provider to install efficient lighting and

controls at a leading logistics company - June 2022

The Investment Manager is Triple Point Investment Management LLP

("Triple Point") which is authorised and regulated by the Financial

Conduct Authority. Triple Point manages private, institutional, and

public capital.

The Company was admitted to trading on the Specialist Fund

Segment of the Main Market of the London Stock Exchange on 19

October 2020 and was awarded the London Stock Exchange's Green

Economy Mark.

For more information, please visit

http://www.tpenergytransition.com/

IMPORTANT INFORMATION

Each of Akur Limited ("Akur") (which is regulated in the UK by

the FCA) and J.P. Morgan Securities plc (which conducts its UK

investment banking activities as "J.P. Morgan Cazenove") (which is

authorised by the Prudential Regulation Authority (the "PRA) and

regulated in the UK by the FCA and the PRA), is acting exclusively

for the Company and for no--one else in connection with the

Migration and other matters described in this announcement and will

not regard any other person as its client in relation thereto and

will not be responsible to anyone for providing the protections

afforded to its clients or providing any advice in relation to the

matters described herein. Neither Akur nor J.P. Morgan Cazenove,

nor any of their respective directors, officers, employees,

advisers or agents accepts any responsibility or liability

whatsoever for this announcement, its contents or otherwise in

connection with it or any other information relating to the

Company, whether written, oral or in a visual or electronic

format.

APPIX

Investment policy

The Company intends to achieve its investment objective by

investing in a diversified portfolio of Energy Transition Assets

typically via the acquisition of equity in, or the provision of

debt financing to, the relevant Investee Company. The Company may

invest in opportunities in the United Kingdom (and the Crown

Dependencies) and Europe.

The Group will invest in a range of Energy Transition Assets

which meet the following criteria:

-- contribute towards the energy transition to lower, or zero, carbon emissions

-- are established technologies

-- contribute to the generation of stable and predictable income

across the Company's portfolio, as a whole, arising from:

o long-term revenues based on availability, usage, consumption

or energy savings-based contracts with good quality industrial,

governmental, and corporate Counterparties or off-takers (as

assessed by the Investment Manager's due diligence processes),

including Counterparties which represent multiple end-users; or

o assets with income from wholesale or merchant sources

(including, but not limited to, battery energy storage, pumped

storage or other power storage and discharge systems and renewable

power assets), typically where the Investee Company benefits from

an option to put in place a long term fixed contractual price if it

deems it necessary to do so and where operated by a reputable

operator; and

-- entitle the Company to receive cash flows over the medium to

long-term in Developed Country Currencies. The Company may, but

does not intend to, enter into any currency hedging

arrangements.

The Group's portfolio of Energy Transition Assets will

predominantly comprise operational Energy Transition Assets. It

will invest in either single assets or portfolios of multiple

assets.

Subject to the investment restrictions set out below, the Group

may, also invest in assets that are in the Development Phase or the

Construction Phase, either directly or through funding of a

third-party developer, where such investments will deliver an

attractive risk adjusted return.

In addition, the Company may invest in or acquire minority

interests in companies with a strategy that aligns with the

Company's overarching investment objective, such as developers,

operators or managers of Energy Transition Assets ("Other Related

Companies")

The Group will seek to diversify its commercial exposure through

contractual relationships, directly or indirectly (through the

Investee Company), with a range of different Counterparties and

off-takers, as appropriate to the relevant investment.

Investments may be acquired from a single or a range of vendors

and the Group may also enter into joint venture arrangements

alongside one or more co-investors, where the Group retains control

or has strong minority protections. Recognising the different risk

profiles and business models of the various technologies, the Group

can invest across both debt and equity investments. Debt

investments will include market standard downside protections

including, but not limited to, cash reserve accounts, security and

have robust contractual and covenant protections.

Investment restrictions

The Company will invest and manage its assets with the objective

of spreading risk and, in doing so, will maintain the following

investment restrictions:

-- no single debt commitment or debt investment to fund, via an

Investee Company, one or more Energy Transition Asset(s) will

represent more than 20 per cent. of Adjusted Gross Asset Value. No

single equity investment into an Energy Transition Asset directly

or via an Investee Company, will represent more than 20 per cent.

of Adjusted Gross Asset Value except, where the Group has control

over an Investee Company which holds multiple Energy Transition

Assets and such assets are standalone economic operations, between

which risk can be apportioned separately, this restriction shall

apply to each individual Energy Transition Asset;

-- the aggregate maximum exposure to any Counterparty will not

exceed 20 per cent. of Adjusted Gross Asset Value (and where an

Energy Transition Asset derives revenues from more than one source,

the relevant Counterparty exposure in each case shall be calculated

by reference to the proportion of revenues derived from payments

received from the Counterparty, rather than any other source). This

restriction does not apply to circumstances where all, or

substantially all, of the revenue generated by an Energy Transition

Asset is derived through connection to the wholesale electricity

market, for example, transmission or distribution networks, where

there are multiple potential off-takers;

-- the aggregate maximum exposure to assets in the Development

Phase and the Construction Phase will not exceed, 25 per cent. of

Adjusted Gross Asset Value, provided that, within this limit, the

aggregate maximum exposure to assets in the Development Phase will

not exceed 5 per cent. of Adjusted Gross Asset Value, and the

aggregate exposure to any one Developer will not exceed 10 per

cent. of Adjusted Gross Asset Value. The restriction on

Construction Phase assets will not apply to assets where on-site

commissioning is expected to be completed within a period of three

months and any equipment on order is sufficiently insurance

wrapped;

-- at least 70 per cent. of the value of the Group's portfolio

of Energy Transition Assets will comprise United Kingdom based

investment;

-- the Group will not invest more than 5 per cent. of Adjusted

Gross Asset Value, in aggregate, in the acquisition of minority

stakes in Other Related Companies, and at all times such

investments will only be made with appropriate minority protections

in place;

-- neither the Group nor any of the Investee Companies will

invest in any UK listed closed-ended investment companies; and

-- the Company will not conduct any trading activities which are

significant in the context of the Group as a whole.

Compliance with the above investment limits will be measured at

the time of investment or in the case of commitment at the time of

commitment, and noncompliance resulting from changes in the price

or value of assets following investment will not be considered as a

breach of the investment limits.

For the purposes of the foregoing, the term "Adjusted Gross

Asset Value" shall mean the aggregate value of the total assets of

the Company as determined using the accounting principles adopted

by the Company from time to time as adjusted to include any

third-party debt funding drawn by, or available to, any

unconsolidated Holding Entity.

Borrowing Policy

The Directors intend to use gearing to enhance the potential for

income returns and long-term capital growth, and to provide capital

flexibility. However, the Company will always follow a prudent

approach for the asset class with regards to gearing, and the Group

will maintain a conservative level of aggregate borrowings.

Gearing will be employed either at the level of the Company, at

the level of any Holding Entity or at the level of the relevant

Investee Company and any limits set out in this document shall

apply on a look-through basis. The Company's target medium term

gearing for the Wider Group will be up to 40 per cent. of Gross

Asset Value, calculated at the time of drawdown.

The Group may enter into borrowing facilities at a higher level

of gearing at the Investee Company or Holding Entity, provided that

the aggregate borrowing of the Wider Group shall not exceed a

maximum of 45 per cent. of Gross Asset Value, calculated at the

time of drawdown.

Debt may be secured with or without a charge over some or all of

the Wider Group's assets, depending on the optimal structure for

the Group and having consideration to key metrics including lender

diversity, cost of debt, debt type and maturity profiles.

Intra-group debt between the Company and (i) Holding Entities

and/or (ii) Investee Companies subsidiaries will not be included in

the definition of borrowings for these purposes.

Hedging and Derivatives

The Company will not employ derivatives for investment purposes.

Derivatives may however be used for efficient portfolio

management.

The Wider Group will only enter into hedging contracts (in

particular, in respect of inflation, interest rate, currency,

electricity price and commodity price hedging) and other derivative

contracts when they are available in a timely manner and on

acceptable terms. The Company reserves the right to terminate any

hedging arrangement in its absolute discretion. Any such hedging

transactions will not be undertaken for speculative purposes. The

Company can, but does not intend to, enter into any currency

hedging.

Cash management

The Company may hold cash on deposit for working capital

purposes and awaiting investment and, as well as cash deposits, may

invest in cash equivalent investments, which may include government

issued treasury bills, money market collective investment schemes,

other money market instruments and short-term investments in money

market type funds ("Cash and Cash Equivalents"). There is no

restriction on the amount of Cash and Cash Equivalents that the

Company may hold and there may be times when it is appropriate for

the Company to have a significant Cash and Cash Equivalents

position.

Definitions

"Adjusted Gross Asset for the purposes of the Investment Policy,

Value" or "Adjusted the aggregate value of the total assets

GAV" of the Company as determined using the

accounting principles adopted by the

Company from time to time, as adjusted

to include any third-party debt funding

drawn by, or available to, any unconsolidated

Holding Entity

"Board" the board of directors of the Company

or any duly constituted committee thereof

------------------------------------------------

"Company" Triple Point Energy Transition plc

------------------------------------------------

"Construction Phase" in respect of a new development Energy

Transition Asset, the phase where contracts

have been agreed and relevant permits

are in place

------------------------------------------------

"Counterparty" In the case of an equity investment,

the contracting counterparty from which

the Group, directly or indirectly, generates

revenue. In the case of a debt commitment

or debt investment, the borrower

------------------------------------------------

"Crown Dependencies" the Bailiwick of Jersey, the Bailiwick

of Guernsey and the Isle of Man

------------------------------------------------

"Developed Country GBP, USD, Euro or such other currency

Currency" of a country classified by the United

Nations Secretariat as having a developed

economy that the Board determines, from

time to time, to provide low currency

risk

------------------------------------------------

"Development Phase" in respect of a new development Energy

Transition Asset, the initial phase before

relevant contracts or permits are in

place

------------------------------------------------

"Developer" a company or other organisation that

obtains relevant permissions and permits,

for example planning and grid connection,

in order to enable an Energy Transition

Asset to be ready-to-build, such that

construction can commence.

------------------------------------------------

"Energy Transition" the global drive to address the climate

emergency through the transition of energy

systems to lower or zero carbon

------------------------------------------------

"Energy Transition standalone lower carbon, efficient energy

Assets" projects which contribute to Energy Transition

------------------------------------------------

"Euro" or "EUR" the currency adopted by those nations

participating in the third stage of the

economic and monetary union provisions

of the Treaty on European Union, signed

at Maastricht on 7 February 1992

------------------------------------------------

"Europe" together the member states of the European

Economic Area and the European Free Trade

Association, together with Andorra, Monaco

and San Marino

------------------------------------------------

"Feed in Tariff" a UK government programme designed to

promote the uptake of renewable and low-carbon

electricity generation technologies,

via payments at a fixed price for electricity

generated

------------------------------------------------

"Gross Asset Value" the aggregate value of the total assets

of the Company as determined with the

accounting principles adopted by the

Company from time to time

------------------------------------------------

"Group" the Company and the Holding Entities

(together, individually or in any combination

as appropriate)

------------------------------------------------

"Holding Entity" TEEC Holdings Limited and any other holding

companies established by or on behalf

of the Company from time to time to acquire

and/or hold one or more Investee Companies

------------------------------------------------

"Investment Manager" Triple Point Investment Management LLP

------------------------------------------------

"Investee Company" a company or special purpose vehicle

which owns and/or operates one or more

Energy Transition Assets into which the

Group makes an equity or debt investment

------------------------------------------------

"Investment Policy" the Company's published investment policy,

from time to time

------------------------------------------------

"Listing Rules" the listing rules made by the FCA under

section 73A of FSMA, as amended from

time to time

------------------------------------------------

"London Stock Exchange" London Stock Exchange plc

------------------------------------------------

"Main Market" the London Stock Exchange's main market

for listed securities

------------------------------------------------

"Ordinary Shares" ordinary shares of GBP0.01 each in the

capital of the Company and " Ordinary

Share " shall be construed accordingly

------------------------------------------------

"SFS Admission" the admission of the Ordinary Shares

to trading on the Specialist Fund Segment

of the Main Market of the London Stock

Exchange on 19 October 2020 following

the Company's initial public offer

------------------------------------------------

"Shareholder" the holder of Ordinary Shares

------------------------------------------------

"Sterling" or "GBP" the lawful currency of the United Kingdom

or "GBP" or "pence"

------------------------------------------------

"United Kingdom" or the United Kingdom of Great Britain and

"UK" Northern Ireland

------------------------------------------------

"Wider Group" together the Group and the Investee Companies

------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFELFDLEESELS

(END) Dow Jones Newswires

October 24, 2022 10:00 ET (14:00 GMT)

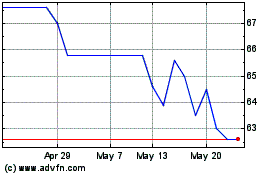

Triple Point Energy Tran... (LSE:TENT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Triple Point Energy Tran... (LSE:TENT)

Historical Stock Chart

From Jan 2024 to Jan 2025