Debt Resolve, Upon Proof of Funds, Grants Harmonie Extension to Complete $7 Million Funding by June 20, 2008 Debt Resolve Receiv

June 10 2008 - 4:00PM

PR Newswire (US)

WHITE PLAINS, N.Y., June 10 /PRNewswire-FirstCall/ -- Debt Resolve,

Inc. ("Debt Resolve") (AMEX:DRV) announced today that, after

receiving proof of funds, the Company granted Harmonie

International LLC ("Harmonie") an extension until June 20th to

fulfill its commitment to invest $7 million in the Company. Debt

Resolve has entered into a Securities Purchase Agreement with

Harmonie for the private placement of Debt Resolve's stock at a

price of $2.36 per share, and warrants to purchase additional

shares, which could result in additional cash to the Company. This

and prior delays were caused by Harmonie's regulatory and trading

issues unrelated to Debt Resolve. Harmonie has reconfirmed its

commitment to fund Debt Resolve. The parties do not expect any

further delay in funding and this date is considered to be a final

date, with time being of the essence. Debt Resolve also announced

that on June 4th the Company received a letter from the Amex

advising of their intent to file a delisting application with the

Securities and Exchange Commission ("SEC"), due to the deficiency

of the Company pursuant to Section 1003(a)(iv) of the Amex Company

Guide caused by Harmonie's failure to fund by May 30th. The Company

will appeal the Amex intent by requesting an oral hearing and

paying all required fees within the prescribed time. At the hearing

the Company intends to seek an additional extension of time to

complete the Harmonie transaction. The Company may have additional

rights to appeal to the Amex Committee on Securities, the Amex

Board and the SEC. Kenneth Montgomery, CEO of Debt Resolve, stated,

"Harmonie International is a strategic investor that will provide

not only capital but also international finance and banking

expertise. We are confident we will receive the Harmonie funding by

June 20th and be in full compliance with the AMEX listing

requirements." William E. Donahue, Jr., CEO of Harmonie

International LLC, stated, "We regret the unavoidable delays

experienced in this transaction and wish to express our full

confidence in Debt Resolve and our intention to fully fund. As

international bankers we remain convinced of Debt Resolve's value

proposition. It offers the right solution at the right time for

both domestic and international markets." About Debt Resolve, Inc.

Debt Resolve provides lenders, collection agencies, debt buyers and

utilities with a patent-based online bidding system for the

resolution and settlement of consumer debt and a collections and

skip tracing solution that is effective at every stage of

collection and recovery. Through its subsidiary, First Performance

Corporation, Debt Resolve is actively engaged in operating a

collection agency for the benefit of its clients, which include

banks, finance companies and purchasers of distressed accounts

receivable. The stock of Debt Resolve is traded on the American

Stock Exchange. Debt Resolve is headquartered in White Plains, New

York. For more information, please visit the website at

http://www.debtresolve.com/. DATASOURCE: Debt Resolve, Inc.

CONTACT: David Rainey of Debt Resolve, Inc., +1-914-949-5500, Web

site: http://www.debtresolve.com/

Copyright

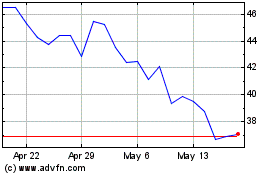

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Jan 2025 to Feb 2025

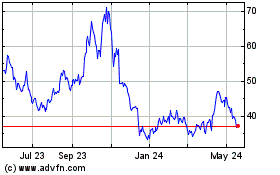

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Direxion Daily Real Estate Bear 3X Shares (American Stock Exchange): 0 recent articles

More Debt Resolve News Articles