Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

May 15 2024 - 12:33PM

Edgar (US Regulatory)

DEFA 14A

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT

TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT

NO. ____)

Filed by the Registrant [X]

Filed by a Party other than the [_]

Registrant

Check the appropriate box:

[ ] Preliminary

Proxy Statement

[_] Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2))

[_] Definitive Proxy Statement

[x] Definitive

Additional Materials

[_] Soliciting Materials under

Rule 14a-12

BNY Mellon Municipal Income Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (check the appropriate box):

[X] No fee required.

[_] Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities

to which transaction applies: _______

(2) Aggregate number of securities

to which transaction applies: _______

(3) Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11: ___

(4) Proposed maximum aggregate

value of transaction: _______

(5) Total Fee Paid: _______

[_] Fee paid previously with

preliminary materials.

| [_] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0- 11(a)(2) and identify the filing for which the offsetting

fee was paid previously. |

Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: _______

(2) Form, Schedule or Registration

Statement No.: _______

(3) Filing Party: _______

(4) Date Filed: _______

BNY Mellon Municipal Income, Inc. (NYSE: DMF)

PROTECT YOUR LONG-TERM INVESTMENT

VOTE ON THE WHITE PROXY CARD – FOR – THE BOARD-APPROVED PROPOSALS |

Ahead of the Annual Meeting on June 12, 2024, at 11:00 a.m. ET, we are asking all DMF stockholders to make your voices heard and help us safeguard your long-term investment. We will NOT let Saba Capital and Bulldog Investors, two known activist hedge funds, take steps that may imperil the Fund’s ability to meet its investment objective and generate consistent income for you.

___________________________________________________________________________ |

|

On the WHITE proxy card, you will see two

proposals. Your Board recommends voting: ✓FOR your

qualified, elected Board members

X

AGAINST the

Board declassification proposal |

|

IMPORTANT: PLEASE DISCARD ANY PROXY

CARD YOU RECEIVE FROM SABA OR BULLDOG.

|

| We are fighting to protect your Fund and its ability to provide reliable, consistent income and deliver on its investment objective. |

|

VOTE FOR YOUR DIRECTORS

|

|

VOTE AGAINST BOARD DECLASSIFICATION

|

|

Francine J. Bovich, Roslyn M. Watson, and Tamara

Belinfanti are Qualified and Experienced

ü

Collective 80 years of asset management

expertise, including closed-end funds

ü

Trusted fiduciaries committed

to advancing your best interests over the long term

ü

Expert stewardship has led Fund

to outperform its benchmark

ü

Focused on what matters most—Fund

has delivered consistent distributions over the past 10 years, helping you meet your financial goals

*As of 2/29/2024

|

|

A Classified Board Protects the Stability of your

Investment

ü

Our current Fund structure enhances the independence

of your directors, who are accountable to you

ü

Our Board is ideally set-up to promote stability and

continuity, so you always have qualified experts serving at all times

Dangers of Declassification

×

Declassification means that activist investors could gain control of the Board in a single

meeting and make sudden changes to your investment

×

Activists can take steps to pursue short-term gains at the expense of long-term stockholders |

|

WE WILL ALWAYS STAND UP FOR ALL STOCKHOLDERS

VOTE today FOR the Board-approved

Proposals on the WHITE proxy card

Protect your options and the future of your

investment

|

Important

Information about the Fund

This material is not an advertisement and

is intended for existing shareholder use only. This document and the information contained herein relates solely to BNY Mellon Municipal

Income, Inc. (DMF). The information contained herein does not relate to, and is not relevant to, any other fund or product advised by

BNY Mellon Investment Adviser, Inc. or any of its affiliates. This document is not an offer to sell any securities and is not a solicitation

of an offer to buy any securities.

Common shares for the closed-end fund identified

above are only available for purchase and sale at current market price on a stock exchange. A closed-end fund's dividend yield, market

price and NAV will fluctuate with market conditions. The information for this Fund is provided for informational purposes only and does

not constitute a solicitation of an offer to buy or sell Fund shares.

Performance results reflect past performance

and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. All returns assume

reinvestment of all dividends. The market value and net asset value of a fund's shares will fluctuate with market conditions. Closed-end

funds may trade at a premium to NAV but often trade at a discount.

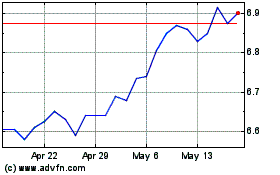

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Oct 2024 to Oct 2024

BNY Mellon Municipal Inc... (AMEX:DMF)

Historical Stock Chart

From Oct 2023 to Oct 2024