Peru's Mining, Hydrocarbon Projects May Total $43 Billion By 2017

February 09 2010 - 3:04PM

Dow Jones News

Investments in Peru's mining and hydrocarbon sectors are

expected to reach $43 billion within the next seven years, but the

most significant new projects are not expected to come on line

before 2012.

A report Tuesday by Peru's oil, mining and energy society, the

SNMPE, said after a contraction in international demand for metals

and hydrocarbons in 2009, projects in Peru's mining and hydrocarbon

sectors are expected to reach $43 billion in the next five to seven

years.

"The financial crisis meant a reprogramming of investments and a

contraction in the demand for metals and hydrocarbons," said Hans

Flury, SNMPE president.

As a result, mining export values, which represent about 60% of

Peru's overall export values, dropped by $2 billion in 2009 from

$18.5 billion in 2008 to about $16 billion in 2009.

Now, however, as demand picks up again, a total of $43 billion

is expected in projected investments, Flury said. Of the total,

about $35 billion is planned for the mining sector and $8 billion

for the hydrocarbon sector.

A further $3.4 billion will be invested in electricity

production and transmission projects.

While Flury would not forecast precise investment figures for

2010 or 2011, a report published Monday by Scotiabank said mining

sector gross domestic product should rise by about 1% in 2010,

although significant investments will not be seen until 2012.

New operations in 2012 include Aluminum Corp. of China Ltd.

(ACH), or Chinalco's, Toromocho copper project, with an expected

investment of over $2 billion, and Southern Copper Corp.'s (PCU)

Tia Maria project, an investment of about $1 billion.

Negative factors for this year, Scotiabank said, would be a

possible 25% decrease in production from the Yanacocha gold mine,

run by Newmont Corp. (NEM). The decrease is so far unconfirmed by

Newmont, the bank noted.

The most significant project in 2010, the bank said, would be

Compania Minera Antamina SA's $1.3 billion investment to expand

copper and zinc production in 2012.

As of 2013, several new projects are expected to start,

including a $3.6 billion copper mining project by Xstrata PLC

(XTA.LN) and a $2.5 billion iron mining investment by Strike

Resources Ltd. (SRK.AU).

Anglo American PLC (AAUKY, AA.UK) is also slated to invest $5

billion in two copper mining projects.

In 2009, the SNMPE noted, Peru became the world's second biggest

copper producer, a long way behind Chile, but just ahead of the

U.S.

-By Sophie Kevany, Dow Jones Newswires; 51-198-903-8043;

sophie.kevany@dowjones.com

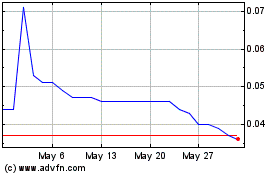

Strike Resources (ASX:SRK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Strike Resources (ASX:SRK)

Historical Stock Chart

From Feb 2024 to Feb 2025