TIDMATC

RNS Number : 2089Q

All Things Considered Group PLC

27 June 2022

27 June 2022

All Things Considered Group Plc

("ATC", the "Company" or the "Group")

Final Results

Solid growth demonstrating strength of integrated business

model

All Things Considered Group Plc (AQSE: ATC), the independent

music company housing talent management, live booking,

livestreaming and talent services, is pleased to announce audited

results for the year ended 31 December 2021.

Financial Highlights

-- Revenue increased 28% to GBP9.1m (2020: GBP7.1m)

-- Revenue and other operating income increased 37% to GBP10.3m (2020: GBP7.5m)

-- Adjusted loss before tax* (and before non-controlling

interest) of GBP2.7m (2020: loss of GBP0.3m), partly due to a

non-recurring loss in H1 2021 resulting from a technical outage at

the Glastonbury 'Live at Worthy Farm' livestreamed event which was

disrupted by some technical issues caused by a third-party

supplier. This resulted in customer refunds and a reduction in

ticket sales

-- Adjusted loss before tax for H2 2021 of GBP0.1m,

demonstrating a solid performance during the prevailing

Covid-constrained environment

-- Improved cash position with net cash, after short term debt,

of GBP4.4m as at 31 December 2021 (2020: GBP1.6m)

*adjusted loss is the loss before tax adjusted to exclude

GBP0.6m of IPO and related costs

Operational Highlights

-- GBP2m strategic investment by Deezer into Driift, the Group's

pay-per-view livestreaming service, and five-year exclusive

collaboration arrangement with Dreamstage to leverage technical and

commercial potential

-- Significant number of new clients added to ATC's Management

and Live Agency rosters, despite market disruption from

Covid-related restrictions

-- Strengthened Board and management team, including appointment

of CFO post period end, providing capacity to scale

-- Further expansion into North American market with addition of

new services and larger footprint, including opening of New York

office post period end

-- Milestone listing on the Apex segment of the AQSE Growth

Market in December 2021, providing funding for further organic and

acquisitive growth

Current Trading and Outlook

-- Performance in line with management expectations, with good momentum into 2022

-- Significant upturn in live music activity following

relaxation of Covid-19 restrictions, benefitting ATC's Live Agency

and Management divisions

-- Strong and growing pipeline for the Group's evolving hybrid

live performance formats delivered by Driift, expected to generate

higher margin business going forward. Exemplified by the Little Mix

direct from the O2 livestream which generated substantial

livestream ticket sales alongside a broadcast into cinemas that was

number 5 in that weekend's UK cinema charts

Adam Driscoll, Chief Executive Officer of ATC Group plc,

commented :

"We are pleased to report on a year of significant advancements

for the Group, which saw double digit revenue growth despite

significant disruption from Covid-19 restrictions, the further

establishment of our new service offerings, an expanding market

footprint, and culminating in our successful IPO.

"The Group's unique business model based on an integrated

service approach for artists, or 'one-stop-shop,' and deep culture

of innovation, has demonstrated resilience and adaptability within

the rapidly changing music industry. An example of this is the

Driift produced and directed for-mobile performance for Westlife

that attracted a record-breaking online audience of 28 million

concurrent viewers in China alone.

"Strong momentum has continued through 2022 as market conditions

return to more normalised levels with the opening up of live events

and related activity. The music industry continues its path of

structural change, driven by new technologies, changing music

consumption behaviour, and artists' ownership over their commercial

interests, leaving the Group positioned to capitalise on new growth

opportunities. Supported by a healthy pipeline of opportunities,

the Board looks forward to a year of growth and with confidence in

achieving market expectations."

-S-

For more information, please contact:

ATC Group Via Alma PR

Adam Driscoll, CEO

Rameses Villanueva, CFO

Canaccord Genuity +44(0)20 7523 8000

Aquis Corporate Adviser and Broker

Adam James / Patrick Dolaghan

Alma PR +44(0)20 3405 0205

Financial PR

Hilary Buchanan / Susie Hudson / Lily

Soares Smith

Notes to Editors

ATC Group is a prominent independent music company offering live

rights, live agency, production, artist management and investment

and a range of other music artist services. ATC Group is the only

independently owned company in the industry housing talent

management, live booking, livestreaming and talent services within

the same group.

The Company has an established, long-standing client base with

over 60 artists on its management roster and over 400acts on the

live roster. One of its livestreaming offerings, Driift, has

delivered shows with Niall Horan, Andrea Bocelli, Kylie, Johnny

Marr, The Smile and others, selling over 600,000 tickets across 190

countries since being established in June 2020.

The Group's five key divisions, grouped under two segments,

are:

-- Artist management and development

-- ATC Management - artist management

-- ATC Live- live event booking agency for artists

-- ATC Services

-- Polyphonic - an artist partnerships venture

-- Live streamed events

-- Driift, a global livestreaming business, and Flymachine, a livestreaming platform

The Group is headquartered in London, with offices in Los

Angeles, New York and Copenhagen and is led by an experienced

management team who have operated across multiple music industry

sectors.

For more information see: www.atcgroupplc.com

Co-Chairs' Statement

We are pleased to present our first Annual Report and Accounts

as a listed business, reporting on a year of significant milestones

and solid growth. The results achieved reflect both the challenges

and opportunities that came with 2021. Despite the impact of

COVID-19 restrictions on the earnings potential for our Live Agency

and Artist Management divisions, the early-mover establishment of

Driift proved a strategic success, driving overall Group revenue

growth of 28% compared to the prior year.

The Group ended the year in an improved cash position following

two significant rounds of investment: the IPO, together with a

Deezer investment of GBP2m into Driift. This provides the Group

with greater resources and flexibility to pursue its organic and

acquisitive growth strategy as trading conditions normalise through

2022.

People

It was pleasing that we were able to retain the services of

nearly all of the Group's dedicated employees during the pandemic

and strengthen the senior management team in readiness for the IPO.

It is a testament to everyone in the Group that we ended two tough

years in a significantly better place and our thanks go out to all

our people.

In particular, it would be remiss not to thank the Group's CEO,

Adam Driscoll as he was instrumental in attracting investment into

the business and getting the Group prepared for a public

listing.

Board and Governance

In preparation for the IPO we established a new Board and

implemented governance procedures appropriate for a listed

business. We welcomed Andy Glover and Shirin Foroutan to the Board

as non-executive directors who bring strong experience across

finance and the music industry. Post the listing of the Group on

AQSE, the Board was further enhanced by the recruitment of our

Chief Financial Officer, Ram Villanueva. We have established a good

working relationship across the Board and the Group is beginning to

see the benefits of our collaboration.

Summary and Outlook

Despite the significant consequences to the music sector of

COVID-19 lockdown strategies, the Group closed 2021 in a stronger

position with a strengthened operating platform, a further

diversified offering and an enhanced geographic reach.

Worthy of note is the foothold the Group has established in the

important North American market. The office in Los Angeles

increased its management footprint, opened up the important

promotion business through the acquisition of 100 per cent.

Interest in Your Army USA (a US-based electronic promotions

business) and established digital technology capability through the

development of namethemachine (a software and media development

company with a focus on emerging technology and transmedia

solutions). The opening of an office in New York in early 2022 is

an important step, not just for accessing the East Coast USA market

but also for signalling the Group's intent generally.

Driift continues to mature and evolve its business model now

that fans are able to return to watching live music in person. The

Smile's 'Full Circle' show performed and recorded at the end of

January 2022 proved to be an important watershed moment for Driift,

a concept that took in ticket purchasers from both around the world

to watch remotely and locally in-person.

The US and UK markets were the first to properly open up to live

touring with the EU lagging a couple of months behind. Whilst this

impacted the Group's first quarter, the important summer festival

season is largely untouched and we are confident that the autumn

touring season will not suffer as it did in 2021. Whilst business

is returning to normal, it is worth noting that the two-year gap in

touring as a result of the COVID-19 pandemic has created a

short-term over-supply of talent which is allowing promoters to

competitively price their offers. Ticket sales are yet to return to

their pre-COVID-19 levels for many shows, not just because of the

oversupply but also because there is still some fan nervousness to

purchase.

Against this backdrop, the strength of the Group's proposition,

unique holistic approach and pipeline of opportunities enables the

Board to be confident in continued growth for ATC Live and ATC

Management in the current year. Both divisions are looking to add

executive talent to strengthen their propositions and are focused

on attracting established artists to their rosters, as well as

growing and breaking new acts.

Importantly, the 10-person executive management team is working

well together and are committed to the Group's future. As the

market recovers from the last two years this will help us win new

business and continue our growth. The team is well diversified in

respect of gender and race and we are committed to ensuring that

balance of representation is maintained as we expand.

Brian Message and Craig Newman

Co-chairs

CEO Review

Overview

The Group's resilient business model and embedded culture of

innovation was demonstrated throughout 2021, a year that challenged

the global music industry with the effects of the COVID-19

pandemic. The Group delivered solid turnover growth, despite the

substantial downturn in revenues in the industry as a whole.

The Group's performance was achieved through the continued

development of our livestreaming business alongside the great work

delivered by our artist management and artist services' divisions.

At ATC Live, our live agency business, the gradual removal of

restrictions around live events in the second half of the year is

delivering growth in 2022 and beyond. The completion of our IPO in

December was a substantial achievement and has positioned the Group

for growth and expansion over the coming years.

Key operational highlights for 2021 included the production and

delivery of the global livestream of 'Live at Worthy Farm' which

was the livestream replacement of the COVID-19-cancelled 2021

edition of the Glastonbury Festival; the acquisition of the

remaining 51 per cent. Stake in Your Army in North America that

wasn't previously held by the Group; the investment by Deezer of

GBP2m into the Driift business; the delivery of the ground-breaking

Kid Amnesiac Radiohead project in conjunction with Epic Games (a

first for the platform with the launch of a non-game application on

the Epic Game Store. The application delivered access to a digital

Radiohead exhibition which generated over 6 million downloads

within weeks of being available); the addition of a significant

number of new clients to our management and live agency rosters;

and the growth of our composer division. 2022 has continued to see

substantial Group-wide developments which are detailed below.

We successfully completed our IPO on December 21, 2021 with

admission onto the Aquis Growth Market in London. The IPO was

supported by both institutional and retail investors and the

Company raised a total of GBP4.15 million (before expenses). The

net proceeds are being used to invest into each of ATC's five

business divisions and to support the Directors' growth strategy

for the Group. As the fundraising was completed only 10 days before

our financial year end, the results reported here were effectively

delivered ahead of the Group bringing in the new financing which is

set to spur future growth and development.

I am very pleased that our management team remains so well

represented in the shareholder table. Our executive board directors

and senior managers held 42 per cent. of the shares as at 31

December 2021.

Current Trading

The completion of the IPO in the final days of 2021 gave the

Group a great opportunity to start 2022 with a huge sense of

positivity and ambition. The first few months of the year have

continued in the same spirit and we are seeing good developments in

our existing businesses and some clear opportunities to broaden

their scope and reach. Additionally, strong new partnerships are

emerging for the Group that will further strengthen our position as

the music industry experiences further digital transformation in

the coming years.

As part of those developments, we have been quick to strengthen

our management team and I was delighted to welcome Rameses

Villanueva to the Board as Group CFO on 28 February 2022 to provide

support for the next stage of the growth strategy.

Reassuringly, the live music industry is continuing to see a

significant upturn in activity following the relaxation of COVID-19

restrictions and, as a result, ATC's Live Agency and Management

divisions are benefitting.

At ATC Management, hotly tipped band The Goa Express joined the

roster while 2021 additions, The Smile and Amaarae, have made a

strong impact in 2022 with successful tours, music releases and

sold-out shows.

At ATC Live we have seen 93 new clients join the roster since

the beginning of 2021 including Nation of Language, Connie

Constance and Billy Nomates and many of our existing clients have

won industry plaudits. At SXSW, a leading international industry

event in Texas, ATC Live clients won the prestigious Grulke prizes

for both US and International artists, while at The Great Escape

festival in the UK, The Times' review of the event listed '5 key

artists to watch' - 4 of which were represented by ATC Live.

Business indicators are increasingly strengthening; in three

consecutive weeks in January and February, three of ATC Live's

clients achieved Top 3 UK album chart status in the week of

release. Whilst the re-establishment of the live market is a work

in progress in 2022, navigating differing international

restrictions and customer caution, the longer-term view remains

very positive.

The Group's livestreaming division, Driift, successfully

delivered the first of its 'Full Circle' events in January with ATC

Management client 'The Smile', which garnered a number of '5 star'

reviews and wide audience acclaim. This new hybrid format brought

together a live ticketed audience in a bespoke venue designed

specifically for a global livestreaming audience and demonstrated

that Driift can benefit from a diversified revenue mix, as the

Directors anticipated. This format is expected to generate higher

margin business for Driift, and further demonstrates that the

Company remains at the forefront of the evolution of the growing

livestreaming sector. More recently Driift delivered a livestream

for Little Mix direct from the O2 and generated substantial numbers

of livestream tickets alongside a broadcast into cinemas that saw

the company take the number 5 position for that weekend's UK cinema

charts.

Since its inception in mid-2020 Driift has now sold over 600,000

tickets in more than 190 countries around the world. We continue to

see substantial interest from globally recognised artists who are

looking to integrate a livestream into their more traditional

business activities and recent partnerships with organisations like

the Tate Museums continue to show that this innovative format will

continue to be a growth sector for the music industry.

Our service businesses are trading in line with management

expectations and are seeing growth as the global music market

emerges from the challenges of the pandemic. The Group recently

opened an office in New York to facilitate the continued expansion

of the US management and services businesses.

We announced on 7 April 2022, that following receipt of a

short-term promissory note loan of $6m, the Group had made a

minority investment into a newly formed company, alongside a number

of other parties. The funding group's total investment of $80m

enabled the new venture to acquire Napster, with the aim of

bringing blockchain and web3 to artists and fans via future

developments in the Napster business. Our equity interests in the

newly formed company were subject to a pledge in favour of the

lender, as sole security against ATC's obligations under the loan

arrangement. The recent volatility in the crypto markets has led us

to reassess the Company's capacity to refinance the original loan.

We have therefore taken the decision to hand back our equity

interests to the original loan holder with negligible financial

impact to the Group. We continue to believe that blockchain

technology and non-fungible tokens (NFTs) will increasingly have an

impact on the holding and distribution of copyrights in the medium

and long term and we continue to have an option to invest into the

new Napster venture. It is beneficial to us to be able take a

little more time to assess the landscape and determine what level

of participation might be achievable whilst also taking stock of

other opportunities that are being presented in this space.

In summary, 2022 business activity is delivering upon the aims

we set ourselves when completing the IPO. These were to use the new

capital to increase our pool of agents, managers and clients to

drive profitability; to enable Driift to scale its offering and

drive revenue growth and margin; to invest in our service

businesses and to seek out new opportunities and participate in key

music industry developments. With current trading in line with

expectations, I look forward to further expanded activity and

strong developments during the rest of the year.

Adam Driscoll

CEO

CFO Review

Overview

During the year, the Group's results were in line with

management expectations and demonstrated resilience during the

Covid-restrained environment, with revenue and other operating

income of GBP10.3 million representing growth of 37% from 2020

(GBP7.5 million) and adjusted loss before tax and non-controlling

interests ('NCI') of GBP2.7 million (2020: GBP0.34 million loss

before tax and NCI).

Following the successful fundraise at the Group's IPO in

December 2021, ATC retains a healthy net cash position (after

current debt) of GBP4.2 million and net cash position (after

current and long-term debt) at year end of GBP2.3 million.

Revenue and other operating income

The Group's consolidated revenue and other operating income was

up 37% to GBP10.3m (2020: GBP7.5m). Core revenue (excluding other

operating income) accounted for 89% (2021: GBP9.1m vs 2020:

GBP7.1m) and posted 28% growth.

2021 2020

Live streamed events

- Core revenue 4,642,212 4,716,692

- Other operating income 545,979 0

5,188,191 4,716,692

--------------------------- ----------- ----------

Artist management and development

- Core revenue 4,501,426 2,383,493

- Other operating income 617,517 434,762

5,118,943 2,818,255

--------------------------- ----------- ----------

Total 10,307,134 7,534,947

=========================== =========== ==========

Despite the impact on the artist management and development

businesses as a consequence of the COVID-19 pandemic and associated

global lockdowns, the increase in revenue and other operating

income was driven by the following:

-- Livestreamed events - Driift tapped into the consumer desire

to remain connected with artists and live performances by

delivering shows in-home via a streaming mechanism. Driift

generated GBP5.2 million in 2021, a 10% increase over the previous

year (2020: GBP4.7 million) and represented 50% of the consolidated

revenue and other operating income (2020: 63%).

-- Artist management and development - The consolidation of ATC

Artist Management Inc. (formerly known as Courtyard Productions,

Inc), which became a wholly owned subsidiary on 19 February 2021

also contributed to a 12% increase (GBP0.9 million) in consolidated

revenue and other operating income in 2021.

During the year, the Group also received COVID related

government grants amounting to GBP0.52 million in 2021 (2020:

GBP0.42 million).

Administrative expenses

Administrative expenses, excluding IPO listing related costs,

increased from GBP1.4 million in 2020 to GBP4.8 million in

2021.

2021 2020

Artist management and

development 3,652,198 1,166,200

Live streamed events 1,121,944 242,187

Total 4,774,142 1,408,387

======================= ========== ==========

The increase is due to the additional overheads of businesses

that were acquired in 2021, which increased expenses by GBP2.3

million (2020: nil), and because Driift traded for only 6 months in

2020 (2021: GBP1.1 million vs 2020: GBP0.2 million).

Excluding these items, consolidated administrative expenses

increased by 40% to GBP2.6 million in 2021 (2020: GBP1.2 million),

principally due to the following:

-- New hirings in the UK management business with the objective

of growing the artist, writer, producer and composer rosters which

resulted in an increase in salary cost of approximately GBP0.3

million; and,

-- An increase in Polyphonic's expenses of approximately GBP0.2

million resulting from the release of 'Sticky', the fourth album by

Frank Carter and the Rattlesnakes on 15 October 2021. This release

was tied to a significant tour across the UK and Europe from

November 2021 through to February 2022.

Following the receipt of the proceeds from the IPO in December

2021, the Group has been able to invest in further improving its

internal systems, procedures and processes as a result of being

publicly listed.

IPO and net cash/(debt)

The Group listed on the Apex segment of the Aquis Growth Market

in December 2021 and raised a total of GBP4.1m, before costs, from

both institutional investors and individual investors. As a result

of the IPO, the Group's net cash position has improved from a net

debt to net cash position.

The placing shares represented approximately 25.7% of the

enlarged share capital at the time. Alongside the funds raised, a

director's loan and a loan to Beggars Group Limited was repaid

2021 2020

Current

Cash and cash equivalents 5,532,272 2,178,505

Funds held on behalf of

clients (1,027,793) 0

Borrowings (ST) (124,068) (582,230)

Right of use liabilities

(ST) (140,287) (136,865)

Net cash/(debt) after

current debt 4,240,124 1,459,410

--------------------------- ------------ ------------

Long term

Borrowings (LT) (1,676,986) (1,725,548)

Right of use liabilities

(LT) (248,238) (388,525)

(1,925,224) (2,114,073)

--------------------------- ------------ ------------

Net cash/(debt) 2,314,900 (654,663)

=========================== ============ ============

At the year end, the Group's net cash position was GBP2.3

million (2020: net debt GBP0.65 million), which will allow the

Group to further grow the Live and Management businesses by hiring

new agents, and managers. It also provides additional working

capital to further develop Driift, Polyphonic and the Services

division and to pursue the Group's acquisition plans.

Financing costs of GBP0.097m (2020: GBP0.099m) was comprised

mainly of interest expenses on loans of GBP0.083 million (2020:

GBP0.082 million).

Adjusted loss before tax

The loss before IPO and related costs increased to GBP2.7

million (2020: loss GBP0.34 million)

2021 2020

Loss before tax (3,306,518) (340,831)

IPO and related costs 616,735 0

Loss before listing fees (2,689,783) (340,831)

========================== ============ ==========

The increase in the loss was due to the substantial investment

into Driift, principally to deliver the Glastonbury 'Live at Worthy

Farm' event which was disrupted by some technical issues caused by

a third-party supplier. This resulted in customer refunds and a

reduction in ticket sales . The loss incurred by segment was as

follows:

2021 2020

Artist management and

development (546,538) (469,476)

Live streamed events (2,143,245) 128,646

Total (2,689,783) (340,831)

======================= ============ ==========

Earnings per share

Basic and diluted earnings per share was (34.51) pence per share

(2020: (4.25) pence per share)

Reconciliation between the statutory consolidated income

statement vs. consolidated income statement in the Prospectus for

the 12 months to 31 December 2020

The FY20 comparatives differ from those in the Growth Prospectus

('Prospectus') dated 14 December 2021 due to the inclusion in the

Prospectus of the results of ATC Artist Management Inc (previously

Courtyard Productions, Inc) as it was under common control for that

period. As required under IFRS 3 business combinations, the FY20

comparatives reported in the annual report and accounts (and

preliminary announcement) include the results from the date of

acquisition, 19 February 2021.

The differences in Revenue, Administrative expenses, Loss before

tax and Net assets (excluding NCI) and Earnings (loss) per share

lines are shown in the table below:

Statutory accounts Prospectus Differences

Revenue 7,100,185 7,489,436 (389,251)

Administrative expenses (1,408,387) (1,778,168) 369,781

Loss before tax (340,831) (412,739) 71,908

Equity attributable to

the shareholders of the

parent company (964,613) (1,196,639) 232,026

Earnings (loss) per share

- In pence (4.25) (5.29) 1.04

Going Concern

The accounts have been prepared on a going concern basis. The

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future, based on projections for at least twelve months from the

date of approval of the financial statements.

Rameses Villanueva

CFO

Consolidated statement of comprehensive

income Consolidated statements

of comprehensive income

For

For the year ended 31 December 2021 2021 2020

Notes GBP GBP

Revenue 3 9,143,638 7,100,185

Cost of sales (8,297,894) (6,207,950)

Gross profit 845,744 892,235

Other operating income 1,163,496 434,762

Administrative expenses 4 (5,390,877) (1,408,387)

Provision for amounts owed by associates

and joint ventures - (235,250)

Operating loss 3 (3,381,637) (316,640)

Share of results of associates

and joint ventures 167,568 40,012

Finance income 4,852 34,652

Finance costs (96,968) (98,855)

Provision against amounts owed

by participating interests (333) -

Adjusted loss before tax (2,689,783) (340,831)

IPO and related costs (616,735) -

-------------------------------------------------- ------------ -------------

Loss before taxation (3,306,518) (340,831)

Income tax expense 5 (1,256) (966)

Loss for the year (3,307,774) (341,797)

Other comprehensive income:

Items that will not be reclassified to

profit or loss

Revaluation gain on unlisted investments 139,061 -

Currency translation differences (5,208) (189)

Total items that will not be reclassified

to profit or loss 133,853 (189)

Total other comprehensive income for

the year 133,853 (189)

Total comprehensive income for the year (3,173,921) (341,896)

Loss for the financial year is attributable

to:

- Owners of the parent company (2,353,468) (291,792)

- Non-controlling interests (954,306) (50,005)

(3,307,774) (341,797)

Total comprehensive income for the year

is attributable to:

- Owners of the parent company (2,219,615) (291,891)

- Non-controlling interests (954,306) (50,005)

(3,173,921)) (341,986)

Earnings per share

2021 2020

pence pence

Basic and diluted 6(34.51) (4.25)

======= ======

Consolidated statement of financial position

As at 31 December 2021 2021 2020

Notes GBP GBP

ASSETS

Non-current assets

Goodwill 7 1,135,403 -

Property, plant and equipment 398,506 500,672

Investments 244,604 726,017

1,778,513 1,226,689

Current assets

Trade and other receivables 2,558,201 1,506,709

Cash and cash equivalents 5,532,272 2,178,505

8,090,473 3,685,214

Total assets 9,868,986 4,911,903

EQUITY

Called up share capital 8 95,840 32,649

Share premium account 8 3,983,970 2,449,703

Merger reserve 2,883,611 -

Currency translation reserve (9,750) (4,542)

Retained earnings (4,898,864) (3,442,423)

Equity attributable to the shareholders

of the parent company 2,054,807 (964,613)

Non-controlling interests 197,649 10,395

Total equity 2,252,456 (954,218)

LIABILITIES

Non-current liabilities

Borrowings 1,676,986 1,725,548

Other creditors 53,085 9

Right of use lease liabilities 248,238 388,525

1,978,309 2,114,082

Current liabilities

Trade and other payables 5,373,866 3,032,944

Borrowings 124,068 582,230

Right of use lease liabilities 140,287 136,865

5,638,221 3,752,039

Total liabilities 7,616,530 5,866,121

Total equity and liabilities 9,868,986 4,911,903

Consolidated statement of changes in equity

For the year ended December Share Share Merger Currency Retained Total Non-controlling Total

2021 capital premium reserve translation earnings interest

account reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January 2020 19,556 1,852,394 - (4,353) (3,240,482) (1,372,885) - (1,372,885)

Year ended 31 December 2020:

Loss for the year - - - - (291,791) (291,791) (50,005) (341,796)

Other comprehensive income:

Currency translation

differences on

overseas subsidiaries - - - (189) - (189) - (189)

Total comprehensive income for

the

year - - - (189) (291,791) (291,980) (50,005) (341,985)

Issue of share capital 13,093 597,309 - - - 610,402 - 610,402

Acquisition of non-controlling

interests - - - - 89,850 89,850 60,400 150,250

At 31 December 2020 32,649 2,449,703 - (4,542) (3,442,423) (964,613) 10,395 (954,218)

Year ended 31 December 2021:

Loss for the year - - - - (2,353,468) (2,353,468) (954,306) (3,307,774)

Other comprehensive income:

Revaluation gain on unlisted

investments 139,061 139,061 - 139,061

Currency translation

differences on

overseas subsidiaries - - - (5,208) - (5,208) - (5,208)

Total comprehensive income for

the

year - - - (5,208) (2,214,407) (2,219,615) (954,306) (3,173,921)

Issue of share capital of

previous

parent 1,709 399,550 - - 401,259 - 401,259

Issue of share capital 95,840 3,983,970 - - 4,079,810 - 4,079,810

Merger reserve (34,358) (2,849,253) 2,883,611 - - - - -

Retained earnings movements

due to

increased investment by NCI - - - 757,966 757,966 - 757,966

Acquisition of non-controlling

interests - - - - - (58,796) (58,796)

Other movements in

non-controlling

interests - - - - - 1,200,356 1,200,356

Balance at 31 December 2021 2,883,611 2,054,807

95,840 3,983,970 (9,750) (4,898,864) 48 197,649 2,252,456

Other movements in non-controlling interest relate to additional

investments in Driift Holdings Limited in the year, a subsidiary of

All Things Considered Group Plc.

Consolidated statement of cash flows

For the year ended 31 December 2021 2021 2020

GBP GBP GBP GBP

Cash flows from operating activities

Loss for the year after tax (3,307,774) (341,797)

Adjustments for:

Taxation charged 1,256 966

Finance costs 96,968 98,855

Finance income (4,852) (34,652)

Loss on disposal of property,

plant and equipment - 6,143

Depreciation of property, plant

and equipment 133,023 127,549

Share of results of associates

and joint ventures (167,568) (40,012)

Provision against investment in

associates and joint ventures 333 226,282

Movements in working capital:

Increase in trade and other receivables (572,660) (366,982)

Increase in trade and other payables 1,136,345 2,182,495

Cash (absorbed by)/generated

from operations (2,684,929) 1,858,847

Interest paid (96,968) (98,855)

Tax paid (1,256) (1,246)

Net cash (outflow)/inflow

from operating activities (2,783,153) 1,758,746

Investing activities

Purchase of property, plant and

equipment (20,983) (8,642)

Purchase of subsidiaries

(net of cash acquired) 274,700 -

Investment in unlisted shares (53,085) -

Net amount withdrawn in associates

and joint ventures - 30,971

Interest received 4,852 34,653

Net cash generated from

investing activities 205,483 56,981

Financing activities

Proceeds from issue of shares

in subsidiary subscribed

by non-controlling interest - 150,250

Proceeds from issue of shares

in previous parent 300,025 -

Proceeds from issue of shares 4,011,094 610,402

Proceeds from borrowings 500,000 275,000

Repayment of borrowings (640,386) (839,729)

Proceeds from non-controlling

interest additional investment

(Driift) 2,000,000 -

Repayment of bank loans (95,414) (29,295)

Payment of lease liabilities (136,865) (127,430)

Net cash generated from

financing activities 5,983,453 39,198

Net increase in cash and cash

equivalents 3,360,784 1,854,925

Cash and cash equivalents at beginning

of year 2,178,505 309,640

Effect of foreign exchange

rates (7,017) 13,940

Cash and cash equivalents

at end of year 5,532,272 2,178,505

1 General information

All Things Considered Group Plc ("ATC Group plc") was incorporated

in England and Wales on 20 May 2021 as a public company limited

by shares under the Companies Act 2006.

ATC Group plc's registered office is The Hat Factory, 168 Camden

Street, London NW1 9PT. The Group's principal activity during

the year was music artist management and livestreamed events.

The Consolidated Group financial statements represents the consolidated

results of ATC Group plc and its subsidiaries, (together referred

to as the "Group"). The Parent Company financial statements present

information about the Company as a separate entity and not about

its Group.

These are the first consolidated financial statements of the

Group following the reorganisation of the Group to facilitate

the listing. The result of the application of the capital reorganisation

is to present the consolidated financial statements (including

comparatives) as if the Company has always owned the Group. The

share capital structure of the Company as at the date of the

Group reorganisation is pushed back to the first date of the

comparative period (1 January 2020). A Merger Reserve is created

as a separate component of equity, representing the difference

between the share capital of the Company at the date of the Group

reorganisation and that of the previous top organisation of the

Group .

Except for IFRS 16, the implementation of IFRS had no impact

on the consolidated financial information of the Group. The implementation

of IFRS 16 led to an increase in the loss for the year by GBP16,886,

an increase in assets by GBP323,758 and an increase in liabilities

of GBP388,525. There was no effect on cash flows.

2 Basis of preparation and measurement

2.1 Basis of preparation

The Consolidated Group Financial Information has been prepared

in accordance with International Financial Reporting Standards

in conformity with the requirements of the Companies Act 2006

("IFRS").

Unless otherwise state, the Consolidated Group Financial Information

is presented in Pounds Sterling (GBP) which is the currency of

the primary economic environment in which the Group operates.

Monetary amounts in these financial statements are rounded to

the nearest GBP.

The Consolidated Group Financial Information has been prepared

under the historical cost convention except for certain financial

instruments that have been measured at fair value. The principal

accounting policies adopted are set out below.

2.2 Basis of consolidation

The Consolidated Group Financial Information comprises the financial

statements of ATC Group plc and its subsidiaries listed in note

17 for "Subsidiaries" to the Consolidated Group Financial Information.

The financial statements of all Group companies are adjusted,

where necessary, to ensure the use of consistent accounting policies.

The Group was formed after the Company, prior to its IPO and

listing on AQSE, completed a share for share transaction with

All Things Considered Limited. The Board has taken the view that

the most appropriate way to account for this in line with IFRS

is to deem the share for share exchange as a group reconstruction.

This has been accounted for under the basis of merger accounting

given that the ultimate ownership before and after the transaction

remained the same. There is currently no specific guidance on

accounting for group reconstructions such as this transaction

under IFRSs. In the absence of specific guidance, entities should

select an appropriate accounting policy and IFRS permits the

consideration of pronouncements of other standard-setting bodies.

This group reconstruction as scoped out of IFRS 3 has therefore

been accounted for using predecessor accounting principles resulting

in the following practical effects;

(a) The net assets of the Company and the predecessor group,

All Things Considered Limited and its subsidiary undertakings

(the "Predecessor Group"), are combined using existing book values,

with adjustments made as necessary to ensure that the same accounting

policies are applied to the calculation of the net assets of

both entities;

(b) No amount is recognised as consideration for goodwill or

negative goodwill;

(c) The consolidated profit and loss account includes the profits

or losses of the company and the Predecessor Group for the entire

period, regardless of the date of the reconstruction, and the

comparative amounts in the consolidated financial statements

are restated to the figures presented by the Predecessor Group;

(d) The retained earnings reserve includes the cumulative results

of the Company and the Predecessor Group, regardless of the date

of the reconstruction, and the comparative amounts in the statement

of financial position are restated to those presented by the

Predecessor Group.

Acquisitions are accounted for under the acquisition method from

the date control passed to the Group. On acquisition, the assets

and liabilities of a subsidiary are measured at their fair values.

Any excess of the cost of acquisition over the fair values of

the identifiable net assets acquired is recognised as goodwill.

A subsidiary is defined as an entity over which ATC Group plc

has control. ATC Group plc controls an entity when the Group

is exposed to, or has rights to, variable returns from its involvement

with the entity and has the ability to affect those returns through

its power over the entity. Subsidiaries are fully consolidated

from the date on which control is transferred to the Group. They

are deconsolidated from the date that control ceases.

Changes in the Group's interest in a subsidiary that do not result

in a loss of control are accounted for as equity transactions.

The carrying amounts of the Group's interests and the non-controlling

interests are adjusted to reflect the changes in their relative

interests in the subsidiary. Any difference between the amount

by which the non-controlling interests are adjusted and the fair

value of the consideration paid or received is recognised directly

in equity and attributed to owners of the Company.

Intra-group transactions, balances and unrealised gains on transactions

are eliminated; unrealised losses are also eliminated unless

cost cannot be recovered. Where necessary, adjustments are made

to the financial statements of subsidiaries to ensure consistency

of accounting policies with those of the Group.

The total comprehensive income of non-wholly owned subsidiaries

is attributed to owners of the parent and to the non-controlling

interests in proportion to their relative ownership interests.

3 Segmental analysis

Artist management Live streamed

and development events Total

2021 2021 2021

GBP GBP GBP

Revenue 4,501,426 4,642,212 9,143,638

Cost of sales (2,088,401) (6,209,493) (8,297,894)

Gross profit 2,413,025 (1,567,281) 845,744

Other operating income 523,896 - 523,896

Other income 93,621 545,979 639,600

Administrative expenses (4,268,933) (1,121,944) (5,390,877)

Provision for amounts owed by associates

and joint ventures - - -

Operating profit/(loss) (1,238,391) (2,143,245) (3,381,636)

Share of results of associates and

joint ventures 167,568 - 167,568

Finance income 4,852 - 4,852

Finance costs (83,833) - (83,833)

Interest on finance leases (13,135) - (13,135)

Provision against amounts owed by

participating interests (333) - (333)

Adjusted loss before tax (546,538) (2,143,245) (2,689,783)

IPO and related costs (616,735) - (616,735)

-------------------------------------------- ----------------- ------------- -----------

Profit/(Loss) before taxation (1,163,273) (2,143,245) (3,306,518)

Income tax expense (1,256) - (1,256)

Profit/(Loss) for the year (1,164,529) (2,143,245) (3,307,774)

Assets and liabilities

Total assets 6,473,124 3,395,862 9,868,986

Total liabilities (5,432,212) (2,184,318) (7,616,530)

----------------- ------------- -----------

Net assets 1,040,912 1,211,544 2,252,456

================= ============= ===========

Artist management Live streamed

and development events Total

2020 2020 2020

GBP GBP GBP

Revenue 2,383,493 4,716,692 7,100,185

Cost of sales (1,862,392) (4,345,849) (6,207,950)

Gross profit 521,392 370,843 892,235

Other operating income 434,762 - 434,762

Administrative expenses (1,166,200) (242,187) (1,408,387)

Provision for amounts owed by associates

and joint ventures (235,250) - (235,250)

Operating loss (445,296) 128,656 (316,640)

Share of results of associates and

joint ventures 40,012 - 40,012

Finance income 34,652 - 34,652

Finance costs (98,845) (10) (98,855)

Loss before taxation (469,476) 128,646 (340,831)

Income tax expense (966) - (966)

Loss for the year (470,443) 128,646 (341,797)

Assets and liabilities

Total assets 2,317,095 2,594,808 4,911,903

Total liabilities (3,530,360) (2,335,761) (5,866,121)

----------------- ------------- -----------

Net assets (1,213,265) 259,047 (954,218)

================= ============= ===========

Revenue

2021 2020

GBP GBP

Revenue analysed by geographical market

United Kingdom 5,068,283 3,139,084

Europe 860,023 1,668,000

United States of America 2,631,178 1,373,101

Rest of the world 584,154 920,000

9,143,638 7,100,185

4 Administrative expenses by nature

2021 2020

GBP GBP

Staff costs 2,364,472 782,420

Rent, rates and services costs 367,960 35,472

IPO and related costs 616,735 -

Legal and professional fees 642,641 148,105

Consultancy fees 580,895 279,528

Depreciation of property, plant and equipment 133,023 127,549

Exchange losses 61,406 (12,517)

Profit or loss on sale of tangible assets (19,694) 6,143

Travelling expenses 120,476 19,536

Other expenses 522,963 22,151

5,390,877 1,408,387

.

5 Earnings per share

2021 2020

Basic and diluted earnings/(loss) (34.51) pence (4.25) pence

per share

Basic and diluted number of shares

in issue 9,584,020 6,871,599

Basic earnings per share is calculated by dividing the

profit/loss

after tax attributable to the equity holders of All Things

Considered

group plc by the numbers of shares in issue after the allotment

of ordinary shares on 14 December 2021. The same number of shares

is used for the corresponding period in order to provide a

meaningful

comparison.

6 Income tax expense

2021 2020

GBP GBP

Current tax

UK corporation tax on losses for the current

period - (280)

Foreign taxes and reliefs 1,256 1,246

1,256 966

The difference between the statutory income tax rate and the effective

tax rates are summarised as follows:

2021 2020

GBP GBP

Profit/(loss) before income taxes (3,307,774) (412,739)

------------- ------------------

Expected tax at statutory UK

corporation tax rate of 19% (628,477) (78,420)

Increase/(decrease) in tax

resulting

from:

117,50

Effect of different tax rates

in foreign jurisdictions (27,081) 12,913

Tax losses utilised 181,597 -12,412

Capital allowances less

depreciation (1,894) 680

Losses carried forward 471,027 23,347

Non-deductible expenditure 101,070 55,535

Other adjustments (94,985) (676)

1,256 966

============ ==================

At 31 December 2021the Group has GBP5,496,781 (2020:

GBP2,615,515)

of tax losses available to be carried forward against

future profits.

From April 2023, the corporation tax rate will increase

from 19% to 25%.

7 Goodwill

Goodwill

GBP

Cost

At 1 January 2021 -

Additions 1,135,403

-------------

At 31 December 2021 1,135,403

-------------

Impairment -

At 1 January 2021 -

Charge for the year -

-------------

At 31 December 2021 -

-------------

Net book value

At 31 December 2021 1,135,403

=============

At 31 December 2020 -

=============

On 1 January 2021, the group acquired a further 40% share in ATC Live

LLP, bringing the group's interest to 90%, for GBPnil consideration

resulting in goodwill of GBP517,438.

On 12 February 2021, the remaining 51% interest in Your Army LLC,

previously a 49% associate, was acquired by the Group for consideration

of $640,000 (equating to GBP474,179) resulting in goodwill of GBP354,188.

On 19 February 2021, 100% of ATC Artist Management Inc (formerly Courtyard

Productions Inc) was acquired for GBPnil consideration, resulting

in goodwill of GBP233,231.

On 12 April 2021, the group acquired a further 10% share in Familiar

Music Group LLC, bringing the group's interest to 55%, for GBPnil

consideration resulting in goodwill of GBP30,546.

ATC Live ATC Artist Your Army Familiar Total

LLP Management LLC Music Group

Inc LLC

GBP GBP GBP GBP GBP

Goodwill on acquisitions

Total consideration

(see below) - - 474,179 - 474,179

Plus: Fair value

of previously held

equity interest 434,506 - 115,257 - 549,763

Less: Share of fair

value of net

(assets)/liabilities

acquired (see below) 82,932 233,231 (235,248) 30,546 111,461

-------- ---------- ------------- ---------- ---------

Total goodwill 517,438 233,231 354,188 30,546 1,135,403

======== ========== ============= ========== =========

Consideration satisfied

by:

Cash - - 474,179 - 474,179

======== ========== ================= ========== =========

Share of fair value

of net assets/(liabilities)

acquired:

Cash and cash equivalents 566,897 10,571 166,827 4,583 748,878

Property, plant and

equipment 8,065 946 68 - 9,079

Trade and other receivables 11,793 391,892 71,529 3,618 478,832

Trade and other payables (628,901) (636,640) (3,176) (63,740) (1,332,457)

Borrowings (50,000) - - - (50,000)

-----------

(92,146) (233,231) 235,248 (55,539) (145,668)

Percentage acquired 90% 100% 100% 55%

(82,932) (233,231) 235,248 (30,546) 111,461

============ ============ ============= =========== =========

Net cash inflow/(outflow)

arising on acquisition

Cash consideration - - (474,179) - (474,179-

Total cash and cash

equivalents acquired 566,897 10,571 166,827 4,583 748,879

----------- ----------------- ----------- ---------

566,897 10,571 307,352 4,583 274,700

============= =========== ================= =========== =========

On each of the acquisitions, no separate intangible assets were identified

and the difference between the consideration and the fair value of

assets acquired was all attributed to goodwill.

Impairment testing was undertaking using projections for three years

and a terminal value. Applying an appropriate discount rate, there

was adequate headroom for each element of goodwill.

8 Reserves

2021 2020 2021 2020

Ordinary share capital Number Number GBP GBP

Issued and fully paid

Ordinary shares of GBP0.01

(2020: GBP1) each 95,840,020 32,649 95,840 32,649

Number

of shares Share capital

No. GBP

Issued share capital in All

Things Considered Ltd at 31

December 2020 34,358 34,358

At 31 December 2020 34,358 34,358

=========== =============

Exchanged for shares in All

Things Considered Group Plc 6,871,599 68,716

Share issued on incorporation 1 -

Shares issued 14 December

2021 2,712,420 27,124

----------- -------------

At 31 December 2021 9,584,020 95,840

=========== =============

The company has one class of Ordinary shares. The Ordinary shares

have full voting, dividend and capital distribution (including on

winding up) rights. They do not confer any rights of redemption or

carry any right to fixed income.

During the year ended 31 December 2020, 13,093 Ordinary shares of

GBP1 each were issued for proceeds of GBP610,402 to provide additional

working capital for All Things Considered Limited, a subsidiary of

All Things Considered Group plc.

On 11 November 2021, All Things Considered plc issued 6,871,599 Ordinary

shares of GBP0.01 each in exchange for the entire share capital of

All Things Considered Limited.

On 14 December 2021, 2,712,420 shares were issued leading to a further

GBP27,412 of share capital and share premium of GBP3,983,970, net

of share issue costs.

On 14 December 2021, 119,800 warrants were granted to Canaccord Genuity

Limited to subscribe for Ordinary Shares of GBP0.01 each in All Things

Considered Group Plc. The charge to the profit and loss account in

respect of these is immaterial for 2021 .

Merger reserve

A merger reserve is created as a separate component of equity, representing

the difference between the share capital of the Company at the date

of the Group reorganisation and that of the previous parent company

of the Group .

Currency translation reserve

The currency translation reserve represents cumulative foreign exchange

differences arising from the translation of the financial statements

of foreign subsidiaries.

9 Related party transactions

Transactions with related parties for the year ended 31 December

2021

During the year, the Group paid rent of GBP150,000 (2020: GBP150,000)

to Pagham Investments Limited, a company which close family members

of two of the directors Craig Newman and Brian Message have a

significant interest in. The Group also paid rent of GBP178,240

(2020: GBP23,370) to Craig Newman during the year.

During the year the Group recharged overheads totalling GBP20,554

(2020: GBP79,903) to the following LLPs that the Group is a member

of and has a significant interest in:

* ATC 9 LLP: GBP20,554 (2020: GBP27,535)

* ATC Live LLP: GBPnil (2020: GBP52,368).

In turn the group was recharged overheads totalling GBP800,468

(2020: GBP204,069) by the following LLPs that the Group is a

member of and has a significant interest in:

* ATC 4 LLP: GBP798,898 (2020: GBP87,482)

* ATC 9 LLP: GBP1,570 (2020: GBP13,143)

* ATC Live LLP: GBPnil (2020: GBP103,444).

During the year, the Group paid interest of GBP5,389 (2020: GBP3,363)

to director Craig Newman and GBP5,389 (2020: GBP3,363) to director

Brian Message.

The remuneration of the directors and key management personnel

is set out in note 11.

Balances with related parties as at 31 December 2021

At 31 December 2021, the Group owed GBP1,015,027 (2020: GBP1,000,000)

to Pagham Investments Limited, a company which close family members

of two of the directors, Craig Newman and Brian Message, have

a significant interest in.

At 31 December 2021, the following represent the amount of members

capital in LLPs and LLCs attributable to the Group and shown

in 'investments in associates and joint ventures':

2021 2020

Members Provision Conversion Net Members Provision Net

capital to capital

subsidiaries

GBP GBP GBP GBP GBP GBP GBP

ATC 1

LLP - - - - 53,451 (53,451) -

ATC 3

LLP - - - - 90,755 (90,755) -

ATC 4

LLP - - - - 171,337 (53,109) 118,228

ATC 7

LLP 398 - - 398 26,283 (25,251) 1,032

ATC 9

LLP 52,060 - - 52,060 40,060 - 40,060

ATC Live

LLP 434,406 - (434,406) - 467,478 - 467,478

One Eskimo

LLC - - - - 3,716 (3,716) -

Your

Army

LLC 115,272 - (115,272) - 132,182 132,182

952,290 - (549,678) 52,458 952,290 (226,282) 726,008

10 Events after the reporting date

On 30 March 2022 the Group secured and received a short-term

promissory note loan of $6m. On the same date the Group invested

the $6m into a new company, Hypnos Capital, formed with the

express intention of investing in the music digitisation,

blockchain and web3 spaces. The minority investment was made

alongside a number of other parties who together with the

Group have invested over $80m in the new venture. On 10 May

2022, Hypnos Capital announced that it acquired Napster.

The Group's equity interest in the newly formed company is

subject to a pledge in favour of the lender, as sole security

against the Group's obligations under the loan arrangement.

Due to the recent volatility in the crypto markets, the Directors

have reassessed the Company's capacity to refinance the original

loan. The Directors have therefore taken the decision to

transfer the equity interest back to the original loan holder

with negligible financial impact to the Group. The Directors

continue to believe that blockchain technology and non-fungible

tokens (NFTs) will increasingly have an impact on the holding

and distribution of copyrights in the medium and long term

and the Group continues to have an option to invest into

the new Napster venture. It is beneficial to the Group to

be able to take a little more time to assess the landscape

and determine what level of participation might be achievable

whilst also taking stock of other opportunities that are

being presented in this space.

11 Notice of AGM and Posting of Annual Report

The Company's Annual General Meeting ("AGM") will be held

virtually on 27 July 2022 at 9:30am. The Company's Annual

Report and Accounts and Notice of AGM will be published on

the Company's website shortly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSEAEFMEESEFM

(END) Dow Jones Newswires

June 27, 2022 02:00 ET (06:00 GMT)

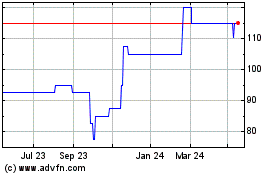

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Nov 2024 to Dec 2024

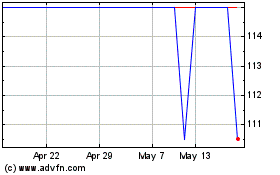

All Things Considered (AQSE:ATC)

Historical Stock Chart

From Dec 2023 to Dec 2024