TIDMBOR

RNS Number : 2921N

Borders & Southern Petroleum plc

31 May 2022

31 May 2022

Borders & Southern Petroleum plc

("Borders & Southern" or "the Company")

Audited Results for the 12 month period ended 31 December

2021

Borders & Southern (AIM: BOR), the London based independent

oil and gas exploration company with assets offshore the Falkland

Islands, announces its audited results for the year ended 31

December 2021. Full copies of the Company's Annual Report and

Accounts, including the Company Overview, Chairman's Statement,

Remuneration Committee Report, Directors' Report, Auditor's Report

and full Financial Statements, will be available on the Company's

website and posted to Shareholders along with the notice of the AGM

shortly.

Summary

-- Cash balance on 31 December 2021: $0.714 million (2020: $2.18 million)

-- Administrative expense for the year: $1.1 million (2020: $1.0 million)

-- Operating loss of $1.0 million (2020: $1.0 million)

-- Farm-out process continues

-- Post year-end events:

- extended Production Licences and Discovery Area through to 31 December 2022

- raised $1.8 million (before expenses) through the issue of 103,858,914 new Ordinary shares

- the total number of Ordinary shares in issue is now 587,957,318

- the Open Offer for excess shares was significantly over-subscribed

- currently evaluating different development options including

an accelerated production development

For further information please visit www.bordersandsouthern.com

or contact:

Borders & Southern Petroleum plc

Howard Obee, Chief Executive

Tel: 020 7661 9348

Strand Hanson Limited (Nominated, Financial Adviser & Joint

Broker)

Ritchie Balmer / James Bellman

Tel: 020 7409 3494

Auctus Advisors LLP (Joint Broker)

Jonathan Wright

Tel: 07711 627449

Tavistock (Financial PR)

Simon Hudson / Nick Elwes

Tel: 020 7920 3150

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 (as amended) as it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Notes to Editors:

Borders & Southern Petroleum plc is an oil & gas

exploration company listed on the London Stock Exchange AIM (BOR).

The Company operates and has a 100% interest in three Production

Licences in the South Falkland Basin covering an area of nearly

10,000 square kilometres. The Company has acquired 2,517 square

kilometres of 3D seismic and drilled two exploration wells, making

a significant gas condensate discovery with its first well.

Competent Person Disclosure:

The technical aspects of this announcement have been reviewed,

verified and approved by Dr Howard Obee in accordance with the

Guidance Note for Mining, Oil and Gas Companies, issued by the

London Stock Exchange in respect of AIM companies. Dr Obee is a

petroleum geologist with more than 30 year's relevant experience.

He is a Fellow of the Geological Society and member of the American

Association of Petroleum Geologists and the Petroleum Exploration

Society of Great Britain.

Chairman's and CEO's review

The Company reports an operating loss for 2021 of $1.0 million

(compared to $1.0 million in 2020). Administrative expense for the

year was $1.1 million (compared to $1.0 million in 2020) The cash

balance at year end was $0.714 million (2020: $2.18 million). The

Company continues to be debt-free. Due to the declining cash

balance the Company decided in late 2021 to raise additional funds.

This was completed in April this year through a $600,000

Subscription for 34,702,000 new Ordinary Shares and an Open Offer

for $1.2 million through the issue of 69,156,914 new Ordinary

Shares. The response to the Open Offer was extremely positive and

resulted in a significant over-subscription and we are grateful for

the support from existing shareholders. The funding was approved by

shareholder resolutions at a General Meeting in April 2022.

The funding coincided with a significant upturn in oil price.

Brent crude started to strengthen from the beginning of the 2022

but spiked significantly higher (towards $130 per barrel) during

March as a response to the tragic events in Eastern Europe. It is

always difficult to predict future oil price movements, but there

are clearly new considerations now in play for the energy

transition, such as energy security. It is uncertain what impact

this will have on oil & gas company strategies and from our

perspective, what bearing it will have on our ability to attract

partners to the Darwin project, but we will continue, with the help

of our advisors, to promote the strong merits of a development.

Our technical and commercial work recently has concentrated on

investigating a range of Darwin development scenarios. This focus

has been on reducing initial capital expenditure, delivering a fast

payback on that capital, minimising the environmental footprint

and, at the same time, ensuring the break-even oil price is below

$40 a barrel.

As a result we have prioritised a phased development concept

starting with around 25,000bpd of liquids production and using that

cash flow to increase production after a few years. Initial

production could come from 2 wells with a further well for gas

re-injection. Our initial studies have concluded that this approach

greatly reduces capital expenditure and results in a payback of

that capital within two years.

Over the coming months we plan to commission an externally led

technical study to scrutinise these plans and assumptions and will

be in a position to report these results when available. If this

study supports our internal findings, we believe this will make the

Darwin development project much more attractive to incoming

investors and partners as it will offer an investment with lower

capital commitments, robustness under most near term oil price

scenarios and a quick pay back on the invested capital.

In January we applied for, and were granted, an extension to our

Production Licences and Discovery Area. The revised expiry date is

31 December 2022. This is the maximum extension currently available

and did not come with additional work obligations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

2021 2020

--------------------------------------------------

$'000 $'000

-------------------------------------------------- -------- --------

Administrative expenses (1,096) (1,046)

-------------------------------------------------- -------- --------

Loss from operations (1,096) (1,046)

Finance income 74 55

Finance expense (1) (11)

-------------------------------------------------- -------- --------

Loss before tax (1,023) (1,002)

Tax expense - -

-------------------------------------------------- -------- --------

Loss for the year and total comprehensive

loss for the year attributable to equity owners

of the parent (1,023) (1,002)

-------------------------------------------------- -------- --------

Basic and diluted loss per share (see note (0.21) (0.21)

4) cents cents

-------------------------------------------------- -------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 December 2021

2021 2020

------------------------------- ----------------- -----------------

$'000 $'000 $'000 $'000

------------------------------- ------ --------- ------ ---------

Assets

Non-current assets

Property, plant and equipment 22 151

Intangible assets 292,746 292,241

------------------------------- ------ --------- ------ ---------

Total non-current assets 292,768 292,392

------------------------------- ------ --------- ------ ---------

Current assets

Other receivables 183 225

Cash and cash equivalents 714 2,184

------------------------------- ------ --------- ------ ---------

Total current assets 897 2,409

------------------------------- ------ --------- ------ ---------

Total assets 293,665 294,801

------------------------------- ------ --------- ------ ---------

Liabilities

Current liabilities

Trade and other payables (126) (240)

------------------------------- ------ --------- ------ ---------

Total net assets 293,539 294,561

------------------------------- ------ --------- ------ ---------

Equity attributable to

the equity owners of the

parent company

Share capital 8,530 8,530

Share premium 308,602 308,602

Other reserves 1,778 1,777

Retained deficit (25,355) (24,332)

Foreign currency reserve (16) (16)

------------------------------- ------ --------- ------ ---------

Total equity 293,539 294,561

------------------------------- ------ --------- ------ ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2021

Foreign

Share Share Other Retained currency

capital premium reserves deficit reserve Total

$'000 $'000 $'000 $'000 $'000 $'000

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 1 January

2020 8,530 308,602 1,777 (23,330) (16) 295,563

Loss and total comprehensive

loss for the year - - - (1,002) - (1,002)

Balance at 31 December

2020 8,530 308,602 1,777 (24,332) (16) 294,561

Loss and total comprehensive

loss for the year - - - (1,023) - (1,023)

Recognition of share-based

payments - - 1 - - 1

------------------------------ --------- --------- ---------- --------- ---------- --------

Balance at 31 December

2021 8,530 308,602 1,778 (25,355) (16) 293,539

------------------------------ --------- --------- ---------- --------- ---------- --------

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share capital This represents the nominal value of shares

issued.

Share premium Amount subscribed for share capital in excess

of nominal value.

Other reserves Fair value of options issued less transfers

to retained deficit on expiry.

Retained deficit Cumulative net gains and losses recognised

in the Consolidated Statement of Comprehensive

Income.

Foreign currency reserves Differences arising on the translation of

foreign operation to US dollars.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2021

2021 2020

----------------

$'000 $'000 $'000 $'000

--------------------------------------- ------ -------- ------ --------

Cash flow from operating activities

Loss before tax (1,023) (1,002)

Adjustments for: Depreciation 129 95

Share-based payment 1 -

Finance costs 1 11

Finance income (74) (54)

Unrealised foreign currency movements - 2

--------------------------------------- ------ -------- ------ --------

Cash flows used in operating

activities before changes in

working capital (966) (948)

Decrease in other receivables 42 8

Increase/(decrease) in trade

and other payables 10 (61)

--------------------------------------- ------ -------- ------ --------

Net cash outflow from operating

activities (914) (1,000)

Cash flows used in investing

activities

Interest received - 2

Purchase of intangible assets (505) (476)

------ ------

Net cash used in investing activities (505) (474)

--------------------------------------- ------ -------- ------ --------

Cash flows used in financing

activities

Lease interest (1) (11)

Lease payments (124) (62)

------ ------

Net cash used in financing activities (125) (73)

-------- --------

Net decrease in cash and cash

equivalents (1,544) (1,547)

--------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the beginning of the year 2,184 3,682

Exchange gain on cash and cash

equivalents 74 49

--------------------------------------- ------ -------- ------ --------

Cash and cash equivalents at

the end of the year 714 2,184

--------------------------------------- ------ -------- ------ --------

Notes

1. Accounting policies

Basis of preparation

The financial information for the year ended 31 December 2021

set out in this announcement does not constitute the Company's

statutory accounts. These financial statements included in the

announcement have been extracted from the Group annual financial

statements for the year ended 31 December 2021. The financial

statements have been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards adopted for use in the European Union. However, this

announcement does not itself contain sufficient information to

comply with IFRS.

The auditor has issued its opinion on the Group's financial

statements for the year ended 31 December 2021 which is unmodified

and is available for inspection at the Company's registered address

and will be posted to the Group's website.

2. Going concern

The consolidated financial statements have been prepared on a

going concern basis which assumes the continuity of normal business

activity and the realisation of assets and settlement of

liabilities in the normal course of business.

Subsequent to balance date, the Company raised US$1.8 million

(GBP1.35 million) before expenses through a subscription and open

offer to existing shareholders. We believe this provides sufficient

funding for the company until early 2023 so in the absence of a

farm-out agreement bringing in working capital into the Company,

additional funds may need to be raised before mid 2023. These

events or conditions indicate the existence of a material

uncertainty which may cast doubt on the Group and Parent Company's

ability to continue as a going concern and therefore that the Group

and Company may be unable to realise their assets in the normal

course of business.

3. Basic and dilutive loss per share

The calculation of the basic and dilutive loss per share is

based on the loss attributable to ordinary shareholders divided by

the weighted average number of shares in issue during the year. The

loss for the financial year for the Group was $ 1,023,000 (2020 -

loss $1,002,000) and the weighted average number of shares in issue

for the year was 484,098,484 (2020 - 484,098,484). During the year

the potential ordinary shares are anti-dilutive and therefore

diluted loss per share has not been calculated. At the Statement of

Financial Position date, there were 6,200,000 (2020: 6,100,000)

potentially dilutive ordinary shares being the share options.

4. Subsequent date events

In January 2022, the Company was advised that its licences in

The Falkland Islands had been renewed until end 2022 in line with

current practices.

In March 2022 the Company announced that it had raised $600,000

through a share placement and it planned an open offer to existing

shareholders to raise up to a further $1,200,000. The open offer

was oversubscribed so the applications were scaled back to raise

the full $1.8 million before expenses. Both capital raises were

approved at the general meeting in April.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR URUVRUKUVOAR

(END) Dow Jones Newswires

May 31, 2022 02:00 ET (06:00 GMT)

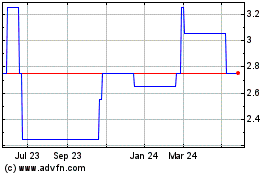

Borders & Southern Petro... (AQSE:BOR.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

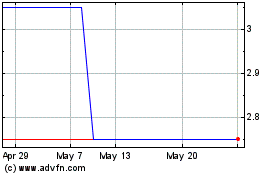

Borders & Southern Petro... (AQSE:BOR.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025