The Indian economy can be considered one of the dominant

economies in the world thanks to its attractive GDP growth rate of

approximately 7.5%, and the incredible size of the market.

Furthermore, the country has seen more liberalized trade and

pro-business practices including broad programs in terms of

privatization, capital market reorganization and industrial

policies all of which have helped to keep growth levels high in the

country.

In fact, even during 2008, when many of the major nations in the

world were facing market turmoil, India delivered a suburb growth

rate of 6%. In addition to this strength, domestic consumption has

also been rising, making India less impacted by foreign shocks than

some of its more export-oriented peers in the region.

Impressive investment in the country by the Foreign

Institutional Investor also added to its advantage coupled with

falling inflation over the past six months. Liquidity across the

nation has also improved, largely thanks to the Cash Reserve Ratio

(CRR) reduction being made two times by the Reserve Bank of India

(RBI). (Top Three Emerging Market Consumer ETFs)

There are still some significant risks to the Indian economy

despite the many positives of the nation. In the past month,

investors have seen a rise in the inflation rate in India which, if

it continues, may hamper the purchasing power for citizens in the

country.

However, an interest rate cut by the Central Bank is also on the

horizon which may boost inflation even more. Additionally, rising

oil prices remains a matter of concern for the economy as India

imports more than 70% of its oil, suggesting that there are

definitely headwinds to the economy.

Nevertheless, investors have a variety of options to play the

Indian stock market. However, investors should note that due to

capital controls and high expense ratios, many Indian ETFs are not

nearly as popular as some of their other BRIC counterparts.

Additionally, the performance in the Indian market hasn’t been

robust to say the least over the past few years.

In 2011, for example, India’s ETFs saw a major setback as the

economy was surrounded by high inflation, a falling rupee, and

lackluster foreign capital investment. Fortunately, 2012 has

delivered a completely new scenario to the country. FDI has poured

in and the stock market is on a nice bull run, adding almost 20%

when compared to December lows.(India ETFs: Behind The Crash)

For investors intrigued by these trends, there are a number of

options available. We think that given the risks of the market, it

could be ideal to focus on some of the large cap ETFs in the space,

including the three following funds:

WisdomTree India Earnings Fund ETF (EPI)

Initiated in February 2008, the fund seeks to track the

performance of the WisdomTree India Earnings Index. This

fundamentally weighted index focuses on companies which are traded

in India and are profitable and eligible to be purchased by foreign

investors. The fund currently holds a total of 161 stocks with

39.39% of net asset in the top 10 holdings.

EPI is highly exposed to the financial sector which makes up

26.3% of assets while it is light on consumer staples and

telecommunication services. Attributable to the volatility in the

Indian market in fiscal 2011, the fund has delivered a negative

return of 15.49% over a period of one year while it isn’t cheap

compared to broader funds; the product has an expense ratio of 83

basis points.

PowerShares India Portfolio ETF (PIN)

The fund was initiated in May 2008 and was designed to

replicate, before fees and expenses, the performance of the Indian

Equity market as a whole through a group of 50 stocks. These 50

stocks represent the largest stocks listed on the National Stock

Exchange (NSE) and Sensex, the two major indices of Indian market.

The fund has a total holding of 50 stocks and charges investors

fees of 78 basis points.

The fund is highly concentrated in its top 10 holdings with more

than 50% of its assets going to this group of securities. This

means that the fund is not spread out and does not offer immense

diversification benefits. Infosys Ltd occupies the top position in

the fund followed by Reliance Industries Ltd and Oil & Natural

Gas Corp. Ltd, ensuring that the energy sector is the biggest from

an industry perspective.

Possibly due to the high concentration risk and volatility in

the market, the fund delivered a negative return of 35.47% over the

past year, although it has bounced back strongly in 2012.

iShares S&P India Nifty 50 Index Fund ETF

(INDY)

Introduced in November 2011, INDY is the most recent addition in

the Indian large cap ETF space. The product seeks to track the

performance of the S&P CNX Nifty Index which consists of 50 of

the largest Indian companies. The fund holds 50 stocks in total but

puts over half of the portfolio in the top 10 companies.

The fund has an expense ratio of 89 basis points and appears to

be focused on large cap companies of India. However, the

concentration risk of the company is high and assets are not spread

among a variety of firms (see the Zacks ETF Center

for more info on ETF Investing).

Again, Infosys Ltd and Reliance Industries Ltd takes the top 2

position in the top 10 list although the sector breakdown is a

little different. Banks takes the top position in terms of sector

holding While the fund has delivered a total return of 36.34% over

the trailing one year period.

India ETF Outlook

India ETFs did not perform well in the last year attributable to

the global crisis, instability in the market and higher inflation;

however, 2012 look to be a different scenario for global markets as

well as Indian stocks in particular. Global growth, although

expected to be somewhat tepid, could give emerging markets like

India an opportunity to lead, especially if domestic consumption

drives prices higher.

In particular though, the growth for India’s economy this year

could be quite high, with many putting it in the range of 7% to 10%

for the year. Given this high growth, and FII’s inflows into the

market, 2012 could be a great bounce back year for India,

suggesting that an allocation to the nation’s ETFs could be long

overdue for many investors (Three Overlooked Emerging Market

ETFs).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

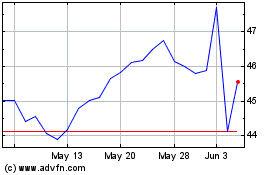

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

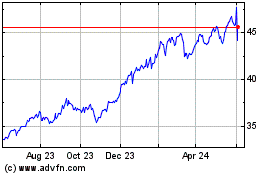

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Jan 2024 to Jan 2025