false

0001389545

0001389545

2024-11-22

2024-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: November 22, 2024

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-33678

|

68-0454536

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange On Which Registered

|

|

Common Stock, par value $0.01 per share

|

|

NBY

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

On November 22, 2024, NovaBay Pharmaceuticals, Inc. (the “Company”) held its 2024 Special Meeting of Stockholders (the “Special Meeting”), whereby the Company’s stockholders were asked to consider three (3) proposals, each of which is described in more detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on October 16, 2024, as supplemented from time to time (collectively, the “Proxy Statement”). There were 4,885,693 outstanding shares entitled to vote as of the record date and 2,091,083 shares present in person or by proxy at the Special Meeting, representing approximately forty-three percent (43%) of the shares outstanding and entitled to vote. The voting results with respect to one of the three proposals, as certified by the inspector of election for the Special Meeting, are presented below.

|

1.

|

To approve the sale of Avenova, representing substantially all of the assets of the Company (the “Asset Sale”), pursuant to the Asset Purchase Agreement dated September 19, 2024, by and between the Company and PRN Physician Recommended Nutriceuticals, LLC.

|

As disclosed below under Item 8.01, which is incorporated herein by reference, the Special Meeting was adjourned with respect to this Proposal One to solicit additional proxies.

|

2.

|

To approve the liquidation and dissolution of the Company (the “Dissolution”), pursuant to the Plan of Complete Liquidation and Dissolution of the Company (the “Plan of Dissolution”), which, if approved, will authorize the Company to liquidate and dissolve in accordance with the Plan of Dissolution, and pursuant to the discretion of the Board of Directors to proceed with the Dissolution.

|

As disclosed below under Item 8.01, which is incorporated herein by reference, the Special Meeting was adjourned with respect to this Proposal Two to solicit additional proxies.

|

3.

|

To grant discretionary authority to the Board of Directors to adjourn the Special Meeting from time to time, if necessary or appropriate, to establish a quorum or, even if a quorum is present, to permit further solicitation of proxies if there are not sufficient votes cast at the time of the Special Meeting in favor of Proposal One and/or Proposal Two.

|

|

For

|

Against

|

Abstain

|

|

1,818,153

|

249,255

|

23,675

|

At the time of the Special Meeting, there were insufficient votes to approve Proposal One, which sought the approval for the Asset Sale pursuant to the Asset Purchase Agreement, and Proposal Two, which sought the approval for the Dissolution pursuant to the Plan of Dissolution. Accordingly, the Special Meeting was adjourned on Proposal One and Proposal Two, and as announced at the Special Meeting, such meeting will reconvene at 11:00 a.m. Pacific Time on December 18, 2024 virtually at http://www.virtualshareholdermeeting.com/NBY2024SM. During the period of adjournment, the Company will continue to solicit stockholder votes on Proposal One and Proposal Two.

On November 22, 2024, the Company issued a press release announcing that it had adjourned the Special Meeting. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, which is incorporated by reference.

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NovaBay Pharmaceuticals, Inc.

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Justin M. Hall

|

| |

|

Justin M. Hall

|

| |

|

Chief Executive Officer and General Counsel

|

Dated: November 22, 2024

Exhibit 99.1

NovaBay Pharmaceuticals to Reconvene Special Meeting of Stockholders on December 18, 2024

Initial meeting adjourned due to insufficient votes to reach the 50% threshold of outstanding common shares voting in favor of Proposal One and Proposal Two

Stockholders who have not voted are strongly encouraged to vote FOR Proposal One and Proposal Two

EMERYVILLE, Calif. (November 22, 2024) – NovaBay® Pharmaceuticals, Inc. (NYSE American: NBY) (“NovaBay” or the “Company”) announces that its Special Meeting of Stockholders held on November 22, 2024 has been adjourned until December 18, 2024 at 11:00 a.m. Pacific time to provide stockholders additional time to vote on Proposal One and Proposal Two. Both proposals received significant support based on the shares that have been voted by stockholders but have yet to reach the 50% threshold of favorable votes of all outstanding shares of common stock required to approve each proposal.

| |

●

|

Proposal One is a proposal to approve the sale of Avenova, representing substantially all of the assets of the Company (the “Asset Sale”), pursuant to the Asset Purchase Agreement, dated September 19, 2024, by and between the Company and PRN Physician Recommended Nutriceuticals, LLC.

|

| |

●

|

Proposal Two is a proposal to approve the liquidation and dissolution of the Company, pursuant to the Plan of Complete Liquidation and Dissolution of the Company (the “Plan of Dissolution”) which, if approved, would authorize the Company to liquidate and dissolve in accordance with the Plan of Dissolution, and pursuant to the discretion of the Board of Directors to proceed with the dissolution.

|

As of the Special Meeting of Stockholders, approximately 89.0% of the shares that had been voted on Proposal One and 88.5% of the shares that had been voted on Proposal Two were voted in its favor. The Board of Directors continues to believe that the approval of Proposal One and Proposal Two is in the best interests of NovaBay and its stockholders, and one of the leading independent proxy voting advisory groups, Institutional Shareholder Services (“ISS”), recommended that stockholders vote FOR Proposal One and FOR Proposal Two. Proposal One and Proposal Two are further described in the Definitive Proxy Statement, filed with the Securities and Exchange Commission (“SEC”) on October 16, 2024 (the “Special Meeting Proxy Statement”), as supplemented by the Additional Definitive Proxy Soliciting Materials filed on November 6, 2024 and November 12, 2024.

Adjournment of Special Meeting of Stockholders

The adjourned meeting will be held in a virtual format and stockholders will be able to listen and participate in the virtual special meeting, as well as vote and submit questions during the live webcast of the meeting by visiting http://www.virtualshareholdermeeting.com/NBY2024SM and entering the 16‐digit control number included in your proxy card.

NovaBay encourages any stockholder as of the record date of October 15, 2024 who has not yet voted its shares on Proposal One or Proposal Two or is uncertain if their shares have been voted on Proposal One or Proposal Two to contact their broker or bank to vote their shares. The Board of Directors and management requests that these stockholders consider and vote their proxies as soon as possible on Proposal One and Proposal Two, but no later than December 17, 2024 at 11:59 p.m. Eastern time.

Stockholders who have previously submitted their proxy or otherwise voted on Proposal One and Proposal Two at the Special Meeting of Stockholders and who do not want to change their vote need not take any action. For questions relating to the voting of shares or to request additional or misplaced proxy voting materials, please contact NovaBay’s proxy solicitor, Sodali & Co, for assistance in voting your shares U.S. Toll Free at (800) 607-0088.

As described in the Special Meeting Proxy Statement, a stockholder may use one of the following simple methods to vote their shares of common stock, or change their previously submitted vote, before the December 18, 2024 adjourned meeting with respect to Proposal One or Proposal Two:

| |

●

|

By Internet – www.proxyvote.com. If you have Internet access, you may transmit your voting instructions up until 11:59 p.m., Eastern time, the day before the adjourned Special Meeting date, that is, December 18, 2024. Go to www.proxyvote.com. You must have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

|

| |

●

|

By telephone – 1-800-690-6903. You may vote using any touch-tone telephone to transmit your voting instructions up until 11:59 p.m., Eastern time, the day before the adjourned Special Meeting date, that is, December 17, 2024. Call 1-800-690-6903 toll free. You must have your proxy card in hand when you call this number and then follow the instructions.

|

| |

●

|

By mail – Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided.

|

Votes must be received by 11:59 p.m. Eastern time on December 17, 2024 to be counted. After this time, votes can only be cast during the adjourned Special Meeting on December 18, 2024 at 11:00 a.m. Pacific time at http://www.virtualshareholdermeeting.com/NBY2024SM.

About NovaBay Pharmaceuticals, Inc.

NovaBay’s leading product Avenova® Lid & Lash Cleansing Spray is often recommended by eyecare professionals for blepharitis and dry eye disease. Manufactured in the U.S., Avenova spray is formulated with NovaBay’s patented, proprietary, stable and pure form of hypochlorous acid. All Avenova products are available directly to consumers through online distribution channels such as Amazon.com and Avenova.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. These forward-looking statements are based upon the Company and its management’s current expectations, assumptions, estimates, projections and beliefs. Such statements include, but are not limited to, statements regarding the Asset Sale (including the Asset Purchase Agreement, by and between PRN Physician Recommended Nutriceuticals, LLC and the Company, dated as of September 19, 2024 and as amended on November 5, 2024), the potential liquidation and dissolution of the Company and related matters. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or achievements to be materially different and adverse from those expressed in, or implied by, these forward-looking statements. Other risks relating to NovaBay’s business, including risks that could cause results to differ materially from those projected in the forward-looking statements in this press release, are detailed in the Company’s latest Form 10-K, subsequent Forms 10-Q and/or Form 8-K filings with the SEC and the Special Meeting Proxy Statement, as supplemented including by the Supplement to the Special Meeting Proxy Statement dated as of November 12, 2024, especially under the heading “Risk Factors.” The forward-looking statements in this release speak only as of this date, and the Company disclaims any intent or obligation to revise or update publicly any forward-looking statement except as required by law.

Additional Information and Where to Find It

In connection with the solicitation of proxies, on October 16, 2024, NovaBay filed the Special Meeting Proxy Statement with the SEC with respect to the Special Meeting to be held in connection with the Asset Sale and a potential voluntary liquidation and dissolution of the Company. Promptly after filing the Special Meeting Proxy Statement with the SEC, NovaBay mailed the Special Meeting Proxy Statement and a proxy card to each stockholder entitled to vote at the Special Meeting to consider the Asset Sale and potential dissolution. Subsequently, the Company filed a Supplement to the Special Meeting Proxy Statement on November 12, 2024. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT NOVABAY HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the Special Meeting Proxy Statement, any amendments or supplements thereto, and any other relevant documents filed by NovaBay with the SEC in connection with the Asset Sale and potential dissolution at the SEC’s website (http://www.sec.gov) or at the Company’s investor relations website (https://novabay.com/investors/) or by writing to NovaBay Pharmaceuticals, Inc., Investor Relations, 2000 Powell Street, Suite 1150, Emeryville, CA 94608. The information provided on, or accessible through, our website is not part of this communication, and therefore is not incorporated herein by reference.

Participants in the Solicitation

NovaBay and its directors and executive officers may be deemed to be participants in the solicitation of proxies from NovaBay’s stockholders in connection with the Asset Sale and the potential dissolution. A list of the names of the directors and executive officers of the Company and information regarding their interests in the Asset Sale and the potential dissolution, including their respective ownership of the Company’s common stock and other securities is contained in the Special Meeting Proxy Statement. In addition, information about the Company’s directors and executive officers and their ownership in the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and filed with the SEC on March 26, 2024, as amended on March 29, 2024 and as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing.

Socialize and Stay Informed on NovaBay’s Progress

Like us on Facebook

Follow us on X

Connect with NovaBay on LinkedIn

Visit NovaBay’s Website

Avenova Purchasing Information

For NovaBay Avenova purchasing information:

Please call 800-890-0329 or email sales@avenova.com

Avenova.com

NovaBay Contact

Justin Hall

Chief Executive Officer and General Counsel

510-899-8800

jhall@novabay.com

Investor Contact

Alliance Advisors IR

Jody Cain

310-691-7100

jcain@allianceadvisors.com

# # #

v3.24.3

Document And Entity Information

|

Nov. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 22, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

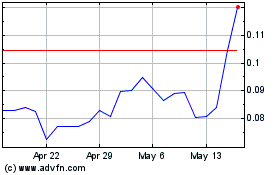

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Jan 2025 to Feb 2025

NovaBay Pharmaceuticals (AMEX:NBY)

Historical Stock Chart

From Feb 2024 to Feb 2025