S&P 500 Expected to Be Volatile This Week

December 11 2023 - 4:21AM

Finscreener.org

On Friday, the

S&P 500 achieved a

new peak for the year, bolstered by the latest jobs report and

University of Michigan consumer survey data, which indicated a

robust economy and easing inflation. The development has heightened

optimism for the economyU+02019s potential U+02019soft

landing.U+02019

The S&P 500 experienced a

0.41% increase, closing at 4,604.37, while the Nasdaq Composite edged up by 0.45%, finishing at 14,403.97.

The

Dow Jones Industrial Average also saw gains, rising by 130.49 points, or

0.36%, to conclude at 36,247.87.

Last week, the S&P 500

posted its highest yearly close and surpassed its 2023 intraday

high set in July, reaching over 4,609 during afternoon trading on

Friday. It marks an approximate 20% increase for the year, with the

index at its highest since March 2022. All major averages ended the

week on a positive

note, with the broad market index up by 0.2% and the Dow

slightly higher, marking their longest winning streak since 2019.

The Nasdaq climbed 0.7%.

Michael Arone, Chief Investment

Strategist at State Street Global Advisors, noted that the

employment data reflects an economy far from recession. He

emphasized that declining inflation expectations and improving

consumer sentiment are encouraging signs supporting the soft

landing scenario.

"The trajectory for stocks and

risk assets remains upbeat as long as the soft landing scenario

holds," he stated. He highlighted that factors like decreasing

inflation and an improved balance between labor supply and demand,

without a significant rise in unemployment, are positive indicators

for market sentiment.

Jobs report and interest

rates

Last Tuesday, the Job Openings

and Labor Turnover Survey (JOLTS) revealed the lowest labor market

figures since March 2021, with job openings dropping to 8.773

million against an expected 9.4 million.

On the flip side, continuing

claims recently reached a two-year peak and showed a significant

drop of 64,000 from the prior week — the most substantial decrease

since July. It marks only the second reduction in continuing claims

in the past 11 weeks, suggesting a trend towards a softer job

market, although future data may show some

fluctuations.

In further positive news for

optimistic market watchers, there was an upward adjustment in

productivity to 5.2% from the initially reported 4.9%, alongside a

decrease in unit labor costs to 2.6% from 3.2%.

Yields on the 10-year Treasury

reached a three-month low of 4.106% on Friday but have since

climbed by approximately 12 basis points to 4.25% following the

latest employment data. This rise, occurring after a roughly 90

basis point drop in 10-year yields over seven weeks, hints that the

decline may have been too rapid.

Although the increase

doesnU+02019t change the recent downward trend, it raises questions

about whether market expectations regarding the trajectory of

yields and potential Federal Reserve rate cuts next year are overly

optimistic.

As for the Federal

ReserveU+02019s future actions, BloombergU+02019s probability

estimates for a rate cut next year have decreased over the past

week. Last month, the likelihood of a cut at the March FOMC meeting

was around 76%, but this has now reduced to 48%.

While no surprises are

anticipated at the upcoming FOMC meeting, Federal Reserve Chair

Jerome Powell might adopt a more hawkish tone than the market

currently expects. The Fed will also have new inflation data to

consider before announcing its rate policy, with NovemberU+02019s

Consumer Price Index (CPI) due on Tuesday morning and the Producer

Price Index (PPI) set for release on Wednesday.

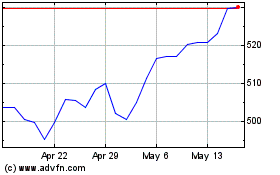

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Oct 2024 to Nov 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Nov 2023 to Nov 2024