TIDMHUM

RNS Number : 7808B

Hummingbird Resources PLC

06 June 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

06 June 2023

Hummingbird Resources pl c

("Hummingbird" or the "Group")

2022 Audited Annual Results

Hummingbird Resources plc ("Hummingbird" or the "Group") (AIM:

HUM), is pleased to announce its audited financial results for the

year ended 31 December 2022.

Financial results

-- Sales of US$143.3 million (2021: US$156.6 million) were

generated from 80,445 ounces ("oz") of gold sold in 2022 at an

average price of US$1,782/oz (2021: 87,553 oz sold at an average

price of $1,788/oz), with additional US$7.0 million (2021: US$6.2

million) revenue generated from sale of Single Mine Origin ("SMO")

gold.

-- EBITDA of US$3.7 million (2021: US$ 28.2 million).

-- Adjusted EBITDA (1) of negative US$7.0 million (2021: positive US$18.6 million).

-- Diluted loss per share of US$ 8.71 cents (2021: loss per

share of US$ 3.22 cents (restated)).

-- Total bank debt US$115.7 million (2021: US$61.8 million).

-- Net debt of US$109.8 million (2) (2021: $21.0 million (2) ).

o (1) (Adjusted EBITDA Earnings before interest, tax,

depreciation and amortisation, effect of impairment charges,

foreign currency translation gains/losses and other non-recurring

expense adjustments but including IFRS 16 lease payments.)

o (2) (Net debt/cash including the value of gold inventory.)

Operational results

-- 80,653 oz of gold poured in 2022 (2021 : 87,558 oz).

-- All in Sustaining Cost ("AISC") of US$1,782 per oz in 2022 (2021 : US$1,536 per oz)

-- Group Reserves materially increased to 4.13 million ounces

("Moz") (2021: 1.12Moz) following the extensive drilling campaigns

completed at Yanfolila and Kouroussa in 2021 being converted into

Reserves, and the completion of a Definitive Feasibility Study

("DFS") in June 2022 on Dugbe, in Liberia.

-- Group Resources increased to 7.28Moz (2021: 7.12Moz).

-- DFS completed at Dugbe in Liberia by joint venture partners

Pasofino Gold Ltd ("Pasofino"), of which the Group retains a

majority 51% interest in Dugbe, showcasing: a h igh DFS pre-tax NPV

of US$690 million (US$530 million post tax); si gnificant 2.76Moz

Reserve base; long life of mine ("LOM") of 14 years, with upside

given the material exploration potential available; and a low AISC

profile of US$1,005 per oz to underpin a gold mine of material

value.

-- Achieved full compliance of the World Gold Council ("WGC")

and Responsible Gold Mining Principles ("RGMPs") in November

2022.

Dan Betts, Interim Chairman and CEO of Hummingbird,

commented:

" The past year we achieved several key milestones we set

ourselves to fulfil for the year, while facing challenges at our

Yanfolila mine in Mali, especially the earlier part of 2022.

Commencing construction at our Kouroussa Gold Mine in Guinea with a

target of achieving first gold pour by the end of Q2 2023, to

fulfil our strategic objective of becoming a multi-asset,

multi-jurisdiction gold producer remains well on target with

Kouroussa commissioning progressing well towards first gold pour

within this quarter. We also set ourselves the goal to materially

increase the Group's Reserves base to showcase LOM increase at all

our assets. This was achieved with the release of our updated Group

Reserves and Resources statement in June 2022 highlighting a

material increase in Group Reserves to 4.1Moz. Further, another key

focus area was to deliver a robust and valuable DFS at Dugbe via

our joint venture partners Pasofino. As per the highlights above

this was achieved in June 2022, with a strategic review underway

with Pasofino on the best options to create value for all

stakeholders at the asset. As well documented, we faced operational

challenges at our Yanfolila mine in Mali during 2022, impacting the

achievements as noted above. Pleasingly, post operational changes

made mid-way through the year, we saw material improvements in the

production, AISC profile and cash flow generation of the mine as

seen in our Q4-2022 and Q1-2023 results.

For 2023, the year has started well, and the Group is at a

pivotal junction for growth, with Yanfolila performing better and

Kouroussa commissioning underway towards first gold pour and then

to name plate production for H2-2023. Further, with a strategic

partner in place with CIG, endorsing the Group 's strategy for

growth, we are confident and excited about the Group's prospects

for the remainder of 2023 and beyond."

Interim Chairman and CEO's Statement

During the past year our key priorities were to: commence

construction at our Kouroussa Gold Mine in Guinea with a target of

achieving first gold pour by the end of Q2 2023; to fulfil our

strategic objective of becoming a multi-asset, multi-jurisdiction

gold producer; analyse, understand and increase the Group's

Resources and Reserves profile on the back of the 2021 exploration

drilling campaign; to assist our joint venture partners Pasofino,

to deliver a robust and valuable definitive feasibility study

("DFS") at Dugbe; to continue to improve on our Environmental,

Social and Governance ("ESG") initiatives, including SMO; to

achieve full compliance of the year 3 WGC RGMPs; and to achieve

better overall performance at Yanfolila in Mali.

With Yanfolila ending the year in a significantly better state

than at the beginning and with Kouroussa on track to pour gold

imminently, I am pleased to be able to report that we have achieved

all of those objectives.

In early January 2022, the Group formally commenced construction

at Kouroussa following the mobilisation of equipment and personnel

in December 2021, by the Project's construction and engineering

firm WACOM, in line with the Project schedule and targeted first

gold pour by the end of Q2 2023. Throughout the year construction

advanced from first breaking ground and clearance works, towards

the major civil work construction phase. By Q4 2022, an increasing

focus turned to 'operational readiness' programmes, with James

Francis joining the Group as General Manager for Kouroussa to lead

the business forward.

Despite the well documented macro global inflationary challenges

(which persist), and despite the regional backdrop of ECOWAS

sanctions and restricted movements of people and goods in the

region I am pleased to be able to report that the Kouroussa project

remained on track and on budget throughout the period. Furthermore,

as this Annual report goes to print, we are within days of "first

gold" at Kouroussa with the project currently going through its

commissioning phase and so I am confident that it will be delivered

ahead of schedule and on budget. This will be the second mine that

the Hummingbird team have designed, financed, and built on time and

on budget; and given the challenging environment it is an extremely

commendable achievement by the team.

In 2021 we embarked on a targeted c.44,000-meter exploration

drilling campaign at Kouroussa and Yanfolila, with a focus to

increase our overall Group Reserves profile and provide meaningful

LOM extensions at our assets. This cumulated in the release of our

updated Group Resources and Reserves statement in June 2022, which

showcased a material uplift to Kouroussa's Reserves profile to 647

kilo ounces ("Koz") at a high grade of 4.15 grammes a tonne ("g/t")

and added Reserves net of depletions at Yanfolila totalling 719

Koz, including extending the underground Reserves profile at

Yanfolila to 278 koz at 3.94 g/t. Further, at Dugbe via our joint

venture partner, Pasofino, final DFS results were announced on 13

June 2022, establishing a material maiden Reserves profile at Dugbe

of 2.76 million ounces ("Moz") in which the Group retains a

controlling 51% interest. The material uplift in the Group's

Reserves profile was a significant achievement for the Group during

2022. This work has led the Group to two significant conclusions

that will shape our focus going forward. Firstly, the exploration

potential at Kouroussa is significant and we will be looking to

ramp up our regional exploration efforts to extend the mine life as

soon as possible. Secondly, the exploration potential at Yanfolila

would seem to lie mainly in the underground potential which could

go on for many years, and as time goes by will shape our focus

towards making Yanfolila a smaller underground operation focussed

on cost and profitable ounces.

On Dugbe, as noted above, our joint venture partner Pasofino

released a detailed and robust DFS with key highlights being:

strong financial metrics, with a pre-tax NPV 5% of US$690 million,

26.35% IRR (23.6% post-tax); fast capital payback of approximately

3.5 years from start of production; a large mineral Reserve with

potential for expansion of 2.27 Moz of gold, with a long 14-year

LOM; and a detailed Environmental and Social Impact Assessment

("ESIA") study also completed.

With a robust Dugbe DFS completed, an increasing focus then

turned towards working on a strategic review with our joint venture

partner Pasofino on determining the best options to generate

maximum value of Dugbe for all stakeholders. The strategic review

remains ongoing, and we are confident of highlighting in 2023, a

pathway towards unlocking the material value of that asset to our

shareholders.

In relation to ESG, November 2022 saw a key milestone for the

Group as it achieved Year 3 full compliance of the WGC RGMPs.

Hummingbird is committed to operating responsibly with strict ESG

protocols and practices. Adopting the WGC RGMPs is a key part of

Hummingbird's strategy for building a long term, responsible mining

company. Meeting and where possible exceeding these requirements

demonstrate our continued commitment to adhering to international

best practice ESG standards. Ever since the Company was founded,

ESG concepts have been more than just a word to us. We want to be

at the forefront of developing the art of responsible mining in the

industry leaving a lasting positive legacy in the regions and

communities in which we operate. For this reason, we established

the Pygmy Hippo foundation ("PHF") in 2011 to work to preserve the

regional environment around our projects. In addition, we have

worked very closely to establish community health benefit

initiatives with our partner Critical Care International ("CCI")

whilst seeking to increase transparency and exposure through our

support of Single Mine Origin Gold ("SMO") creating a universe of

environmental, social, healthcare and transparency impacts against

which we can be measured.

SMO continues to gain increased industry recognition in 2022,

with multiple jewellery brands using and endorsing SMO gold in

their products, including British jewellers Boodles. As I noted in

last year's annual report, the SMO initiative gives us the

opportunity to showcase mining as the force for good that we at

Hummingbird fundamentally believe can and should be. It also gives

us the opportunity to be a part of a larger movement that future

proofs mining in a world of increased scrutiny and showcases

responsible mines for all the valuable work that they do. I believe

this initiative has the scope to transcend our Group and be a

driver of change for the positive impact the mining industry

delivers more broadly.

Regrettably, the achievements as highlighted above were

significantly hampered by the operational underperformance at

Yanfolila in Mali during 2022, particularly for the first three

quarters of the year. A key driver of this was the continual

underperformance of our mining contractor's fleet, materially

hindering the ability to follow the scheduled mine plans. The

Group, in turn, took decisive and necessary actions to stabilise

ongoing production challenges and return Yanfolila to a cashflow

positive position by addressing the poor mining performance of the

Yanfolila mine both in the immediate and longer term. The Group

stepped in to support our mining contractor by providing additional

fleet such as extra excavators, reinforcing the contract miner's

maintenance teams to improve the overall mining fleet performance

coupled with several other work stream initiatives; ultimately

(post year-end) our relationship with our contract miner has come

to an end and mining activities are now being carried out by a new

contractor with much more internal support.

Pleasingly, by the end of 2022, the decisive initiatives the

Group took as noted above, coupled with on site management changes,

saw Yanfolila' s operational performance materially improve, which

has continued into 2023. Hummingbird's Q4 2022 production and AISC

profile were amongst some of the best recorded for several years.

Gold production was 28,264 oz at an AISC profile of US$1,248 per

oz, leading to a materially improved Group EBITDA of c.US$11

million for the Q4 2022 quarter. This was a hugely positive outcome

at the end of what was a challenging year at Yanfolila.

2023 Outlook:

In March 2023, the Group secured a key, regionally influential

strategic partner and strengthened the balance sheet with a c.US$17

million placement led by CIG group. The placement has helped ensure

Kouroussa gets into production as scheduled for first gold pour by

the end of Q2 2023 and provides the ability to help fast-track

further exploration at the asset. This investment by new and

existing shareholders endorses the Group's growth strategy in the

West African region and beyond.

With this support, we will achieve our strategic goal this year

of being a multi-asset, multi-jurisdiction gold producer.

At Yanfolila, a key focus is to maintain the improved

operational performance, as exhibited by our Q4 2022 and Q1 2023

operational results and to bring online Yanfolila' s underground

mine by year end for a full year of production in 2024. Further, at

Dugbe, with a strategic review underway, our goal for 2023 is to

show a pathway to unlocking the material value of that asset for

all stakeholders.

On exploration, given limited drilling was undertaken in 2022,

we are cognisant of the need to increase the Group's exploration

activities to maintain and extend the Group's Reserves base. This

is a priority for us going forward. We are completing a detailed

review of exploration plans at Kouroussa and Yanfolila, with

expectations in 2H 2023 and 2024 to have reinitiated exploration

campaigns at those assets, particularly at Kouroussa.

We successfully achieved Year 3 WGC RGMP full compliance at both

corporate and Yanfolila site levels, as part of our increasing

focus to ensure these and other leading international ESG standards

are embedded into the Group's and mine site's procedures and

policies. Importantly we aim to continue to enhance sustainable

community livelihood programmes and projects at our assets, whilst

growing the SMO initiative across the broader gold market.

On a final note, I would like to thank our previous chairman,

Russell King for his time and valuable guidance at the company.

Since his retirement in June 2022, I have assumed the role of

Interim Chairman in addition to being CEO. It is probably fair to

say that the environment in the middle of last year for attracting

a suitable Chair to help us drive forward with our next stage of

growth was somewhat sub optimal; but we are in much better shape

now as Kouroussa comes online, and it is indeed our intention to

find such a candidate. Whilst we will not rush into a hasty

decision, it remains a priority for the group going forward.

In conclusion, with Yanfolila's operational performance

improving, and Kouroussa's birth imminent, the Group is at a

pivotal juncture for exponential growth, a key focus for the

executive team this year is to show improved cash flow generation

and a stronger balance sheet for the Group to underpin our growth

strategy and ultimately drive shareholder returns.

Dan Betts

Interim Chairman and Chief Executive Officer

Consolidated Statement of Comprehensive Income - For the year

ended 31 December 2022

2022 2021 Restated

$'000 $'000

-------------------------------------------- ---- ---------- --------------

Revenue 150,519 162,777

Production costs (126,527) (113,606)

Amortisation and depreciation (37,357) (38,317)

Royalties and taxes (5,620) (6,297)

-------------------------------------------------- ---------- --------------

Cost of sales (169,504) (158,220)

Gross (loss)/profit (18,985) 4,557

Share based payments (1,941) (1,459)

Other administrative expenses (11,791) (10,263)

-------------------------------------------------- ---------- --------------

Operating loss (32,717) (7,165)

Finance income 3,641 4,071

Finance expense (14,156) (8,190)

Share of joint venture profit/(loss) 4 (46)

(Impairment)/reversals in impairment

of financial assets (316) 108

Losses on financial assets and liabilities

measured at fair value (715) (3,134)

-------------------------------------------------- ---------- --------------

Loss before tax (44,259) (14,356)

Tax 4,269 1,617

-------------------------------------------------- ---------- --------------

Loss for the year (39,990) (12,739)

================================================== ========== ==============

Attributable to:

Equity holders of the parent (34,279) (12,656)

Non-controlling interests (5,711) (83)

------------------------------- --------- ---------

Loss for the year (39,990) (12,739)

=============================== ========= =========

Loss per share (attributable to equity

holders of the parent)

Basic ($ cents) (8.71) (3.22)

Diluted ($ cents) (8.71) (3.22)

========================================= ======= =======

Consolidated Statement of Financial Position - For the year

ended 31 December 2022

2022 31 December 2021

$'000 Restated

$'000

------------------------------------------------------- --- -------- -----------------

Assets

Non-current assets

Intangible exploration and evaluation assets 129,652 91,287

Intangible assets software 143 235

Property, plant and equipment 204,393 144,591

Right of use assets 25,488 35,986

Investments in associates and joint ventures 133 129

Financial assets at fair value through profit or loss 1,532 3,530

Deferred tax assets 9,571 3,868

370,912 279,626

----------------------------------------------------------- -------- -----------------

Current assets

Inventory 15,748 13,148

Trade and other receivables 51,852 25,152

Unrestricted cash and cash equivalents - 32,571

Restricted cash and cash equivalents 3,892 4,168

71,492 75,039

----------------------------------------------------------- -------- -----------------

Total assets 442,404 354,665

============================================================ ======== =================

Liabilities

Non-current liabilities

Borrowings 71,840 61,812

Lease liabilities 15,845 27,556

Deferred consideration 1,801 4,627

Other financial liabilities 26,795 9,092

Provisions 27,120 21,644

143,401 124,731

----------------------------------------------------------- -------- -----------------

Current liabilities

Trade and other payables 66,081 33,708

Lease liabilities 11,819 9,961

Deferred consideration 1,776 -

Other financial liabilities 15,000 15,000

Provisions 830 611

Borrowings 43,862 -

Bank overdraft 1,741 -

141,109 59,280

Total liabilities 284,510 184,011

------------------------------------------------------------ -------- -----------------

Net assets 157,894 170,654

============================================================ ======== =================

Equity

Share capital 5,828 5,814

Share premium 17,425 17,425

Retained earnings 97,177 137,895

------------------------------------------------------------ -------- -----------------

Equity attributable to equity holders of the parent 120,430 161,134

============================================================ ======== =================

Non-controlling interest 37,464 9,520

Total equity 157,894 170,654

============================================================ ======== =================

Consolidated Statement Cash Flows - For the year ended 31

December 2022

2022 2021

$'000 Restated

$'000

Net cash inflow from operating activities 13,181 22,703

-------------------------------------------------------------- --------- ---------

Investing activities

Purchases of intangible exploration and evaluation assets (5,876) (9,992)

Purchases of property, plant and equipment (82,942) (22,295)

Pasofino funding 4,665 10,141

Pasofino funding utilisation - (10,946)

Sale of shares in other companies - 2,538

Interest received 2 -

Net cash used in investing activities (84,151) (30,554)

-------------------------------------------------------------- --------- ---------

Financing activities

Exercise of share options 14 -

Lease principal payments (10,741) (11,014)

Lease interest payments (2,862) (3,006)

Loan interest paid (3,452) (721)

Commissions and other fees paid (4,724) (5,413)

Loans repaid - (13,278)

Loan drawdown 58,695 66,365

Net cash generated from financing activities 36,930 32,933

-------------------------------------------------------------- --------- ---------

Net (decrease)/increase in cash and cash equivalents (34,040) 25,082

Effect of foreign exchange rate changes (548) 589

Cash and cash equivalents at beginning of year 36,739 11,068

Cash and cash equivalents at end of year 2,151 36,739

============================================================== ========= =========

Consolidated Statement of Changes in Equity - For the year ended

31 December 2022

Total

equity

Shares attributable

Share to be Share Retained to the Non-controlling

capital issued premium earnings parent interest Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

------------------- --------- ----------- ------------ --------- ------------- ---------------- ---------

Balance at 1

January

2021 5,344 17,407 488 150,246 173,485 9,776 183,261

Prior year equity

adjustment -

IFRS

16 - - - (699) (699) (173) (872)

Balance at 1

January

2021(restated) 5,344 17,407 488 149,547 172,786 9,603 182,389

Comprehensive

income

for the year

restated:

Loss for the year

(restated) - - - (12,656) (12,656) (83) (12,739)

-------------------

Total

comprehensive

income for the

year - - - (12,656) (12,656) (83) (12,739)

Transactions with

owners in their

capacity as

owners:

Shares issued as

consideration in

asset purchase 470 (17,407) 16,937 - - - -

------------------- --------- ----------- ------------ --------- ------------- ---------------- ---------

Total transactions

with owners in

their

capacity as

owners 470 (17,407) 16,937 - - - -

Share based

payments - - - 1,004 1,004 - 1,004

As at 31 December

2021 (restated) 5,814 - 17,425 137,895 161,134 9,520 170,654

=================== ========= =========== ============ ========= ============= ================ =========

Comprehensive

income

for the year:

Loss for the year - - - (34,279) (34,279) (5,711) (39,990)

-------------------

Total

comprehensive

loss for the year - - - (34,279) (34,279) (5,711) (39,990)

Transactions with

owners in their

capacity as

owners:

Pasofino minority

interest after

earn-in - - - (9,528) (9,528) 33,655 24,127

Total transactions

with owners in

their

capacity as

owners - - - (9,528) (9,528) 33,655 24,127

Exercise of share

options 14 - - - - - 14

Share based

payments - - - 3,089 3,089 - 3,089

As at 31 December

2022 5,828 - 17,425 97,177 120,430 37,464 157,894

=================== ========= =========== ============ ========= ============= ================ =========

Notes to the Consolidated Financial Statements

1. General information

Hummingbird Resources PLC is a public limited company with

securities traded on the AIM market of the London Stock Exchange.

It is incorporated and domiciled in the United Kingdom and has a

registered office at 49-63 Spencer Street, Hockley, Birmingham,

West Midlands, B18 6DE.

The nature of the Group's operations and its principal

activities are the exploration, evaluation, development, and

operating of mineral projects, principally gold, focused currently

in West Africa.

2. Basis of preparation

The preliminary announcement does not constitute statutory

financial statements for the years ended 31 December 2022 and 31

December 2021.

The financial information for the year ended 31 December 2022

has been extracted from the Group's audited financial statements

which were approved by the Board of Directors on 05 June 2023 and

which, if adopted by the members at the Annual General Meeting,

will be delivered to the Registrar of Companies for England and

Wales. The report of the auditor on the 31 December 2022 financial

statements was unqualified but contained a material uncertainty

paragraph relating to going concern and did not contain a statement

under Section 498(2) or Section 498(3) of the Companies Act

2006.

Statutory accounts for the year ended 31 December 2021 have been

delivered to the Registrar of Companies. The Auditor has reported

on those accounts; their report was unqualified but contained a

material uncertainty paragraph relating to going concern and did

not contain a statement under Section 498 (2) or Section 498(3) of

the Companies Act 2006.

3. Going concern

The financial position of the Group, its cash flows, liquidity

position and borrowing facilities are set out in the Financial

Review. At 31 December 2022, the Group had net cash and cash

equivalents of $2.2 million, (made up of $3.9 million of restricted

cash in line with the Group's loan arrangements and $1.7 million of

overdraft) and total borrowings of $115.7 million. Details on the

Group's borrowings are set out in note 19 to the financial

statements .

The Group has prepared cash flow forecasts based on estimates of

key variables including production, gold price, operating costs,

scheduled debt repayments in line with the Group's debt

arrangements and capital expenditure through to December 2024 that

supports the conclusion of the Directors that there is sufficient

funding available to meet the Group's anticipated cash flow

requirements to this date .

These cashflow forecasts are subject to a number of risks and

uncertainties, in particular the ability of the Group to achieve

the planned levels of production and the recent higher gold prices

being sustained . The Board reviewed and challenged the key

assumptions used by management in its going concern assessment, as

well as the scenarios applied and risks considered, including the

risks and potential disruptions associated with the recent changes

in governments in Mali and Guinea.

The biggest material uncertainty and risks remains ounces

produced and whether the current mine plan can be achieved

(including expected production from the Kouroussa mine which is

currently being commissioned) and mining contractor equipment

performance, and sanctions on Russia, which are also having a

logistical impact on the Group. These production levels are also

key in supporting the scheduled debt repayments over the period

under review. Where additional funding may be required, the Group

believes it has several options available to it, including but not

limited to, use of the overdraft facility, cost reduction

strategies, selling of non-core assets and raising additional funds

from current investors and debt partners .

The Board also considered sensitivities to those cash flow

scenarios (including where production is lower than forecast and

gold prices lower than current levels) which would require

additional funding. Should this situation arise, the Board believe

that they have several options available to them as referenced

above, which would allow the Group to meet its cash flow

requirements through this period, however, there remains a risk

that the Group may not be able to achieve these in the necessary

timeframe.

Based on its review, the Board has a reasonable expectation that

the Group has adequate resources to continue operating for the

foreseeable future and hence the Board considers that the

application of the going concern basis for the preparation of the

Financial Statements is appropriate. However, the risk of

lower-than-expected production levels, timing of VAT offsets and

receipts, increased fuel costs and potential disruptions to supply

chain and the ability to secure any potential required funding at

the date of signing of these financial statements, indicates the

existence of a material uncertainty which may cast significant

doubt on the Group's ability to continue as a going concern .

Should the Group be unable to achieve the required levels of

production and associated cashflows, defer expenditures, obtain

additional funding or renegotiating the current financing

arrangements such that the going concern basis of preparation was

no longer appropriate, adjustment would be required including the

reduction of balance sheet asset values to their recoverable

amounts and to provide for future liabilities should they

arise.

4. Loss per ordinary share

Basic loss per ordinary share is calculated by dividing the net

loss for the year attributable to ordinary equity holders of the

parent by the weighted average number of ordinary shares

outstanding during the year.

The calculation of the basic and diluted loss per share is based

on the following data:

2022 2021

$'000 Restated

$'000

------------------------------------------------------ ------------ ----------------

Loss

Loss for the purposes of basic loss per share being

net loss attributable to equity holders of the

parent (34,279) (12,656)

====================================================== ============ ================

2022 2021

Number of shares Number Number

Weighted average number of ordinary shares for

the purposes of basic loss per share 393,525,771 392,676,809

Adjustments for weighted average share options

and warrants 25,362,582 17,166,492

------------------------------------------------------ ------------ ----------------

Weighted average number of ordinary shares for

the purposes of diluted loss per share 418,888,353 409,843,301

====================================================== ============ ================

2022 2021 Restated

Loss per ordinary share $ cents $ cents

------------------------------------------------------ ------------ ----------------

Basic (8.71) (3.22)

Diluted (8.71) (3.22)

====================================================== ============ ================

At the reporting date there were 29,560,125 (2021: 19,984,137)

potentially dilutive ordinary shares and warrants. For the year

ended 31 December 2022, because there is a reduction in diluted

loss per share due to the loss-making position, therefore there is

no difference between basic and diluted loss per share.

5. Net debt reconciliation

At 1 Foreign

At 31

January exchange Amortisation December

of issue

costs/other

2022 (restated) Cash flow movement (1) 2022

$'000 $'000 $'000 $'000 $'000

Unrestricted cash 32,571 (34,040) (272) - (1,741)

Restricted cash 4,168 - (276) - 3,892

------------------------- ------------------ ------------ ----------- -------------- ----------

Total cash & cash

equivalents 36,739 (34,040) (548) - 2,151

Borrowings (61,812) (55,371) 3,247 (1,766) (115,702)

Lease liabilities (37,517) 13,603 - (3,750) (27,664)

------------------------- ------------------ ------------ ----------- -------------- ----------

Net debt (62,590) (75,808) 2,699 (5,516) (141,215)

------------------------- ------------------ ------------ ----------- -------------- ----------

(1) Included within the other category on lease liabilities is

$761,000 additions to liabilities, $475,000 forfeiture of

liabilities as a result of the renewal of the leases for the

corporate office and interest charge of $2,862,000. Included within

the other category for borrowings is $1.8 million of issue costs

amortisation.

6. Events after the reporting date

Issue of Shares and Strategic Investor

On 7 February 2023 the Company entered into a share subscription

agreement for the investment of US$15 million into the Company by

CIG SA ("CIG"), which was split into two tranches:

o A firm first tranche of circa US$3.8 million, involved the

issue of 39,360,800 new ordinary shares of GBP0.01 of the Company

and;

o A second tranche of circa US$11.2 million, which involved the

issue of 117,724,008 new ordinary shares.

Following the CIG investments, the Group also received an

additional subscription of a total of 23,070,797 shares in the

Company, for circa GBP1.8 million excluding fees from certain

existing institutional shareholders and through an open offer.

All the shares were issued at a subscription price of 7.79

pence, which represented a c.2% premium to the 30-day VWAP. As part

of the share subscription CIG have the right to maintain their

stake.

In aggregate, a total of 180,155,805 ordinary shares in the

Company were issued to CIG and other investors, for a total of

GBP14 million (circa $17 million) excluding fees, to help fund

Kouroussa into production.

7. Availability of accounts

The audited Annual Report and Financial Statements for the year

ended 31 December 2022 and notice of AGM will shortly be sent to

shareholders and published at: www.hummingbirdresources.co.uk.

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Group, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Group currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production when in production, scheduled for first gold pour

within Q2 2023. Further, the Group has a controlling interest in

the Dugbe Gold Project in Liberia that is being developed by joint

venture partners, Pasofino Gold Limited. The final feasibility

results on Dugbe showcase 2.76Moz in Reserves and strong economics

such as a 3.5-year capex payback period once in production, and a

14-year life of mine at a low AISC profile. Our vision is to

continue to grow our asset base, producing profitable ounces, while

central to all we do being our Environmental, Social &

Governance ("ESG") policies and practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Gordon Hamilton Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FIFLERLIRIIV

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

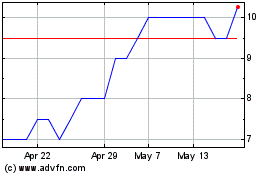

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024