Debt Resolve Creates Alliance With Major Creditors; Schedules

Conference For September WHITE PLAINS, N.Y., Aug. 20

/PRNewswire-FirstCall/ -- Debt Resolve, Inc. ("Debt Resolve")

(AMEX:DRV) announced today that it has developed a revolutionary

consumer driven debt settlement Internet site to be know as

iSettleNow. Go to http://www.isettlenow.com/ to see how consumers

will be empowered to resolve their debt online and avoid the usual

intrusive collection phone calls and letters. The Company is

launching iSettleNow.com in response to consumer demand, the

increased costs of collection, impaired settlement rates and with

the knowledge of a dramatic increase in online banking and general

Internet usage. Debt Resolve also announced that it has established

an Online Debt Resolution Alliance and will hold a conference for

creditors on September 26, 2008 at 9AM at the Cornell Club located

at 6 East 44th Street in New York City to discuss the potential of

the technology and establish industry standards to maximize the

effectiveness of iSettleNow. All inquires should be directed to .

With consumer debt dramatically increasing, default rates rising

and Internet usage becoming the norm in every facet of life,

iSettleNow is the perfect solution for both creditors and

consumers. According to the Federal Reserve, Americans carry

$13.825 trillion in debt. The average household's credit card debt

is $8,565, up almost 15% since 2000. The average college student

graduates with over $20,000 in educational debt. Consumers are

frustrated with traditional collection methods and are ready to use

the Internet to resolve their debt. According to a survey by FiSite

Research, 84% of respondents were favorable to the idea of online

collection services, 83% preferred an online system, and 78%

believed an online would reduce emotional stress. James Burchetta,

the Company's Chairman, stated, "The Board of Directors has

unanimously approved this dramatic expansion of the Company's

business model. It is the consumer that has moved every industry to

the Internet. Once consumers choose a channel like iSettleNow, it

says to the industry 'change or get out of our way.' We believe

iSettleNow will be a prime catalyst to moving collections online.

Just as consumers pushed the banking world to online banking, they

will also push for online debt resolution. It is natural to want to

settle your debts online. The Company's Board has complete faith in

management to execute this exciting new online debt resolution tool

while continuing to offer products directly to the collection

industry. The time is ripe for iSettleNow. There is a perfect storm

of more and more debt worldwide and the realization that it will is

technology, like iSettleNow, that will lowers costs, improve

collections and allow consumers to 'Bid For Financial

Freedom(TM).'" Kenneth Montgomery, the Company's Chief Executive

Officer, stated, "We have expanded our business model to connect

directly with consumers. We will continue to allow creditors,

agencies and debt buyers to use our system, but we expect that full

adoption of online collections will be consumer driven, just as it

was with ATMs and online banking. According to 2006 study by

Forrester, by 2011 76% of online households will bank online. In

preparation for our launch in early 2009, we are inviting major

creditors in every vertical market, credit card, phone, utilities,

health care, student loans and mortgages, to a conference to learn

more about iSettleNow and form an alliance to fully utilize the

iSettleNow technology. We have been meeting with industry leaders

and have received overwhelming encouragement and excitement about

iSettleNow, the 'ebay of debt.' As a pure Internet model we

continue to control expenses and expect to be cash flow positive in

the middle of 2009." David Rainey, President and Chief Financial

Officer, of the Company, said, "In preparation for the launch of

iSettleNow we have drastically reduced are operating costs from

$500k per month a year ago to $180k per month. We phased out our

off line collection businesses FPC, which incubated iSettleNow, to

concentrate on our new consumer site. As we focus on the online

consumer model, iSettleNow, we are able to generate revenue without

the expenses associated with traditional businesses." Revenue for

the second quarter of 2008 was $46,819, compared to $12,507 in the

second quarter of 2007. Net loss for the second quarter of 2008 was

($4,238,148) compared to a loss of ($5,303,731) in the second

quarter of 2007. The net loss for these months ended June 30, 2008

includes $553,411 in non-cash stock-based compensation expense and

$1,631,505 in other non-cash charges. On a per share basis, the net

loss of ($0.48) was less than the net loss of ($0.69) in the second

quarter of 2007, primarily due to lower non-cash expenses and an

increased number of shares outstanding. The Company's financial

statements for the years ended December 31, 2007 and 2006, and the

three months ended June 30, 2008 and 2007 were prepared on a going

concern basis, which contemplates the continuation of the Company

as a going concern and the realization of assets and the

satisfaction of liabilities in the normal course of business. Since

the Company may not have sufficient cash to fund its operations for

the next twelve months, there exists substantial doubt about its

ability to continue as a going concern. The financial statements do

not include any adjustments that might result from the outcome of

this uncertainty. DEBT RESOLVE, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Operations (Unaudited) Three Months

Ended Six Months Ended June 30, June 30, 2008 2007 2008 2007

Revenues $46,819 $12,507 $130,997 $33,128 Costs and expenses:

General and administrative expenses 2,014,030 2,930,906 3,890,490

4,550,123 Depreciation and amortization expense 14,433 14,380

28,970 28,178 Total expenses 2,028,463 2,945,286 3,919,460

4,578,301 Loss from operations (1,981,644) (2,932,779) (3,788,463)

(4,545,173) Other (expense) income: Interest income -- 4,840 190

41,610 Interest expense (33,498) -- (58,692) (70) Interest expense

- related parties (34,071) (7,633) (65,008) (7,635) Amortization of

deferred debt discount (45,781) -- (547,454) -- Other income (337)

-- (338) 10,080 Total other (expense) income (113,687) (2,793)

(671,302) 43,985 Loss from continuing operations (2,095,331)

(2,935,572) (4,459,765) (4,501,188) Loss from discontinued

operations (2,142,817) (2,368,159) (2,650,619) (2,916,683) Net loss

$(4,238,148) $(5,303,731) $(7,110,384) $(7,417,871) Net loss per

common share: basic and diluted (See Note 2) Continuing operations

$(0.24) $(0.38) $(0.51) $(0.58) Discontinued operations $(0.24)

$(0.31) $(0.30) $(0.38) Total $(0.48) $(0.69) $(0.81) $(0.96) Basic

and diluted weighted average number of common shares outstanding

(See Note 2) 8,848,045 7,707,668 8,768,924 7,689,168 DEBT RESOLVE,

INC. AND SUBSIDIARIES Condensed Consolidated Balance Sheets ASSETS

June 30, 2008 (Unaudited) December 31, 2007 Current assets: Cash $

27,489 $ -- Restricted cash 30,191 67,818 Accounts receivable

103,950 84,013 Other receivable 4,712 200,000 Prepaid expenses and

other current assets 63,446 108,189 Total current assets 229,788

460,020 Fixed assets, net 128,487 283,095 Other assets: Deposits

and other assets 108,780 108,780 Intangible assets, net -- 208,848

Total other assets 108,780 317,628 Total assets $ 467,055 $

1,060,743 LIABILITIES AND STOCKHOLDERS' DEFICIENCY Current

liabilities: Accounts payable and accrued liabilities $2,503,794

$1,444,764 Accrued professional fees 1,255,473 1,003,550 Accrued

closing costs - FPC 1,364,458 -- Collections payable 28,960 42,606

Short term notes (net of deferred debt discount of $0 and $29,400,

respectively) 380,000 70,600 Short term note - related party

142,202 -- Lines of credit - related parties 1,037,121 1,011,000

Total current liabilities 6,712,008 3,572,520 Notes payable (net of

deferred debt discount of $211,631 and $70,975, 611,369 254,025

respectively) Total liabilities 7,323,377 3,826,545 Commitments and

contingencies Stockholders' deficiency: Preferred stock, 10,000,000

shares authorized, $0.001 par value, none -- -- issued and

outstanding Common stock, 100,000,000 shares 8,962 8,474

authorized, $0.001 par value, 8,961,864 and 8,474,363 shares issued

and outstanding Additional paid-in capital 45,521,033 42,501,655

Accumulated deficit (52,386,317) (45,275,931) Total stockholders'

deficiency (6,856,322) (2,765,802) Total liabilities and

stockholders' deficiency $467,055 $1,060,743 About iSettleNow and

Debt Resolve, Inc. iSettleNow is a trademarked product of Debt

Resolve allowing the consumer to initiate the settlement process by

making bids using Debt Resolve's patented online dispute resolution

system. Debt Resolve provides lenders, collection agencies, debt

buyers and utilities with a patent-based online bidding system for

the resolution and settlement of consumer debt and a collections

and skip tracing solution that is effective at every stage of

collection and recovery. The stock of Debt Resolve is traded on the

American Stock Exchange. Debt Resolve is headquartered in White

Plains, New York. For more information, please visit our websites

at http://www.debtresolve.com/ and http://www.isettlenow.com/.

Forward-Looking Statements and Disclaimer Certain statements in

this press release and elsewhere by management of the Company that

are neither reported financial results nor other historical

information are "forward-looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995. Such

information includes, without limitation, the business outlook,

assessment of market conditions, anticipated financial and

operating results, strategies, future plans, contingencies and

contemplated transactions of the Company. Such forward-looking

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties and other factors which

may cause or contribute to actual results of the Company's

operations, or the performance or achievements of the Company, or

industry results, to differ materially from those expressed or

implied by the forward-looking statements. In addition to any such

risks, uncertainties and other factors discussed elsewhere in this

press release, risks, uncertainties and other factors that could

cause or contribute to actual results differing materially from

those expressed or implied by the forward-looking statements

include, but are not limited to, events or circumstances which

affect the ability of Debt Resolve to realize improvements in

operating earnings expected from the acquisition of First

Performance; competitive pricing for the Company's products and

services; fluctuations in demand for the Company's products or

services; changes to economic growth in the United States and

international economies; government policies and regulations,

including, but not limited to those affecting the collection of

consumer debt; adverse results in current or future litigation;

currency movements; and other risk factors discussed in the

Company's Annual Report on Form 10-KSB for the year ended December

31, 2007, and in other filings made from time to time with the SEC.

Debt Resolve undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise. Investors are advised, however, to

consult any further disclosures made on related subjects in the

Company's reports filed with the SEC. DATASOURCE: Debt Resolve,

Inc. CONTACT: Ken Montgomery, Debt Resolve, Inc., , mailto: ,

+1-914-949-5500, ext. 222 Web site: http://www.debtresolve.com/

http://www.isettlenow.com/

Copyright

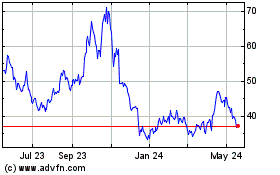

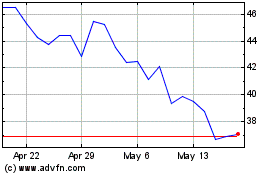

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Jan 2025 to Feb 2025

Direxion Daily Real Esta... (AMEX:DRV)

Historical Stock Chart

From Feb 2024 to Feb 2025