Rogue Baron Plc Quarterly Trading Statement to 30 June 2022

July 29 2022 - 1:00AM

UK Regulatory

TIDMSHNJ

For Immediate Release

29 July 2022

ROGUE BARON PLC

("Rogue Baron" or "The Company")

Quarterly Trading Statement to 30 June 2022

Operational progress in key markets

Rogue Baron PLC (AQSE: SHNJ), a global company in the premium spirits sector,

is pleased to announce a trading statement for the quarter ending 30 June

2022.

In the second quarter, the group sold 689 cases globally resulting in revenue

of $87,492, moving 55% higher compared to the same period in 2021, driven by

both the addition of new markets and continuing demand from existing customers.

In the key strategic US market, the team has been bolstered by an experienced

salesman from Republic National Distributing Company (RNDC), one of the

largest distributors in the US. As per the announcements of April 2022, the

Company has added distribution in a number of European countries (UK, Spain,

Switzerland and Austria). These markets accounted for 14% of total case sales

in the quarter as these markets have just begun to order their initial supply.

The Company has now hired a UK based brand manager to push UK and EU sales with

an initial particular focus on the UK. Progress on expanded USA distribution

has been made and the Company remains very confident of being able to deliver

on this in the near term.

Global consumer trends in the beverage industry continue to shift towards

ultra-premium drinks consumption. The Company has already seen the effect of

this with sales in Europe of its 8-year old Shinju expression. Rogue Baron

intends to capitalise on this trend with the intended future launch of 12 and

15 year old Shinju expressions. Due to strong demand for aged Japanese Whisky

and lack of supply this puts the Company in a strong position not only with

respect to Japanese Whisky but with respect to being able to cross sell other

spirits such as a super-premium tequila. The Company has already had numerous

other approaches from other alcohol brands with respect to being able to

access the Company's USA distribution network We believe this further franks

the value proposition of the Company as the USA liquor market is littered with

failed attempts by overseas brands to enter the country without understanding

the market let alone the regulatory system there.

Given the Company's increasing distribution footprint globally Rogue Baron is

looking at various options to both finance increased sales from current

markets, enter new markets and potentially push new products through its

existing sales platforms. Numerous options are being perused by the board in

order to take advantage of the opportunities that the Company is constantly

being presented with.

Audit Opinion 2021

The Company is working in conjunction with its auditor to resolve the issues

presented in the Company's report and accounts for the year ended 31 December

2021, and will make a further announcement as soon as practicable.

Ryan Dolder, CEO of Rogue Baron, commented:

"We're pleased with the performance of the business in the second quarter of

the year. Our goal over the past couple years, despite the difficulties caused

by Covid, has been to continue to establish new markets, find the right

distribution partners, and once that is in place, drive expedited growth

through sales and marketing. We feel we are achieving that, specifically with

our launch into Europe, despite continuing challenges around global logistics

and sourcing of materials."

The Directors of the Company accept responsibility for the contents of this

announcement

For further information, please contact:

The Company

Ryan

Dolder

rdolder@roguebaron.com

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

+44 (0) 20 7469 0936

AQSE Corporate Broker:

Peterhouse Capital Limited

Lucy Williams

+44 (0) 20 7469 0936

END

(END) Dow Jones Newswires

July 29, 2022 02:00 ET (06:00 GMT)

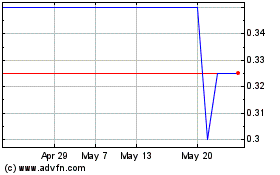

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Dec 2023 to Dec 2024