TIDMHUM

RNS Number : 6442W

Hummingbird Resources PLC

19 April 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

19 April 2023

Hummingbird Resources pl c

("Hummingbird" or the "Company")

Q1 2023 Operational and Trading Update

Consecutive strong quarterly production of +27koz & improved

AISC profile of US$1,109 per oz

Hummingbird Resources plc ("Hummingbird" or the "Company") (AIM:

HUM) is pleased to announce an operational and trading update for

the first quarter of 2023 ("Q1 2023").

Operational update

Yanfolila, Mali

-- Quarterly gold production for Q1 2023 of 27,262 ounces ("oz")

(Q4 2022 of 28,264 oz, and Q1 2022 of 15,548 oz).

-- AISC of US$1,109 per oz for Q1 2023 (a +11% improvement from

Q4 2022 of $1,248 per oz and +50% from Q1 2022 of US$2,235 per

oz).

-- 26,380 oz of gold sold in Q1 2023 at an average realised

price of US$1,878 per oz (Q4 2022: 27,860 oz of gold sold at an

average realised price of US$1,726 per oz). The Company held 2,810

oz of gold inventory on 31 March 2023, valued at c.US$5.6

million.

Kouroussa, Guinea

-- Kouroussa construction is fully funded, on budget and remains

on track for first gold pour by the end of this quarter, Q2

2023.

-- >2.5 million lost time injury ("LTI") free hours now

achieved, a key ongoing safety metric for the Kouroussa

construction team, with over 1,000 construction and mining

personnel on site currently.

Dugbe, Liberia

-- The strategic review of options to best realise the maximum

value of Dugbe for all stakeholders is ongoing with our joint

venture partner, Pasofino Gold Limited ("Pasofino").

Corporate

-- Strategic investment by CIG SA ("CIG") and successful

placement ("the Placement") of c.US$17.1 million during Q1 2023,

completing the funding required to ensure Kouroussa goes into

production as scheduled, and to fast-track exploration at that

asset.

-- Consecutive strong and improved quarterly Group EBITDA, up

+59% to c.US$17.5 million for Q1 2023, versus Q4 2022 of c.US$11

million.

Outlook

-- Similar trends from Q1 2023 levels expected this quarter, Q2 2023.

-- As previously stated, an updated Group wide full year

guidance update to be provided once Kouroussa is in production and

ramping up.

Dan Betts, CEO of Hummingbird, commented:

"Hummingbird's second mine, Kouroussa, remains on track to pour

first gold this quarter. The Project remains on time and on budget,

and will mark a major milestone in the development of the Company

to realising our ambitions of being a multi-mine,

multi-jurisdiction gold producer. The mine will more than double

our production profile, reduce the Group's cost of production, and

diversify risk. The achievement of over 2.5 million LTI free hours

at the Project is also a fantastic accomplishment by the team, for

which we are proud of.

At Yanfolila, we continue to see operational improvements which

is very positive, with a mine adding good cash flow returns to the

business and performing more in line with expectations. Yanfolila

had a positive quarter in terms of production and improved AISC

profile, with many of the operational changes made in H2 2022

coming through to the bottom line in terms of a more stabilised and

predictable performance at the mine.

The quarter also saw the Company take on a strategic investment

from CIG. This investment has helped ensure that we can deliver

Kouroussa without the risk of delay; but possibly more importantly,

it gives us a strategic partner with whom we share a long-term

ambition of continuing to grow Hummingbird into a multi-mine,

multi-jurisdiction gold Company."

Operational Update

Note: Ore mined includes high grade, low grade, and marginal

material. Ore processed is a blend based on preferential feed of

high grade and low grade , with marginal ore added as an

incremental feed source.

Yanfolila, Mali

-- Q1 2023 saw production of 27,262 oz, being another

consecutive strong production quarter for the Company, following Q4

2022 gold production of 28,264 oz.

o Similar trends are expected in Q2 2023, with mining continuing

primarily in the high-grade Komana East ("KE") deposit.

o KE deposit will be largely mined by early Q3 2023, with the

mine plan increasingly shifting to other open pit deposits,

including Sanioumale East ("SE") which is currently being prepared

for mining in H2 2023.

o Further, initial development of the Komana East underground

mine ("KEUG") began in Q1 2023, with first underground production

scheduled by year end, for a full underground production year in

2024, with more details below.

-- Ore processed totalled 366,622 tonnes ("t"), showing another

good consecutive quarterly result, as the key target mine area for

the quarter, being KE, was mined.

-- Mill feed grade for Q1 2023 averaged 2.41 grammes per tonne

("g/t"), in line with the mill feed grade as seen in Q4 2022 of

2.45 g/t.

-- Processing plant recovery rates for Q1 2023 were 94.41%, in

line with the Company's historical average, and as seen in Q4

2022.

-- KEUG initial development work began in Q1 2023, with portal

hole access works started, design works completed and key

underground mining equipment from international underground mining

specialists Epiroc beginning to arrive on site. A more detailed

update will be given in our Q2 2023 operational update on the KEUG

mining progress and economics. With a +278,000 oz Reserve, at 3.94

g/t, and increased mine life potential with further drilling, the

KEUG will be a key deposit to underpin Yanfolila's future

production profile.

-- The contract with Yanfolila's contract miner JCM was

terminated on 31 March 2023 as a result of ongoing poor equipment

availability which materially impacted the operational performance

of Yanfolila. The Company is currently supporting a transition of

mining activities to a new contractor, with the ongoing support

from Corica Mining Services (West African contract mining

specialist, and Kouroussa's contract miner), including the

excavators Corica have supplied for continued mining at Yanfolila

without disruption.

-- As noted in our Q4 2022 Operational and Trading update, a

detailed cost control and reduction programme at Yanfolila was

initiated and remains ongoing with cost improvements starting to

come through at site.

-- Maintaining FY2023 production guidance for Yanfolila, Mali,

of 80,000 - 90,000 oz, with a full year AISC of under US$1,500 per

oz, with an updated Group wide full year guidance update to be

provided once Kouroussa is in production and ramping up.

-- Yanfolila ESG: SE village resettlement begun in Q1 2023 and

is progressing ahead of schedule for completion of new housing

being built for the community, in preparation for mining at the SE

deposit in H2 2023. Resettlement and new village houses are being

built for the community village under the guidance of West African

specialist consultants ESDCO (Environmental and Social Development

Company).

Kouroussa, Guinea

-- As noted in the highlights above, Kouroussa construction is

fully funded, on budget and remains on track for first gold pour by

the end of this quarter, Q2 2023.

-- Final construction, operational readiness and commissioning

programmes are being completed in preparation for first gold

pour.

-- Mining commenced early in the quarter, with ore stockpiles

increasing on the ROM pad in preparation for commissioning and ramp

up to name plate capacity in H2 2023.

Other key operational readiness and construction updates that

occurred for the quarter include:

-- >2.5 LTI free hours now achieved, a key ongoing safety

metric for the Kouroussa construction team, with over 1,000

construction and mining personnel on site currently.

-- Tailings storage facility construction completed, with piping

infrastructure to the processing plant being installed.

-- Power plant equipment arriving on site and being installed in

preparation for commissioning.

-- Permanent mine camp construction scheduled to be completed end of April 2023.

-- Detailed commissioning schedule developed by site and Soutex

(Kouroussa's engineering contractor), with commissioning personnel

identified and being hired, including those that commissioned

Yanfolila in Mali.

-- Processing plant labour requirements for commissioning, ramp

up and full production are in place, with a key focus on hiring

more personnel to fill supporting and managerial roles, with the

emphasis on national and local hires where possible.

-- Increasing key focus on building overall inventory supplies

required for mining and production being implemented.

-- Detailed Kouroussa exploration plans are being developed in

H1 2023 with a view to re-initiated exploration drilling plans in

H2 2023 / 2024, with the focus to increase on Kouroussa's current

Reserves base of 647,000 oz at 4.15 grammes a tonne ("g/t").

Kouroussa ESG:

-- Increasing healthcare and first aid training initiatives

being conducted in the communities and schools at Kouroussa from

our on-site clinical nursing team and global remote healthcare

specialists Critical Care International ("CCI").

-- Community livelihood initiatives and projects advanced during

the quarter, in particular the construction of community market

garden infrastructure and community water bore holes.

Financial update

-- Q1 2023 AISC at US$1,109 per oz, a +11% improvement to Q4

2022 AISC of US$1,248 per oz, and below our full year AISC guidance

of less than US$1,500 per oz for Yanfolila, being a key highlight

of the quarter, largely driven by: lower strip ratios; improved

mining techniques being installed at site; cost control; and good

grades being mined from the KE open pit.

-- Another consecutive strong and improved quarterly Group

EBITDA of c.US$17.5 million for Q1 2023. Strong production and a

reduced AISC profile, coupled with improved gold price received for

gold ounces sold, leading to a +59% improvement from the Q4 2022

Group EBITDA of c.US$11 million, also another key highlight from

the quarter.

-- Capital expenditure of approximately c.US$21m in the quarter,

primarily at Kouroussa, funded from both operating cashflows and

the Placement of c.US$17 million during the quarter.

-- Net debt position c.US$110.8 million end of Q1 2023

(c.US$105.2 million including gold inventory value) consisting

of:

o Gross debt of c.US$118.7 million.

o Cash at bank of c.US$7.9 million.

o Gold inventory value of c.US$5.6 million.

-- Further, c.US$15 million remains available and expected to be

drawn this quarter, Q2 2023, from the Coris Bank International

("Coris Bank") debt facilities.

-- Of the budgeted US$115 million capex for the construction of Kouroussa:

o c.US$83 million has been paid as at the end of Q1 2023.

o c.US$12 million to be paid this quarter and early Q3 2023.

o c.US$20 million contractor deferrals, retention incentives and

working capital not expected to be paid until Kouroussa is in full

production.

-- The balance of Kouroussa's capex to be funded from a

combination of the recent Placement, ongoing operational cashflows

and available debt facilities.

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin (www.singlemineorigin.com). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when in production,

scheduled for first gold pour the end of Q2 2023. Further, the

Company has a controlling interest in the Dugbe Gold Project in

Liberia that is being developed by Pasofino Gold Limited through an

earn-in agreement. The final feasibility results on Dugbe showcase

2.76Moz in Reserves and strong economics such as a 3.5-year capex

payback period once in production, and a 14-year life of mine at a

low AISC profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Gordon Hamilton Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEVLFFXZLFBBD

(END) Dow Jones Newswires

April 19, 2023 02:00 ET (06:00 GMT)

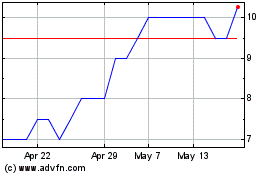

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024