Finance Ministers Urge Greater Information Sharing to Fight Tax Evasion

April 14 2016 - 3:40PM

Dow Jones News

European finance ministers on Thursday urged their counterparts

in the Group of 20 advanced economies to share more information

about the owners of offshore companies and trusts, marking another

step in a global effort to clamp down on tax dodging.

The initiative comes as authorities world-wide are struggling to

contain the fallout from the leak of thousands of private documents

from a Panamanian law firm that specialized in offshore tax deals

for wealthy international clients.

In a letter to the G-20 released by the U.K. Treasury, the

finance ministers of France, Germany, Italy, Spain and the U.K.

said they have agreed to share data on the owners of offshore

entities and called on other jurisdictions to do the same.

The five ministers said that, under their new initiative, such

information will be automatically exchanged among their countries'

tax authorities, allowing them to identify and pursue tax evaders,

money launderers and "aggressive" tax avoiders. The plan builds on

existing information-sharing deals that allow tax authorities to

track citizens' incomes and assets.

"To be fully effective such exchange should be on a global

basis. We therefore hope you will support this initiative," the

ministers wrote their colleagues. They recommended the G-20 ask the

Organization for Economic Cooperation and Development, which has

drawn up a package of measures aimed at closing international tax

loopholes, to develop a single global standard to coordinate such

exchanges.

The trove of confidential documents leaked from the Panamanian

law firm Mossack Fonsesca and the information they contain has

sparked public anger from Iceland to the U.K. to Russia and sown

fresh doubts about the effectiveness of global efforts to rein in

tax avoidance.

The fallout cost Iceland's prime minister his job and prompted

questions in the U.K. about Prime Minister David Cameron's own tax

affairs after it emerged that he once owned shares in an offshore

fund set up by his late father. Mr. Cameron and other senior

figures in government—including Treasury chief George Osborne, a

signatory of the finance ministers' letter—took the unusual step of

making details of their tax arrangements public in an effort to

quell public demands for greater transparency.

The U.S. wasn't among the nations announcing Thursday's

agreement, and nonprofit groups have criticized the country for

allowing foreigners to use shell companies to hide assets in states

such as Nevada, Delaware and Wyoming.

The Treasury Department is close to finishing rules that would

require that banks and other financial institutions know the

beneficial owners behind companies they serve. Treasury also plans

to propose a rule to make foreign-owned limited liability companies

to obtain a tax identification number.

"The misuse of legal entities to obscure beneficial ownership is

a significant weakness in an otherwise strong and resilient U.S.

financial system, and it can only be resolved with meaningful

congressional action," Josh Drobnyk, a Treasury spokesman, wrote in

a blog post on Wednesday.

The Obama administration has asked Congress to enact a law that

would require banks and other financial institutions to provide the

government with account balances and other information on assets

held by foreigners as part of a global information-exchange system

where the U.S. is lagging.

Write to Jason Douglas at jason.douglas@wsj.com and Richard

Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

April 14, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

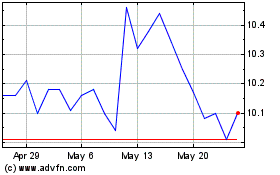

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024