Vulcan Industries Plc Acquisition of Peregrine X Limited

October 14 2022 - 10:48AM

UK Regulatory

TIDMVULC

14 October 2022

Vulcan Industries plc

("Vulcan" or the "Company")

Acquisition of Peregrine X Limited

Vulcan Industries plc (AQSE: VULC) is pleased to announce that it has entered

into binding Heads of Terms to acquire the entire share capital of Peregrine X

Limited and its 100% owned subsidiary Peregrine Analytics Limited ("Peregrine"

together the "Peregrine Group") From Unity Global - FZCO (the "Vendor" or

"Unity Group"). The terms are conditional only on documentation of the

acquisition agreement.

Acquisition rationale

Peregrine has developed an analytical tool and algorithms using High

Performance Capillary Electrophoresis (HPCE), an analytical separation method

technology. Applications are suitable for the analysis of Oil and Water samples

and Medical diagnostic purposes. The initial applications will be to address

oil well-head analysis where functionality to characterise Asphaltenes is

highly sought after. The acquisition of Peregrine will enable the Company to

broaden its industrial engineering activities into the energy sector.

Peregrine Group

Peregrine Analytics has developed its diagnostic technology over the last four

years and is now ready to bring the product to market. The initial target

market is the Middle East where contract negotiations are well advanced with

preliminary tests for clients successfully completed. Peregrine is attending

ADIPEC at the end of October 2022 to formally launch its product and service

offerings.

Peregrine expects to commence the contractual delivery of tests no later than

Q2 2023.

Total Consideration

The total consideration payable is £5,000,000 to be satisfied by the issue of

zero-coupon convertible loan notes with a term of one year ("CLN"). Initial

consideration will be the issue of £1,000,000 notes with deferred consideration

of four tranches of £1,000,000 of notes to be issued on; (a) the receipt of an

independent valuation of the Peregrine Group; (b) the commissioning of a

laboratory facility in the UAE, (c) the signature of contracts for more than

250 tests and (d) the delivery of the first 25 tests. If no tests have been

delivered within the term of the CLN, there is a mutual unwind clause.

The notes may be converted at will by the Company, or after the four tranches

of deferred consideration have been triggered, by Peregrine. The conversion

price is 1p per new ordinary share. Conversion of the full consideration would

result in the issue of 500,000,000 new ordinary shares of £0.0004 each, being

approximately 46.2% of the enlarged share capital today.

In addition, the Company has agreed to enter a Royalty agreement whereby the

vendors will receive a Royalty of 70% of the post tax earnings of the Peregrine

Group This has been capped. At present the Peregrine Group has generated no

revenue and there is no guarantee that revenue will be generated. Both

Peregrine and the Company have options to terminate the Royalty agreement once

2,000 tests have been contracted for and 200 tests delivered.

The Company has agreed to issue 50,000,000 warrants to the Vendor with an

exercise price of 1p and a term to 31 March 2024.

In addition, the Vendor will receive warrants for any shares issued in

settlement of the Royalty agreement with a term to the later of 12 months from

the date of issue or 31 March 2024. The exercise price will be the price of the

related equity issued to settle Royalty obligations. ("Vendor warrants").

Related Party Transaction

The executive directors of Vulcan will receive 5% of the convertible loan notes

and 5% of any royalties paid to Peregrine (the "Related Party Transaction"

pursuant to Rule 4.6 of the AQSE Access Growth Market Rulebook). The 5%

convertible loan notes worth up to £250,000 and 5% of any royalties paid to

Peregrine will be split between Ian Tordoff and Neil Clayton. The remaining

directors of Vulcan, who have no interest in the transaction and who are

independent for these purposes, being John Maxwell and Darren Taylor, having

exercised reasonable skill care and diligence, consider that the Related Party

Transaction is fair and reasonable as far as the shareholders of the Company

are concerned.

Ian Tordoff, Executive Chairman: "The acquisition of Peregrine X (PX) presents

a transformational opportunity for the Group providing Vulcan access to

multiple new geographic markets and revenue streams. The PX technology has

clear competitive advantages which early market engagements bear out. We are

anticipating early adoption from a number of significant producers initially in

the Middle East by considerably reducing well-production down-time. Like many

others in the sector the Group's UK businesses have worked through difficult

trading conditions in the last 24 months and the European outlook for the

period 2023-24 remains volatile. With the addition of PX, Vulcan is reducing

its exposure to UK market conditions whilst extending its international client

base and revenue generating capabilities. We welcome Justin Last and the PX

team to the Group and look forward to working closely with PX to accelerate the

roll-out globally.

Justin Last CEO Peregrine Analytics Limited: "This is an exciting milestone in

our growth story and a great opportunity for both companies. We believe the

Peregrine analytical capabilities have huge potential to disrupt data analytics

in multiple sectors, but initially the Oil & Gas industry. The Company has

identified significant opportunities and has been engaged with a number of

clients who have long sought a solution to improved oil analytics data capture.

Through the development of AI algorithms, Peregrine intends to develop various

near real-time modelling techniques for oil components, primarily providing

solutions for existing deposition issues. I am looking forward to working with

the wider management team and I thank everyone who has been involved in getting

us to this point including our valued investors, trusted advisers, and our

enthusiastic channel partners."

For further information, visit: https://vulcanplc.com

The directors of Vulcan accept responsibility for this announcement.

Contacts

Vulcan Industries plc Via Vox Markets

Ian Tordoff, Chairman

First Sentinel Corporate Finance Ltd +44 7876 888 011

(AQSE Corporate Adviser)

Brian Stockbridge

Jenny Liu

Vox Markets (Media and Investor Relations) vulcan@voxmarkets.co.uk

Kat Perez +44 7881 622 830

Paul Cornelius + 44 7866 384 707

About Vulcan

Vulcan has been incorporated to build a group of UK companies providing high

quality products and services to the engineering, manufacturing and engineering

sectors, particularly focussed on metal fabrication and precision engineering,

which have underlying profitability and growth potential and can benefit from

being part of a larger group focussed on similar or complementary sectors to

the target.

Vulcan seeks to acquire and consolidate traditional but historically profitable

engineering, manufacturing and industrial SMEs for value and to enhance this

value in part through group synergies, but primarily by unlocking growth which

is not being achieved as a standalone private company. The group will also

optimise productivity through the introduction of new technologies and

processes. For more information visit https://www.voxmarkets.co.uk/listings/PLU

/VULC

About Unity Global - FZCO

The Vendor is a subsidiary of the Unity Group, a mergers and acquisitions firm

that specialise in attracting investment and creating opportunities for small

to medium-sized enterprises ("SMEs") to scale. https://www.unity-group.com/

Forward Looking Statements

This news release may contain "forward-looking" statements and information

relating to the Company. These statements are based on the beliefs of Company

management, as well as assumptions made by and information currently available

to Company management. The Company does not undertake to update forward-looking

statements or forward-looking information, except as required by law.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014. Upon the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to be in the pub

END

(END) Dow Jones Newswires

October 14, 2022 11:48 ET (15:48 GMT)

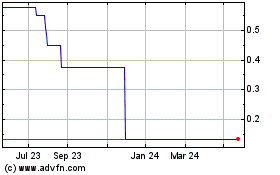

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Dec 2023 to Dec 2024