TIDMUKOG

RNS Number : 9716B

UK Oil & Gas PLC

14 October 2020

UK Oil & Gas PLC

("UKOG" or the "Company")

Turkey Resan licence update

UK Oil & Gas PLC (London AIM: UKOG) is pleased to announce

that further to its 23 July release, it has now successfully

executed the participation agreement (i.e. farmin agreement) and

the joint operating agreement with Aladdin Middle East Ltd ("AME")

for its 50% interest in the 305 km(2) Turkish Resan Licence

("Licence") and the respective oil appraisal and exploration

programme.

Further to its successful 02 October equity raise, UKOG will now

fund its agreed share of key initial preparatory operations so that

the first oil appraisal well, currently planned as Basur-3, a

surface location for which has now been chosen, can be drilled as

soon as practicable in early 2021.

Resan Licence: material overlooked recoverable oil volumes

As reported on 23 July, Xodus Group Ltd's ("Xodus") June 2020

report calculates the Licence to contain materially significant

recoverable discovered and undiscovered prospective resource

volumes (see glossary definitions), with calculated aggregate mean

and high gross cases of 43.4 million barrels (UKOG net 21.7

"mmbbl") and 84 mmbbl (UKOG net 42 mmbbl) respectively, details of

which are shown in table 1 below:

Table 1: Total Licence aggregate discovered and undiscovered

prospective resources (mmbbl)

Total Resan Licence Low Case Mid Case Mean Case High Case

(mmbbl)(1) (P90) (P50) (average) (P10)

Gross recoverable 18.9 39.2 43.4 84 (2)

---------- ---------- ------------ -----------

U KOG net recoverable

(50% WI) 9.45 19.6 21.7 42 (2)

---------- ---------- ------------ -----------

Gross oil in place 1 42 275 321 607

---------- ---------- ------------ -----------

Notes: 1. Table 1 shows an arithmetic sum of Xodus' June 2020

Basur and Resan discovered resources and Prospect A undiscovered

resources (see glossary definition). 2. Xodus report states that in

the high case, 20% of OIP could reasonably expected to be

recovered, however, tabulated P10 volumes show only c. 13.8%

recovery. A 20% high case recovery would equate to a P10

recoverable volume of 120 mmbbl (60 mmbbl UKOG net).

Of the total resources shown in Table 1, the majority lies

within the known Basur-Resan accumulation which is estimated to

contain aggregate mean and high case discovered recoverable volumes

of 37.2 mmbbl (UKOG net 18.6 mmbbl) and 67 mmbbl (UKOG net 33.5

mmbbl), respectively. The remainder, classified as undiscovered

prospective resources, lies within undrilled prospect A.

The following summarises the key points made in the Company's 23

July 2020 release and highlights why the board views the Licence to

present a compelling and material growth opportunity for the

Company:

-- Overlooked material discovered resource and "oil-play":

The Licence holds the significant 50 km(2) Basur-Resan

geological feature tested at its western end by the 1964 Basur-1

oil discovery. Basur-1 flowed 500 bbl to surface over a 6-hour

period from naturally fractured and dolomitised Cretaceous age

Mardin limestones, an extrapolated rate equivalent to 2,000 bbl of

oil per day. Basur-Resan is a geological lookalike to AME's proven

producing E. Sadak field, 20 km south west, and sits within the

continuation of the same geological fold and thrust feature. E.

Sadak is the first Turkish field to demonstrate the commerciality

of the deeper Mardin play in the area. Prior to the E. Sadak

discovery in 2014, exploration in the area focussed primarily upon

shallower traditional Cretaceous objectives.

-- Rapid success case monetisation possible - months versus years in UK:

E. Sadak was discovered and put into production in the same

year, 2014, and has seen a total of 10 wells drilled to date.

Unlike UK, which requires numerous planning and regulatory steps

before production can commence, Turkish petroleum law Article 6

(10) states that licensees are obliged to develop the field and

commence production following a discovery. E. Sadak thus

demonstrates that licensees are able to transition a successful

well test directly into long-term production with minimal delay.

For comparison, the Company's Horse Hill field was granted

production status in March 2020, over 4 years after its first flow

test in 2016, albeit a relatively quick process in UK terms.

-- Greater recoverable resources than current UK projects:

(see table 1 above and tables 1 and 2 on page 15 of UKOG's 2019

Annual Report).

-- Similar chance of success to UK appraisal projects:

Moveable hydrocarbons to surface have been demonstrated by the

Basur-1 flow test, as is the case for UKOG's Loxley gas discovery.

Greatest geological uncertainty in all UKOG's appraisal projects

is, therefore, the respective reservoir's ability to deliver

sustained commercial rates and volumes, a typical appraisal stage

uncertainty.

-- Significantly lower cost operations than UK:

Basur-3 well and flow test gross costs are estimated by AME at

$3 million (GBP2.4 million) vs $7.5 million (GBP6 million) for a UK

equivalent depth well e.g. UKOG's recent Horse Hill-2.

-- Modest project and country entry cost:

UKOG pays first $5 million of drilling and seismic costs, which

equates to $0.115 per Xodus recoverable mean case net barrel.

-- AME are a highly credible and successful Turkish operator

with a 60-year in-country history. Possess key strategic knowledge

as operator of first producing Mardin field, E. Sadak.

-- Good benchmark crude price and guaranteed oil sales:

Produced crude is expected to be of Arab medium to light

quality, which currently realises prices of c. $46/bbl, marginally

above the $41/bbl current Brent price. Oil can be readily exported

on existing roads to the Batman refinery 80 kms to the west.

Turkish petroleum law states that a Turkish refinery must accept

all indigenous oil and pay market price.

-- Prime geological address, overlooked petroleum system:

AME's nearby E. Sadak field firmly establishes the licence area

to contain an extension of the prolific 'naturally fractured'

limestone fold and thrust petroleum system of the Kurdistan region

of Iraq ("KRI"), 80 km to the south, which, in turn, is part of the

wider Iraq-Iran Zagros petroleum system, one of the world's most

important. The KRI system was itself only proven relatively

recently after Iraq war 2, long after original Basur-Resan drilling

between 1954 and 1970.

Stephen Sanderson UKOG's Chief Executive commented:

"When compared to our material Loxley and Arreton appraisal

projects, Resan offers even greater upside for similar risk,

significantly lower operational costs and, more critically, given

success, a far quicker route to production and cash flow. Resan is

therefore a compelling and material growth opportunity that could

provide potentially transformational reserves growth in the short

term. It is a valuable addition to UKOG's portfolio.

We look forward to the imminent start of preparations to drill

the first Basur-Resan appraisal well and to a long and successful

relationship with our new partner AME."

Qualified Person's Statement

Matt Cartwright, UKOG's Commercial Director, who has over 36

years of relevant experience in the global oil industry, has

approved the information contained in this announcement. Mr

Cartwright is a Chartered Engineer and member of the Society of

Petroleum Engineers.

For further information, please contact:

UK Oil & Gas PLC

Stephen Sanderson / Kiran Morzaria Tel: 01483 941493

WH Ireland Ltd (Nominated Adviser and Broker)

James Joyce / James Sinclair-Ford Tel: 020 7220 1666

Communications

Brian Alexander Tel: 01483 941493

Glossary

discovered resources are those quantities of petroleum which are

estimated, on a given date, to be potentially

recoverable from known (i.e. discovered) accumulations,

but w hose commerciality is dependent upon

a contingency e.g. further appraisal/production

testing, increased oil price, technology application,

government sanction etc.

dolomite/dolomitisation a crystalline form of calcium carbonate or

lime. The geological process of turning the

more common calcite crystalline form of calcium

carbonate into dolomite . increases the pore

space in the rock by approximately 13% thus

improving the rocks ability to store oil and

improve potential oil flow.

----------------------------------------------------------

limestone a sedimentary rock predominantly composed of

calcite (a crystalline mineral form of calcium

carbonate or lime) of organic, chemical or

detrital origin. Minor amounts of dolomite,

chert and clay are common in limestones. Chalk

is a form of fine-grained limestone

----------------------------------------------------------

mean value the expected or average outcome of a defined

probability distribution, in this case the

calculated distribution of oil in place

----------------------------------------------------------

o il discovery an o il accumulation for which one or several

exploratory wells have established through

testing, sampling and/or electric logging the

existence of a significant quantity of potentially

moveable hydrocarbons

----------------------------------------------------------

o il field an accumulation, pool or group of pools of

o il in the subsurface that produces o il to

surface

----------------------------------------------------------

O IP or o il in the quantity of o il that is estimated to exist

place in naturally occurring accumulations within

the ground before any extraction to surface

via production

----------------------------------------------------------

prospect a project associated with a potential accumulation

that is sufficiently well defined to represent

a viable drilling target

----------------------------------------------------------

prospective resources/undiscovered are defined as those quantities of petroleum

resources which are estimated, on a given date, to be

potentially recoverable from Undiscovered accumulations.

----------------------------------------------------------

P10, P50, P90 High, mid and low case scenarios with a 10%,

values 50%, 90% probability respectively, that a stated

volume will be equalled or exceeded

----------------------------------------------------------

recoverable volumes those quantities of petroleum (oil in this

& recovery factor case) estimated, as of a given date, to be

potentially recoverable from known accumulations.

The recovery factor represents the percentage

of the OIP that can be recovered to surface

via production and normally ranges from 10-50%

----------------------------------------------------------

well test, flow involves testing a well by flowing hydrocarbons

test to surface, typically through a test separator

over a flowing period. Key measured parameters

are gas flow rates, downhole pressure and surface

pressure. The overall objective is to identify

the well's capacity to produce hydrocarbons

at a commercial flow rate and volumes.

----------------------------------------------------------

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFFSFIDESSEIS

(END) Dow Jones Newswires

October 14, 2020 02:00 ET (06:00 GMT)

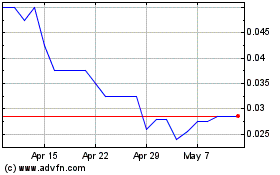

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uk Oil & Gas (LSE:UKOG)

Historical Stock Chart

From Apr 2023 to Apr 2024