Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-267520

February 12, 2025

| |

2025 THE TOP ETF INNOVATORS |

|

|

|

|

State Street Global Advisors

1 Iron Street, Boston, MA 02210 • www.ssga.com

|

| |

|

| |

As the investment management arm of State Street, we draw from our global scale and market-tested expertise to create original solutions and better outcomes for our clients and the world's investors. |

| |

|

|

|

| |

|

|

|

| |

Wide Access to Diverse

Investment Opportunities

|

| |

|

|

|

| |

After creating many of the world's first exchange-traded funds, our family of ETFs has been giving investors new and better ways to invest for over 30 years.

Our global ETF business is committed to delivering simple, well-crafted and innovative solutions that can help investors execute on investments strategies, no matter how complex.

|

| |

|

| |

TICKER NAME |

CATEGORY |

EXPENSE |

| |

|

|

|

| |

SPY • SPDR® S&P 500® ETF TRUST |

• LARGE BLEND |

• 0.0945% |

| |

GLD® • SPDR® GOLD SHARES |

• COMMODITY |

0.40% |

| |

SOY • SPDR® S&P® DIVIDEND ETF |

• MID-CAP VALUE |

0.35% |

| |

DECO • SPDR® GALAXY DIGITAL ASSET ECOSYSTEM ETF |

• DIGITAL ASSETS |

0.65% |

| |

TOTL • SPDR®DOUBLELINE®TOTAL RETURN TACTICAL ETF |

• INTERMEDIATE CORE |

0.55% |

| |

|

• PLUS BOND |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Disclosures

Investing involves risk including the risk of loss of principal.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETFs' net asset value. Brokerage commissions and ETF expenses will reduce returns.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

Passively managed funds invest by sampling the index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the index.

Diversification does not ensure a profit or guarantee against loss.

Investing in commodities entails significant risk and is not appropriate for all investors. Important Information Relating to GLD:

GLD has filed a registration statement (including a prospectus) with the Securities and Exchange Commission ("SEC") for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents GLD has filed with the SEC for more complete information about

|

GLD and this offering. Please see the GLD prospectus for a detailed discussion of the risks of investing in GLD shares. You may get these documents for free by visiting EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, GLD or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053.

GLD is not an investment company registered under the Investment Company Act of 1940 (the "1940 Act") and is not subject to regulation under the Commodity Exchange Act of 1936 (the "CEA''). As a result, shareholders of GLD do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA.

GLD shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of GLD shares relates directly to the value of the gold held by GLD (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. GLD does not generate any income, and as GLD regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Share will decline over time to that extent.

GLD® is a registered trademark of World Gold Trust Services, LLC used with the permission of World Gold Trust Services, LLC.

The Fund may invest in companies within the cryptocurrency, digital asset and blockchain industries that use digital asset technologies or provide products or services involved in the operation of the technology. The technology relating to digital assets, including blockchains and cryptocurrency, is new and developing and the risks associated with digital assets may not fully emerge until the technology is widely used. The effectiveness of the Fund's strategy may be limited given that the operations of companies in the cryptocurrency, digital asset and blockchain industries are expected to be significantly affected by the overall sentiment related to the technology and digital assets, and that the companies' stock prices and the prices of digital assets could be highly correlated. Certain features of digital asset technologies, such as decentralization, open source protocol, and reliance on peer-to-peer connectivity, may increase the risk of fraud or cyber-attack.

Restrictions imposed by governments on digital asset related activities may adversely impact blockchain companies and, in turn, the Fund. Companies within the cryptocurrency, digital asset and blockchain industries may also be impacted by the risks associated with digital asset markets generally.

The Fund may invest in companies that rely on technologies such as the Internet and depend on computer systems to perform business and operational functions, and therefore may be prone to operational and information security risks resulting from cyber-attacks and/or technological malfunctions. Successful cyber-attacks against, or security breakdowns of, a company included in the Fund's portfolio may result in material adverse consequences for such company, as well as other companies included in the portfolio, and may cause the Fund's investments to lose value.

Concentrated investments in a particular industry tend to be more volatile than the overall market and increases risk that events negatively affecting such industries could reduce returns, potentially causing the value of the Fund's shares to decrease.

DECO and TOTL are actively managed. The sub adviser's judgments about the attractiveness, relative value, or potential appreciation of a particular sector, security, commodity or investment strategy may prove to be incorrect, and may cause the Fund to incur losses. There can be no assurance that the sub-adviser's investment techniques and decisions will produce the desired results.

The value of certain of the Fund's investments in cryptocurrency ETFs and ETPs that invest in crypto assets and in publicly traded securities of companies engaged in digital asset-related businesses and activities are subject to fluctuations in the value of the crypto asset, which may be highly volatile. The market for crypto asset futures contracts may be less developed, and potentially less liquid and more volatile, than more established futures markets.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates rise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Intellectual Property Information: The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates ("S&POJI") and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones")

and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P OJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P OJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

Distributor State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member FINRA, is distributor for SPDR S&P 500, a unit investment trust.

SSGA Funds Management has retained Galaxy Digital Capital Management LP ("Galaxy Digital") and Doubleline Capital LP as the sub-advisor.

Galaxy Digital and Doubleline Capital LP are not affiliated with State Street Global Advisors Funds Distributors, LLC

Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit ssga.com. Read it carefully.

© 2025 State Street Corporation. All Rights Reserved.

State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC. One Iron Street, Boston, MA 02210

Not FDIC Insured - No Bank Guarantee - May Lose Value

7452380.1.3.AM.RTL I SPD003795 I Exp. Date:

12/31/2025

SPDR® GOLD TRUST has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov or by visiting www.spdrgoldshares.com. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus if you request it by calling 1-866-320-4053.

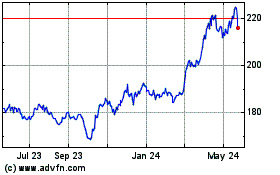

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Feb 2024 to Feb 2025