TIDMTENT

RNS Number : 3471I

Triple Point Energy Transition PLC

02 December 2022

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION FOR THE PURPOSES OF THE UK VERSION OF THE MARKET ABUSE

REGULATION (EU) NO. 596/2014.

2 December 2022

Triple Point Energy Transition plc

("TENT" or the "Company" or, together with its subsidiaries, the

"Group")

RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2022

The Board of Triple Point Energy Transition plc (ticker: TENT)

is pleased to announce its unaudited results for the six months

ended 30 September 2022.

30 September

2022 31 March 2022 30 September 2021

------------------------------------------- ------------- -------------- ------------------

Net Asset Value ("NAV") GBP100.3m GBP96.1m GBP94.5m

NAV per share 100.26 pence 96.12 pence 94.50 pence

V alu e of the portfolio GBP84.1m GBP78.8m GBP28.5m

Ongoing charges ratio (annualised) (1) 1.89% 1.38% 1.16%

Dividend declared per s hare 2.75 pence 5.50 pence 2.75 pence

Capital committed awaiting deployment (1) GBP44.9m GBP44.9m -

Fully invested portfolio valuation

(including commitments at cost) (1) GBP129.0m GBP123.6m GBP28.5m

(1) Alternative performance measures

Highlights

-- Dividends paid, in the six months ended 30 September 2022,

substantially covered, at 0.98x, by cash flows generated from the

portfolio, net of cash expenses and cash finance costs of the Group

.

-- The Company has declared an interim dividend for the period

from 1 July to 30 September 2022 of 1.375 pence per Ordinary Share,

payable on or around 6 January 2023 to holders of Ordinary Shares

on the register on 16 December 2022.

-- Total NAV return of 7.2% for the six months ended 30

September 2022 (31 March 2022: 4.9%, 30 September 2021: 0.4 %

).

-- Weighted average project life remaining of 31.3 years,

underpinned by strong contractual cashflows.

-- Discount rate in respect of Hydroelectric Portfolio increased by 50bps.

-- No impact expected from Electricity Generator Levy based on

information published to date.

-- Robust portfolio performance despite volatile markets.

-- Further portfolio diversification via an additional

investment in efficient lighting, completed post the period end

.

-- On 25 August 2022, shareholders approved an amended

Investment Policy and associated change to the Company's name,

which provides a broader mandate of "energy transition" reflecting

better the nature of the current portfolio of investments and

offering a greater number of opportunities for investment.

-- Following the period end, on 28 October 2022, the Company's

shares transferred to trading on the Premium Segment of the Main

Market of the LSE and were admitted to the premium listing segment

of the Official List of the Financial Conduct Authority.

John Robert s, the Company's Chair, commented:

" We are pleased to announce strong results for the six months

ended 30 September 2022, which have been delivered during a period

of extreme geo-politcal and economic volatility. The results

reflect the strength and defensive nature of the portfolio, which

has been constructed to faciliate the energy transition and help

corporates to reduce their energy costs. "

For further information, please contact:

Triple Point Investment Management LLP

Jonathan Hick

Ben Beaton +44 (0) 20 7201 8989

J.P. Morgan Cazenove (Corporate Broker)

William Simmonds / Jérémie Birnbaum

(Corporate Finance)

James Bouverat / Liam MacDonald-Raggett

(Sales) +44 (0) 20 7742 4000

Akur Limited (Financial Adviser)

Tom Frost

Anthony Richardson

Siobhan Sergeant +44 (0) 20 7493 3631

Sapience Communications (PR Adviser)

Richard Morgan Evans +44 (0) 20 3195 3240

Jamie Gittings +44 (0) 73 0850 9608

LEI: 213800UDP142E67X9X28

Further information on the Company can be found on its website:

http://www.tpenergytransition.com/

NOTES:

The Company is an investment trust which aims to invest in

assets that support the transition to a lower carbon, more

efficient energy system and help the UK achieve Net Zero.

Since its IPO in October 2020, the Company has made the

following investments and commitments:

-- Harvest and Glasshouse : provision of GBP21m of senior debt

finance to two established combined heat and power ("CHP") assets,

located on the Isle of Wight, supplying heat, electricity and

carbon dioxide to the UK's largest tomato grower, APS Salads

("APS") - March 2021

-- Spark Steam : provision of GBP8m of senior debt finance to an

established CHP asset in Teesside supplying APS, as well as a

further power purchase agreement through a private wire arrangement

with another food manufacturer - June 2021

-- Hydroelectric Portfolio (1) : acquisition of six operational,

Feed in Tariff ("FiT") accredited, "run of the river" hydroelectric

power projects in Scotland, with total installed capacity of 4.1MW,

for an aggregate consideration of GBP26.6m (excluding costs) -

November 2021

-- Hydroelectric Portfolio (2) : acquisition of a further three

operational, FiT accredited, "run of the river" hydroelectric power

projects in Scotland, with total installed capacity of 2.5MW, for

an aggregate consideration of GBP19.6m (excluding costs) - December

2021

-- BESS Portfolio : commitment to provide a debt facility of

GBP45.6m to a subsidiary of Virmati Energy Ltd (trading as

"Field"), for the purposes of building a portfolio of four

geographically diverse Battery Energy Storage System ("BESS")

assets in the UK with a total capacity of 110MW - March 2022

-- Energy Efficient Lighting (1): Funding of c.GBP1m to a

lighting solutions provider to install efficient lighting and

controls at a leading logistics company - September 2022.

-- Energy Efficient Lighting (2): Commitment of c.GBP1m to a

lighting solutions provider to install efficient lighting and

controls at a leading logistics company, of which GBP0.3m invested

to date - November 2022.

The Investment Manager is Triple Point Investment Management LLP

("Triple Point") which is authorised and regulated by the Financial

Conduct Authority. Triple Point manages private, institutional, and

public capital.

Following its IPO on 19 October 2020, the Company was admitted

on the premium listing segment of the Official List of the

Financial Conduct Authority and was admitted to trading on the

Premium Segment of the Main Market of the London Stock Exchange on

28 October 2022. The Company was also awarded the London Stock

Exchange's Green Economy Mark.

CHAIR'S STATEMENT

Introduction

On behalf of the Board, I am pleased to present the interim

report of the Company covering the period from 1 April 2022 to 30

September 2022.

During the period, following approval by shareholders, the

Company adopted a revised investment policy which broadened its

scope, to cover the wider energy transition sector. The Company

also changed its name to Triple Point Energy Transition plc, from

Triple Point Energy Efficiency Infrastructure Company plc to better

reflect the nature of our existing portfolio and the revised

investment policy.

Investment Activity

During the period, the Company made an investment of over GBP1

million into accounts receivable financing, purchasing the rights

to future receivable payments from a lighting service provider. The

transaction funded the installation of Light Emitting Diodes

("LEDs") at a warehouse operated by one of the UK's leading

logistics businesses.

At a time when many businesses are seeing significant increases

in their energy bills, providing solutions that reduce energy costs

and accelerate the transition to Net Zero are actions the Company

is keen to accelerate.

This investment furthers the Company's diversification in the

sources of income and types of technology.

Financial Results

The six months ended 30 September 2022 saw a high level of

market volatility, manifesting at the end of the period in sharp

rises in gilt and bond yields, high levels of inflation and growing

concern around the depth and length of a recession. This has been

reflected in bond markets through inverted yield curves and in

equity markets through share price falls.

Despite the deterioration in the macroeconomic environment, the

strong contractual and defensive nature of the Company's investment

portfolio has facilitated a strong financial performance over the

period.

We are delighted to have returned a NAV per share of 100.26

pence for the period ended 30 September 2022 (31 March 2022: 9 6.12

pence). This combined with the 2.75 pence per share dividends paid

has delivered a total NAV return of 7.2% over the six months.

An improved outlook for power forecasts, by independent market

advisors, along with the higher inflation expectations, from the

Office for Budget Responsibility, underpinned a GBP4.8 million

increase in the valuation of the portfolio. This has negated the

impact of higher discount rates, which in the energy sector

generally have started to increase following many years of

compression.

Profit before tax was GBP6.9 million (30 September 2021: GBP0.4

million), with earnings per share of 6.88 pence (30 September 2021:

0.004 pence). Revaluation of the Company's wholly owned subsidiary

contributed GBP5.0m to the profit before tax, with the balance

being represented by earnings from the Hydroelectric and CHP

Portfolios, offset by expenses incurred at Company level.

The operating expenses for the six months ended 30 September

2022 amounted to GBP0.9 million (31 September 2021: GBP0.6m). The

Company's ongoing charges ratio ("OCR") is 1.89% (30 September

2021: 1.16%). In accordance with the Investment Management

Agreement, following deployment of more than 75% of IPO proceeds,

the management fee is now charged on full NAV. This has been the

lead driver of the increase in the OCR versus the corresponding six

months ended 30 September 2021, where it was charged in reference

to deployed funds as the 75% threshold was not met until December

2021.

Distributions

Cash dividend cover, represented by cash income from the

portfolio, net of Company and subsidiary expenses and finance

costs, increased significantly to 0.98x in the six months ended 30

September 2022. This was facilitated by the maiden dividend

distribution received from the Hydroelectric Portfolio and a full

contribution, over the period, from investments completed in the

year ended 31 March 2022.

As stated previously , the Board is targeting total dividends of

5.50 pence per share (2) for the year ending 31 March 202 3. We

remain focused on our ambition that our dividend should be covered

by cash earnings as soon as practicable, and to that end, note that

this financial year will not only benefit from a full year of

earnings from the Hydroelectric and CHP Portfolios, but will also

benefit from income from the BESS Portfolio as the investment

commitment is deployed.

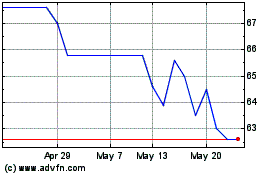

Whilst the Company's share price has fallen along with other

energy investment trusts following recent market turbulence, the

substantially covered dividend, when considered along side the

growth in NAV over the period, show s the strong underlying

fundamentals of the Company in the current operating environment.

The Board continue s to closely monitor the Company's share price

discount to NAV and will keep under consideration the best

interests of shareholders.

Notes:

(2) The dividend and return targets stated are Pound Sterling

denominated returns targets only and not a profit forecast. There

can be no assurance that these targets will be met, and they should

not be taken as an indication of the Company's expected future

results.

Environmental, Social and Governance ("ESG")

The emphasis on energy transition is reflected in the

sustainability and ESG approach adopted by the Investment Manager.

Our focus remains on ensuring that the Investment Manager continues

to integrate climate change into its investment decision making.

Taking into account the risks and opportunities associated with

climate change is important for protecting our assets and

maximising their potential. The details of the Investment Manager's

approach to ESG integration, including climate analysis and

disclosures in line with Task Force on Climate related Financial

Disclosure ("TCFD") will be reported in the annual report for the

year ending 31 March 2023.

Post Balance Sheet

On 28 October 2022, the Company was admitted to the premium

listing segment of the Official List of the Financial Conduct

Authority and migrated to trading on the Premium Segment of the

Main Market of the London Stock Exchange. This will enable the

Company to attract capital from a wider range of investors, such as

retail investors. In addition, admission to the Premium Listing

Segment is a key criterion to facilitate the Company's inclusion in

the FTSE indices. A small number of minor amendments to the

investment policy were approved by the Board following discussions

with the FCA regarding the migration. The investment policy can be

found on the Company' website:

https://www.tpenergytransition.com/investors/72/

In November 2022, the Company also committed to further

follow-on investments of, c.GBP1 million into accounts receivable

financing, purchasing the rights to future receivable payments from

a lighting service provider. As at the date of this report GBP0.3m

of that commitment has been deployed. The investments will enable

the installation of LEDs at additional logistics warehouses, with

the same counterparties as the previous efficient lighting

transaction.

GBP5.5m of the BESS Portfolio facility commitment was deployed

following the commissioning of the first energy storage asset in

mid-November 2022.

Outlook

Significant economic volatility, centered around energy markets

caused by the ongoing conflict in Ukraine has manifested itself in

both higher wholesale energy prices in the UK and much of Europe,

as well higher rates of inflation across the wider economy.

Market forecasters expect inflation and energy prices to remain

elevated over the coming 12-24 months, which provides an attractive

operating environment given the nature of its underlying revenues.

These two factors have driven much of the increase in the forecast

cashflows for the Group and accordingly the NAV uplift, as outlined

above and covered in further detail in the Investment Manager's

report. Given the forecast contraction in UK Gross Domestic Product

over the coming 6-12 months, the attractiveness of energy

infrastructure assets, where returns are typically not correlated

to the wider economy and benefit from rising inflation, presents an

attractive area of opportunity for investors.

This also facilitates attractive pipeline opportunities across a

range of areas in the Company's target sectors, due to two factors.

Firstly, the expected returns that can be achieved by generation

and storage assets have increased, making more projects

commercially viable. Secondly, higher energy prices are encouraging

companies to reduce their energy costs through behind the meter

solutions such as on-site solar and LED lighting to reduce

demand.

Driven by these tailwinds, the Company has a pipeline of

opportunities totalling GBP634m, with assets across a diverse range

of transition technologies including solar, CHP, LED lighting,

BESS, hydrogen electrolysers, electric vehicle charging, biomass

and heat pumps.

The Review of Electricity Market Arrangements ("REMA")

consultation that was launched during the period is the largest

review of the electricity market for some decades, as it seeks to

review in particular the way that electricity prices are set and

over what geographic regions. Whilst the consultation has only

recently closed, it would be reasonable to assume there will be a

range of impacts on energy infrastructure, which further supports

the rationale for the Company's strategy of owning and operating a

diverse range of assets. The Company will continue to monitor the

outcomes of the consultation closely.

The Company is reviewing the recently announced Electricity

Generator Levy and awaits further detailed drafting of the relevant

legislation in due course. Based on the information announced to

date, the Company does not expect to be impacted by this levy.

John Roberts

Chai r

1 December 2022

INVESTMENT MANAGER'S REPORT

Portfolio Performance

As at 30 September 2022, the Company had committed capital into

17 different assets spread across combined heat and power,

hydroelectric power, battery energy storage and LED lighting.

Combined Heat and Power:

The investee companies have benefited from attractive trading

conditions during the period, driven by the higher-than-expected

prices seen on the wholesale electricity markets. The income stream

from power trading is currently exceeding the revenues derived from

the behind the meter contracts through the heat and power supply to

the co-located glasshouses. The latest available projections from

the investee companies, based on third party power market research

forecasts, indicate continued attractive trading conditions over

the projection period.

Hydroelectric:

The nine run of the river schemes forming the Hydroelectric

Portfolio have generated a combined power output of 4,893 MWh of

green electricity during the six month period to 30 September

2022.

During the period, the Investment Manager has been working with

the long-standing partner operating the Hydroelectric Portfolio to

renegotiate the operation and maintenance (O&M) contracts. The

renegotiated contracts include more monitoring and reporting on

agreed KPIs.

In parallel, the Investment manager has restarted the

development of an optimisation project at the Loch Blair

hydroelectric scheme. If consented, the construction of a small dam

upstream of the plant intake will increase the generation from the

newly created attenuation capacity.

BESS:

The development and construction of the Battery Energy Storage

System Portfolio has continued during the period. The first asset

reached Commercial Operations Date ("COD") in mid-November 2022,

following sign off by the BESS operator and the independent

technical advisor. This will enable the asset to benefit from the

expected volatility in power markets over the upcoming winter

period. The Investment Manager has been actively working with

Field, the developer and sponsor, on the remaining three assets

which are expected to be commissioned in H2 FY24.

LED:

During the period, the Company's lighting service partner

completed the installation of LED lighting at a logistics

warehouse, totalling c.GBP1m and in September the Company received

the first monthly payment, with income contracted over the next

five years. Since 30 September 2022, further funding commitments to

the lighting specialist to enable the installation of LEDs at

additional warehouses with the same counterparty have been made,

with GBP0.3m drawn down in the post balance sheet period against

these commitments and a further c.GBP0.8m expected in respect of

further installations by the end of the financial year.

Pipeline

The Company invests across the energy infrastructure system,

from supply to demand.

The three target segments for the Company are:

-- Low Carbon Generation- as the UK moves to a lower carbon,

decentralised, energy system as part of the transition to Net Zero.

This will involve investing in renewable energy assets, rather than

centralised fossil fuel generation.

-- Transmission and Storage- the energy from renewables needs to

be available to consumers when required, not based on the

availability of wind, water and solar resources. Balancing the

supply and demand for energy is vital in enabling the transition to

Net Zero, for example through BESS.

-- Onsite supply and demand reduction - reducing demand through

"Behind the Meter" investments are an important factor in the

transition to Net Zero, particularly at a time of higher energy

prices. Technologies like solar PV enable business and consumers to

generate their energy requirement on site, giving additional

security of supply and lower cost energy. Technologies such as LED

lighting enable customers to reduce the amount of energy

consumed.

By investing across the energy infrastructure system, the

Company enables its shareholders to benefit from a broad range of

different risk and return profiles, as well as diversifying its

exposure away from any one single technology or part of the power

system. Accordingly, the Company has a pipeline of opportunities

totalling GBP634m, with assets across a diverse range of transition

technologies as demonstrated in the chart below.

Gearing

As at 30 September 2022, the Company had not drawn on the GBP40m

Revolving Credit Facility ("RCF") that it secured in March 2022 at

a fixed all-in drawn interest rate of 4.5% (excluding drawn

monitoring fee of 0.25%). The RCF is expected to be largely drawn

to fund BESS Portfolio commitments during FY24 as well as other

future investments.

The RCF matures in March 2024 and the Company has been in

discussions with the lender in relation to the extension of the

facility. These discussions are expected to successfully conclude

prior to 31 March 2023, with the lender having expressed appetite

to extend. Given the rising interest rate environment, it is

anticipated that the interest rate on the extension would increase

when compared to the current borrowing rate. Based on current

benchmark rates as at the date of this report, this is not forecast

to alter the Company's ability to pay a covered dividend.

As at 30 September 2022, the undrawn RCF and group cash balances

totalled GBP55.6m with remaining investment commitments of

GBP44.9m.

Portfolio Valuation

The Investment Manager is responsible for carrying out the fair

market valuation of the Group's investments. The Company engages

Mazars as an external, independent, and qualified valuer to assess

the validity of the discount rates used by the Investment Manager

in the determination of fair value. Portfolio valuations are

carried out on a semi-annual basis on 31 March and 30 September

each year.

For non-market traded investments (being all the investments in

the current portfolio), the valuation is based on a discounted cash

flow methodology and adjusted in accordance with the International

Private Equity Valuation Guidelines, where appropriate, to comply

with IFRS 13 and IFRS 10, given the special nature of portfolio

investments.

The valuation for each investment in the portfolio is derived

from the application of an appropriate discount rate to reflect the

perceived risk to the investment's future cash flows to give the

present value of those cash flows. The Investment Manager exercises

its judgement in assessing the expected future cash flows from each

investment based on its expected life and the financial model

produced by each project entity. In determining the appropriate

discount rate to apply to a given investment the Investment Manager

considers the relative risks associated with the revenues.

While Gilt yields rose sharply at the end of September 2022, in

part, as a market reaction to the UK Government's mini budget of 23

September 2022, transaction discount rates, at 30 September 2022,

did not reflect a similar increase. Accordingly, we have seen a

smaller incremental change in discount rates relative to the change

in the risk-free rate. The Company's choice of discount rates also

reflects the approach taken to both power price and inflation

forecasting.

For the six months ended 30 September 2022, the discount rates

range from 5.50% to 8.25% (31 March 2022: 5.0% to 8.25%) and the

weighted average portfolio discount rate is 6.41% (31 March 2022:

6.11%). This increase was driven by 50 bps increase in the discount

rate used in the Hydroelectric Portfolio. If the BESS Portfolio had

been fully drawn at 30 September 2022, the weighted average

portfolio discount rate would have been c.7%.

The valuation of the portfolio by the Investment Manager and

reviewed and supported by the Directors as at 30 September 2022 was

GBP84.1 million (31 March 2022: GBP78.8 million).

Valuation movements

The CHP Portfolio has been held at par. The underlying risk

-free rate has increased but conversely there has been a reduction

in the in the risk premium attached to the borrowers. The CHP

Portfolio performed strongly in the six months ended 30 September

2022, contributing to improved debt service cover ratios, beyond

those anticipated at financial close, thereby supporting a par

valuation. The latest forecasts prepared for the Company, by the

borrower, also project an improved operating environment going

forward, based on independent market forecasts for such assets. The

CHP assets are in line with other similar energy assets over the

same period and has led to a significant increase in the cash

reserves of the borrowers, given the restrictions on distribution

to shareholders under the terms of our debt.

The initial deployment into the BESS Portfolio continues to be

valued at par as the initial drawdown took place on financial close

in March 2022, with fair value being equal to the upfront costs

incurred on the transaction.

The valuation of the energy efficient lighting portfolio has

seen a write down of GBP0.1m due to an increase in the discount

rate applied. The increase has been made in reference to recent

comparable transactional activity, at the valuation date, being

higher than the effective interest rate.

As a result of the majority of the debt investments being valued

at or around par, the fair value movements for the six months ended

30 September 2022 are principally attributable to the equity

investment into the Hydroelectric Portfolio. A breakdown of the

movement in the Directors' valuation is detailed and explained

below.

Valuation Movement in the six months ended 30 September 2022

The opening valuation as at 31 March 2022 was GBP78.8 million.

Allowing for cash movements relating to investments completed in

the six months ended 30 September 2022 (comprising a lighting as a

service debt investment into energy efficient lighting of GBP1.1

million and GBP0.6 million of principal repayments from the CHP

Portfolio), the rebased valuation as at 30 September 2022 was

GBP79.3 million.

Each movement between the rebased valuation of GBP79.3 million

and the 30 September 2022 valuation of GBP84.1 million is

considered, in turn, below:

Inflation

The ongoing crisis in Ukraine, in addition to the multiple

primary impacts felt in Ukraine itself, has driven an increase in

energy and commodity prices. This, along with supply chain

bottlenecks has continued to place significant upward pressure on

inflation.

Given the quantum of the increase, consensus amongst the

forecasters and broad increases across prices in multiple sectors,

portfolio inflation assumptions have been updated. The methodology

adopted in relation to inflation, for both RPI and CPI, follows the

latest available (November 2022) Office for Budget Responsibility

forecast for the 12 months from the 30 September 2022 valuation

date. Thereafter, a long term 3.00% assumption is made in relation

to RPI, dropping to 2.40% in 2031 to reflect the 0.60% reduction as

RPI is phased out and replaced with CPIH.

Our long-term assumption for CPI remains at 2.25% and stays flat

thereafter. We also model a power curve indexation assumption, as

wholesale power prices are not intrinsically linked to consumers'

prices, of 3.00% staying flat thereafter . The updated inflation

assumptions have been accretive to the valuation of the

Hydroelectric Portfolio by GBP4.1 million.

Power Prices

The valuation as at 30 September 2022 applies long-term, forward

looking power prices from a leading third -party consultant. A

blend of the last two quarters' central case forecasts is taken and

applied. Where fixed price arrangements are in place, the financial

model reflects this price for the relevant time and subsequently

reverts to the power price forecast using the methodology

described. The updated power price forecast has been accretive to

the valuation of the Hydroelectric Portfolio by GBP2.7 million.

Discount Rates

The GBP2.4m reduction in the valuation of the portfolio,

attributable to movement in discount rates, has been principally

due to the Hydroelectric Portfolio. As at 30 September 2022 a

discount rate of 5.50% has been applied to the Hydroelectric

Portfolio (31 March 2022: 5.00%), and a discount rate of 6.50% in

respect of the optimisation at the Loch Blair scheme, which is

subject to further planning consents. The increase in the discount

rate has been driven by a combination of a review of discount rates

on recently completed comparable transactions and proprietary

information derived from participation in market transactions and

the elevated regulatory / policy risk.

Balance of Portfolio Return

This refers to the balance of valuation movements in the six

months ended 30 September 2022 (excluding the above) which has been

accretive to valuations of GBP0.4 million. The balance of portfolio

return is calculated as the expected return, reflecting the net

present value of future cashflows brought forward to the valuation

date at the prevailing discount rate.

The main driver of the portfolio return has been a combination

of the unwinding of the discount rate as it is brought forward to

30 September 2022, along with updated cost forecasts reflecting

agreements entered, in relation to the Hydroelectric Portfolio

during the six-month period.

Investment Commitment

As at 30 September 2022, the Company had outstanding investment

commitments , in relation to the BESS Portfolio which has a total

capacity of 110 MW.

BESS asset Battery hour Location Size in MW Operational

duration date

1(st) BESS One hour North of England 20 MW November 2022

asset

------------- ----------------- ----------- --------------

2(nd) BESS Two hours Scotland 50 MW H2 FY24

asset

------------- ----------------- ----------- --------------

3(rd) BESS Two hours Wales 20 MW H2 FY24

asset

------------- ----------------- ----------- --------------

4(th) BESS One hour South-East 20 MW H2 FY24 .

asset England

------------- ----------------- ----------- --------------

Please refer to Note 11 for further information

Fully Invested Portfolio Valuation

The valuation of the portfolio on a fully invested basis can be

derived by adding the valuation at 31 March 2022 and the expected

outstanding commitments are as follows:

GBP'000

---------------------------------------- -------

Portfolio valuation as at 30 September

2022 84,140

Future investment commitments at cost 44,941

Portfolio valuation once fully invested 129,081

------------------------------------------ -------

Key Sensitivities

The following chart illustrates the sensitivity of the Company's

NAV per share to changes in key input assumptions (with labels

indicating the impact on the NAV in pence per share).

For each of the sensitivities, it is assumed that potential

changes occur independently of each other with no effect on any

other base case assumption, and that the number of investments in

the portfolio remains static throughout the modelled life.

Financial Review

The Company applies IFRS 10 and qualifies as an investment

entity. IFRS 10 requires that investment entities measure

investments, including subsidiaries that are themselves investment

entities, at fair value except for subsidiaries that provide

investment services which are required to be consolidated.

The Company's single, direct subsidiary, TEEC Holdings, is the

ultimate holding company for all the Company's investments.

It is, itself, an investment entity and is therefore measured at

fair value.

NAV

The Company's NAV as well as the valuation of the investment

portfolio are calculated semi-annually on 31 March and 30 September

each year. Valuations are provided by the Investment Manager and

are subject to review by Mazars with the other assets and

liabilities of the Company calculated by the Administrator.

The NAV is reviewed and approved by the Board. All variables

relating to the performance of the underlying assets are reviewed

and incorporated in the process of identifying relevant drivers of

the discounted cash flow valuation.

NAV Bridge for the six months ended 30 September 2022

The movement in NAV was driven by the following factors:

Investment income of GBP2.8 million comprising GBP1.6 million of

interest income to TENT, via TEEC Holdings, from the interest on

the CHP Portfolio and the shareholder loans to the Hydroelectric

Portfolio together with a GBP1.1 million of dividend received, via

TEEC Holdings, from distributions originating from the

Hydroelectric Portfolio. Fund expenses of GBP0.9 million and

dividends paid in the period of GBP2.8 million. The revaluation of

the portfolio, via TEEC Holdings, contributed a further GBP5.0m to

NAV. The aggregated impact of the investment income earned, company

expenses, dividends paid and revaluation of the portfolio led to a

4.3% increase in NAV from GBP96.1 million to GBP100.3 million.

Operating Results

Profit before tax was GBP6.9 million (30 September 2021: GBP0.4

million), with earnings per share of 6.88 pence (30 September 2021:

0.004 pence). Revaluation of the Company's wholly owned subsidiary

contributed GBP5.0m to the Profit before tax, with the remainder

being represented by earnings from Hydroelectric and CHP Portfolios

offset by expenses incurred at Company level. The earnings from the

BESS Portfolio, which predominantly comprised non utilisation fees

on the commitments awaiting deployment, and Energy Efficient

Lighting Portfolio were recognized in their entirety at the

Company's subsidiary, TEEC Holdings Limited, level together with

subsidiary entity level expenses and finance costs. The portfolio

earnings and expenses at subsidiary level are reflected within the

GBP5.0 million revaluation.

Operating Expense and Ongoing Charges

The operating expenses for the six months ended 30 September

2022 amounted to GBP0.9 million (30 September 2021: GBP0.6m). The

Company's ongoing charges ratio ("OCR") for the period is 1.89% (30

September 2021: 1.16%). Management fees are now charged on full

NAV. This has been the predominate driver of the increase in the

OCR, versus the corresponding six months ended 30 September 2021,

during which the management fee was charged in reference to

deployed funds in accordance with the Investment Management

Agreement until deployment of IPO proceeds exceeded 75% (from

December 2021) .

Cash Dividend Cover(1)

The Company measures dividend cover on a look through basis to

include the income and operating expenses of TEEC Holdings, which

is its wholly owned subsidiary. Summarised below are the cash

income, cash expenses and finance costs incurred by the Company and

TEEC Holdings in the six months ended 30 September 2022. The

cashflow statement for the Company alone does not capture the total

income and expenses of the Group as the interest income, financing

costs and further expenses are received and paid for by TEEC

Holdings.

Six months ended

30 September 2022

Operating Cash Income Received from Investments GBP'000

CHP Portfolio - Loan Interest 1,570

Hydroelectric Portfolio - Dividend 1,148

Hydroelectric Portfolio - Loan Interest (Holdco) 613

BESS Portfolio - Non utilisation fees and drawn

interest (Holdco) 637

Energy Efficient Lighting Portfolio - Lighting

as a service (Holdco) 11

(A) Total Investment Cash 3,979

-------------------

Operating Cash Expenses and Finance Costs

Company expenses - cash paid (915)

Subsidiary expenses - cash paid (Holdco) (169)

RCF Non utilisation fees - cash paid* (Holdco) (203)

(B) Total Expenses and Finance Costs Cash (1,287)

-------------------

(C) (A - B) Net Cash 2,692

-----

(D) Dividends Paid (2,750)

-------

(E) (C / - D) Cash Dividend Cover 0.98x

-----

(1) Alternative performance measure

*One off RCF arrangement fee cash paid in the six months ended

30 September 2022 of GBP454k excluded.

The Company's dividends paid in the six months ended 30

September 2022 of GBP2.8 million (2.750 pence per share) have been

predominately covered by cash flows generated from the portfolio

net of expenses and finance costs at company and subsidiary

level.

The Company remains focused on dividend cover being in excess of

1.0x and note the Company, via its subsidiary, will benefit from

additional operating cash contribution from further deployment of

the GBP44.9 million commitments into the BESS Portfolio.

Sustainability and the approach to Environmental, Social and

Governance

Triple Point as Investment Manager remains committed to best

practice in responsible investment.

Sustainability Disclosures

A disclosure for the Company in line with the European Union's

Sustainable Financial Disclosure Regulation ("SFDR") requirements

for Article 6 and Article 8, is publicly available on our website

https://www.tpenergytransition.com/. The Company keeps under review

the Articles against which it discloses.

TENT publishes an annual Task Force on Climate-related Financial

Disclosure (TCFD) report. The next disclosure will appear within

the Company's annual report for the year ending 31 March 2023.

Although not presently required to publish these disclosures, we

believe it is important to provide transparency on our

sustainability approach wherever possible.

TENT's approach and alignment to sustainable practices

The Investment Manager continues to review and evolve TENT's

sustainability approach, reflecting the Investment Manager's belief

that the process contributes value to the strategy and presents an

opportunity to differentiate.

As the Company moves forward with its new name, there is a

renewed focus on demonstrating alignment and success in

contributing to the energy transition system. TENT will explicitly

track asset selection against the UK Climate Change Committee

("CCC") 6th carbon budget balanced pathway.

Asset type* TENT universe alignment UK CCC balanced pathway

alignment

CHP Portfolio Onsite energy generation Use of surplus electricity

& efficient consumption

------------------------------ ----------------------------

Hydroelectric Distributed energy generation Low carbon & decentralised

Portfolio

------------------------------ ----------------------------

BESS Portfolio Energy storage & distribution A more flexible electricity

system

------------------------------ ----------------------------

Lighting solutions Onsite energy generation Decarbonise industry

& efficient consumption

------------------------------ ----------------------------

* Based on current portfolio asset exposure

The Company's contribution to this energy transition view will

be demonstrated using lifetime tCO(2) e avoided (to be reported in

the annual report). Transition contribution will include embodied

(for assets constructed under the Investment Manager's exposure)

and Scope 3 carbon and this data will be estimated where it cannot

yet be acquired and accounted for according to current Partnership

for Carbon Accounting Financials ("PCAF") standards, or equivalent

best practice if appropriate. On-going consideration of technology

phase-out timelines will also be reflected in decision making and

deal structure, to ensure no more than marginal exposure to

technologies after any known phase out dates. As the Investment

Manager identifies opportunities in Europe, the team will apply

equivalent appropriate carbon budgets and phase out pathways.

Assessment of each investment for operational quality through

additional ESG analysis and asset optimisation

Alongside ascertaining the energy transition alignment and scale

for each investment, the wider operational ESG risks and

opportunities associated with each asset are assessed using a

combination of in-house expertise and materiality-based

sustainability frameworks. Where weaker behaviours may be

identified, these results will feed into asset optimisation

activity, where the Investment Manager will look to use its

investor influence to improve behaviours and outcomes (for example

improving the avoided carbon, improving health & safety

approaches and outcomes, improving community relations, identifying

opportunities to benefit a just transition). Strong portfolio asset

management is also expected to further increase the quality of the

data available to evidence the outcomes of the assets in relation

to the energy efficiency and transition theme and engagement work.

Outcomes will continue to be reported as tCO2e avoided and an

aggregated lifetime tCO(2) e avoided, in addition to asset specific

outcomes including annual reporting of asset alignment to the

Sustainable Development Goals.

Climate analysis

Our ESG analysis also includes climate analysis. Possible

impacts of climate change on the investments are considered through

scenario analysis in order to quantify the possible physical and

financial impacts on an asset and establish a sensible path of

mitigation.

The Investment Manager continues to develop and improve its

approach to climate analysis, with a current focus on the

development of transitional and physical risk registers and

application of scenario analysis using dedicated tools. The annual

TCFD report will contain details of the refined approach.

Sustainability transparency commitment

In summary, the Investment Manager remains committed to a strong

approach to information sharing and oversight for sustainability

across Triple Point and for TENT, as outlined in the disclosures

committed to and the processes described. The Investment Manager

will continue to review alignment to existing regulation and

emergence of new regulation and endeavours to respond in a timely

and appropriate way to all changes.

The Company will also share asset specific performance data

which demonstrates alignment to the carbon transition pathway and

contribution the Investment Manager has had in improving

sustainability performance.

All related data and reporting will be provided annually.

Market Review

European energy markets have been going through a very volatile

period. The ongoing conflict in Ukraine and the knock-on impact to

the restriction of the supply of gas from Russia to Europe have

pushed gas prices to unprecedented levels. This has further

impacted inflation, which central banks are fighting through

raising interest rates. Financial markets have been in turmoil.

The UK Government announced in October 2022 a new Energy Prices

Bill to help households, businesses and others with energy costs.

The Bill puts into law the support measures that have been

announced over the last few months, including the Energy Price

Guarantee for domestic consumers and the Energy Bill Relief Scheme

for businesses and non-domestic properties. The Bill includes

powers to stop volatile and high gas prices setting the cost of

electricity produced by much cheaper renewables. A new

Cost-Plus-Revenue Limit in England and Wales, if enacted would

ensure consumers are not paying significantly more for electricity

generated from renewables and nuclear and it will reduce the impact

of the unprecedented wholesale prices on consumers.

However, on 17 November 2022 the UK Government elected to not

avail itself of the provisions of the Energy Prices Bill but

instead announced an Electricity Generator Levy on nuclear,

renewables and biomass generation . The levy will apply to what the

government believes to be exceptional generation receipts over

GBP75 per MWh, albeit mitigated by an allowance, from 2023-2028.

Such exceptional income would be taxed at a rate of 45%. The

Company has considered the announcement and considers this not to

impact its tax liabilities based on its projections, and it notes

that the levy only applies to groups generating more than 100 GWh,

which is in excess of the Hydroelectric Portfolio annual

generation.

The UK Government is currently digesting the feedback from the

consultation that took place between July and October 2022 on the

Review of Electricity Market Arrangements to identify reforms

needed to transition to a decarbonised, cost effective and secure

electricity system. There are a range of options being considered

to deliver an enduring electricity market framework that will work

for businesses, industry and households. A move toward different

forms of geographic pricing - either regional or nodal - has been

put forward by the Electricity System Operator ("ESO"), National

Grid, and others as a way to accelerate progress towards Net Zero.

We consider that this would create both winners and losers and

highlights the importance of a diversified portfolio of

technologies spread across different parts of the UK. Other

potential outcomes could be changes to Short Run Marginal Cost

pricing, where gas generators no longer set the price for the whole

generation fleet. It is expected that many of the complex reforms

envisaged by REMA will take some years to progress and fully

implement.

Finally, we are starting to see energy security concerns play a

meaningful role in energy procurement, with a rise in our pipeline

segment that focuses on on-site solutions, such as rooftop solar

and battery storage located behind the meter. Given that some

scenario forecasts by the ESO envisage temporary rota load shedding

(blackouts) in January 2023, businesses are seeking to ensure they

are less reliant on energy from the grid. This is in addition to

the more obvious benefits of significantly cheaper and greener

energy from such projects.

We remain confident in the long-term attractiveness of the

energy transition sector, with Net Zero transition commitments

enshrined in law in the UK, and believe TENT is well placed to take

advantage of the opportunities that those commitments

necessitate.

Outlook

The positive outlook for the Company is driven by three primary

factors:

-- Energy prices are forecast, by independent market

forecasters, to remain at elevated levels over the medium term. For

the existing portfolio, this offers the prospect of higher than

budgeted returns. In respect of the Company's pipeline this offers

particular opportunities in respect of the onsite generation and

energy efficiency segment as businesses and consumers look to

reduce their energy consumption and bills.

-- Inflation is also expected to remain high over the next 12-24

months. In the event that inflation turns out to be higher than

forecast in the Company's projections, this would be accretive to

NAV given the component of RPI linked revenues in the Company's

portfolio.

-- The diversified business model of the Company leaves it well

placed in the face of an increasingly uncertain regulatory

environment. This has been evidenced by the recently announced

Electricity Generation Levy which, based on information published

to date, will not impact the Company. We also believe the Company

is well placed in the face of further regulatory changes, such as

those that might arise from REMA. The broader government focus on

energy security and resilience, is also expected to benefit the

Company's pipeline.

Jonathan Hick

TENT Fund Manager

Triple Point Investment Management LLP

1 December 2022

PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties for the Company continue

to be those outlined on pages 67 -73 of the Annual Report for the

year ended 31 March 2022 and the Board expects those to remain

valid for the remainder of

the year. Below provides an update on any changes to the risks in the period.

Ability to raise additional finance (Net impact: Moderate to

High , Likelihood: Moderate)

The impact and likelihood scores for this risk have increased in

the period for two key reasons. The Company's share price is

currently trading below the Net Asset Value, which impacts the

Company's ability to issue shares, and potentially to fully

implement the strategy. In response to the current share price, the

Company continues to issue positive market announcements, to

demonstrate the continued performance of the underlying assets and

the dividend cover. Additionally, a strong pipeline of investment

opportunities has been built, ready for when future capital becomes

available.

The Company's RCF matures in March 2024, which presents a

refinancing risk. The Company has been in discussions with the

lender in relation to the extension of the facility. These

discussions are expected to successfully conclude prior to 31 March

2023, with the lender having expressed appetite to extend. Given

the rising interest rate environment, it is anticipated that the

interest rate on the extension would increase when compared to the

current borrowing rate. Based on current benchmark rates as at the

date of this report, this is not forecast to alter the Company's

ability to pay a covered dividend.

Weather changes impacting renewable energy production levels

(Net Impact: Moderate, Likelihood: Moderate to High)

The increased seasonality of rainfall and river flows in the

Scottish Highlands has the potential to improve or worsen the

production levels in the Hydroelectric Portfolio. The Investment

Manager has a programme of optimisation projects to smooth the

impact of intermittent rainfall e.g. through the use of log

barriers in key locations to expand the pooling storage of water

reserves.

Since the last Annual Report, the following risks have been

removed from the Principal Risks:

Geopolitical changes causing economic disruption

At the last reporting date, the Company considered the potential

disruption to supply chains and energy markets from the invasion of

Ukraine to be a notable risk. As this development has unfolded, the

impact on the Company's portfolio has been limited.

Significant abortive costs in terms of financial cost and

time

The Company does not consider abort costs to be a material risk

given the nature of the assets in its pipeline and the exclusivity

arrangements over pipeline that the Company benefits from.

Emerging risks

The emerging risks identified on page 73 of the Annual Report

for the year ended 31 March 2022, continue to be closely monitored

and below provides an update on how some of the emerging risks have

developed in the period.

Change to energy market regulation and policies

On the 18 July 2022 the Government launched the Review of

Electricity Market Arrangements ("REMA") consultation, which closed

in October of this year. REMA could represent a material change in

the way that energy prices are set, including de-coupling gas

prices from renewables prices, reforming the capacity market and

considering regional or nodal pricing. The Company believes its

diversified portfolio of assets - with different technologies in

different energy market segments, spread across different regions

of the UK - leave it well positioned to withstand regulatory

changes. It will continue to monitor REMA as it develops, which is

expected to be over a number of years, noting the potential impacts

could increase or decrease revenues for different asset

classes.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors confirm that to the best of their knowledge this

condensed set of financial statements which have been prepared in

accordance with IAS 34 as adopted by the UK, give a true and fair

view of the assets, labilities, financial position and profit or

loss of the Company. T he operating and financial review includes a

fair review of the information required by DTR 4.2.7 and DTR 4.2.8

of the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority namely: an indication of

important events that have occurred during the period and their

impact on the condensed financial statements and a description of

the principal risks and uncertainties for the remaining six months

of the financial year; and material related party transactions in

the period as disclosed in Note 11 .

The Directors, all of whom are independent and non-executive,

are:

-- Dr John Roberts (Chair)

-- Rosemary Boot (Senior Independent Director)

-- Sonia McCorquodale

-- Dr Anthony White

Shareholder information is as disclosed on the Triple Point

Energy Transition plc website.

Approval

This Directors' responsibilities statement was approved by the

Board of Directors and signed on its behalf by:

John Roberts

Chair

1 December 2022

INDEPENT REVIEW REPORT TO TRIPLE POINT ENERGY TRANSITION PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2022 which comprises the Interim

Condensed Statement of Comprehensive Income, Interim Condensed

Statement of Financial Position, Interim Condensed Statement of

Changes in Equity, Interim Condensed Statement of Cash Flows and

notes to Interim Financial Statements.

We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of and

has been approved by the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

Company will be prepared in accordance with UK adopted

international accounting standards. The condensed set of financial

statements included in this interim financial report has been

prepared in accordance with UK adopted International Accounting

Standard 34, "Interim Financial Reporting".

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2022 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting its responsibilities in

respect of half-yearly financial reporting in accordance with the

Disclosure Guidance and Transparency Rules of the United Kingdom's

Financial Conduct Authority and for no other purpose. No person is

entitled to rely on this report unless such a person is a person

entitled to rely upon this report by virtue of and for the purpose

of our terms of engagement or has been expressly authorised to do

so by our prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

BDO LLP

Chartered Accountants

London

Date: 1 December 2022

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Interim Condensed Statement of Comprehensive Income

For the six months ended 30 September 2022 (unaudited)

For the six months For the six months

ended ended

30 September 2022 30 September 2021

Unaudited Unaudited

Notes Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 3 2,793 - 2,793 1,019 - 1,019

Profit / (loss) arising

on the revaluation

of investments at

the period end 9 - 5,016 5,016 - (83) (83)

Investment return 2,793 5,016 7,809 1,019 (83) 936

------- ------- ------- --------- -------- ---------

Investment management

fees 4 326 109 435 90 30 120

Other expenses 4 48 2 10 49 2 418 16 434

80 8 119 92 7 508 46 554

Profit/(loss) before 1,98

t axation 5 4,897 6,882 511 (129) 382

------- ------- ------- --------- -------- ---------

Taxation 5 - - - - - -

Profit/(loss) after 1,98

taxation 5 4,897 6,882 511 (129) 382

------- ------- ------- --------- -------- ---------

Other comprehensive

income - - - - - -

Total comprehensive 1,98

Income / (loss) 5 4,897 6,882 511 (129) 382

------- ------- ------- --------- -------- ---------

Basic & diluted

earnings / (loss)

per share (pence) 6 1.99p 4.90 p 6.88 p 0.005p (0.001p) 0.004p

------- ------- ------- --------- -------- ---------

The total column of this statement is the Income Statement of

the Company prepared in accordance with International Financial

Reporting Standards ( IFRS ) as adopted by the UK . The

supplementary revenue return and capital columns have been prepared

in accordance with the Association of Investment Companies

Statement of

Recommended Practice (AIC SORP).

Interim Condensed Statement of Financial Position

As at 30 September 202 2 (unaudited)

As at 30 September As at 31 March

2022 2022

Unaudited Audited

Note GBP'000 GBP'000

Non-current assets

Investments at fair value through

profit or loss 9 84,872 78,952

------------------ ----------------------------------------------------

Current assets

Trade and other receivables 466 453

Cash and cash equivalents 15,348 17,144

15,814 17,597

------------------ ----------------------------------------------------

Total assets 100,686 96,549

------------------ ----------------------------------------------------

Current liabilities

Trade and other payables (41 7 ) (412)

(41 7 ) ( 412 )

------------------ ----------------------------------------------------

Net assets 100,269 96,137

================== ====================================================

Equity attributable to equity

holders

Share capital 10 1,000 1,000

Share premium 13 13

Special distributable reserve 90,190 91,444

Capital reserve 8,216 3,319

Revenue reserve 8 50 361

Total equity 100,269 96,137

================== ====================================================

Shareholders' funds

Net asset value per Ordinary Share 8 100.26 p 9 6 . 12 p

The statements were approved by the Directors and authorised for

issue on 1 December 202 2 and are

signed on behalf of the Board by:

Dr John Roberts

Chair

Company registration number: 12693305

Interim Condensed Statement of Changes in Equity

For the six months ended 30 September 2022 (unaudited)

Special

Issued Share Distributable Capital Revenue

Capital Premium Reserve Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2022 1,000 13 91,444 3,319 361 96,137

-------- -------- -------------- -------- -------- -------

Distributions to

/ Contributions

from owners

Issue of share capital - - - - - -

(1,49 6

Dividends paid (1,254) ) (2,750)

-------- -------- -------------- -------- -------- -------

Sub-total - - (1,254) - (1,496) (2,750)

-------- -------- -------------- -------- -------- -------

Total comprehensive

income for the period - - - 4,897 1,98 5 6,882

As at 30 September

2022 1,000 13 90,190 8,216 85 0 100,269

======== ======== ============== ======== ======== =======

For the six month ended 30 September 2021 (unaudited)

Special

Issued Share Distributable Capital Revenue

Capital Premium Reserve Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 April 2021 1,000 - 97,009 ( 185) ( 336) 97,488

-------- -------- -------------- -------- -------- -------

Distributions to

/ Contributions from

owners

Issue of share capital* - 1 - - - 1

D ividends paid - - (3,375) - - (3,375)

-------- -------- -------------- -------- -------- -------

Sub-total - 1 (3,375) - - (3,374)

-------- -------- -------------- -------- -------- -------

Total comprehensive

income / (loss) for

the period - - - (129) 511 382

As at 30 September

2021 1,000 1 93,634 (314) 175 94,496

======== ======== ============== ======== ======== =======

* - 675 Ordinary 1 pence shares issued for GBP658

The Company's distributable reserves consist of the Special

distributable reserve, Capital reserve attributable to realised

gains and Revenue reserve. There have been no realised gains or

losses at the reporting date.

Interim Condensed Statement of Cash Flows

For the six months ended 30 September 2022

For the six For the six

months ended months ended

30 September 30 September

2022 (Unaudited) 2021 (Unaudited)

Note GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 6,882 382

(Gain) / Loss arising on the revaluation

of investments at the period end 9 ( 5,016 ) 83

Cash flow Generated by operations 1,86 6 465

Interest income (1,644) (1,019)

Interest received 1,640 605

Dividend income (1,148) -

Dividend received 1,148

(Increase)/decrease in receivables ( 9 ) 3

Increase in payables 5 67

Net cash flows from / (used in)

operating activities 1,85 8 121

--------------------------------- -----------------

Cash flows from investing activities

Purchase of financial assets at

fair value through profit or loss 9 (1,469) (8,232)

Loan Principal repaid 565 637

Net cash flows (used in) investing

activities (904) (7,595)

--------------------------------- -----------------

Cash flows from financing activities

Issue of shares - 1

Costs of Share Issue - -

Dividends paid (2,750) (3,375)

Net cash flows from financing activities (2,750) (3,374)

--------------------------------- -----------------

Net (decrease) in cash and cash

equivalents (1,796) (10,848)

Reconciliation of net cash flow

to movements in cash and cash equivalents

Cash and cash equivalents at beginning

of period 17,144 76,553

Net (decrease) in cash and cash

equivalents (1,796) (10,848)

--------------------------------- -----------------

Cash and cash equivalents at end

of the period 15,348 65,705

================================= =================

Notes to the Interim Financial Statements

For the six months ended 30 September 2022

1. General Information

The Company is registered in England and Wales under number

12693305 pursuant to the Companies Act 2006. The address of its

registered office, which is also its principal place of business,

is 1 King William Street, London EC4N 7AF.

The Company's Ordinary Shares were first admitted to trading on

the Specialist Fund Segment of the Main Market of the London Stock

Exchange under the ticker TEEC on 19 October 2020. On 30 August

2022 following approval by shareholders at the AG M , held on the

25 August 2022, Triple Point Energy Efficiency Infrastructure

Company plc changed its name to Triple Point Energy Transition plc

, trading on the Specialist Fund Segment of the Main Market of the

London Stock Exchange under the ticker TENT . On 28 October 2022

the Ordinary Shares of the Company were admitted to the premium

listing segment of the Official List of the Financial Conduct

Authority and were admitted to the Premium Segment of the Main

Market of the London Stock Exchange.

The Company's Objective is to generate an attractive total

return for investors comprising stable dividend income and capital

preservation, with the opportunity for capital growth through

acquiring and realising value from of a diversified portfolio of

energy transition investments in the United Kingdom and Europe

.

The Company currently makes its investments through its sole

holding company TEEC Holdings. The Company controls the investment

policy of TEEC Holdings to ensure it acts in a manner consistent

with the investment policy of the Company.

The Company has appointed Triple Point Investment Management LLP

as its Investment Manager pursuant to the Investment Management

Agreement dated 25 August 2020. The Investment Manager is

registered in England and Wales under number OC321250 pursuant to

the Companies Act 2006. The Investment Manager is regulated by the

FCA, number 456597.

2. Basis of Preparation

The interim financial statements included in this report have

been prepared in accordance with IAS 34 Interim Financial

Reporting. The interim financial statements have been prepared

under historical cost convention, as modified by the revaluation of

financial assets at fair value through profit or loss.

The interim financial statements have also been prepared as far

as relevant and applicable to the Company in accordance with the

Statement of Recommended Practice: Financial Statements of

Investment Trust Companies and Venture Capital Trusts ("SORP")

issued in April 2021 by the Association of Investment Companies

("AIC").

The interim financial statements are presented in sterling,

which is the Company's functional currency and rounded to the

nearest thousand, unless otherwise stated. The accounting policies,

significant judgements, key assumptions are consistent with those

used in the latest audited financial statements to 31 March 2022

and should be read in conjunction with the Company's annual audited

financial statements for the year ended 31 March 2022.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 March 2023 or

2022 but is derived from those accounts. Statutory accounts for

2022 and 2021 have been delivered to the Registrar of Companies.

The auditors have reported on those accounts: their reports were

unqualified, did not draw attention to any matters by way of

emphasis and did not contain statements under s498(2 ) or (3) of

the Companies Act 2006 .

Ba sis of Consolidation

The objective of the Company through its subsidiary TEEC

Holdings Limited is to invest, via individual corporate entities

for equity investments, or through advancing proceeds to corporate

entities for debt investments, in Energy Transition Assets. TEEC

Holdings typically will issue equity and will borrow to finance its

investments.

The Directors have concluded that in accordance with IFRS 10,

the Company meets the definition of an investment entity having

evaluated the criteria that needs to be satisfied. Under IFRS 10,

investment entities are required to hold subsidiaries at fair value

through profit or loss rather than consolidate them on a

line-by-line basis, meaning TEEC Holdings' cash and working capital

balances are included in the fair value of the investment rather

than in the Company's assets and liabilities. TEEC Holdings has one

investor which is the Company. However, in substance, TEEC Holdings

is investing the funds of the investors of the Company on its

behalf and is effectively performing investment management services

on behalf of many unrelated ultimate beneficiary investors.

Going Concern

The Directors, in their consideration of going concern, have

reviewed comprehensive cash flow forecasts prepared by the

Company's Investment Manager and believe that it is appropriate to

prepare the financial statements of the Company on a going concern

basis.

In arriving at their conclusion that the Company has adequate

financial resources, the Directors were mindful that the Group had

outstanding commitments in relation to the BESS Portfolio of

GBP44.9 million, unrestricted cash of GBP15.6 million as at 30

September 2022 and an undrawn revolving credit facility ("RCF")

(available for investment in new or existing projects and working

capital) of GBP40.0 million through TEEC Holdings. The heightened

inflationary environment, is a tailwind for the C ompany by virtue

of the inflation linked revenue from the Hydro electric P ortfolio,

which in absolute terms is greater than the inflation linked costs

incurred by the Company. The Company's net assets at 30 September

2022 were GBP100.3 million and total expenses for the period were

GBP 0.9 million, which when annualised represented approximately

1.89% of average net assets during the period.

At the date of approval of this document, based on the aggregate

of investments and cash held, the Company has substantial operating

expenses cover. The Directors are satisfied the Company has

sufficient resources to continue to operate for the foreseeable

future, a period of not less than 12 months from the date of this

report. Accordingly, they continue to adopt the going concern basis

in preparing these financial statements.

Segmental reporting

The Chief Operating Decision Maker (the "CODM") being the Board

of Directors, is of the opinion that the Company is engaged in a

single segment of business, being investment in Energy Transition

Assets.

The Company has no single major customer. The internal financial

information used by the CODM on a quarterly basis to allocate

resources, across performance and manage the Company presents the

business as a single segment comprising the portfolio of

investments in Energy Transition Assets.

Seasonal and cyclical variations

The Company's results do not vary significantly during reporting

periods.

3. Investment Income

For the six months end For the six months end

ed 30 ed 30

September 2022 (Unaudited) September 2021 (Unaudited)

------------------------------- --------------------------------

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Interest on cash

deposits 7 - 7 4 - 4

Interest income

from investments 1,638 - 1,638 1,015 - 1,015

Dividend income

from investments 1,148 - 1,148 - - -

2,793 - 2,793 1,019 - 1,019

------- ------------- ------- -------- ------------- -------

4. Operating Expenses

For the six months end For the six months end

ed 30 ed 30

September 2022 (Unaudited) September 2021 (Unaudited)

------------------------------- -------------------------------

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment Management

fees 326 109 435 90 30 120

Directors' fees 100 - 100 100 - 100

Company's audit fees:

- statutory audit

of the group financial

statements 38 - 38 38 - 38

- Assurance-related

services pursuant

to legislation 35 - 35 25 - 25

Other operating expenses 29 7 10 30 7 225 10 235

Irrecoverable VAT

on Administration

fees 12 - 12 30 6 36

80 8 119 92 7 508 46 554

---------- --------- -------- ------------- -------- -------

The Directors' fees exclude employer's national insurance

contribution and travel expenses which are included

as appropriate in other operating expenses. There were no other emoluments.

5. Taxation

The tax for the period shown in the statement of Comprehensive

Income is as follows.

For the six months end For the six months

ed 30 end ed 30

September 2022 (Unaudited) September 2021 (Unaudited)

-------------------------------- --------------------------------

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profit / (Loss) before

taxation 1,98 5 4,897 6,882 511 (129) 382

---------- --------- -------- ----------- --------- --------

Corporation tax at

19% 377 931 1,308 97 (25) 72

Effect of:

Tax relief for dividends

designated as interest

distributions (312) - (312) (97) - (97)

Dividends not taxable (218) - (218) - - -