Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-267520

February 3, 2025

Video Interview Transcript

[00:00:00] Keith Black: I'm Keith Black with RIA Channel, joined today by George Milling-Stanley, Chief Gold Strategist for State Street Global Advisors. Welcome, George.

George Milling-Stanley: Hello, Keith. Good to see you again.

Keith Black: 2024 marked the 20th anniversary of GLD. Tell me what changes the launch of that product has brought to the gold landscape.

[00:00:24] George Milling-Stanley: we were described as having, as having [00:00:30] essentially democratized investing in gold. Um, we were told that we had taken the friction out of investing in gold. What we did was essentially, um, World Gold Council in partnership with State Street Global Advisors, basically made it easier for investors to gain exposure to movements in the price of gold without necessarily the need to have the gold in their own possession.

[00:00:55] George Milling-Stanley: And that brought an awful lot of changes to the supply demand matrix [00:01:00] for gold. One of the reasons why we wanted to try to revitalize gold investment back in 2004 was because, um, at the time, investment was accounting for about 10 percent of total gold demand every year, um, about the same amount as was going into industrial applications, mostly in electronics, and a full 80 percent of each year's demand back in 2004 was going into the jewelry business.

[00:01:26] George Milling-Stanley: And we figured that that was dangerous overexposure to, uh, [00:01:30] to just one, uh, demand source. Um, so what we wanted to do was to try to change that picture. And I think that we have the average over the last five years, looking at, uh, the demand statistics. That jewelry is just a little under half. Um, and that investment is around about 30 percent up from about 10 percent.

[00:01:51] George Milling-Stanley: And that's more or less evenly split between exchange traded funds and the traditional bars and coins. There's a lot of countries that don't [00:02:00] have reliable physically backed gold exchange traded funds. So that's essentially the, uh, the difference that, uh, that the launch of GLD 20 years ago has made.

[00:02:10] Keith Black: Well, congratulations. Now, what are the main drivers of gold right now? How do you see the outlook on those drivers going into 2025?

[00:02:18] George Milling-Stanley: Yeah, look, we had a pretty good year in 2024. Um, I think that, uh, main driver in 2025 is going to continue to be, um, significant central [00:02:30] bank demand. Central banks, mostly in the emerging markets, not exclusively, but mostly in the emerging markets, have been very strong buyers of gold for 15 straight years now.

[00:02:41] George Milling-Stanley: Uh, and we're looking forward to, uh, to a 16th year of continued good demand. I think that most of these emerging market central banks have too much of their official reserves in their own view, in dollar denominated debt instruments, too much exposure to the US, and nowhere near enough [00:03:00] exposure to gold, less than 5 percent on average across the emerging markets.

[00:03:04] George Milling-Stanley: So that's the sort of balance that they have been trying to redress for the last 15 years. Um, they haven't really moved the needle very much. They still want to continue along that path, and I think so we're going to see continued strong central bank demand - that's been with us for a good long time. We expect that to continue.

[00:03:22] George Milling-Stanley: In addition to that, again, with the emerging markets leading, we are expecting to see significant increases [00:03:30] in, uh, in gold jewelry demand and in demand for, for gold as an investment. We saw a big jump in investment demand in the emerging markets last year. Toward the end of the year, we started to see an increase in jewelry.

[00:03:43] George Milling-Stanley: Some of that I think was in anticipation of Chinese New Year, which comes up just, uh, just next month. Um, but I think that there has been a general trend to stronger jewelry demand across China and India, which are the two titans of gold jewelry demand in the emerging markets, but other [00:04:00] countries as well.

[00:04:00] George Milling-Stanley: So I think that's going to be the second major driver. And the third driver, and again, this is something we identified that was driving prices up 27 percent in 2024, was a significant revival in Western world investment, rather different from the emerging market revival in investment demand. The Western world investment was driven, I think, mostly by macroeconomic considerations, the fears of a recession, the, the likelihood [00:04:30] of, of, um, you know, the, the possibility that Jerome Powell's mantra of higher for longer on interest rates might well mean too high for too long and actually tip the U.S.

[00:04:41] George Milling-Stanley: economy into recession. I think that those fears have significantly receded, um, but nevertheless people are, are still very concerned at the sticky rate of inflation, it is, it is a lot higher than the Fed would like it to be, even though they've had some success in bringing the rate of inflation down.

[00:04:59] George Milling-Stanley: And the [00:05:00] economy in the U. S. and the labor market are still running along like an express train. And I think that's a little disturbing, uh, to, to a number of people. Uh, and I think also, geopolitical considerations have played a role in 2024, and I'm not seeing an awful lot of improvement in the geopolitical situation.

[00:05:18] George Milling-Stanley: We still have an armed conflict in Europe with the potential to turn nuclear at the push of a button. The conflict in the Middle East, uh, in 2024 spread way beyond just being inside the borders of [00:05:30] Israel, and there's now open conflict between Israel and Iran, and major conflict also between Israel and Lebanon, in spite of attempts to, to engineer a ceasefire.

[00:05:40] George Milling-Stanley: So I think that those, uh, considerations are really what drove Western investment demand to increase in 2024. And I think that those considerations will remain in place for 2025, Keith.

[00:05:55] Keith Black: And George, you recently published a survey on the impact of gold ETFS. Were there any [00:06:00] surprises for you personally in those results?

[00:06:03] George Milling-Stanley: Uh, yeah, look, what we did, we surveyed somewhere around a thousand people, um, uh, people who had a quarter of a million dollars in investable assets. And, um, a couple of things that, that surprised me a year ago when we did the same kind of survey, um, something like 20 percent of the people that we surveyed owned some, had some exposure to movements in the gold price. That almost doubled in the most recent survey, it was [00:06:30] 38 percent of the investors that we surveyed held some gold.

[00:06:33] George Milling-Stanley: So that was one surprise that the near doubling. And I think the second thing was that I'd always thought that people my age and older, the baby boomer generation, if you like, I'd always thought that those were the people who had the best understanding of gold. Because they'd lived through Black Monday in in1987, for example, and the bursting of the dot com bubble.

[00:06:57] George Milling-Stanley: They'd lived through significant inflation in the [00:07:00] 70s. Um, I've always thought that they would be, logically, the people who would own the most gold. So I was somewhat surprised to find that 61 percent of the millennials that we surveyed owned gold. And that compared with only 35 percent of Gen Xers, and a mere 20 percent

[00:07:18] George Milling-Stanley: for baby boomers. So that was a big big surprise. I expected boomers to be taking the lead in gold investment and as it turns out, uh, it's millennials along with uh along [00:07:30] with gen x.

[00:07:32] Keith Black: It's definitely a bullish sign for the long run. How do you see the role of gold in a portfolio?

[00:07:37] George Milling-Stanley: I think um the most, the reason most people throughout history have bought gold is because it offers them protections.

[00:07:45] George Milling-Stanley: Um, it offers them diversification because gold does not have a strong relationship with stocks or bonds. The typical things you'd find in any properly balanced portfolio. So that's the first thing that is offering protection there. [00:08:00] Historically, gold has also offered protection against sustained high inflation.

[00:08:04] George Milling-Stanley: And let me define those terms for you, Keith. Um, by sustained, I mean a minimum of two years and by high inflation, I mean more than 5 percent increase in the rate of inflation a year. Um, and we probably haven't had much of that since the 1970s. But whenever we have had sustained high inflation, then the gold price has done very, very well on an annual basis, going up in the 13, 14, 15 percent area.

[00:08:29] George Milling-Stanley: [00:08:30] So I think that people still expect gold to offer them protection against sustained high inflation. There's also a general belief. I mentioned Black Monday in 1987 and the bursting of the dot com bubble in 2000. Um, there's a general belief that historically gold has offered some protection against potential weakness in the equity market.

[00:08:51] George Milling-Stanley: Um, and there are always fears that, uh, that the equity market might not perform. It hasn't really performed very much in the first week of the year, for example. [00:09:00] I know it's still very, very early days yet. Um, but nevertheless, gold has in the past offered some protection against potential weakness in equities.

[00:09:09] George Milling-Stanley: And the last thing I'll mention, again, historically, um, gold has always offered some protection against weakness in the, uh, in, in the dollar exchange rate. Um, and I think that people are expecting that the, the dollar will gradually revert to the mean. In other words, go back to the pre-2022 levels. It [00:09:30] was in 2022 that, uh, that the dollar surged to a 20 year plus high against just about every other currency.

[00:09:38] George Milling-Stanley: And that also was something of a headwind for gold in 2022. Most commentators, including myself, have been wondering when we were going to see some kind of a reversion to the mean in the dollar, if the Fed is able to continue cutting interest rates. Even though they've already indicated that they they're planning on slowing the pace of cuts if the Fed is [00:10:00] able to continue cutting interest rates, then logically one would expect the dollar to come down somewhat. It has been much much higher than the long term average for a couple of years now, and I think a lot of people are expecting it to decline.

[00:10:14] Keith Black: Thanks for sharing with us today George and congratulations again on 20 years of GLD.

George Milling-Stanley: Thanks, Keith. Good to be with [00:10:30] you.

Important Risk Information

Investing involves risk, and you could lose money on an investment in SPDR® Gold Trust (“GLD®” or “GLD”).

This video is provided for informational purposes only and should not be considered investment advice or an offer for a particular security or securities. The views and opinions expressed by the speaker are those of his or her own, and do not necessarily represent the views of State Street or its affiliates.

Commodities and commodity-index linked securities may be affected by changes in overall market movements, changes in interest rates and other factors such as weather, disease, embargoes, or political and regulatory developments, as well as trading activity of speculators or arbitrageurs in the underlying commodities.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Diversification does not ensure a profit or guarantee against loss.

Investing in commodities entails significant risk and is not appropriate for all investors.

Important Information Relating to GLD:

GLD has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents GLD has filed with the SEC for more complete information about GLD and this offering. Please see the GLD prospectus for a detailed discussion of the risks of investing in GLD shares. You may get this document for free by visiting ssga.com at www.ssga.com/gldprospectus, EDGAR on the SEC website at sec.gov or by visiting spdrgoldshares.com. Alternatively, the Funds or any authorized participant will arrange to send you the prospectus if you request it by calling 866.320.4053.

GLD is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders of GLD do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA.

GLD shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of GLD shares relates directly to the value of the gold held by GLD (less its expenses), and fluctuations in the price of gold could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the gold represented by them. GLD does not generate any income, and as GLD regularly sells gold to pay for its ongoing expenses, the amount of gold represented by each Share will decline over time to that extent.

The World Gold Council name and logo are a registered trademark and used with the permission of the World Gold Council pursuant to a license agreement. The World Gold Council is not responsible for the content of, and is not liable for the use of or reliance on, this material. World Gold Council is an affiliate of GLD’s sponsor.

GLD® is a registered trademark of World Gold Trust Services, LLC used with the permission of World Gold Trust Services, LLC.

State Street Global Advisors and its affiliates have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

The whole or any part of this work may not be reproduced, copied or retransmitted or any of its content disclosed to third parties without SSGA’s express written consent.

Intellectual Property Information: The S&P 500® Index is a product of S&P Dow Jones Indices LLC or its affiliates (“S&P DJI”) and have been licensed for use by State Street Global Advisors. S&P®, SPDR®, S&P 500®, US 500 and the 500 are trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and has been licensed for use by S&P Dow Jones Indices; and these trademarks have been licensed for use by S&P DJI and sublicensed for certain purposes by State Street Global Advisors. The fund is not sponsored, endorsed, sold or promoted by S&P DJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of these indices.

For more information, please contact the Marketing Agent for GLD and GLDM: State Street Global Advisors Funds Distributors, LLC, One Iron Street, Boston, MA, 02210; T: +1 866 320 4053 spdrgoldshares.com

© 2025 State Street Corporation. All Rights Reserved.

State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, One Iron Street, Boston, MA 02210

Not FDIC Insured • No Bank Guarantee • May Lose Value

7382322.2.1.AM.RTL

Exp. Date 1/31/2026

SPDR® GOLD TRUST has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov or by visiting www.spdrgoldshares.com. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus if you request it by calling 1-866-320-4053.

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

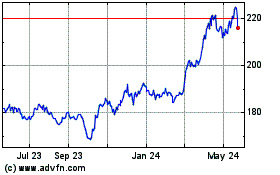

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Feb 2024 to Feb 2025