TIDMATC

RNS Number : 5561H

All Things Considered Group PLC

07 April 2022

All Things Considered Group Plc

("ATC", the "Company" or the "Group")

Trading and Corporate Update and Notice of Results

All Things Considered Group Plc (AQSE: ATC), an independent

music company housing talent management, live booking,

livestreaming and talent services , is pleased to provide the

following trading update.

FY21 Trading Update

The Board is pleased to report that it anticipates results for

the full year ended 31 December 2021 to be in line with management

expectations, with the Group expecting to report total revenue and

other operating income of circa GBP9.9m representing growth of

approximately 23% from 2020 (GBP8.0m). The Group adjusted loss

before tax* and non-controlling interests ('NCI') is expected to be

GBP2.8m (2020: GBP0.4m loss before tax and NCI) primarily due to a

non-recurring loss in H1 2021 as indicated at the time of IPO. The

Group adjusted loss before tax and NCI for H2 2021 is therefore

expected to be approximately GBP0.3m, being in line with

expectations and demonstrating a solid performance during the

prevailing Covid-constrained environment.

Following the successful fundraise at the Group's IPO in

December 2021, ATC retains a healthy cash position with a cash

balance of approximately GBP4.4m at year end.

*Note: all figures are unaudited. Group (loss)/profit before tax

is on a consolidated Group basis and prior to non-controlling

interests in accordance with IFRS. Reference to 'adjusted' figures

refers to the adjustments relating to the non-recurring IPO and

related costs.

Current Trading, Corporate Update and Outlook

The trading outlook for 2022 remains positive and management

expect ATC to record continued growth in revenue going forward. The

live music industry is continuing to see a significant growth in

activity following the relaxation of Covid restrictions and

consequently ATC's live agency and management divisions are

benefitting, with promising new clients including Nation of

Language, Connie Constance and Billy Nomates joining the live

roster and The Goa Express joining the management roster. Business

indicators are increasingly strengthening; in three consecutive

weeks in January and February, three of ATC Live's clients achieved

Top 3 UK album chart status in the week of release.

The Group's livestreaming division, Driift, successfully

delivered the first of its 'Full Circle' events in January with ATC

management client 'The Smile'. This new hybrid format brought

together a live ticketed audience in a bespoke venue designed

specifically for a global livestreaming audience and demonstrated

that Driift can benefit from a diversified revenue mix, as the

Directors anticipated. The show garnered a number of '5 star'

reviews and wide audience acclaim. This new hybrid format will

generate higher margin business for Driift. Importantly, this new

format demonstrates that the Company remains at the forefront of

the evolution of the growing livestreaming sector and Driift will

focus on higher profile artists for these shows in the coming

months in preference to a higher volume of lower margin 'livestream

only' projects.

Elsewhere, the service businesses are trading in line with

management expectations and the Group is benefitting from some

industry consultancy work which is adding to the revenue mix. The

service businesses are seeing growth as the global music market

emerges from the challenges of the pandemic. The Group recently

opened an office in New York to facilitate the continued expansion

of the US management and services businesses.

The Group was pleased to welcome Rameses Villanueva to the Board

as Group CFO on 28 February to bolster the Group's management team

and provide support for the next stage of the growth strategy.

More recently the Group has secured and received a short-term

promissory note loan of $6m. The Group has invested the $6m into a

new company formed with the express intention of investing in the

music digitisation, blockchain/web3 spaces . The minority

investment is made alongside a number of other parties who together

with ATC have invested over $80m in the new venture. ATC's equity

interests in the newly formed company are subject to a pledge in

favour of the lender, as sole security against ATC's obligations

under the loan arrangement. ATC will provide further updates in

relation to the investment and the loan in the near future.

Notice of Results

The Company expects to release its full year results in May

2022.

Adam Driscoll, CEO of All Things Considered, commented:

"Following our successful listing on the AQSE market in December

2021, we are pleased that the Group is seeing the positive impact

of the retreat of Covid restrictions and the opening up of global

music markets. The capital we raised at the end of 2021 has put us

in a strong position to take advantage of new opportunities in an

industry that has been substantially challenged over the last two

years. Our investment in our livestreaming business and the growth

of that segment, alongside our other more established business

units, means that we have a great mix of assets from which to build

a substantial company. The combination of the music industry's

traditional activities moving back to full velocity, alongside a

number of developments in new technologies spurring growth of new

revenue opportunities, means that there are exciting prospects for

the Group in the coming months and years."

For more information, please contact:

ATC Group Via Alma PR

Adam Driscoll, CEO

Rameses Villanueva, CFO

Canaccord Genuity +44(0)20 7523 8000

Aquis Corporate Adviser and Broker

Adam James / Georgina McCooke / Patrick

Dolaghan

Alma PR +44(0)20 3405 0205

Financial PR

Hilary Buchanan / Susie Hudson / Lily

Soares Smith

Notes to Editors

ATC Group is a prominent independent music company offering live

rights, live agency, production, artist management and investment

and a range of other music artist services. ATC Group is the only

independently-owned company in the industry housing talent

management, live booking, livestreaming and talent services within

the same group.

The Company has an established, long-standing client base with

over 50 artists on its management roster and over 400 acts on the

live roster. One of its livestreaming offerings, Driift, has

delivered shows with Niall Horan, Andrea Bocelli, Kylie, Johnny

Marr, The Smile and others, selling over 500,000 tickets across 171

countries since being established in June 2020.

The Group's five key divisions are:

-- ATC Management: artist management;

-- ATC Live: live event booking agency for artists;

-- Livestreaming : through Driift, a global livestreaming

business and Flymachine, a livestreaming platform;

-- ATC Services;

-- Polyphonic; an artist partnerships venture

The Group is headquartered in London, with offices in Los

Angeles, New York and Copenhagen and is led by an experienced

management team who have operated across multiple music industry

sectors.

For more information see: www.atcgroupplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXIFMBTMTIMTMT

(END) Dow Jones Newswires

April 07, 2022 02:10 ET (06:10 GMT)

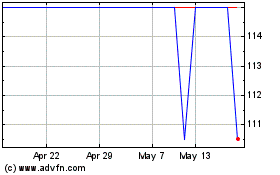

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Nov 2024 to Dec 2024

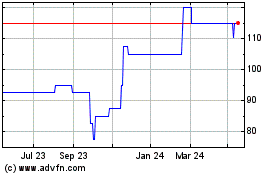

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Dec 2023 to Dec 2024