Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, provides an update to its Mineral Reserve

and Mineral Resource statement as at June 30, 2022.

2022 Mineral Reserve and Mineral Resource Update

Highlights

- Since the June 2021 Mineral Reserve and Mineral Resource

statement, the Company’s exploration drilling has solely focused on

the Galena Complex joint venture (60% USA/40% Eric Sprott).

- Following the success of the Phase 1 drill program at the

Galena Complex, the Phase 2 drill program initially focused on

conversion of mineral resources to mineral reserves with increased

infill drilling in addition to continuing to drill new

targets.

- Year-over-year, P&P silver mineral reserves at the Galena

Complex (100% basis) increased from 16.6 million silver ounces to

20.9 million silver ounces, a 26% increase from the previous

estimate.

- M&I silver mineral resources (exclusive of mineral

reserves) at the Galena Complex on a 100% basis increased from 64.2

million silver ounces to 77.3 million silver ounces, a 20% increase

year-over-year.

- With the restart of mining at the Cosalá Operations in late

2021 and return to full production in early 2022 and limited

exploration conducted on the property, there was only minor

depletion of mineral reserves.

“The Company was successful in converting mineral resources to

mineral reserves and increased confidence categories of mineral

resource as part of the continued drilling at the Galena Complex,”

stated Americas President and CEO Darren Blasutti. “The conversion

of mineral resources to mineral reserves greatly supports our goal

to increase annual production at the Galena Complex. While we

focused on infill drilling, the Company was successful in

continuing to add ounces and increase the overall mineral resource

at the Galena Complex.”

Attributable Mineral Reserves and Mineral Resources

On a consolidated and attributable basis, estimated contained

metal in the proven and probable mineral reserve (“P&P”)

categories totalled 34.7 million ounces of silver (increase of 7%

year-over-year), 107.0 million pounds of zinc (decrease of 23%

y-o-y), 135.7 million pounds of lead (increase of 19% y-o-y) and

32.6 million pounds of copper (increase of 8% y-o-y). Estimated

contained metal in the measured and indicated mineral resource

(“M&I”) categories totalled 78.8 million ounces of silver

(increase of 8% y-o-y), 572 thousand ounces of gold (decrease of 2%

y-o-y), 815.0 million pounds of zinc (increase of 1% y-o-y), 796.0

million pounds of lead (increase of 10% y-o-y) and 32.7 million

pounds of copper (decrease of 5% y-o-y). Please refer to the

Company’s website for a breakdown of the Mineral Reserve and

Mineral Resource statement by asset.

Attributable Proven and Probable Mineral Reserves – June 30,

20221

Silver Mineral Reserves

Proven

Probable

Proven and Probable

Tonnes

Grade

Ounces

Tonnes

Grade

Ounces

Tonnes

Grade

Ounces

(kt)

(g/t)

(koz)

(kt)

(g/t)

(koz)

(kt)

(g/t)

(koz)

Total Silver

954

214

6,550

4,532

193

28,162

5,486

197

34,712

Zinc, Lead and Copper Mineral

Reserves

Proven

Probable

Proven and Probable

Tonnes

Grade

Pounds

Tonnes

Grade

Pounds

Tonnes

Grade

Pounds

(kt)

(%)

(Mlbs)

(kt)

(%)

(Mlbs)

(kt)

(%)

(Mlbs)

Total Zinc

708

2.76

43.1

957

3.03

64.0

1,665

2.92

107.0

Total Lead

871

2.29

44.0

1,422

2.93

91.8

2,293

2.69

135.7

Total Copper

83

0.61

1.1

3,109

0.46

31.5

3,192

0.46

32.6

At the Galena Complex, mineral reserves were successfully

increased as part of the Phase 2 infill drill program. The Company

replaced depletion from mining activities and added silver ounces

through an increase in ore associated with both silver-lead and

silver-copper veins. The Galena Complex added approximately 4.3

million ounces (100% basis) which represents a 26% increase

year-over-year. In addition to adding to the silver mineral

reserve, the Galena Complex added approximately 3.0 million pounds

of copper (100% basis) from the successful drilling of high-grade

silver-copper rich vein systems. The Galena Complex also added

significantly to the silver-lead mineralization which resulted in

adding approximately 64.2 million pounds of lead (100% basis).

The Company resolved the illegal blockade at the Cosalá

Operations and resumed mining and milling activities in Q4-2021. As

a result of the successful restart and with limited exploration

conducted on the property since the previously reported mineral

reserve estimate, the Cosalá Operations silver mineral reserve

decreased slightly to 22.2 million ounces, representing a 2%

decrease year-over-year. Mining has recently focused on the San

Rafael Main Zone which contains higher-grade zinc and lower-grade

silver. Mining of these higher-grade zinc areas resulted in zinc

mineral reserves decreasing from 139.9 million pounds to 107.0

million pounds year-over-year. Lead mineral reserves also decreased

due to mining dilution while copper mineral reserves increased

slightly year-over-year.

As a result of the temporary suspension of mining operations at

Relief Canyon in August 2021, the Company previously reclassified

all proven and probable mineral reserves into measured and

indicated mineral resources. The Company is presently continuing

with metallurgical testing.

Attributable Measured and Indicated Mineral Resources – June

30, 20221

Silver and Gold Mineral Resources –

Exclusive of Mineral Reserves

Measured

Indicated

Measured and Indicated

Tonnes

Grade

Ounces

Tonnes

Grade

Ounces

Tonnes

Grade

Ounces

(kt)

(g/t)

(koz)

(kt)

(g/t)

(koz)

(kt)

(g/t)

(koz)

Total Silver

14,632

34

15,984

23,837

82

62,849

38,469

64

78,834

Total Gold

12,177

0.90

352

10,431

0.66

220

22,608

0.79

572

Zinc, Lead and Copper Mineral Resources

– Exclusive of Mineral Reserves

Measured

Indicated

Measured and Indicated

Tonnes

Grade

Pounds

Tonnes

Grade

Pounds

Tonnes

Grade

Pounds

(kt)

(%)

(Mlbs)

(kt)

(%)

(Mlbs)

(kt)

(%)

(Mlbs)

Total Zinc

1,764

2.14

83.3

8,834

3.76

731.8

10,598

3.49

815.0

Total Lead

2,205

2.33

113.0

10,876

2.85

683.0

13,081

2.76

796.0

Total Copper

507

0.37

4.1

4,409

0.29

28.6

4,916

0.30

32.7

At the Galena Complex, while exploration focused on infill

drilling to increase mineral reserves, drilling also continued with

brownfield exploration to test new targets and define new veins.

The M&I silver mineral resource (100% basis) increased from

64.2 million silver ounces to 77.3 million silver ounces, a 19%

increase compared to last year. M&I lead mineral resource (100%

basis) increased by 18% year-over-year to 709.1 million pounds

while M&I copper mineral resource (100% basis) increased by 4%

year over year to 19.3 million pounds.

The Company continues to advance development further east along

the 5500 Level to allow for continued exploration of the 360

Complex and testing of the Caladay Zone. Development has crossed

the 291 Vein which was previously mined on the 5200 Level. The

Company is concurrently exploring and developing the 291 Vein given

the successful mining of the vein on the 5200 Level.

At the Cosalá Operations, as limited exploration drilling was

conducted on the property the M&I mineral resources are almost

unchanged year-over-year. The Company recently reinterpreted

historic geophysical information and, after incorporating new data

from an IP survey completed this summer, has identified seven major

IP/Mag anomaly trends on property near San Rafael and EC120. A

17-hole drill program is planned to test this area.

Attributable Inferred Mineral Resources – June 30,

20221

Silver and Gold Mineral

Resources

Inferred

Tonnes

Grade

Ounces

(kt)

(g/t)

(koz)

Total Silver

11,808

198

75,097

Total Gold

2,732

0.29

25

Zinc, Lead and Copper Mineral

Resources

Inferred

Tonnes

Grade

Pounds

(kt)

(%)

(Mlbs)

Total Zinc

4,447

2.51

246.0

Total Lead

7,276

3.86

619.9

Total Copper

3,809

0.37

30.9

Inferred silver mineral resources (100% basis) at the Galena

Complex decreased from 106.5 million silver ounces to 103.0 million

silver ounces as a result of successful conversion to M&I

mineral resources and P&P mineral reserves. Inferred lead

mineral resources (100% basis) at the Galena Complex decreased by

18% to 833 million pounds from 1,010 million pounds. The Galena

inferred copper mineral resources (100% basis) increased by 17% to

28.2 million pounds from the previously reported estimate.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Relief Canyon mine in Nevada, USA,

the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned

Galena Complex in Idaho, USA. The Company also owns the San Felipe

development project in Sonora, Mexico. For further information,

please see SEDAR or www.americas-gold.com.

Qualified Persons

Mineral Reserve estimates were prepared by Company personnel

under the supervision of Daren Dell, P.Eng., the Company’s Chief

Operating Officer. Mineral Resource estimates and technical or

scientific information in this news release were prepared

internally by, or under the supervision of, Niel de Bruin, P.Geo.,

the Company’s Director of Geology. Messrs. Dell and De Bruin are

each considered a “qualified person” for the purpose of National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

(“NI 43-101”). These estimates reflect the Company's 60% interest

in the Galena Complex. See “Notes for Mineral Reserve and Mineral

Resource Estimates” below regarding matters relating to review and

verification of sampling, analytical and test data underlying the

information contained in the written disclosure.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to, all mineral resource

and mineral reserve estimates, Americas Gold and Silver’s

expectations, intentions, plans, assumptions and beliefs with

respect to, among other things, estimated production rates and

results for gold, silver and other precious metals, as well as the

related costs, expenses and capital expenditures, the

recapitalization plan at the Galena Complex, exploration program

and completion of the hoist project, including the expected

production levels and potential additional mineral resources

thereat; expected production levels at the Cosalá Operations with

the resumption of mining operations having been achieved;

expectations regarding the level of support from the Mexican

government with respect to the long‐term stability of Cosalá

Operations, and its ability to maintain such support in the

near‐and long‐term; [the timing and conclusions of the data

compilation and analysis occurring at Relief Canyon, and] the

length of time of the temporary suspension in mining operations at

Relief Canyon. Often, but not always, forward-looking information

can be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “potential’,

“estimate”, “may”, “assume” and “will” or similar words suggesting

future outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions, or statements about future events or

performance. Forward-looking information is based on the opinions

and estimates of Americas Gold and Silver as of the date such

information is provided and is subject to known and unknown risks,

uncertainties, and other factors that may cause the actual results,

level of activity, performance, or achievements of Americas Gold

and Silver to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas Gold and Silver, these risks and uncertainties

include risks relating to widespread epidemics or pandemic outbreak

including the COVID-19 pandemic; the impact of COVID-19 on our

workforce, suppliers and other essential resources and what effect

those impacts, if they occur, would have on our business, including

our ability to access goods and supplies, the ability to transport

our products and impacts on employee productivity, the risks in

connection with the operations, cash flow and results of the

Company relating to the unknown duration and impact of the COVID-19

pandemic; interpretations or reinterpretations of geologic

information; unfavorable exploration results; inability to obtain

permits required for future exploration, development or production;

general economic conditions and conditions affecting the industries

in which the Company operates; the uncertainty of regulatory

requirements and approvals; fluctuating mineral and commodity

prices; the ability to obtain necessary future financing on

acceptable terms or at all; and risks associated with the mining

industry such as economic factors (including future commodity

prices, currency fluctuations and energy prices), ground conditions

and other factors limiting mine access, failure of plant,

equipment, processes and transportation services to operate as

anticipated, environmental risks, government regulation, actual

results of current exploration and production activities, possible

variations in ore grade or recovery rates, permitting timelines,

capital and construction expenditures, reclamation activities,

labor relations or disruptions, social and political developments

and other risks of the mining industry. The potential effects of

the COVID-19 pandemic on our business and operations are unknown at

this time, including the Company’s ability to manage challenges and

restrictions arising from COVID-19 in the communities in which the

Company operates and our ability to continue to safely operate and

to safely return our business to normal operations. The impact of

COVID-19 on the Company is dependent on a number of factors outside

of its control and knowledge, including the effectiveness of the

measures taken by public health and governmental authorities to

combat the spread of the disease, global economic uncertainties and

outlook due to the disease, and the evolving restrictions relating

to mining activities and to travel in certain jurisdictions in

which it operates. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Readers are cautioned not to

place undue reliance on such information. Additional information

regarding the factors that may cause actual results to differ

materially from this forward‐looking information is available in

Americas Gold and Silver’s filings with the Canadian Securities

Administrators on SEDAR and with the SEC. Americas Gold and Silver

does not undertake any obligation to update publicly or otherwise

revise any forward-looking information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law. Americas Gold and Silver

does not give any assurance (1) that Americas Gold and Silver will

achieve its expectations, or (2) concerning the result or timing

thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

Cautionary Note to U.S. Investors:

The terms “mineral resource”, “measured mineral resource”,

“indicated mineral resource”, “inferred mineral resource” used in

the press release are Canadian mining terms used in accordance with

NI 43-101 under the guidelines set out in the Canadian Institute of

Mining, Metallurgy and Petroleum Standards. Mineral resources which

are not mineral reserves do not have demonstrated economic

viability.

While the terms “mineral resource”, “measured mineral resource”,

“indicated mineral resource”, and “inferred mineral resource” are

recognized and required by Canadian regulations, they are not

defined terms under standards in the United States and normally are

not permitted to be used in reports and registration statements

filed with the Securities & Exchange Commission (“SEC”). As

such, information contained in the Company's disclosure concerning

descriptions of mineralization and resources under Canadian

standards may not be comparable to similar information made public

by U.S companies in SEC filings. With respect to “inferred mineral

resource” there is a great amount of uncertainty as to their

existence and a great uncertainty as to their economic and legal

feasibility. It cannot be assumed that all or any part of an

“inferred mineral resource” will ever be upgraded to a higher

category. Investors are cautioned not to assume that any part or

all of the mineral deposits in these categories will ever be

converted into mineral reserves.

____________________________ 1 Notes for Mineral Reserve and

Mineral Resource Estimates:

CIM (2014) Definition and Standards were followed for Mineral

Reserve and Mineral Resource Estimates. Mineral Reserves are

estimated at a net smelter return (“NSR”) cut-off value of

US$60/tonne at San Rafael, US$45/tonne at El Cajón, US$45/tonne at

Zone 120 and US$225/tonne at Galena. The NSR cut-off is calculated

using long-term assumptions based on operating results for metal

recoveries, off-site concentrate treatment costs, and on-site

operating costs. Mineral Reserves are estimated using metal prices

of US$20.00 per ounce of silver, US$2.75 per pound of copper,

US$0.90 per pound of lead and US$1.15 per pound of zinc. Numbers

may not add or multiply accurately due to rounding.

Mineral Resources are estimated at a NSR cut-off value of

US$34/tonne at San Rafael, US$45/tonne at El Cajón, US$45/tonne at

Zone 120 and US$198/tonne at Galena. Mineral Resources are

estimated at a 90 g/tonne silver equivalent cut-off grade at

Nuestra Señora. Mineral Resources are estimated at a 2.3% zinc

equivalent cut-off grade at San Felipe. Mineral Resources are

estimated at a 0.17g/tonne gold cut-off grade at Relief Canyon and

are constrained by a $1,500 gold pseudoflow pit shell. Inferred

Mineral Resources at Relief Canyon include existing low-grade

stockpiles. Mineral Resources are estimated using metal prices of

US$1,500 per ounce of gold, US$22.00 per ounce of silver, $3.50 per

pound of copper, US$1.10 per pound of lead and US$1.30 per pound of

zinc. Mineral Resources are reported exclusive of Mineral Reserves.

Mineral Resources do not have demonstrated economic viability.

Numbers may not add or multiply accurately due to rounding.

Inferred Mineral Resources are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is therefore no certainty that the conclusions of the initial

exploration drilling results will be realized. Additionally, where

the Company discusses exploration/expansion potential, any

potential quantity and grade is conceptual in nature and there has

been insufficient exploration to define a Mineral Resource and it

is uncertain if further exploration will result in the target being

delineated as a Mineral Resource.

Varying cut‐off grades have been used depending on the mine,

methods of extraction and type of ore contained in the mineral

reserves. Mineral Resource metal grades and material densities have

been estimated using industry‐standard methods appropriate for each

mineral project with support of various commercially available

mining software packages. The Company’s normal data verification

procedures have been employed in connection with the calculations.

Verification procedures include industry standard quality control

practices. Sampling, analytical and test data underlying the stated

mineral resources and mineral reserves have been verified by

employees of the Company under the supervision of Qualified

Persons, for purposes of 43‐101 and/or independent Qualified

Persons. The Company is not aware of any environmental, permitting,

legal, title, taxation, socio-economic, marketing, political, or

other relevant issues that would materially affect the Mineral

Reserve and Mineral Resource Estimates. Additional details

regarding Mineral Reserve and Mineral Resource estimation,

classification, reporting parameters, key assumptions and

associated risks for each of the Company’s mineral properties are

provided in the respective NI 43‐101 Technical Reports which are

available at www.sedar.com and the Company’s website at

www.americas-gold.com. Additional notes regarding the current

Mineral Reserve and Mineral Resource Statement are available on the

Company’s website at

www.americas-gold.com/operations/reserves-and-resources.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220913005596/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

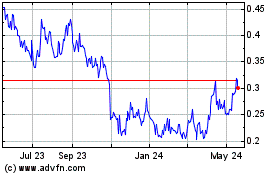

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Feb 2025 to Mar 2025

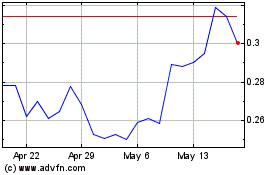

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Mar 2024 to Mar 2025