Telstra Aims to Grow Dividends, Return Excess Cash to Shareholders -- Update

September 15 2021 - 6:35PM

Dow Jones News

By Stuart Condie

SYDNEY--Telstra Corp. Ltd. aims to increase its dividend and

return excess cash to shareholders as key components of the

Australian telecommunications firm's new capital management

framework.

Australia's No.1 communications provider by market share said it

was confident of maintaining its current annual payout of 16

Australian cents (11.7 U.S. cents) per share, and was focused on

growing earnings to maximize dividend imputation. It aims to grow

the dividend over time.

Telstra said it was targeting annual underlying

earnings-per-share growth in the high teens from the 2023 fiscal

year through fiscal 2025, with underlying earnings before interest,

tax, depreciation and amortization growing annually in the

mid-single digits over the same period.

It said it would invest in growth and return excess cash to

shareholders. It listed share buybacks, capital returns and

unfranked dividends as examples of how it could redistribute

cash.

Telstra, which has flagged a return to underlying growth in

fiscal 2022, this year agreed to sell a 49% stake in its mobile

towers infrastructure, using the proceeds to pay down debt and

launch a A$1.35 billion share buyback.

It is looking at options for its fixed-line infrastructure,

which J.P. Morgan this week estimated could be worth A$31.7

billion. The investment bank said Telstra could generate post-tax

proceeds of A$14 billion with the sale of a 49% stake, using half

the cash to cut debt and the other half for a A$6.8 billion buyback

that could boost earnings per share by about 10%-11%.

Telstra's stock has risen 50% since June 2018 and is up 32% this

calendar year at A$3.93, fuelled by its asset monetization strategy

and return to growth following a period in which earnings were hit

by the roll-out of the government-owned National Broadband Network.

Communications firms buy access to the network and resell it to

customers.

Telstra is widely expected by analysts to bid for the NBN if it

is privatized, with the creation of an internal fixed-line

infrastructure unit seen as paving the way.

Telstra on Thursday said it was open to both organic growth and

M&A opportunities.

"Organic growth opportunities could include a long-term or

nation-building infrastructure investment," Telstra said.

The company said it aimed to cut fixed costs by A$500 million

between fiscal 2023 and fiscal 2025. Telstra last month said it had

cut costs by A$2.3 billion since fiscal 2016 and was on track to

hit A$2.7 billion in savings by fiscal 2022.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

September 15, 2021 19:20 ET (23:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

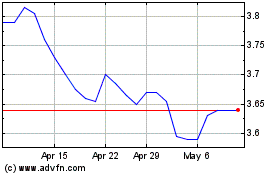

Telstra (ASX:TLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

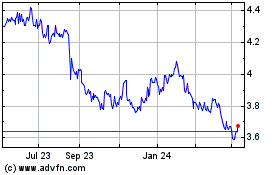

Telstra (ASX:TLS)

Historical Stock Chart

From Dec 2023 to Dec 2024