TIDMTHG

RNS Number : 1809Z

THG PLC

12 May 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN ANNOUNCEMENT OF A FIRM

INTENTION TO MAKE AN OFFER UNDER RULE 2.7 OF THE CITY CODE ON

TAKEOVERS AND MERGERS (THE "CODE"). THERE CAN BE NO CERTAINTY THAT

ANY OFFER WILL BE MADE.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

12 May 2023

THG PLC

("THG" or the "Company")

Termination of discussions with Apollo

On 17 April 2023, THG announced that it was in receipt of a

highly preliminary and non-binding indicative proposal from Apollo

Global Management Inc. ("Apollo") on behalf of certain of its

affiliated funds, to acquire the entire issued and to be issued

share capital of THG (the "Indicative Proposal"). Following receipt

of the Indicative Proposal, the Board of THG entered into a short

period of discussion with Apollo to provide it with an opportunity

to improve the proposed valuation and confirm the structure of its

Indicative Proposal. It has become clear to the Board, supported by

shareholders representing a majority of THG's issued share capital,

that there is no longer any merit in continuing to engage with

Apollo. Consideration and rejection of the Indicative Proposal has

been on a basis consistent with all previous offers for the

Company, some a matter of public record, which were also rejected

based upon inadequate valuations and the nature of those offer

structures. Having discussed with its financial and legal advisors,

the Board has unanimously determined that it is not in the best

interest of THG shareholders to seek an extension to the deadline

set out in the Company's announcement dated 17 April 2023, as

permitted by Rule 2.6(c) of the Code, and, consequently, it has

terminated all discussions with Apollo.

The Company confirms that the profitability and cashflow

improvements delivered during the first quarter of FY 2023, have

continued in Q2, along with ongoing online sales momentum further

supporting the Board's full year guidance. The actions undertaken

by management since the beginning of 2022 to improve operating

leverage, reduce capex and generate working capital efficiencies,

coupled with ongoing deflation in whey commodity prices, underpin

significantly improved profitability and cash flow neutrality in FY

2023. The Company reiterates its expectations to deliver positive

free cash flow in FY 2024 and adjusted EBITDA margins of around

9.0% over the medium term.

Since Lord Allen's appointment as independent Chair in March

2022, the composition of the Company's Board continues to progress

in accordance with its independence and diversity objectives, with

three further independent non-executive Directors appointed,

including the recent appointment of Sue Farr as Senior Independent

Director. Following completion of the divisional reorganisation and

subsequent strategic review, including publication of segmental

performance, the Group now has a full range of strategic options to

maximise shareholder value across the Nutrition, Beauty and

Ingenuity divisions. The timing of the move to the Premium segment

of the Main Market of the London Stock Exchange remains subject to

the outcome of the FCA's review for reform of the listing

regime.

Commenting on today's announcement, Charles Allen, Lord Allen of

Kensington, Chair of THG said:

"THG's Board, in accordance with its fiduciary obligations and

as demonstrated with its recent engagement with Apollo, will always

give due consideration to all potential options which provide the

opportunity to maximise value to THG's shareholders. The Board

remains fully confident in THG's strategic direction and long-term

prospects as an independent company. As stated in our recent

results, with a strong balance sheet and category leading positions

within substantial global end markets that continue to benefit from

long-term structural growth, we have confidence in our ability to

deliver long-term value for shareholders and remain on track to be

cashflow positive in 2024."

As stated in the announcement dated 17 April 2023 and in

accordance with Rule 2.6(a) of the Code, Apollo is required, by not

later than 5.00 p.m. (London time) on 15 May 2023, to do one of the

following: (i) announce a firm intention to make an offer for THG

in accordance with Rule 2.7 of the Code; or (ii) announce that it

does not intend to make an offer for THG, in which case the

announcement will be treated as a statement to which Rule 2.8 of

the Code applies.

The person responsible for arranging for the release of this

announcement on behalf of THG is James Pochin, General Counsel and

Company Secretary.

For further information, please contact:

Jefferies International Limited Tel: +44 (0) 20 7029

Philip Noblet / Ed Matthews / Paul Bundred 8000

/ Gavriel Lambert / Thomas Bective

Barclays Bank PLC Tel: +44 (0) 20 7623

Alastair Blackman / Nicola Tennent / 2323

Callum West

Citigroup Global Markets Limited Tel: +44 (0) 20 7986

Michael Lavelle / Yishai Fransis / Sian 4000

Evans / Robert Farrington

Investor enquiries - THG PLC i nvestor.relations@thg.com

Greg Feehely, SVP Investor Relations

Kate Grimoldby, Director of Investor

Relations and Strategic Projects

Media enquiries Tel: +44 (0) 20 7250

Powerscourt - Financial PR adviser 1446

Victoria Palmer-Moore / Nick Dibden thg@powerscourt-group.com

/ Nick Hayns

THG PLC v iki.tahmasebi@thg.com

Viki Tahmasebi

S

Notes to editors

THG is a vertically integrated, digital-first consumer brands

group, retailing its own brands in beauty and nutrition, plus

third-party brands, via its complete digital commerce solution,

Ingenuity, to an online and global customer base. THG's business is

operated through the following divisions:

THG Beauty: The globally pre-eminent digital-first brand owner,

retailer, and manufacturer in the prestige beauty market, combining

its prestige portfolio of eight owned brands across skincare,

haircare, and cosmetics. It is a global route to market for over

1,300 third-party premium brands through its portfolio of websites,

including Lookfantastic, Dermstore, Cult Beauty and Mankind and the

beauty subscription box brand GLOSSYBOX.

THG Nutrition: A group of digital-first Nutrition brands, which

includes the world's largest online sports nutrition brand

Myprotein, and its family of brands (Myvegan, Myvitamins, MP

Activewear and MyPRO), with a vertically-integrated business model,

supported by global THG production facilities.

THG Ingenuity: Ingenuity provides a complete digital commerce

solution for consumer brand owners across its three pillars of

technology, digital and operations. Being part of the THG group, a

global digital brand owner in Beauty & Nutrition, Ingenuity is

uniquely placed to bring relevant, practical, and international

expertise in every area of commerce.

Rule 26.1 disclosure

In accordance with Rule 26.1 of the Code, a copy of this

announcement will be available (subject to certain restrictions

relating to persons resident in restricted jurisdictions) at

www.THG.com by no later than 12 noon (London time) on the business

day following the date of this announcement. The content of the

website referred to in this announcement is not incorporated into

and does not form part of this announcement.

Important notice

Jefferies International Limited ("Jefferies"), which is

authorised and regulated by the Financial Conduct Authority ("FCA")

in the United Kingdom, is acting exclusively for THG and no one

else in connection with the Indicative Proposal and will not be

responsible to anyone other than THG for providing the protections

afforded to clients of Jefferies nor for providing advice in

relation to the Indicative Proposal or any other matters referred

to in this announcement. Neither Jefferies nor any of its

affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

of Jefferies in connection with this announcement, any statement

contained herein or otherwise.

Barclays Bank PLC, acting through its Investment Bank

("Barclays"), which is authorised by the Prudential Regulation

Authority ("PRA") and regulated in the United Kingdom by the FCA

and the PRA, is acting exclusively for THG and no one else in

connection with the Indicative Proposal and will not be responsible

to anyone other than THG for providing the protections afforded to

clients of Barclays nor for providing advice in relation to a

possible offer or any other matter referred to in this

announcement.

Citigroup Global Markets Limited ("Citi"), which is authorised

by the PRA and regulated in the UK by the FCA and the PRA, is

acting as financial adviser for THG and for no one else in

connection with the matters described in this announcement, the

Indicative Proposal and will not be responsible to anyone other

than THG for providing the protections afforded to clients of Citi

nor for providing advice in connection with the Indicative

Proposal, or any other matters referred to in this announcement.

Neither Citi nor any of its affiliates, directors or employees owes

or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, consequential, whether in contract, in

tort, in delict, under statute or otherwise) to any person who is

not a client of Citi in connection with this announcement, any

statement contained herein, the Indicative Proposal or

otherwise.

This announcement is not intended to, and does not, constitute,

represent or form part of any offer, invitation or the solicitation

of an offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of, any securities, or the solicitation of any

vote or approval in any jurisdiction, whether pursuant to this

announcement or otherwise. Any offer, if made, will be made solely

by certain offer documentation which will contain the full terms

and conditions of any offer, including details of how it may be

accepted.

This announcement has been prepared in accordance with English

law and the Code, and information disclosed may not be the same as

that which would have been prepared in accordance with laws outside

of the United Kingdom. The release, publication or distribution of

this announcement in jurisdictions other than the United Kingdom

and the availability of any offer, if made, to shareholders of the

Company who are not resident in the United Kingdom may be affected

by the laws of relevant jurisdictions. Therefore, any persons who

are subject to the laws of any jurisdiction other than the United

Kingdom or shareholders of the Company who are not resident in the

United Kingdom will need to inform themselves about, and observe

any applicable requirements. Any failure to comply with such

requirements may constitute a violation of the securities law of

any such jurisdiction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OTTLFLLFXELBBBK

(END) Dow Jones Newswires

May 12, 2023 02:00 ET (06:00 GMT)

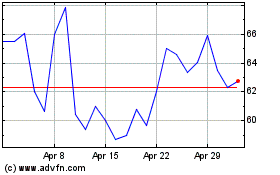

Thg (LSE:THG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Thg (LSE:THG)

Historical Stock Chart

From Jul 2023 to Jul 2024