MARKET MOVEMENTS:

--Brent crude oil falls 0.9% to $82.04 a barrel.

--European benchmark gas rises 4.6% to EUR 50.85 a megawatt

hour.

--Gold futures edged up 0.2% to $1,845 a troy ounce.

--Three-month copper fell 0.7% lower at $9,111 a metric ton.

--Wheat futures fall 1.2% to $7.54 a bushel.

TOP STORY:

Rio Tinto Full-Year Profit, Dividend Down on Weaker Commodity

Prices

Rio Tinto PLC reported a 41% fall in net profit for 2022 and cut

its payout to shareholders, reflecting a downswing in iron ore and

copper prices from elevated levels a year earlier.

The world's second-biggest miner by market value on Wednesday

said it made a net profit of $12.42 billion last year, down from

$21.09 billion in 2021.

Underlying earnings totaled $13.28 billion, compared with $21.38

billion the year earlier, as prices for iron ore--which accounts

for most of Rio Tinto's profits--and copper fell. Analysts had

expected underlying earnings of roughly $13.39 billion, according

to 15 estimates compiled by Visible Alpha.

OTHER STORIES:

Ukraine Grain Shipments Slow as Export Deal With Russia Nears

End

Grain exports from Ukraine have slowed markedly in recent weeks,

pushing up global prices, amid shipping delays and concerns about

the looming expiration of a United Nations-backed deal to give food

cargoes safe passage.

Russia's invasion of Ukraine last year had initially trapped

shipments of wheat, sunflower oil and other agricultural products,

sparking concerns of a global food crisis. Shipments then recovered

later in the year to near prewar levels after Moscow and Kyiv

agreed to a U.N.-backed pact to resume food exports via Black Sea

ports.

Now, with tensions high ahead of the first anniversary of the

invasion, some traders are worried Russia won't extend the grain

deal, which is due to expire on March 19.

---

Chesapeake to Sell Shale Oil Assets to British Chemical Maker

Ineos for $1.4 Billion

Chesapeake Energy Corp. CHK -2.56%decrease; red down pointing

triangle said Tuesday that it has sold oil assets to a division of

U.K. chemical maker Ineos Group AG for $1.4 billion.

The deal involves oil assets in the northern part of the Eagle

Ford shale basin in South Texas. The sale marks the first foray of

Ineos, one of the world's largest chemical producers, into U.S. oil

and gas production, Ineos said in a news release.

---

Iberdrola 2022 Profit Rose, Driven By U.S., Brazil Growth

Iberdrola SA reported a rise in full-year profit with results in

line with its own guidance as growth in the U.S. and Brazil offset

a negative performance in Spain.

---

Kenya Mild Arabica Coffee Price Rises at Auction

Kenya's mild arabica coffee price rose by 3.2% at an auction on

Tuesday, the Nairobi Coffee Exchange said.

Coffee beans were sold at an average price of $221.25 for a

50-kilogram bag compared with $214.40 a bag at the prior auction on

Feb.13, the NCE said.

MARKET TALKS:

Stronger Dollar Keeps Pressuring Gold

1216 GMT - A strong dollar is likely to keep a cap on gold

prices, with the currency key for the precious metal, according to

Commonwealth Bank of Australia. In a note, CBA said that

traditionally gold moves inversely to U.S. treasuries, but last

year the dollar better explained its moves with the currency

inversely tracking the precious metal. CBA's economists expect the

dollar will continue to climb as the U.S. economy continues to show

strength, amid this week's PMI figures. "We think gold prices could

dip lower in the short term, possibly falling below $1,800 a troy

ounce if U.S. economic data continue to surprise on the upside,"

they say. Gold today is up 0.1% to $1,845 an ounce, having slipped

from $1,945 an ounce on Jan. 31. (yusuf.khan@wsj.com)

---

Europe's Carbon Permits Boosted by EU's Climate Ambition,

Economic Outlook

1116 GMT - An improved economic outlook, the expectations of a

recovery in industrial activity and the step-up of the European

Union's climate ambitions have helped drive the cost of carbon

permits to a new high, said Yan Qin, analyst at Refinitiv Carbon

Research. The price of carbon allowances under the European Union's

Emissions Trading System rose to EUR100 for the first time on

Monday. Investors will continue to see European carbon allowance as

an attractive asset to invest in for hedging exposure to

climate-related risks, the analyst says, adding that the expansion

of the Emissions Trading System to the maritime sector and the

introduction of the Carbon Border Adjustment Mechanism could have

prompted proxy hedging by the new entrants into the EU ETS.

(maitane.sardon@wsj.com)

---

China's Reopening Having an Uneven Impact on Commodities

1021 GMT - China's reopening has been mixed for commodities but

oil remains the most primed to benefit, says JPMorgan. "China's

economic recovery will drive its demand for all commodities higher,

but we still believe oil is positioned to benefit the most," the

bank says. Travel has been the most impacted by the reopening,

prompting China's refineries to snap up large amounts of oil. But,

while other commodities such as metals have rallied in anticipation

of extra demand, there have been few signs of it. "Outside of oil

we so far see few signs of a stronger-than-normal demand recovery,"

the bank says, in a note. Brent is last down 1.4% at $81.62 a

barrel. (william.horner@wsj.com)

---

Palm Oil Prices Edge Higher Amid Signs of Rising Demand

1005 GMT - Crude palm oil prices edge higher in late trade amid

signs of rising demand during the holiday season. Strong export

data from cargo surveyors shows that demand for Malaysian palm oil

remains high before the Eid holidays, says a Kuala Lumpur-based

trader. Indonesia has placed temporary export curbs on palm oil,

which could also help drive demand for the commodity in Malaysia,

he adds. The Bursa Malaysia Derivatives contract for May delivery

closed MYR7 higher at MYR4,148 a metric ton.

(yiwei.wong@wsj.com)

---

Oil Slides on Fed Interest Rate Fears

0835 GMT - Oil slips as investors fret that the Federal Reserve

will keep interest rates higher for longer. Brent crude oil is down

0.9% at $82.05 a barrel while WTI declines 1.1% to $75.52. The U.S.

labor market has remained tight and retail sales have shown healthy

growth. Investors are concerned that economic resilience will drive

the Fed to be more aggressive on interest rates. "Markets continue

to come to terms with expectations of a more hawkish Fed, following

a raft of economic data suggesting the Fed still has quite a bit of

work to do," says ING in a note. Later Wednesday, the release of

the Federal Open Market Committee meeting minutes should give

investors a peak at the Fed thinking. (william.horner@wsj.com)

---

Base Metals Slip, Gold Rise Amid Central Bank Hawkishness

0831 GMT - Base metals are falling in early trading, as

hawkishness from central banks continues to keep a cap on prices.

Three-month copper is down 0.8% to $9,102 a metric ton while

aluminum is 1.1% lower at $2,433 a ton. Gold meanwhile is up 0.4%.

A hawkish sentiment had spread across markets, with the European

Central Bank President Lagarde reiterating its stance to look to

hike rates amid persistent inflation, Marex's Rushi Hong in a note

says. Strong PMI readings are also likely to help spur the Fed to

keep tightening, Hong adds, with the S&P Global PMI reading of

50.2 against 48.6 last month raising the expectation of more rate

hikes. (yusuf.khan@wsj.com)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

February 22, 2023 07:40 ET (12:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

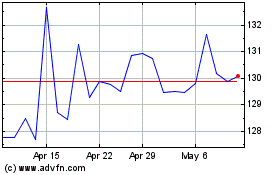

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024