Asian Shares: Emerging Markets Hammered by Rise in U.S. Treasury Yields

November 10 2016 - 11:20PM

Dow Jones News

Asian emerging markets sold off sharply Friday as U.S. Treasury

yields rose overnight.

Indonesia's Jakarta Composite Index was off 2.9%, the

Philippines PSEi tumbled 2.5% and Malaysia's FTSE Bursa Malaysia

KLCI sank 1.1%

In more-developed markets Hong Kong's Hang Seng Index was down

1.5%, South Korea's Kospi was down 0.7%, and Taiwan's Taiex fell

1.8%.

"Global investors are favoring conditions in the U.S. market,"

said Alex Wijaya, senior sales trader at CMC Markets, pointing to

soaring U.S. Treasury yields. "We are seeing a general flowing to

the U.S."

The yield on the benchmark 10-year U.S. Treasury note climbed to

2.118% overnight from 2.070% Wednesday. That came on the back of

the biggest one-day jump in the 10-year yield in over three years

Wednesday.

As offshore investors pulled money out of emerging Asia into

U.S. Treasurys, regional currencies were walloped. Indonesia's

rupiah was down 1.6% Friday according to Thomson Reuters and the

Malaysian ringgit dived 2.7%, according to FactSet.

The rupiah plummet forced the Indonesian central bank Friday to

defend the currency, according to Bank Indonesia Senior Deputy

Governor Mirza Adityaswara, as foreign investors trimmed their

holdings of rupiah assets.

Japan's Nikkei bucked the regional selloff, rising 0.3% even as

the yen gained 0.4% against the dollar.

Australia's S&P/ASX 200 also rose 0.2%, lifted by a

continuing commodities rally.

The yield on the newest 10-year Japanese government bond briefly

rose to -0.025%. Japanese government bond yields were tracking

gains in U.S. Treasury yields overnight. JGB yields were driven

higher by the prospect of rising inflation given U.S.

President-elect Donald Trump's vast plans for spending and tax

cuts.

Rising JGB yields lift the profits of Japan financials, which

invest heavily in the assets. Nomura Holdings was 4.2% higher and

Dai-ichi Life Holdings surged 8.9%.

Japan industrial firms also jumped on expectation they will

benefit from Mr. Trump's infrastructure spending. Mitsubishi Heavy

Industries was up 3.7% and Kawasaki Heavy Industries gained

4.3%.

Commodities also continued to rise on these expectations.

Copper, a core industrial metal, surged 3.6% Thursday, and is up 7%

since the U.S. election. Iron ore jumped 4.4% to a two-year high

Thursday.

This has lifted Australian miners, with BHP Billiton up 1.9%,

Fortescue Metals Group gaining 2.8% and Rio Tinto rising 2.6% on

Friday.

The Bank of Korea left its base rate unchanged at 1.25% Friday,

reflecting uncertainty caused by Mr. Trump's surprise victory, said

Barclays economist Angela Hsieh.

"There are significant near-term uncertainties in the first few

weeks after the election, as markets are waiting for

President-elect Trump to lay out his policy directions," Ms. Hsieh

said. Mr. Trump's protectionist stance should also be a major

concern, she added.

"The situation could be further complicated if the Korea-U.S.

Free Trade Agreement came to be renegotiated, but we think it would

be too early to call," she said.

Biman Mukherji, I-Made Sentana, Stephanie Yang, Kosaku Narioka,

Robb Stewart, Kwanwoo Jun and Christopher Whittall contributed to

this article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

November 11, 2016 00:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

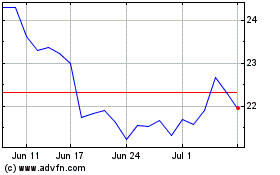

Fortescue (ASX:FMG)

Historical Stock Chart

From Oct 2024 to Nov 2024

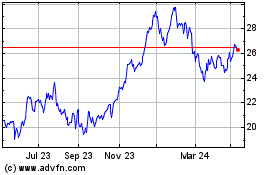

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2023 to Nov 2024