MARKET MOVEMENTS:

-- Brent crude oil is up 0.4% at $79.93 a barrel.

-- European benchmark gas is down 4.5% at EUR25.86 a megawatt

hour.

-- Gold futures are down 0.1% to $1,978 a troy ounce.

-- LME three-month copper futures are down 1.1% at $8,368.50 a

metric ton.

-- Wheat futures are up 3.2% to $6.92 a bushel.

TOP STORY:

Rio Tinto Sees Strong Iron-Ore Sales; Cuts Guidance for Alumina,

Refined Copper

Rio Tinto PLC said it expects full-year iron-ore shipments from

its Australian mining operations to be in the upper half of company

guidance, but cut production estimates for several other

commodities it produces, including alumina and refined copper.

The world's second-largest miner by market value on Wednesday

said 2023 iron-ore shipments are now expected to be in the top half

of its 320 million to 335 million metric ton projection. The

company, which relies on steel ingredient iron ore for the majority

of its profits, said it shipped 79.1 million tons of the commodity

from its Australian iron-ore mines in the second quarter of the

year, down 1% on the same time last year.

Shipments during the period were affected by planned maintenance

at the Dampier port and a train derailment. Output from operations

was 3% higher than the second quarter of 2022 as Rio Tinto's newest

iron-ore mine, Gudai-Darri, started to run consistently at full

capacity, the company said.

--

OTHER STORIES:

Big Banks Don't Need to Drop Clients Amid Climate Risk Push,

Regulators Say

Top U.S. financial regulators said they don't expect big banks

to stop serving any clients or sectors as the institutions take on

climate-related risk.

Regulatory oversight roles won't be leveraged to push banks away

from businesses or sectors, officials for the Office of Comptroller

of the Currency, Federal Deposit Insurance Corp. and Federal

Reserve Board of Governors testified Tuesday at a hearing before a

House subcommittee. Lawmakers have in recent months wrangled over

whether the oil-and-gas industry should be allowed access to

banking services.

Republicans on the Subcommittee on Financial Institutions and

Monetary Policy, which held the hearing, questioned whether banking

regulators are independent of political influence.

--

India's Tata to Build $5 Billion Battery Cell Gigafactory in the

U.K.

Indian conglomerate Tata Group said it will invest 4 billion

pounds ($5.21 billion) to build a battery cell gigafactory in the

U.K.

The project, to be carried out through Tata Group's principal

investment holding company, Tata Sons, marks the group's first

gigafactory outside its home country, it said in a statement on

Wednesday.

The factory will supply electric-vehicle batteries and

energy-storage solutions for customers in the U.K. and Europe, with

the group's auto companies, Jaguar Land Rover and Tata Motors, as

anchor clients.

--

Antofagasta Cuts Full-Year Copper Production Guidance; 1H

Production Rose

Antofagasta on Wednesday cut its full-year copper production

outlook due to construction delays and water availability at Los

Pelambres, although production rose in the first half of the

year.

The Chilean copper miner produced 295,500 metric tons of copper

in the half-year at a net cash cost of $1.75 a pound, up from

268,600 tons at a net cash cost of $1.82 a pound in the first half

of 2022, driven by an improved throughput at Los Pelambres.

--

MARKET TALKS:

Antofagasta's 1H Should Avoid Major Negative Surprises Despite

Weak 2Q

1038 GMT - Chilean copper miner Antofagasta's 1H financial

results could have taken a hit from the fall in 2Q production, but

any major negative surprises in first-half results seem unlikely,

eToro analyst Mark Crouch says in a market comment. "While costs

remain fairly level, it remains to be seen how this fall in input,

alongside a slump in the copper price over the past few months,

will hit the firm's bottom line when it reports its half year

results in three weeks' time," Crouch says. The lagging copper

demand is linked to slowing growth in China, a major copper

importer, he says. "While this could prove problematic if it turns

into a longer-term trend, we don't foresee any major negative

surprises in its upcoming results." Shares are down 2.4% at

1,470.50 pence. (christian.moess@wsj.com)

--

Rio Tinto's Mixed 2Q Could Prompt Downward Consensus

Revision

0829 GMT - Rio Tinto posted in-line 2Q iron-ore shipments and

lifted its full-year shipment guidance, but its Iron Ore Company of

Canada operations and copper production fall below expectations,

Citi analysts write in a research note. "We see the consensus 2023

earnings to be revised lower by mid single-digit percentages on

copper guidance changes, " they say. The Australian miner also

noted a cash outflow from an increase in working capital of $900

million in the first half of 2023, however this shouldn't surprise

the market as higher costs and working capital are current themes

previously flagged for the mining sector, Citi says. The U.S. bank

keeps a buy rating on the stock with a 5,700 pence price target.

Shares are down 0.9% at 5,064 pence. (christian.moess@wsj.com)

--

Base Metal Prices Lower on Weak China Demand

0815 GMT - Base metal prices are falling as weak demand in China

continues to hit prices for industrial goods. Three-month copper is

down 0.7% to $8,399 a metric ton while aluminum is 1.1% lower at

$2,181.50 a ton. Gold meanwhile is up 0.1% to $1,983.30 a troy

ounce. Commonwealth Bank of Australia analyst Vivek Dhar points to

weak property demand with new home sales in China failing to budge

in June, and one of the largest consuming areas of metals

individually is the Chinese property sector. "Confidence remains

critically low," he says in a note, adding that "any policy support

will likely need to be larger and in place for longer than in

previous property downturns to be effective."

(yusuf.khan@wsj.com)

--

India Inflation Likely to Head Higher as El Nino Risks Loom

0803 GMT - Inflation in India is heading higher toward 6% in 3Q,

estimates Radhika Rao, DBS senior economist, noting that El Nino

barometers point to the likelihood of its onset in 2H, spilling

over to winter. "As the risk of strengthening in El Nino looms, the

impact could extend from the summer (kharif) to the winter (rabi)

crop, with the latter dependent on land moisture, groundwater, and

reservoir levels from the summer months," she says in a note. She

sees inflation at risk in certain pockets, including perishables

(vegetables), pulses and food grains. Besides perishable-driven

inflation, food grains, particularly rice, warrant attention as

they are more vulnerable to rainfall, she adds. DBS raises its FY

2024 inflation forecast to 5.2% from 4.8% earlier.

(monica.gupta@wsj.com)

--

Oil Inches Down as China Worries Counter Supply Picture

0758 GMT - Oil prices waver as the market balances signs of

tightening Russian supply against concerns about Chinese demand.

Brent crude oil inches down 0.2% to $79.47 a barrel while WTI slips

0.3% to $75.41 a barrel. Ship tracking data has pointed to

declining Russia oil exports, suggesting Moscow is making good on

its promise to other OPEC members to slash output. But, weaker than

expected Chinese data in recent days has countered that, capping

oil's gains, analysts say. The API's reported Tuesday that U.S.

crude stocks declined by 800,000 barrels, while gasoline stocks

dropped by 2.8 million barrels. Later in the day, the EIA will

release official U.S. crude stocks data.

(william.horner@wsj.com)

--

Gold Has High Chance of Breaching Resistance at Ichimoku Cloud's

Top, Charts Show -- Market Talk

0719 GMT - Gold has a high chance of breaching resistance at the

top of the daily Ichimoku cloud, which is currently near $2,000/oz,

says Quek Ser Leang, market strategist at UOB Global Economics

& Markets Research, in a report, noting the precious metal's

jump on Tuesday. Technical charts show gold's daily moving average

convergence divergence indicator is rising strongly and upward

momentum is building swiftly, while the 21-day exponential moving

average seems poised to cross above the 55-day moving average, he

notes. These developments suggest there's scope for gold to rise

further, but the precious metal must break clearly above the

cloud's top, he adds. Spot gold is up 0.1% at $1,979.51/oz.

(ronnie.harui@wsj.com)

--

Lithium Outlook in Short-Term Remains Uncertain, Rio Tinto

Says

0034 GMT - It's unclear exactly where lithium carbonate spot

prices will head in the short run after a second-quarter rebound,

miner Rio Tinto says in a quarterly report. "Short-term uncertainty

remains as the global economy slows and higher interest rates

dampen consumer spending, " says the company. Automotive market

sentiment has improved in China thanks to tax breaks aimed at

boosting the purchase of electric vehicles over the next four

years, Rio Tinto notes. "Longer term, market fundamentals for

lithium remain strong, as EV adoption continues to rise on

supportive government policies and supply shortfalls requiring

further investment," says the miner, which owns the Rincon lithium

project in Argentina.(rhiannon.hoyle@wsj.com; @RhiannonHoyle)

Write to Barcelona Editors at barcelonaeditors@dowjones.com

(END) Dow Jones Newswires

July 19, 2023 07:31 ET (11:31 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

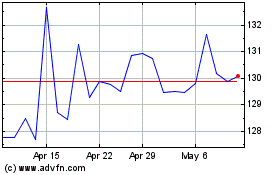

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024