TIDMGCM

RNS Number : 4296D

GCM Resources PLC

02 March 2022

2 March 2022

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT IS NOT FOR

RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY

OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, NEW

ZEALAND, JAPAN, SOUTH AFRICA OR IN OR INTO ANY OTHER JURISDICTION

WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OR BREACH OF ANY

APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN GCM RESOURCES PLC OR ANY OTHER

ENTITY IN ANY SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION (EU NO.

596/2014) AS IT FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("UK MAR").

GCM Resources plc

("GCM" or the "Company")

Placing and Subscription to raise GBP2,130,000

Appointment of Joint Broker & Loan Amendment

GCM Resources plc (LON: GCM), an AIM quoted mining and energy

company i s pleased to announce that the Company has raised gross

proceeds of GBP2.13million through a placing (the "Placing") of

25,291,828 shares and a subscription for 16,171,777 shares (the

"Subscription") of new ordinary 1p shares in the Company

("Fundraising Shares") at a price of 5.14 pence per share ("the

Placing Price"), representing a discount of approximately 36.9% to

the closing mid-market share price on 1 March 2022 (being the last

business day prior to this announcement).

The issue of the Fundraising Shares is within the Company's

existing allotment authorities. The Fundraising Shares equate to

approximately 30.1% of the Company's currently issued share

capital.

The funds raised from the Placing and the Subscription will be

principally be used for development capital on the Company's

high-quality coal resource of 572 million tonnes (JORC 2004

compliant) at the Phulbari Coal and Power Project (the "Project")

in north-west Bangladesh, and provide the Company with sufficient

funds to cover its corporate operating expenses through to Q2

2023.

Placing & Joint broker Appointment

The Company has raised gross proceeds of approximately

GBP1,300,000 by means of a placing (the "Placing") of new Ordinary

Shares (the "Placing Shares") at the Placing Price through ETX

Capital, which is the trading name of Monecor (London) Limited. ETX

Capital is acting as broker in connection with the Placing

The Company intends to issue approximately 25,291,828 Shares, to

raise gross proceeds of approximately GBP1,300,000, to participants

in the Placing. The Placing Shares are expected to be admitted to

trading on AIM on or around 7 March 2022.

GCM is also pleased to announce that it has appointed ETX

Capital as joint broker, as part of the Placing.

Subscription

An issue of 16,171,777 new ordinary shares of 1p each in the

capital of the Company (the "Subscription Shares") to certain

individuals including Polo Resources Ltd at the Issue Price to

raise GBP830,000 (the "Subscription") at an issue price of 5.14p

("the issue price").

Loan Facility Amendment

The Company has, as part of the proposed subscription, agreed to

amend the terms of the loan facility provided by Polo Resources

Limited (the "Facility") of which, as announced on 26 March 2021,

there is GBP300,000 of the initial GBP3.5 million facility

remaining undrawn. The lender may request conversion by the

issuance of new ordinary shares in the Company at 5.14 pence per

share (being the Issue Price) subject to any necessary regulatory

approvals. All other terms of the agreement remain unchanged.

Related party transactions

The participation of Polo in the Subscription and the amendment

of the Loan Facility, constitutes related party transactions

pursuant to the AIM Rules for Companies. The Directors (excluding

Datuk Michael Tang), having consulted with the Company's nominated

adviser, WH Ireland Limited, consider the terms of the Subscription

and amendment of the Loan Agreement, to be fair and reasonable

insofar as the Company's shareholders are concerned.

Admission to trading and total voting rights

The Placing and Subscription Shares will rank pari passu in all

respects with the Company's existing ordinary shares. The Placing

is conditional, inter alia, on there being no breach of the

Company's obligations under the Placing Agreement entered into

between Monecor (London) Ltd (trading as ETX Capital) and the

Company prior to admission of the Placing Shares to trading on AIM

("Admission"), and such Admission becoming effective. Application

will be made to the London Stock Exchange for the Placing Shares to

be admitted to trading on AIM. It is expected that Admission will

become effective and that dealings in the Placing Shares on AIM

will commence at 8.00 a.m. on or around xx March 2022.

On Admission, the Company's issued share capital will consist of

179,056,486 ordinary shares, each with one voting right. There are

no shares held in treasury. Therefore, the Company's total number

of ordinary shares and voting rights will be 179,056,486 and this

figure may be used by shareholders following Admission as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Datuk Michael Tang, CEO of GCM, commented : "I am pleased that

we are able to announce this successful fundraising, with new &

existing investors, to provide funds for our development over the

next year. I look forward to providing further updates in due

course in relation to progress with the Phulbari Coal and Power

Project"

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014 and has

been announced in accordance with the Company's obligations under

Article 17 of that Regulation.

For further information:

GCM Resources plc WH Ireland Ltd

Keith Fulton James Joyce

Finance Director Andrew De Andrade

+44 (0) 20 7290 1630 +44 (0) 20 7220 1666

GCM Resources plc

Tel: +44 (0) 20 7290 1630

info@gcmplc.com; www.gcmplc.com

About GCM Resources

GCM Resources plc (LON: GCM), an AIM listed mining and energy

company, has identified a high-quality coal resource of 572 million

tonnes (JORC 2004 compliant) at the Phulbari Coal and Power Project

(the "Project") in north-west Bangladesh.

Utilising the latest highly energy efficient power generating

technology, the Phulbari coal mine is capable of supporting power

plants of up to 6,000MW. GCM is awaiting approval from the

Government of Bangladesh to develop the Project. The Company has a

strategy of combining the Company's mine proposal with up to

6,000MW of power generation, together with credible,

internationally recognised strategic partners. GCM aims to deliver

a practical power solution to provide the cheapest coal-fired

electricity in the country, in a manner amenable to the Government

of Bangladesh.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUURNRUBUORAR

(END) Dow Jones Newswires

March 02, 2022 11:13 ET (16:13 GMT)

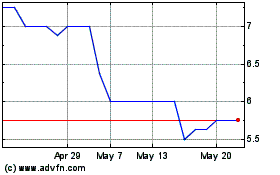

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

GCM Resources (AQSE:GCM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024